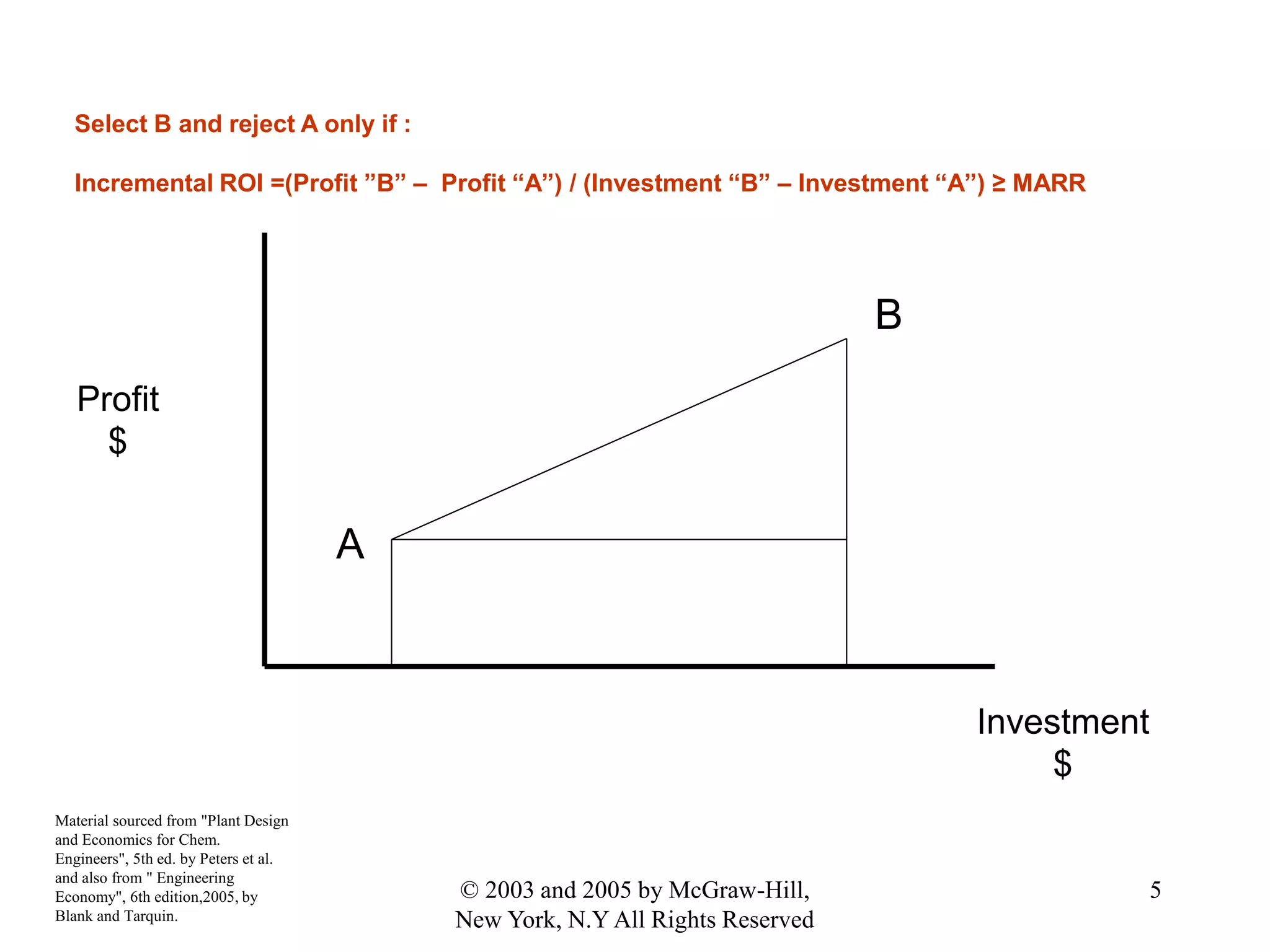

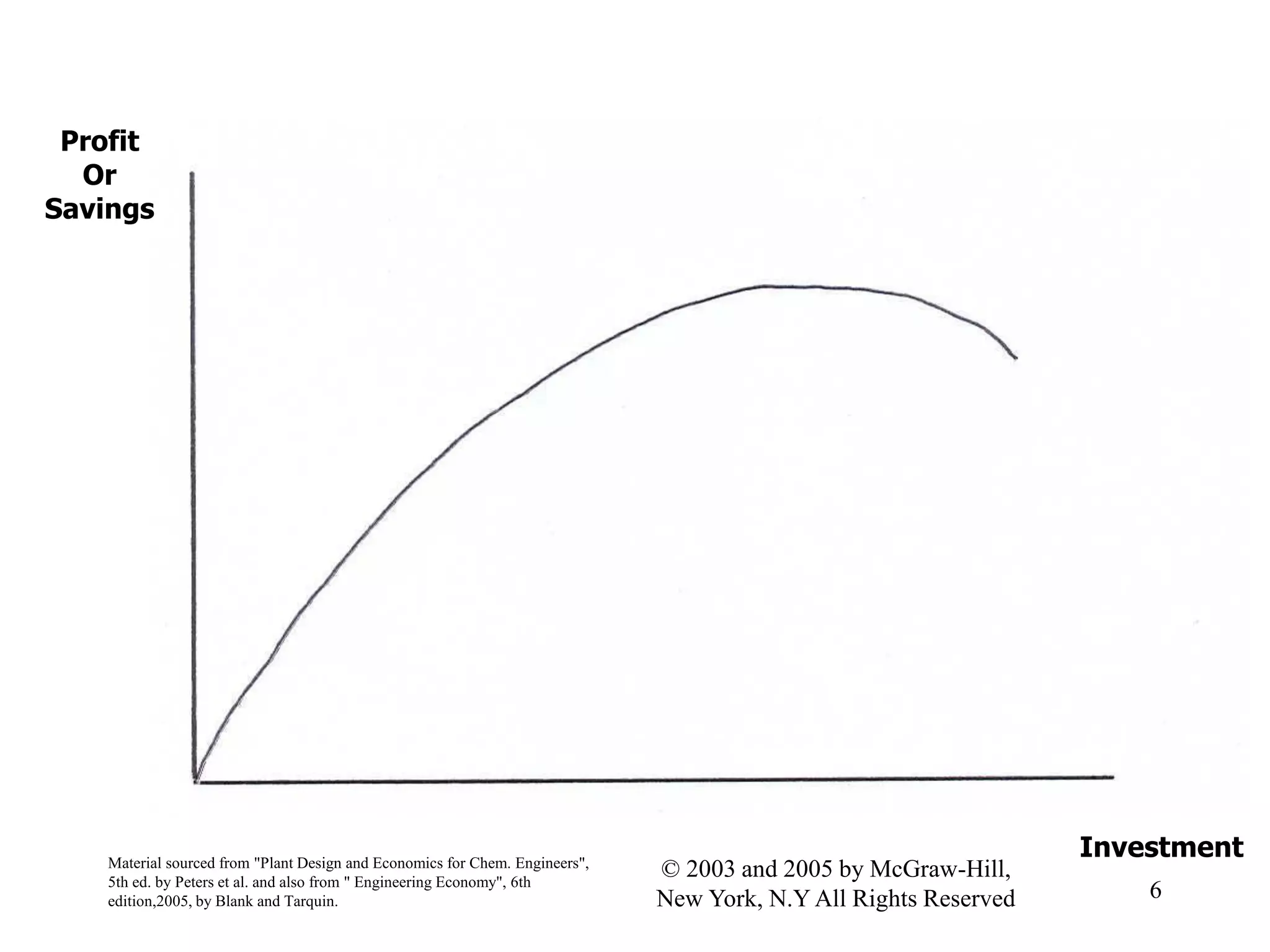

