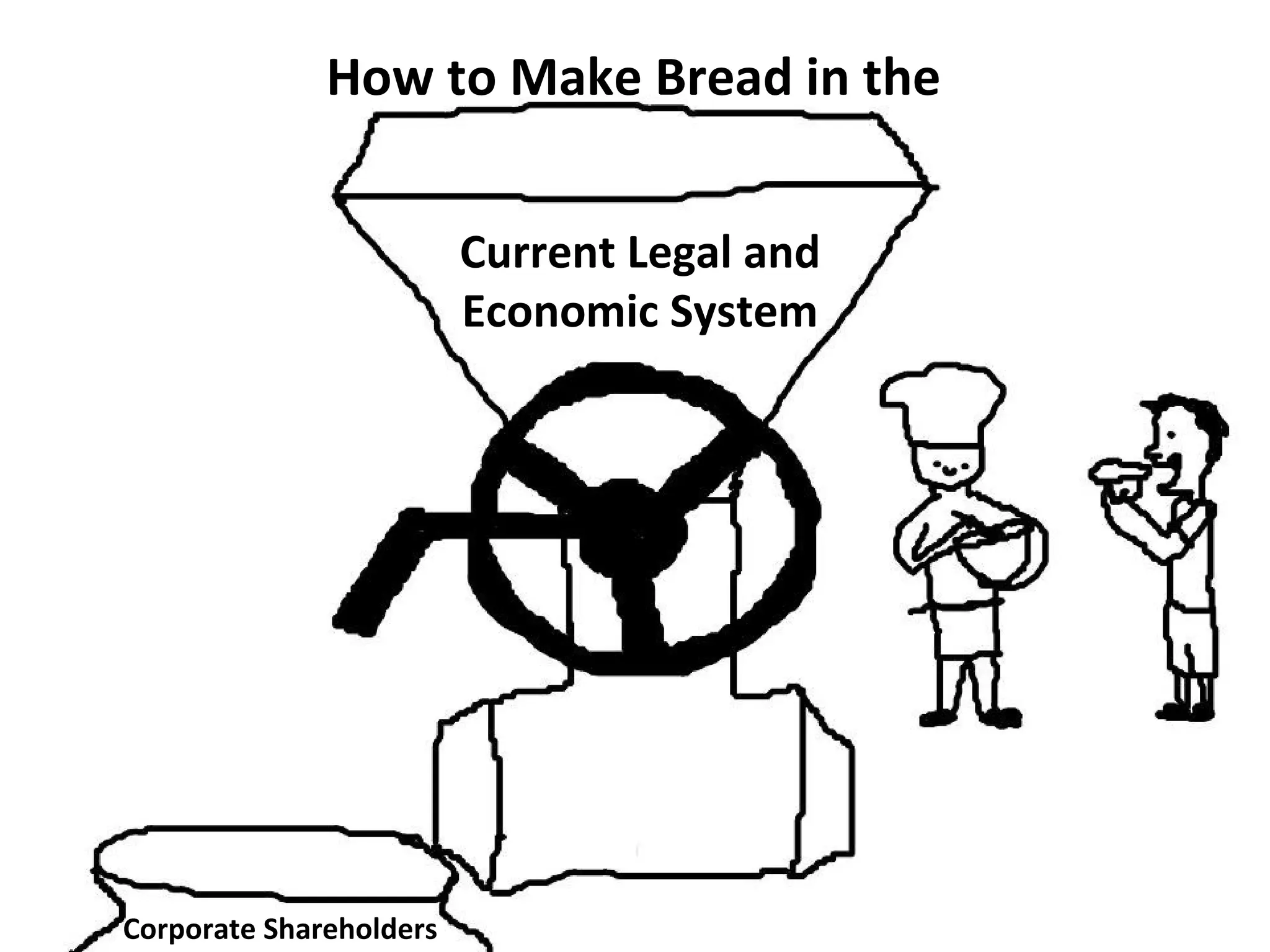

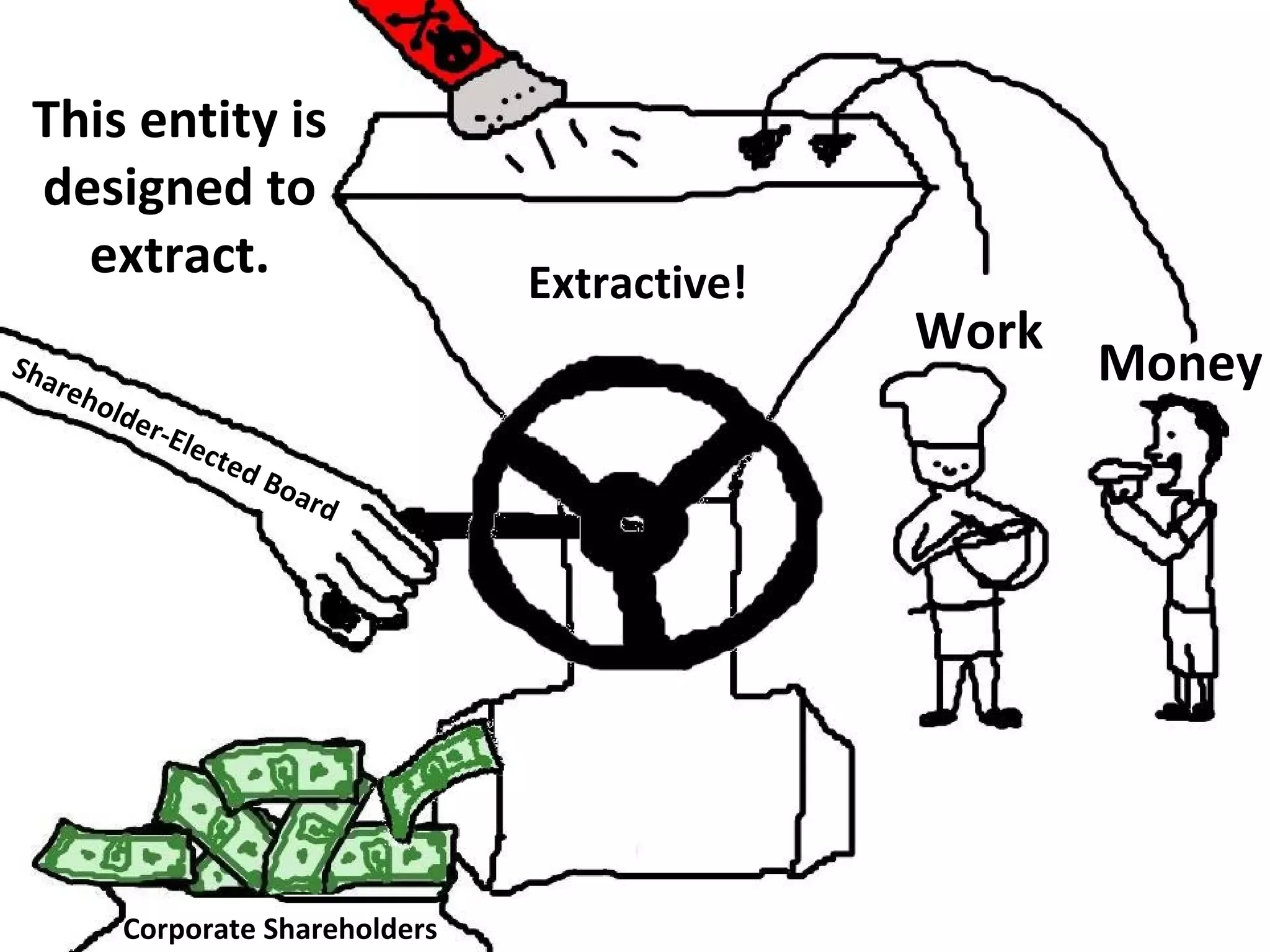

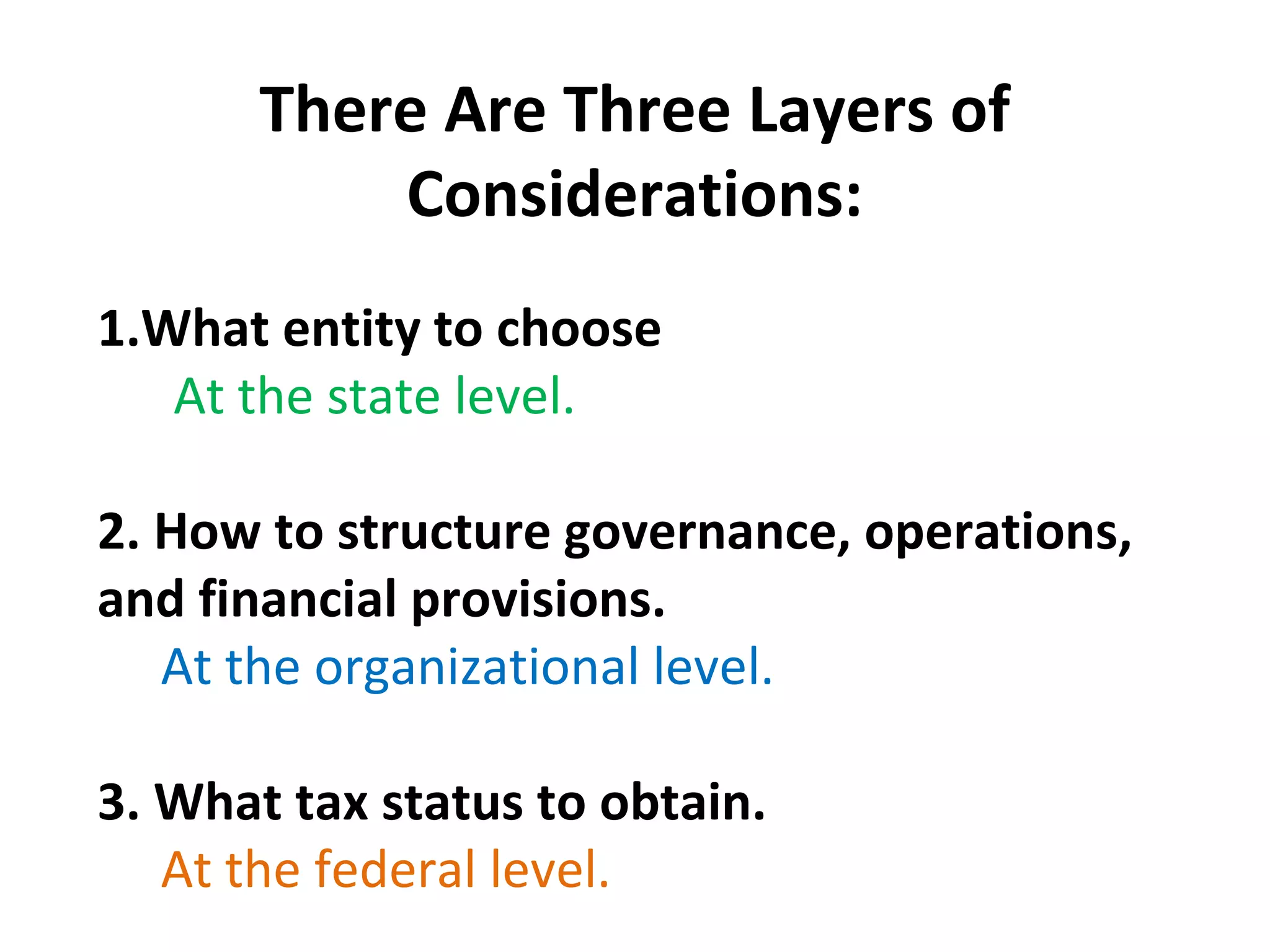

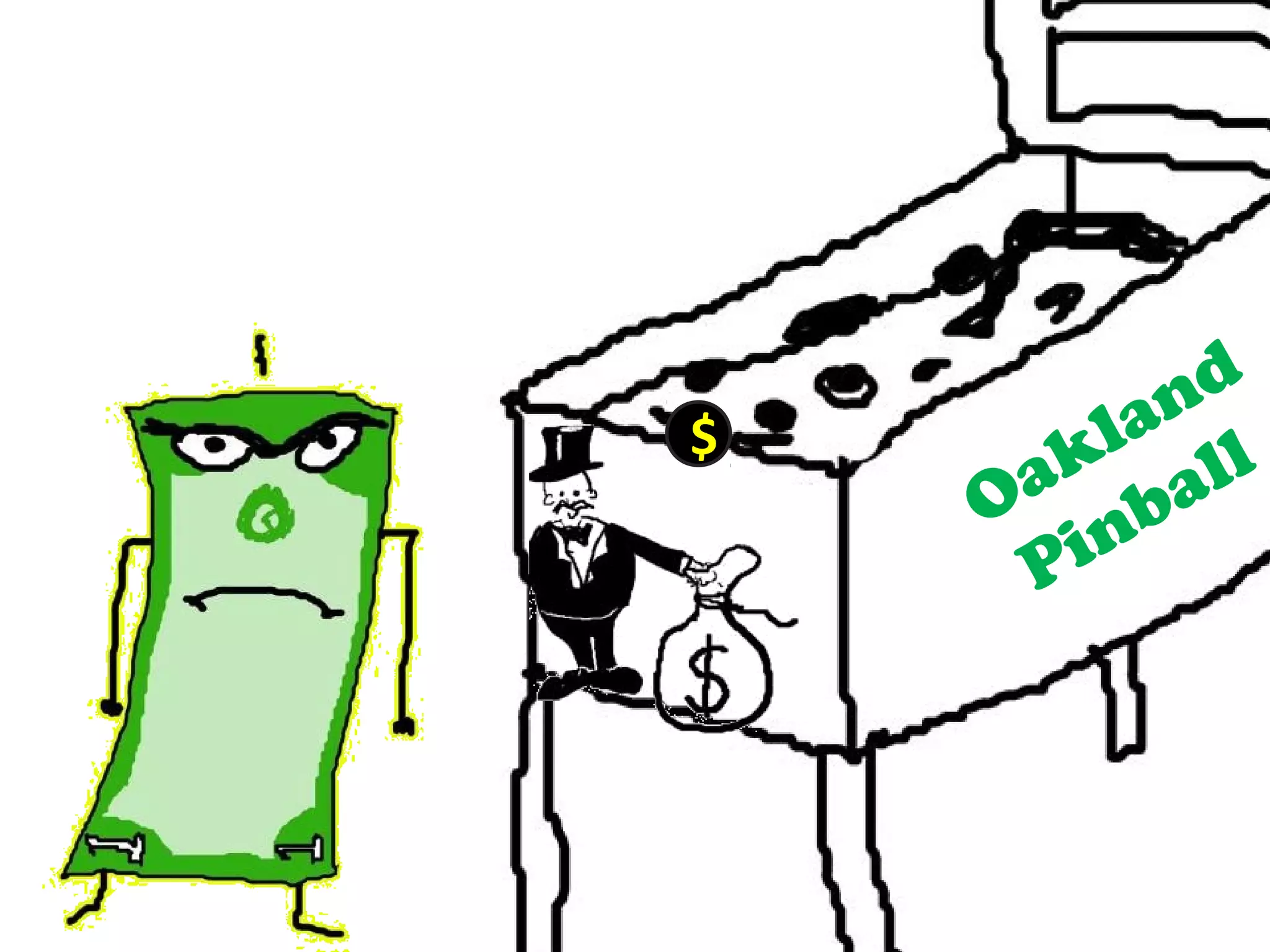

The document discusses legal tools and frameworks for worker cooperatives and the sharing economy, emphasizing the importance of creating new organizational structures that foster collaboration and community engagement. It outlines various cooperative models, regulatory challenges, and strategies for adapting existing laws to better support the new economic paradigm. Key concepts include entity structures, governance, and the need for legal innovation to facilitate equitable access and sustainable practices in economic activities.

![“No person shall buy, sell, deliver, or give milk that has not [been certified].”

SO, what does it mean to be in possession of ….

The issue at stake is not milk or cows or goats, per se…

It’s our right to collectively produce things that we consume.](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-96-2048.jpg)

![What is a Private Club?

