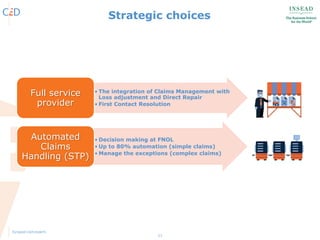

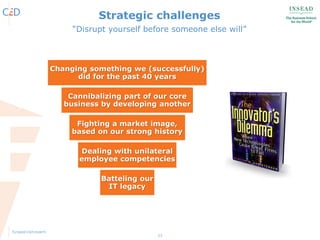

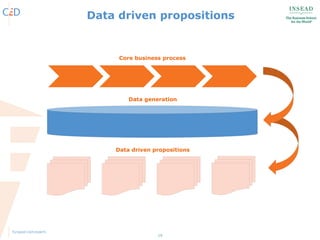

This document summarizes a presentation on leveraging big data for claims management. The presentation discusses the business background of a claims management company, including key figures and core businesses. It then discusses strategic choices around automating claims handling using big data, as well as challenges like disrupting existing business models. Finally, it explores how big data can enable straight through processing of claims and generate new data-driven propositions.