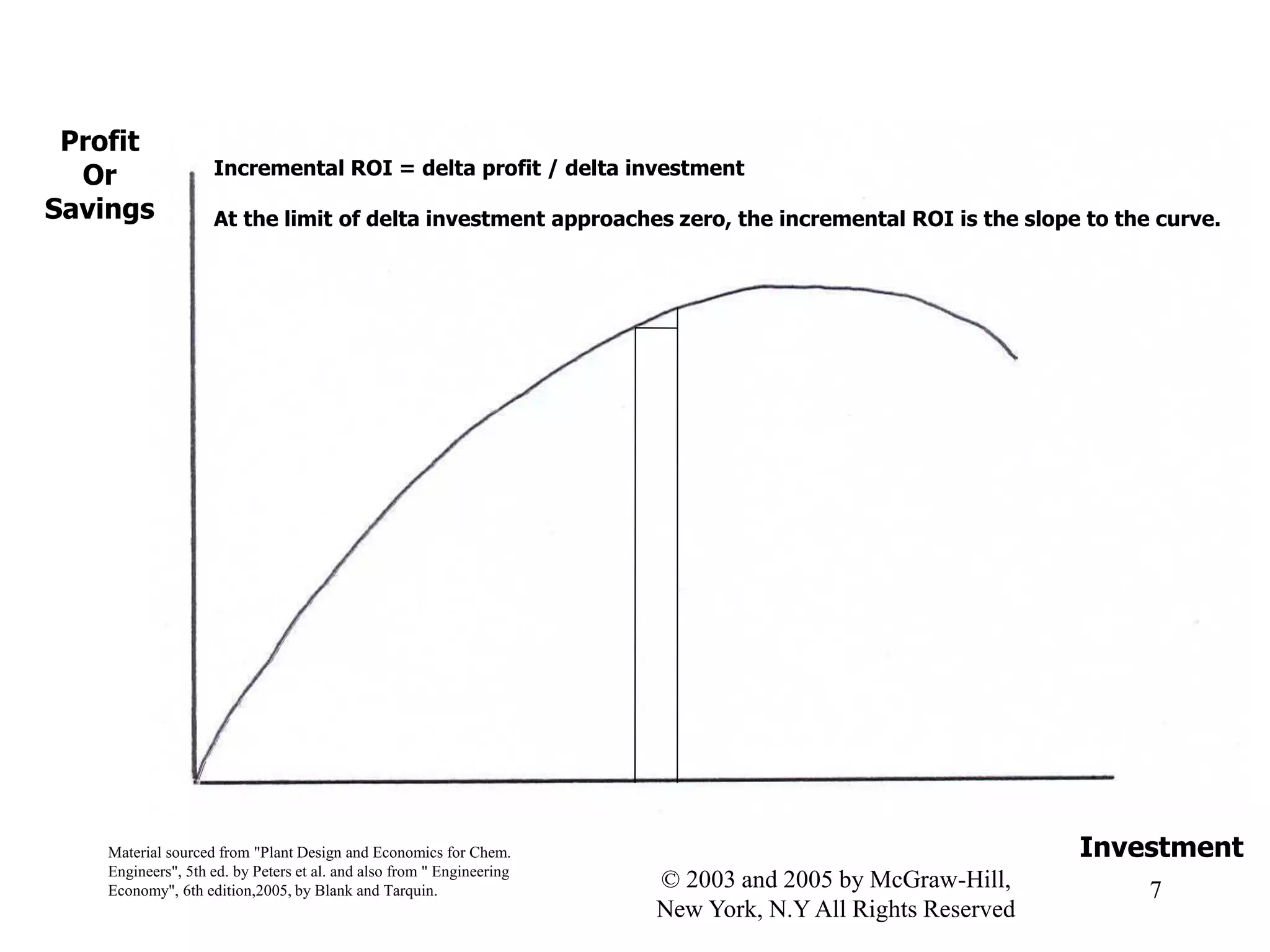

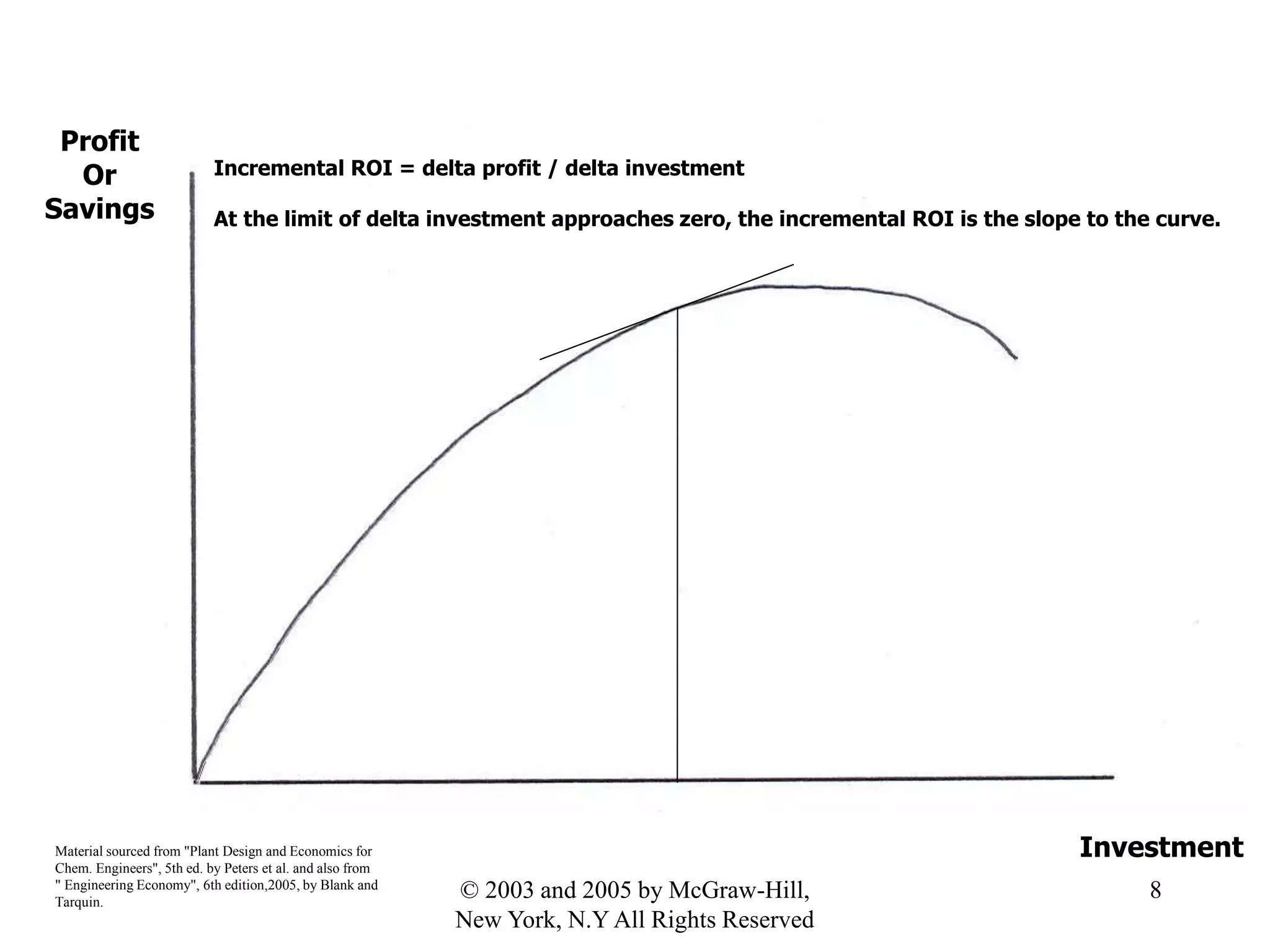

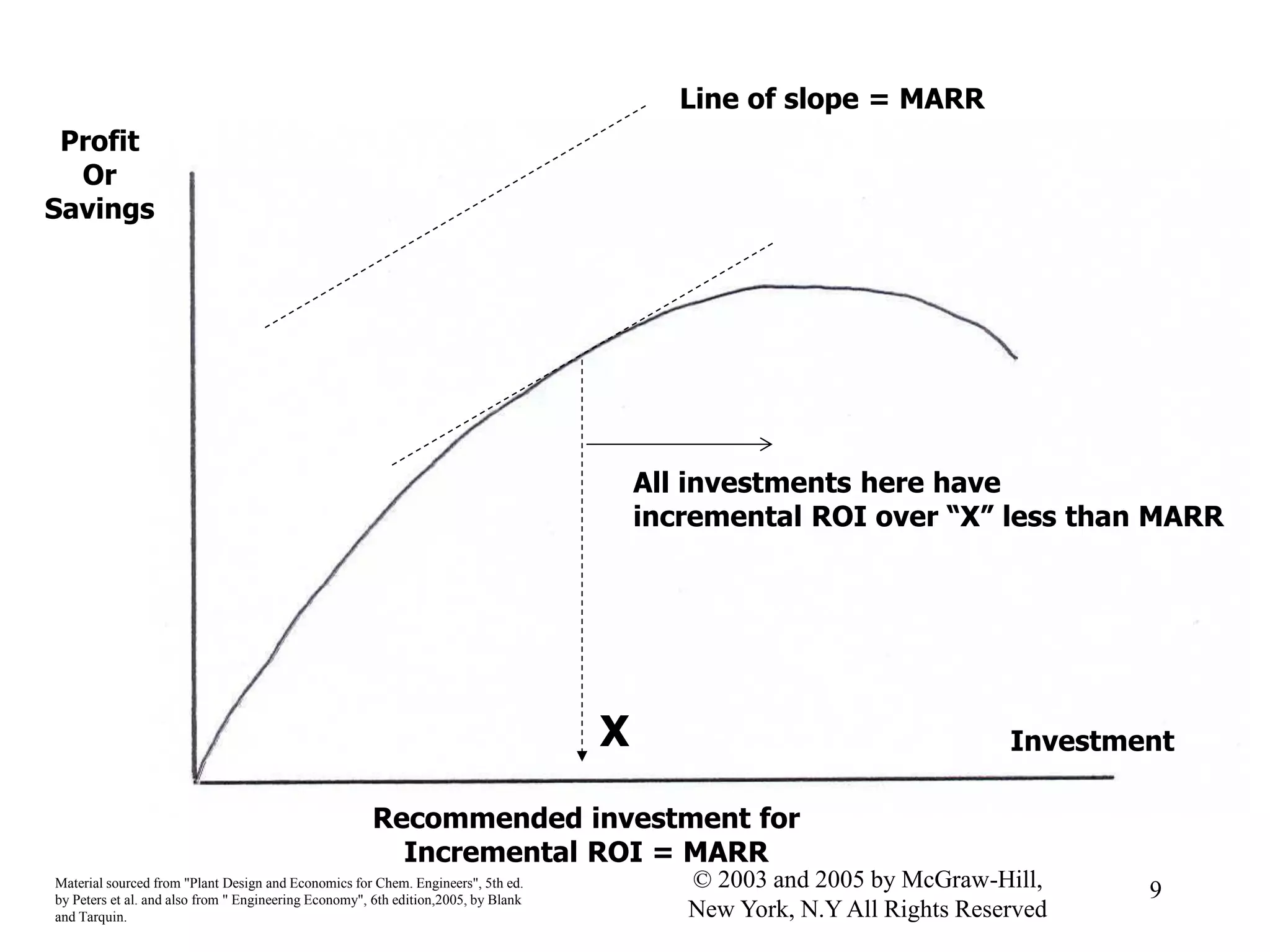

