Recommended

Recommended

More Related Content

What's hot

What's hot (8)

Estate & Medicaid Planning for Individuals with Alzheimer's Disease

Estate & Medicaid Planning for Individuals with Alzheimer's Disease

Providence Retired Teachers Association - Estate & Medicaid Planning

Providence Retired Teachers Association - Estate & Medicaid Planning

Estate Planning & Public Benefits for Individuals with ALS

Estate Planning & Public Benefits for Individuals with ALS

Viewers also liked

Viewers also liked (12)

Ipsr solutions red hat,cisco,microsoft training partner

Ipsr solutions red hat,cisco,microsoft training partner

Flight training for DevOps & HumanOps - IncontroDevOps 2016

Flight training for DevOps & HumanOps - IncontroDevOps 2016

Basic English conversation video - short English conversation

Basic English conversation video - short English conversation

Similar to Compare

Similar to Compare (20)

Types of Life Insurance Policies Available in India

Types of Life Insurance Policies Available in India

A Simple Guide to Understanding Whole Life and Term Life Insurance

A Simple Guide to Understanding Whole Life and Term Life Insurance

Compare

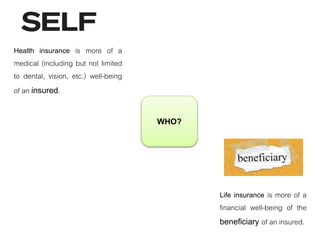

- 1. Health insurance is more of a medical (including but not limited to dental, vision, etc.) well-being of an insured. Life insurance is more of a financial well-being of the beneficiary of an insured. WHO?

- 2. Health insurance can be simplified in terms of money invested by insured in reducing the unpredictable and huge healthcare expenses, if any; and no potential gain in future from the money itself. Life insurance can be simplified in terms of money invested by insured in reducing the financial burden of the beneficiaries in future in the form of the then potential gains. WHY?

- 3. The various products of health insurance are based more on the medical needs of the insured focusing the reduced out of pocket expenses. The various products of life insurance are based more on the financial needs of the insured focusing the increased capital gains. PRODUCTS

- 4. Health insurance does not allow premiums to be accumulated for subsequent years for future benefits, and the premiums cycle restarts after each calendar year; as if the health insurance is bought freshly. Life insurance follows premium accumulations from the beginning of the policy till its maturity. GROWTH

- 5. Health insurance policy life cycle lasts for only a given calendar year and is typically determined by the insurer. It is not Life insurance policy life cycle lasts up to many years as determined by the insurer and the insured. The use of benefits is availed only after the inevitable death of the insured. LIFE CYCLE

- 6. Health insurance premiums are typically monthly or biweekly in nature. Life insurance premium can be monthly, quarterly, semi-annually or annually in nature. FREQUENCY

- 7. The term ‘maturity’ has no significance in health insurance, still it can be approximately translated into the termination or lapse of the policy which when not be renewed, no benefits can be availed. The term ‘maturity’ has greater significance in life insurance which signifies the legitimate termination of policy where the benefits are ready to be utilized. MATURITY

- 8. The liquid benefits of health insurance can be termed as the reduced healthcare costs during the policy period. The liquid benefits of life insurance can be termed as the increased capital after the policy period. CONSUMMATION

- 9. For a short term or an immediate perspective, health insurance is instrumental with or without life insurance. For a long term or a later perspective, life insurance is instrumental along with the concurrent health insurance. PRIORITY

- 10. Health insurance is mandated by the federal government and could lead to monetary fines, if not owned by individuals. Life insurance is a personal choice by individuals with no government mandate, other than encouraging life insurance. MANDATE