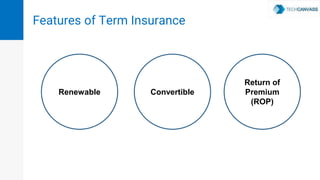

This document provides an overview of different types of term life insurance and cash value life insurance. It discusses level term life insurance, decreasing term life insurance, increasing term life insurance, mortgage life insurance, credit life insurance, and family income coverage under term life insurance. It also discusses features like renewable, convertible, and return of premium for term policies. For cash value life insurance, it outlines whole life insurance, premium payment methods, and modified whole life insurance covering more than one insured.