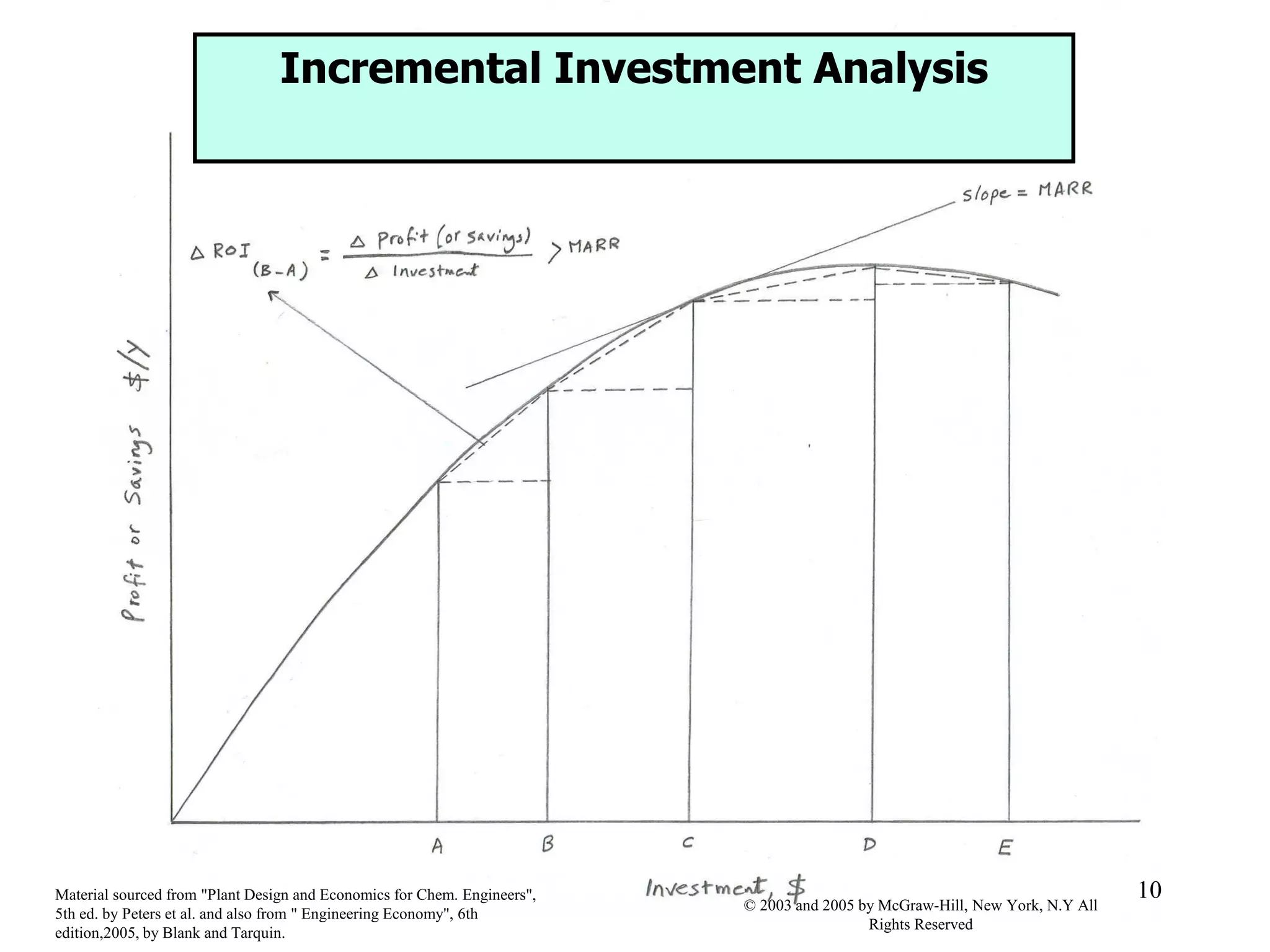

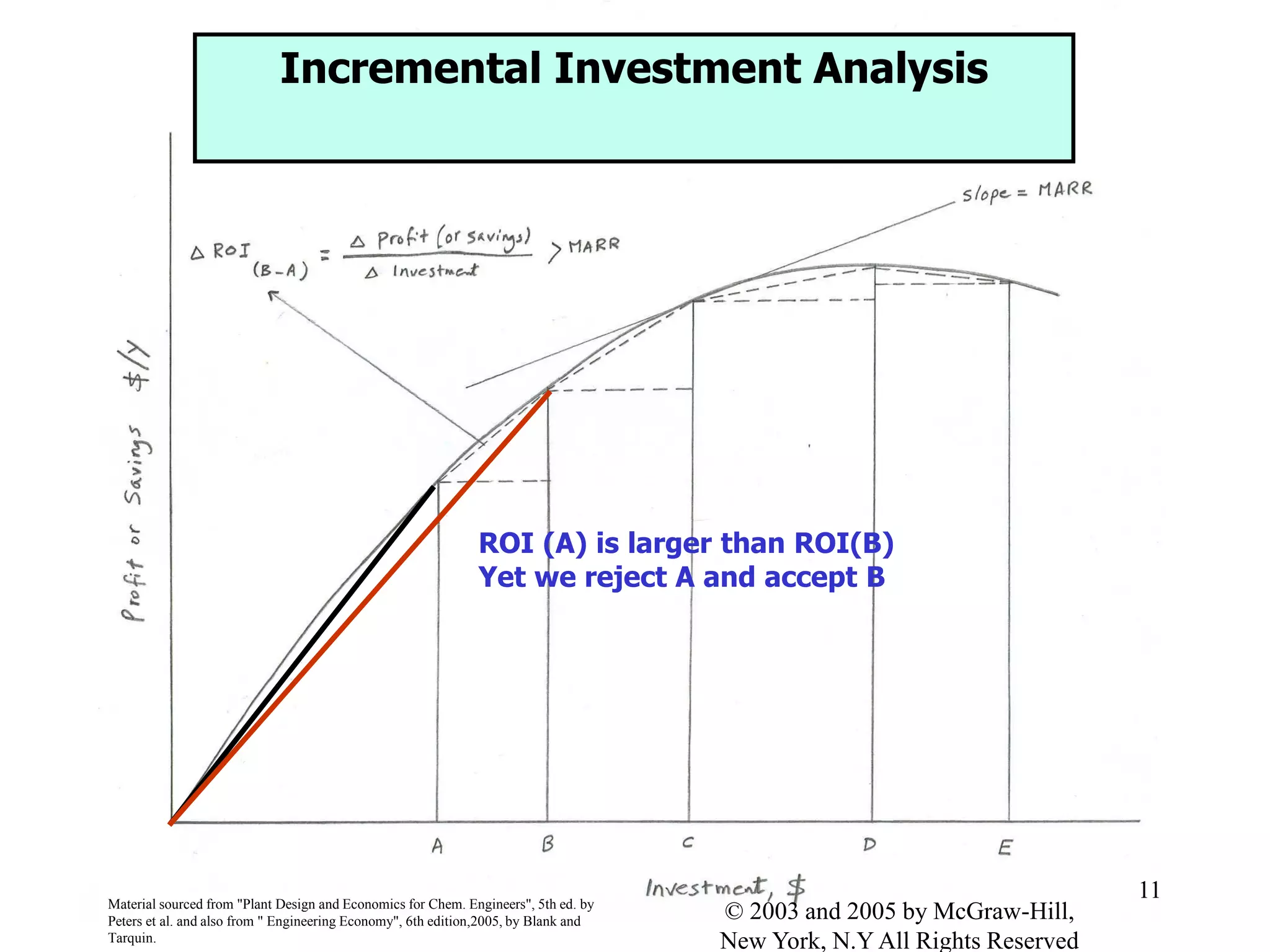