FROM: Appendix B of 28 C.F.R Part 36, www.ada.gov/reg3a.html

Title II of the 1964 Act exempts any "private club or other establishment not in fact

open to the public […]” In determining whether a private entity qualifies as a private

club under Title II, courts have considered such factors as:

•the degree of member control of club operations

•the selectivity of the membership selection process

•whether substantial membership fees are charged

•whether the entity is operated on a nonprofit basis

•the extent to which the facilities are open to the public

•the degree of public funding, and

•whether the club was created specifically to avoid compliance

with the Civil Rights Act.](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-105-2048.jpg)

![Stock Cooperative: A development in which a corporation is formed […] primarily

for the purpose of holding title to […] real property, and all or substantially all of

the shareholders of the corporation receive a right of exclusive occupancy in a

portion of the real property […]

CA Civil Code Section 1351(m)](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-238-2048.jpg)

![Stock Cooperative: A development in which a corporation is formed […] primarily

for the purpose of holding title to […] real property, and all or substantially all of

the shareholders of the corporation receive a right of exclusive occupancy in a

portion of the real property […]

CA Civil Code Section 1351(m)](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-244-2048.jpg)

![GovernancePART 1: Three [or more] Things

I Realized About Governance

It’s all about governance!](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-291-2048.jpg)

![But what about B Corps and

Benefit Corps and [other pretty words]?

A word about profit maximization and how

that affects governance….](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-305-2048.jpg)

![“Determining reasonableness of a restraint on alienation

requires balancing the utility of the purpose served by the

restraint against the harm that is likely to flow from its

enforcement. […] Restraints on alienation of land are used to

accomplish a wide variety of purposes of differing utility:

[…] to retain land in families

[…] to preserve affordable housing

[…] to control entry into communities, like retirement

communities, developed for specialized purposes

[…] to further the conservation, preservation, and

charitable purposes to which land is devoted.”

- Restatement Third of Property, § 3.4 Direct Restraints on Alienation, Comment C at

442 (2000).](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-491-2048.jpg)

![“[Make] your Skill in the Law a

Blessing to your Neighborhood.”

– Cotton Mather (1700ish)](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-545-2048.jpg)

![From the Preamble ABA Model Rules of Professional Conduct:

“Lawyers play a vital role in the preservation of society.”

A lawyer is: “an officer of the legal system and a public citizen having

special responsibility for the quality of justice.”

“[a]s a public citizen, a lawyer should seek improvement of the law,

access to the legal system, the administration of justice and the

quality of service rendered by the legal profession.”

Purpose of Law and Legal Profession](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-555-2048.jpg)

![Lawyers and Civil Disobedience

See: CAL 2003-162

Hmmm: “A state may not forbid or proscribe the advocacy of a

violation of law except where such advocacy is directed to inciting

or producing imminent lawless action and is likely to incite or

produce such action.” (Brandenburg v. Ohio (1969) 395 U.S. 444 [89 S. Ct.

1827].)

“Attorney’s status as a lawyer does not change the analysis. To

the extent speech is constitutionally protected, Attorney has the

First Amendment right to advocate political and social change

through the violation of law, even though the First Amendment

rights of lawyers are limited in certain respects.” (See Standing

Committee on Discipline v. Yagman (9th Cir. 1995) 55 F.3d 1430)

Read more here:

“Civil Disobedience and the Lawyer's Obligation to the Law,” Judith A. McMorrow,

Boston College - Law School, Washington and Lee Law Review, Vol. 48, pp. 139-163,](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-568-2048.jpg)

![By the way…

NY Bar Admission Rules § 520.4 Study of Law in Law Office

(a)General. An applicant may qualify to take the New York State bar examination by […]

(2) the applicant successfully completed the prescribed requirements of the first year of

full-time study in a first degree in law program at an approved law school […]

(5) the applicant thereafter studied law in a law office or offices located within New

York State, under the supervision of one or more attorneys admitted to practice law in

New York State, for such a period of time as, together with the credit permitted pursuant

to this section for attendance in an approved law school, shall aggregate four years.

(b) Employment and instruction requirements. An applicant studying law in a law office or

offices within New York State must be actually and continuously employed during the

required period as a regular law clerk and student in a law office, under the direction and

subject to the supervision of one or more attorneys admitted to practice law in New York

State, and must be actually engaged in the practical work of such law office during

normal business hours. In addition, the applicant must receive instruction from the

supervising attorney or attorneys in those subjects that are customarily taught in

approved law schools.](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-586-2048.jpg)

![Legal Structure of Law Practice, Part 1

• No: Partnerships with non lawyers (Rule 1-310)

• Sole Proprietorship

• Partnership

• Limited Liability Partnership (LLP)