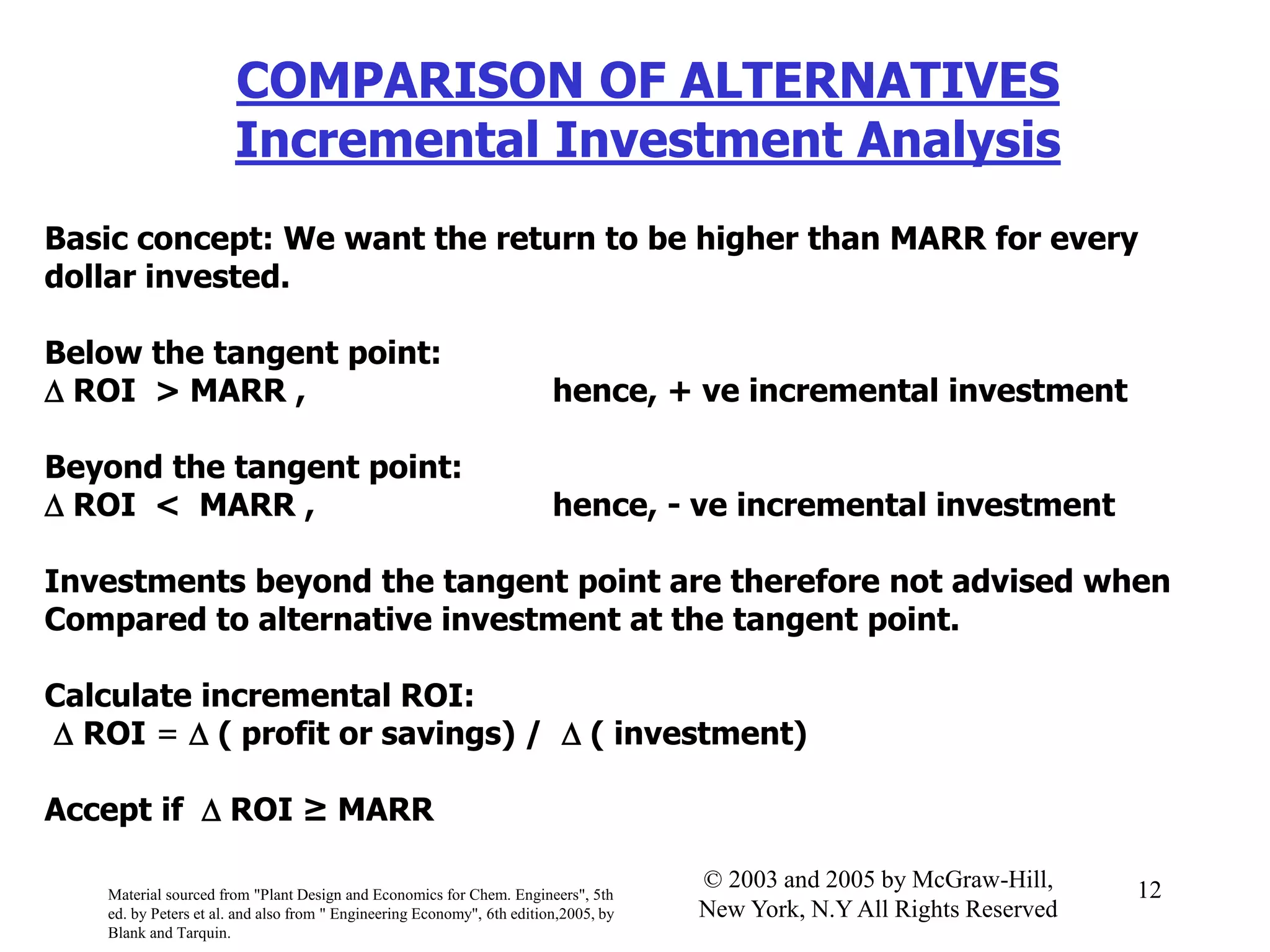

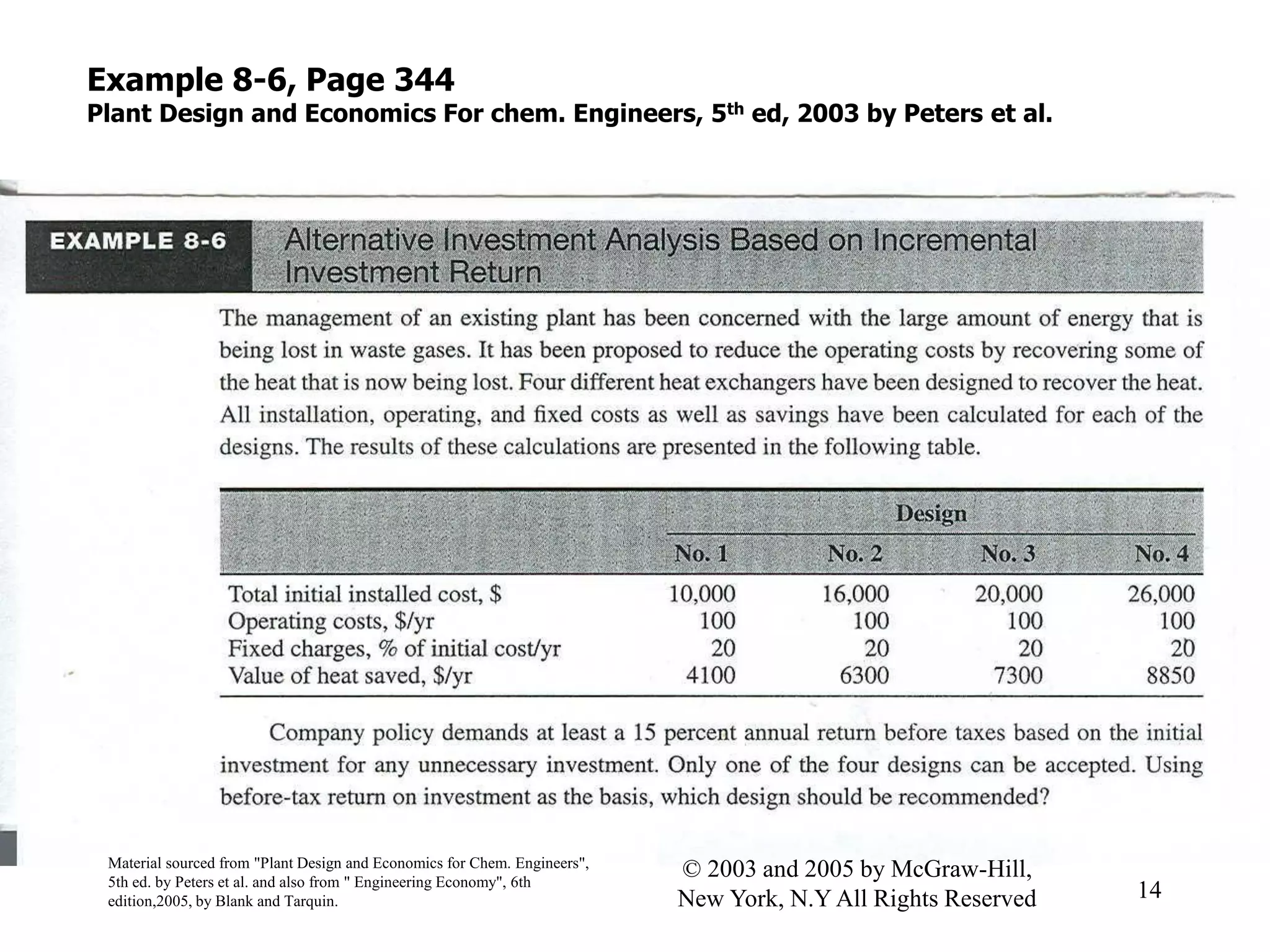

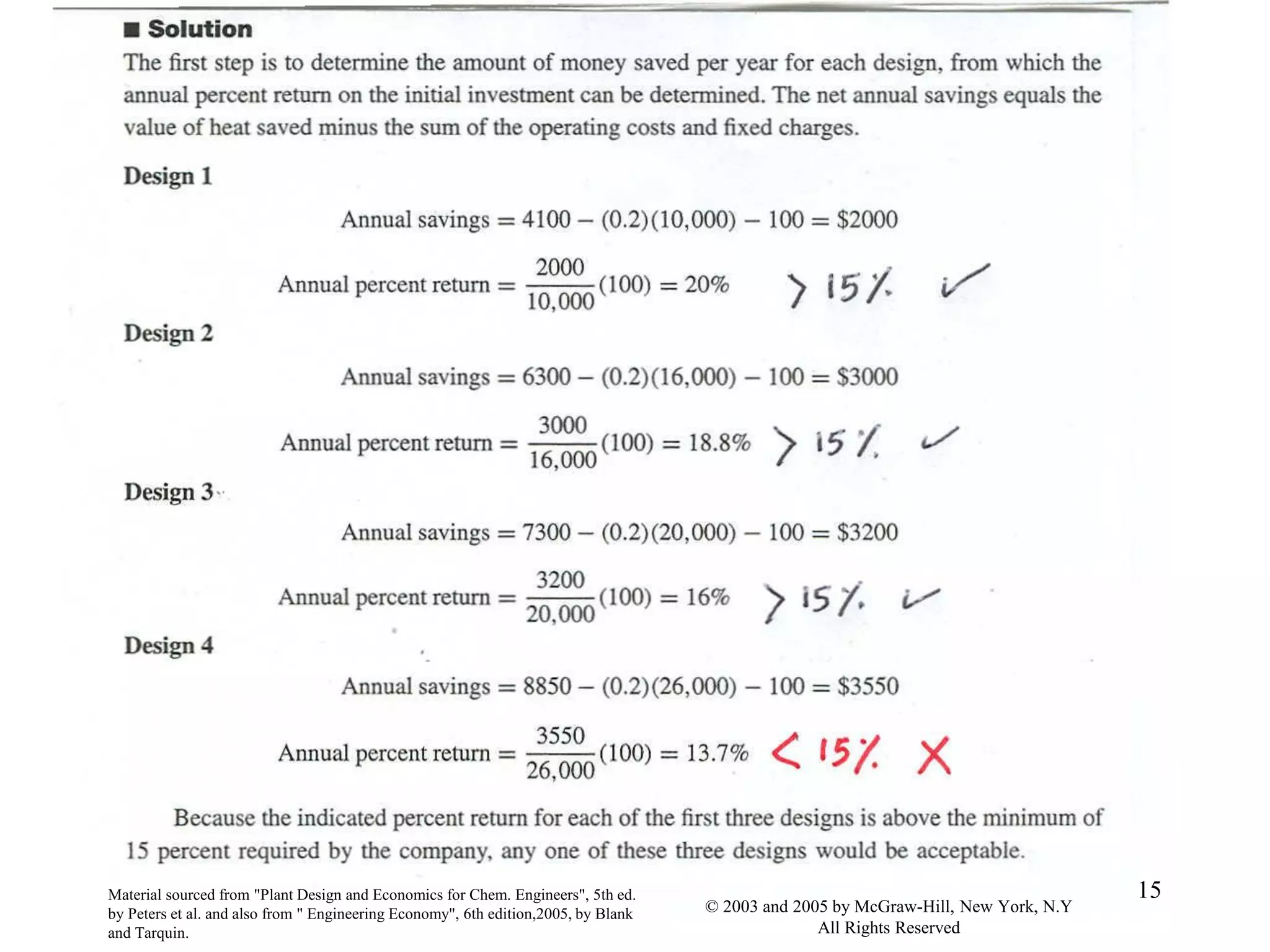

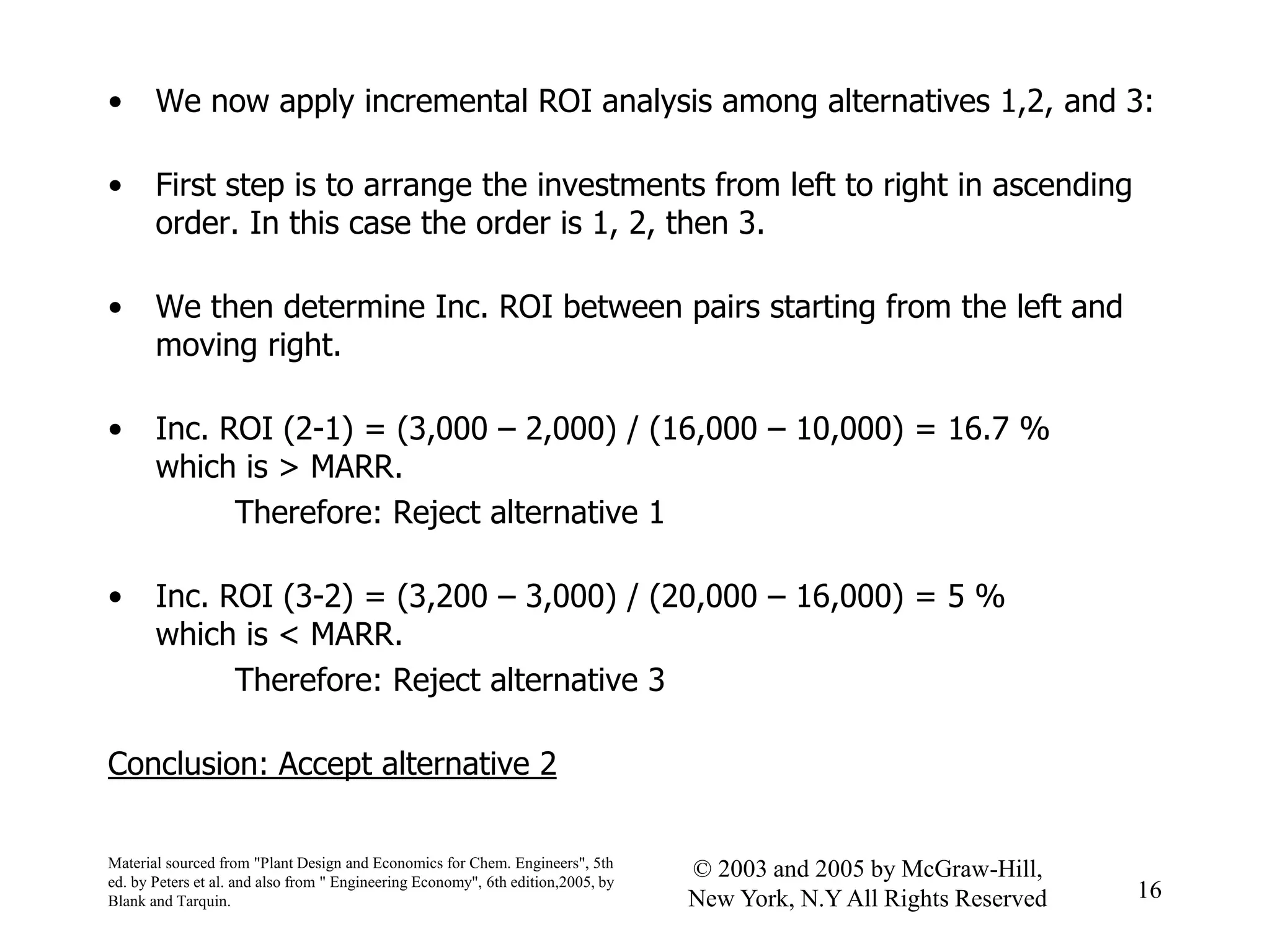

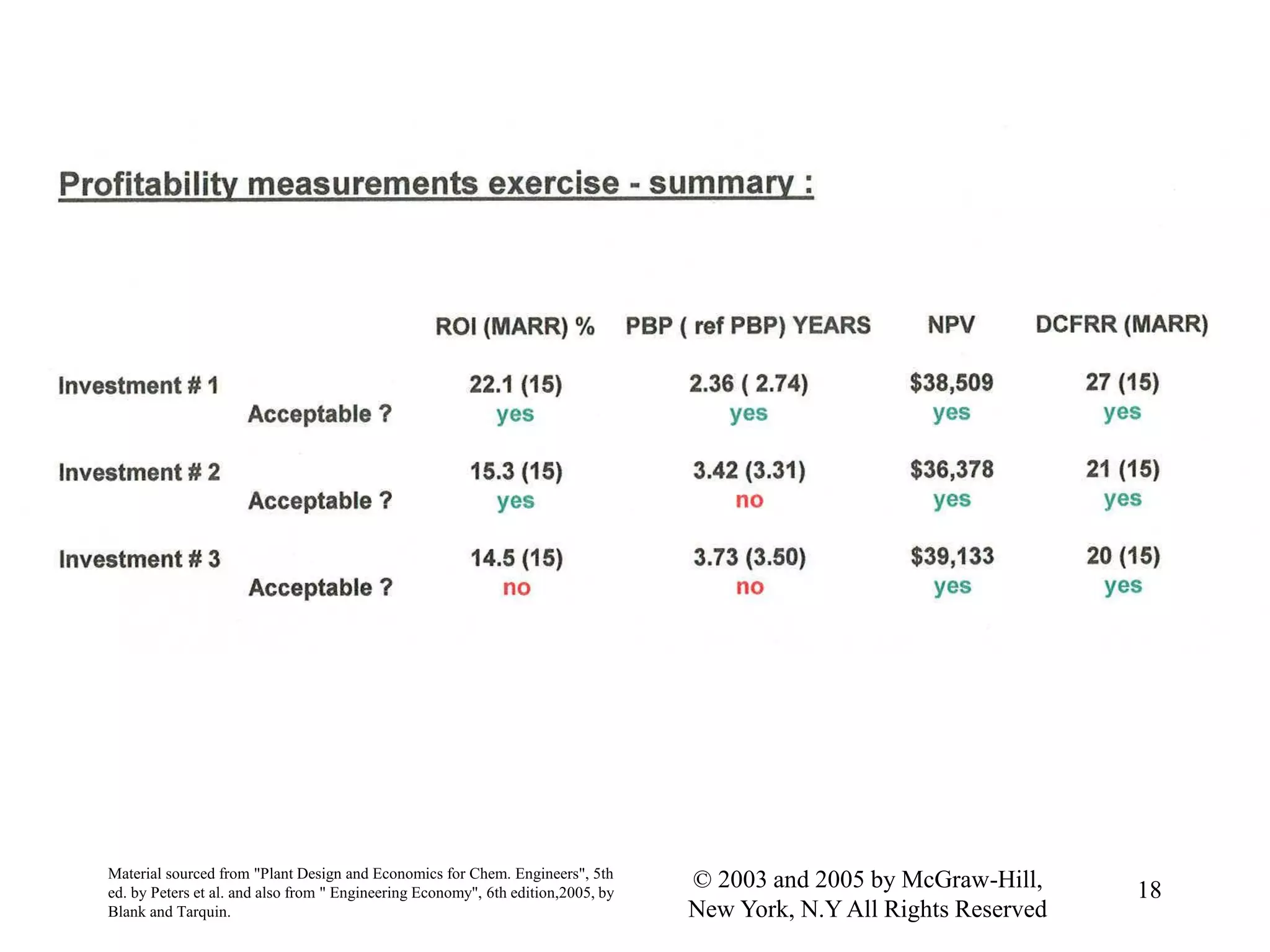