• Professional Corporation

• “Professional corporation” means a corporation organized under the General

Corporation Law […] engaged in rendering professional services in a single profession,

[…]pursuant to a certificate of registration issued by the governmental agency

regulating the profession. (Corporations Code 13400)

•Shares of capital stock in a professional corporation may be issued only to a licensed

person or to a person who is licensed to render the same professional services

(Corporations Code 13406)

•A law corporation is a corporation which is registered with the State Bar of California and has

a currently effective certificate of registration from the State Bar pursuant to the Professional

Corporation Act (Business & Professions Code 6160)

•And if you think you’ll bring in a lot of money, choosing to be taxed as an S-Corp will

save you on taxes.

• Not: LLC, Cooperative Corporation

• Nonprofit: But can you charge regular lawyer fees if you are a

nonprofit?](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-591-2048.jpg)

![CAL 1992-126

Rule 1-320 prohibits an attorney from dividing fees with a

non- attorney even with the consent of the client.

Consequently, an attorney who paid his secretary a

percentage of his legal fees was guilty of the illegal

division of fees. (See Gassman v. State Bar (1976) 18 Cal.3d 125 [132 Cal.Rptr.

675]

Fee-Splitting with Non-Attorneys](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-593-2048.jpg)

![Organization as Client

See Rule 3-600

In representing an organization, a member shall conform his or

her representation to the concept that the client is the

organization itself, acting through its highest authorized officer,

employee, body, or constituent overseeing the particular

engagement. [….]](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-623-2048.jpg)

![The ABA Section on Dispute Resolution has adopted the following principle in a 2002

Resolution:

“Mediation is a process in which an impartial individual assists the parties in reaching a

voluntary settlement. Such assistance does not constitute the practice of law. The

parties to the mediation are not represented by the mediator. […] In disputes where

the parties’ legal rights or obligations are at issue, the mediator’s discussions with

the parties may involve legal issues. Such discussions do not create an attorney-

client relationship, and do not constitute legal advice, whether or not the mediator is

an attorney.”

ABA Section on Dispute Resolution, “Resolution on Mediation and the Unauthorized

Practice of Law,” Adopted by the Section on February 2, 2002](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-634-2048.jpg)

![A lawyer’s time and

advice is [his/her]

stock in trade.

What to charge?](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-644-2048.jpg)

![Rule 4-400 – Gifts from Clients: A member shall not induce a

client to make a substantial gift, including a testamentary gift, to

the member or to the member's parent, child, sibling, or spouse,

except where the client is related to the member.

CAL 2011-180

[…] in deciding whether a gift is “insubstantial,” one must

consider the financial situation of both the client and the lawyer.

“To a poor client, a gift of $100 might be substantial, suggesting

that such an extraordinary act was the result of the lawyer’s

overreaching. To a wealthy client, a gift of $1,000 might seem

insubstantial in relation to the client’s assets, but if substantial in

relation to the lawyer’s assets, it suggests a motivation on the

part of the lawyer to overreach the client-donor. Under either set

of circumstances, the lawyer violates the client’s rights by

accepting

Gifts from Clients](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-650-2048.jpg)

![Fee Agreements

• Legal requirements: See Business & Professions Code 6146-6148

• Business and Professions Code Section 6148: (a) In any case […] in

which it is reasonably foreseeable that total expense to a client,

including attorney fees, will exceed one thousand dollars ($1,000), the

contract for services in the case shall be in writing.

• Rule 3-410: A member who knows or should know that he or she does

not have professional liability insurance shall inform a client in writing,

at the time of the client's engagement of the member, that the member

does not have professional liability insurance whenever it is reasonably

foreseeable that the total amount of the member's legal representation

of the client in the matter will exceed four hours.

• The State Bar has samples, but they are LONG:

http://www.calbar.ca.gov/Portals/0/documents/mfa/Sample-Fee-Agreem](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-651-2048.jpg)

![“[Make] your Skill in the Law a

Blessing to your Neighborhood.”

– Cotton Mather (1700ish)](https://image.slidesharecdn.com/slidesfromday1-150210142311-conversion-gate02/75/Legal-Tools-for-Worker-Cooperatives-and-the-Sharing-Economy-654-2048.jpg)