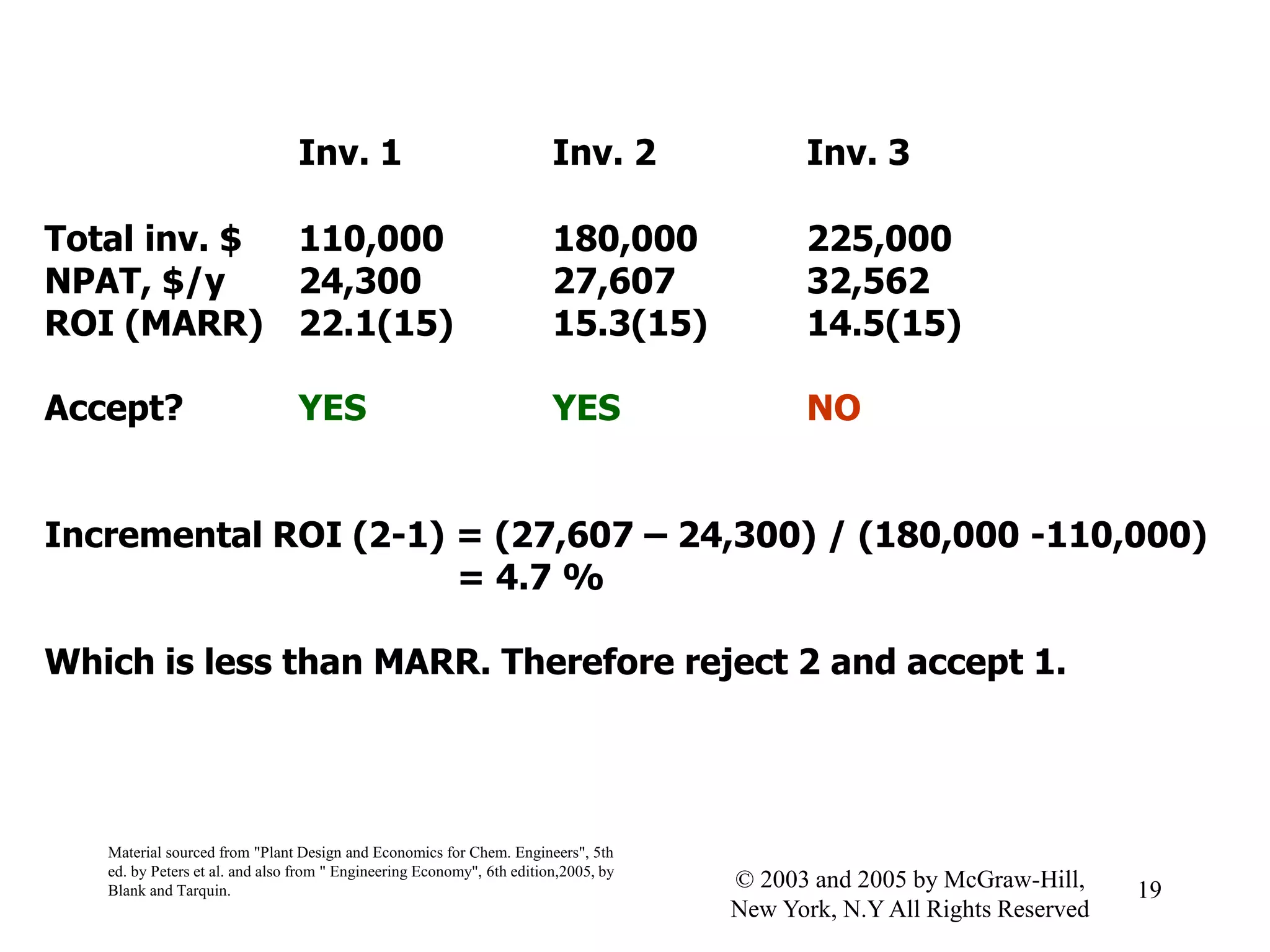

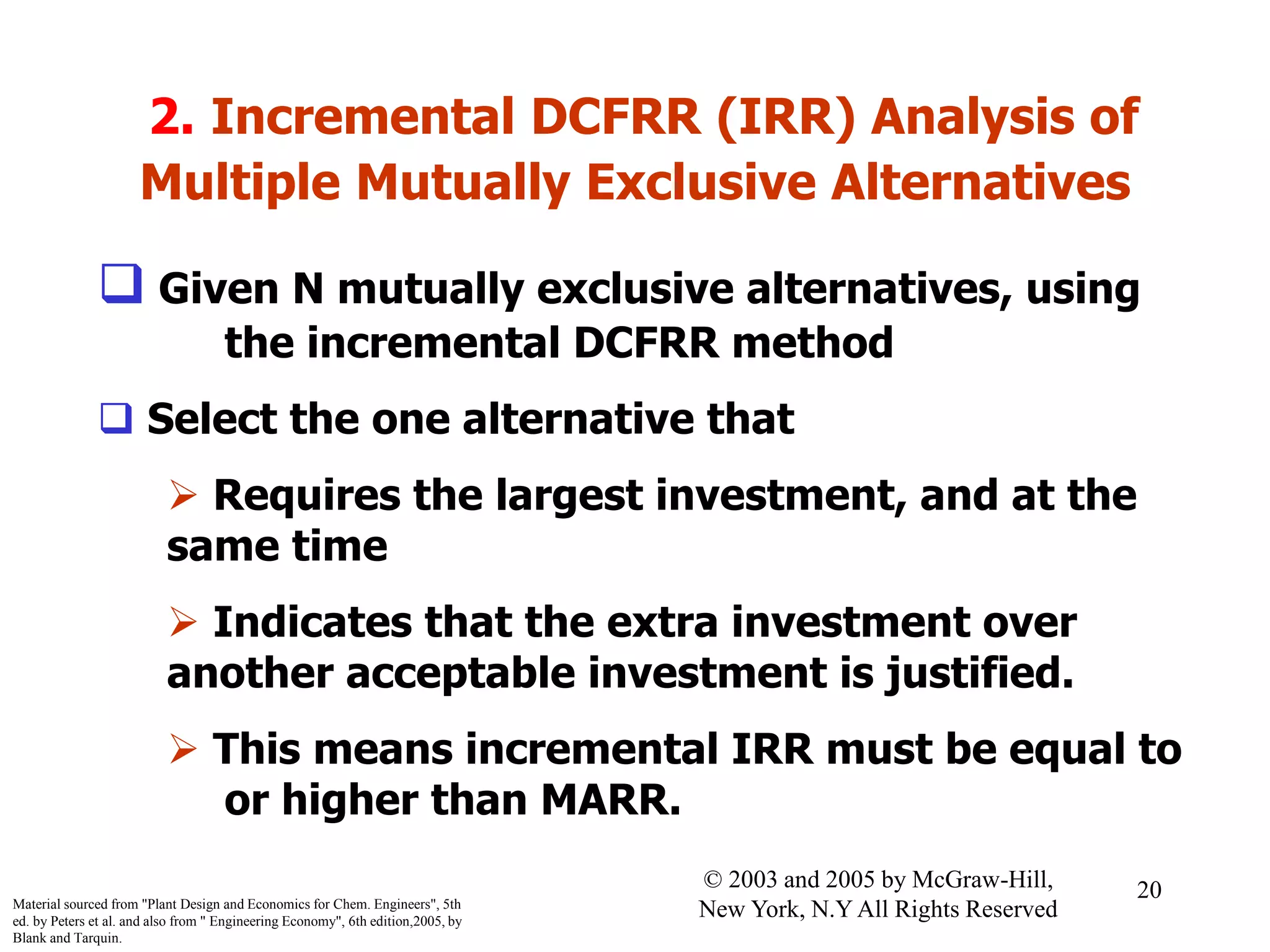

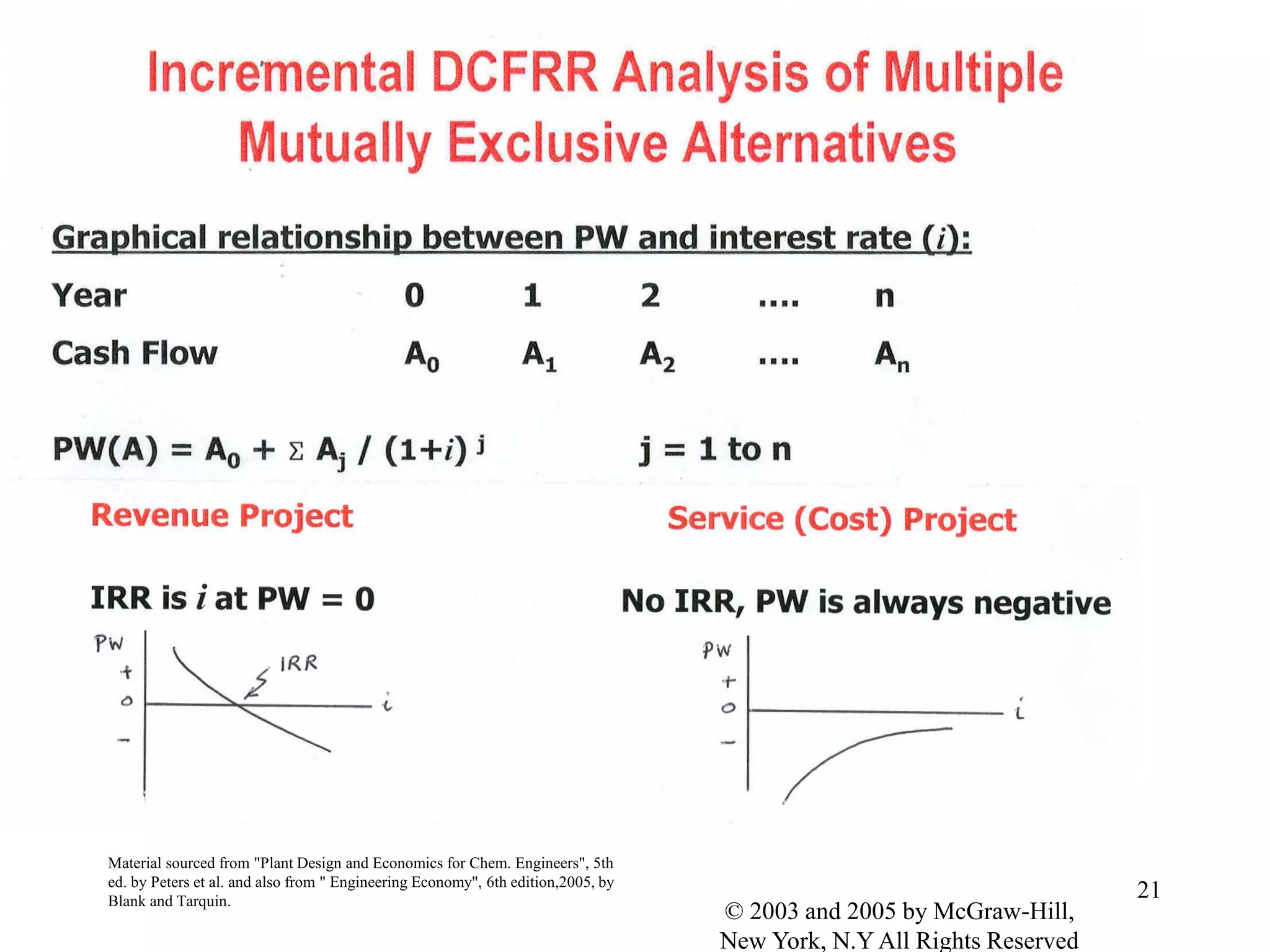

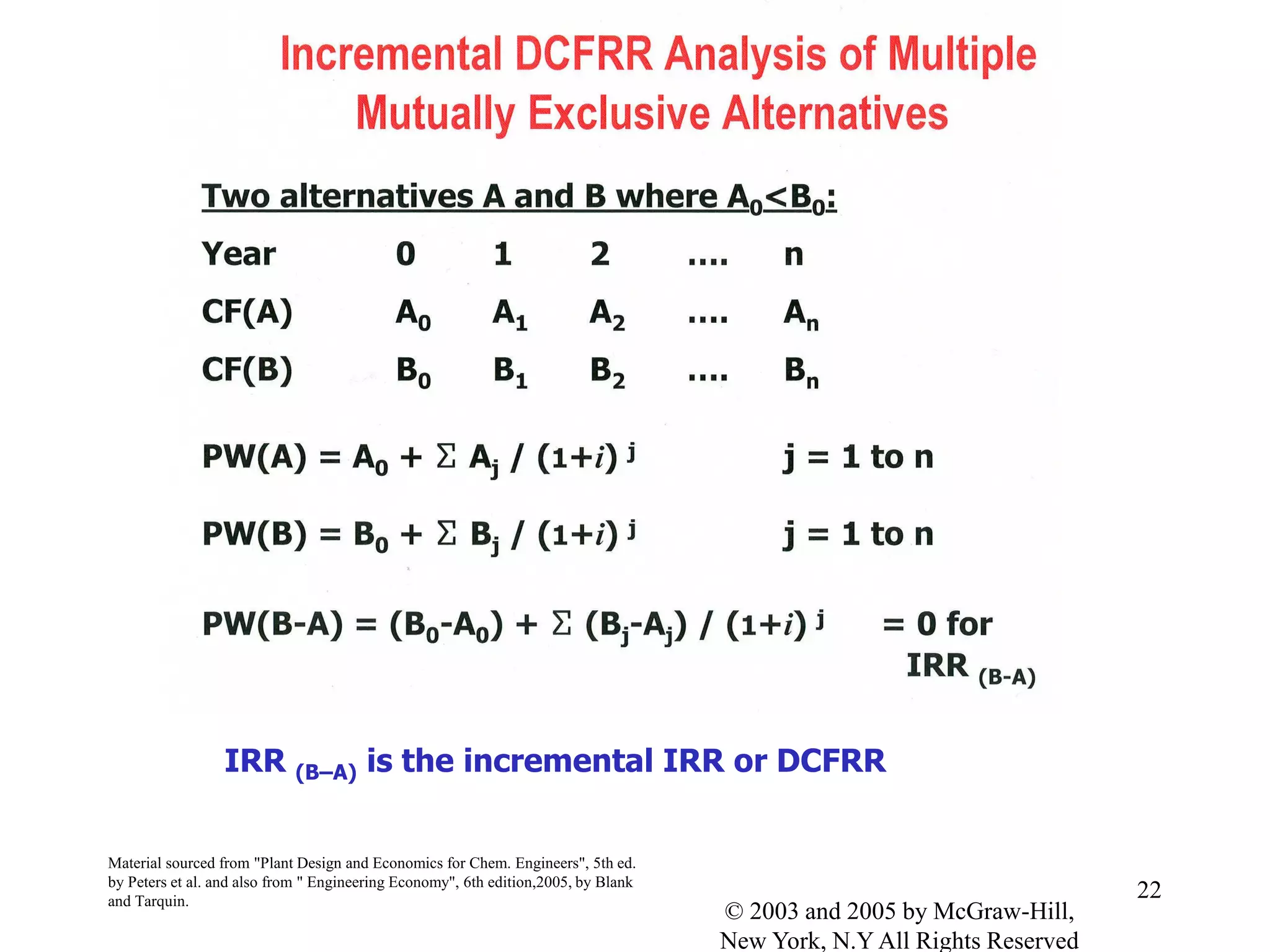

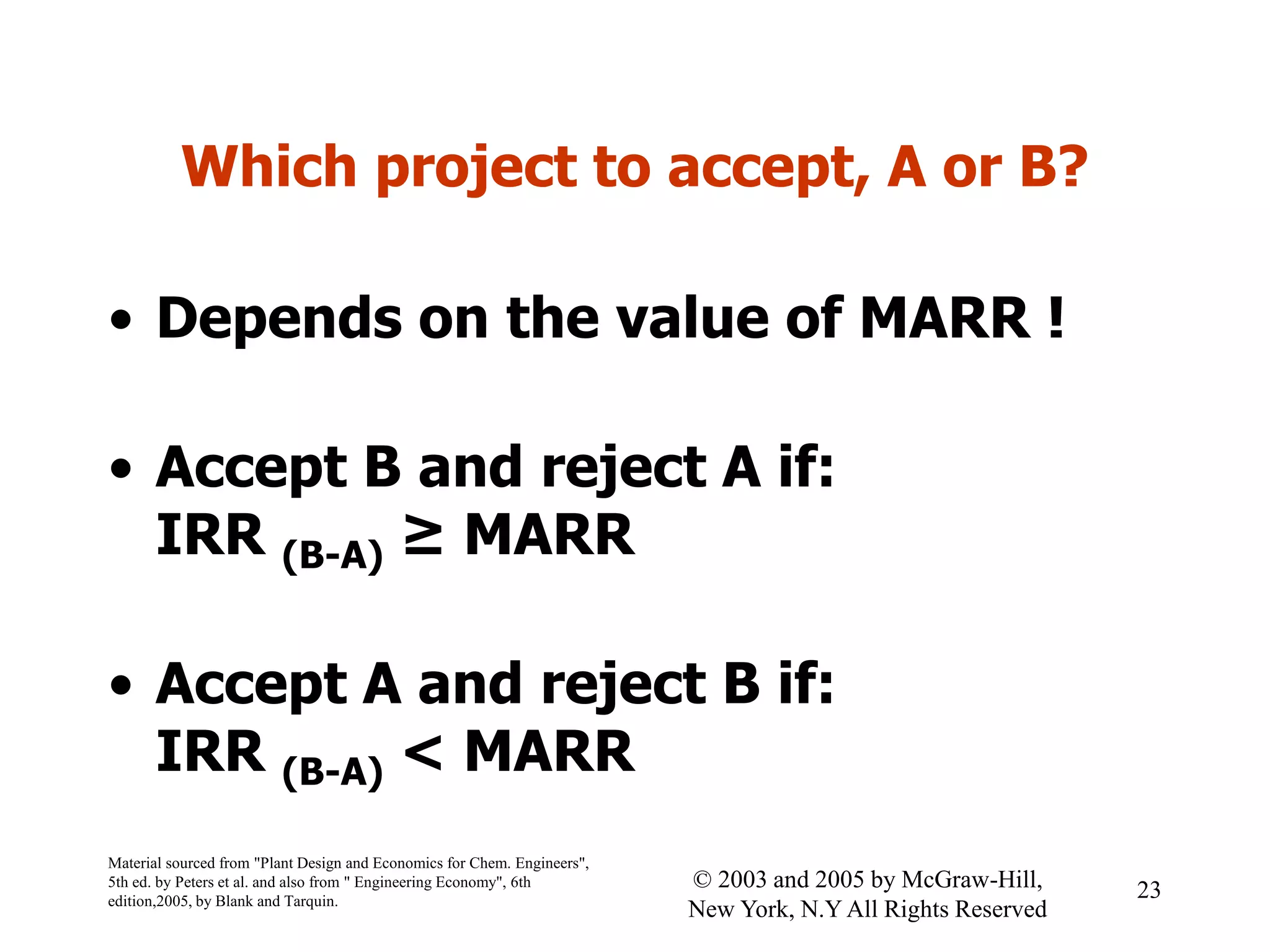

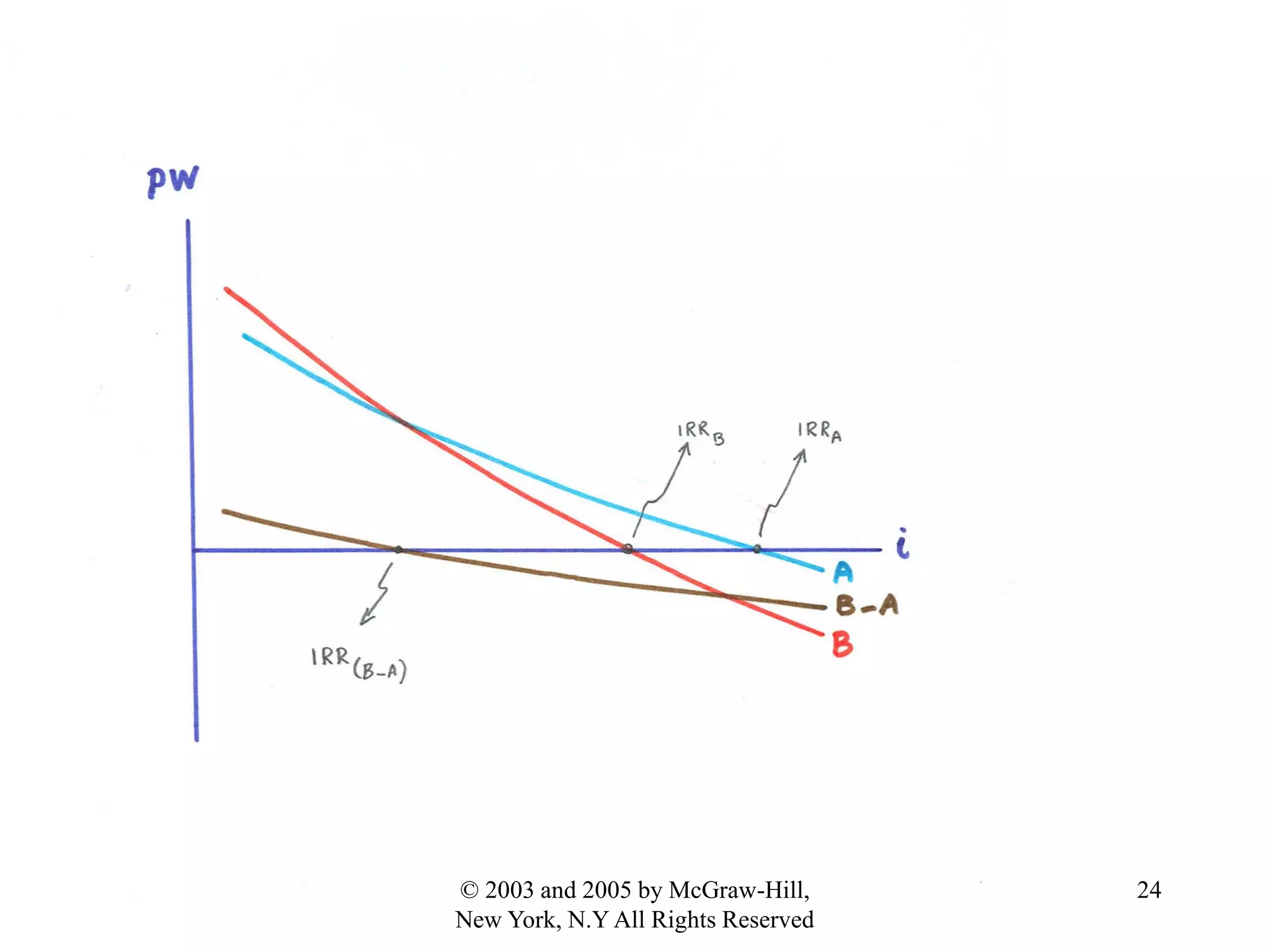

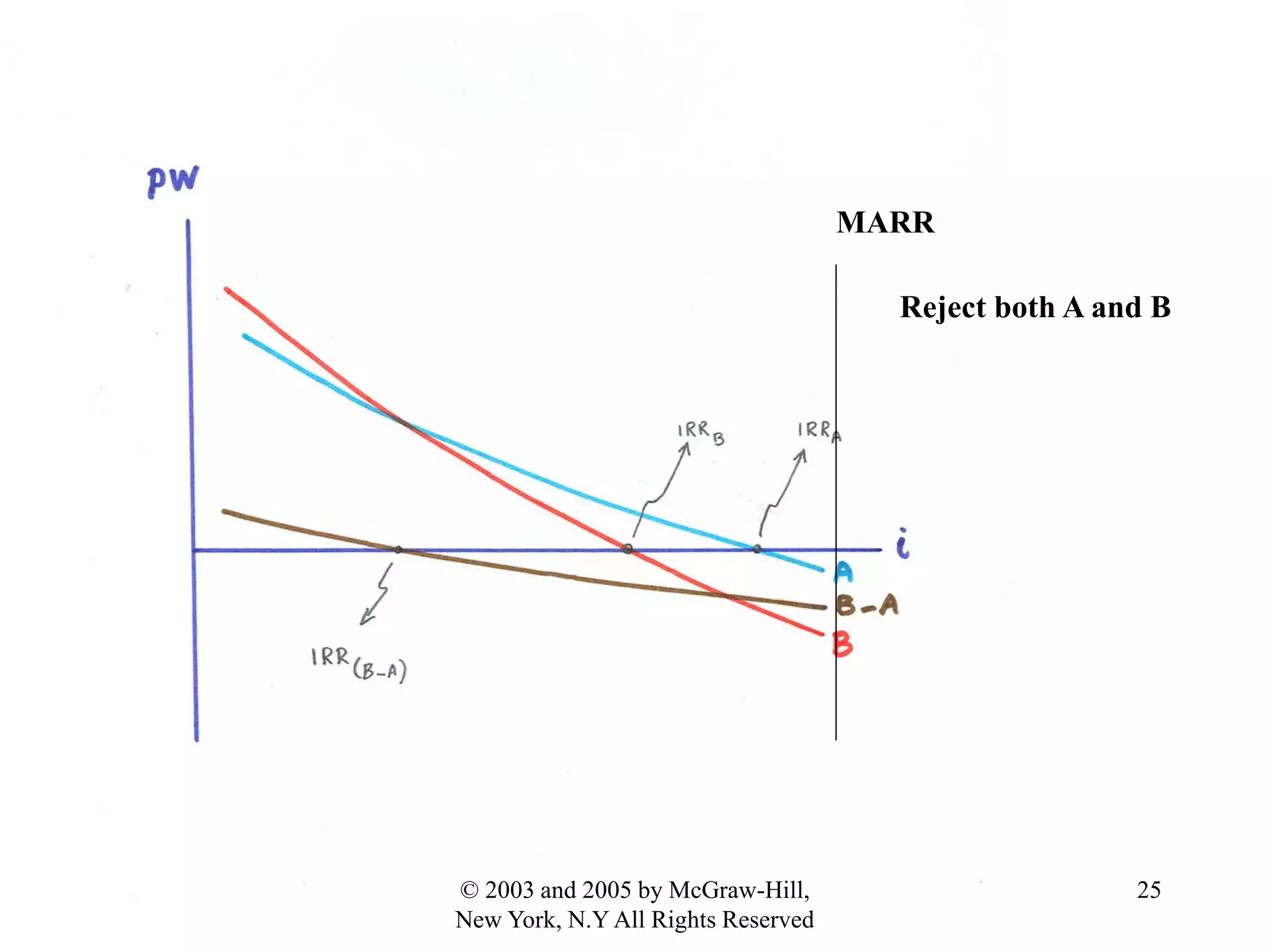

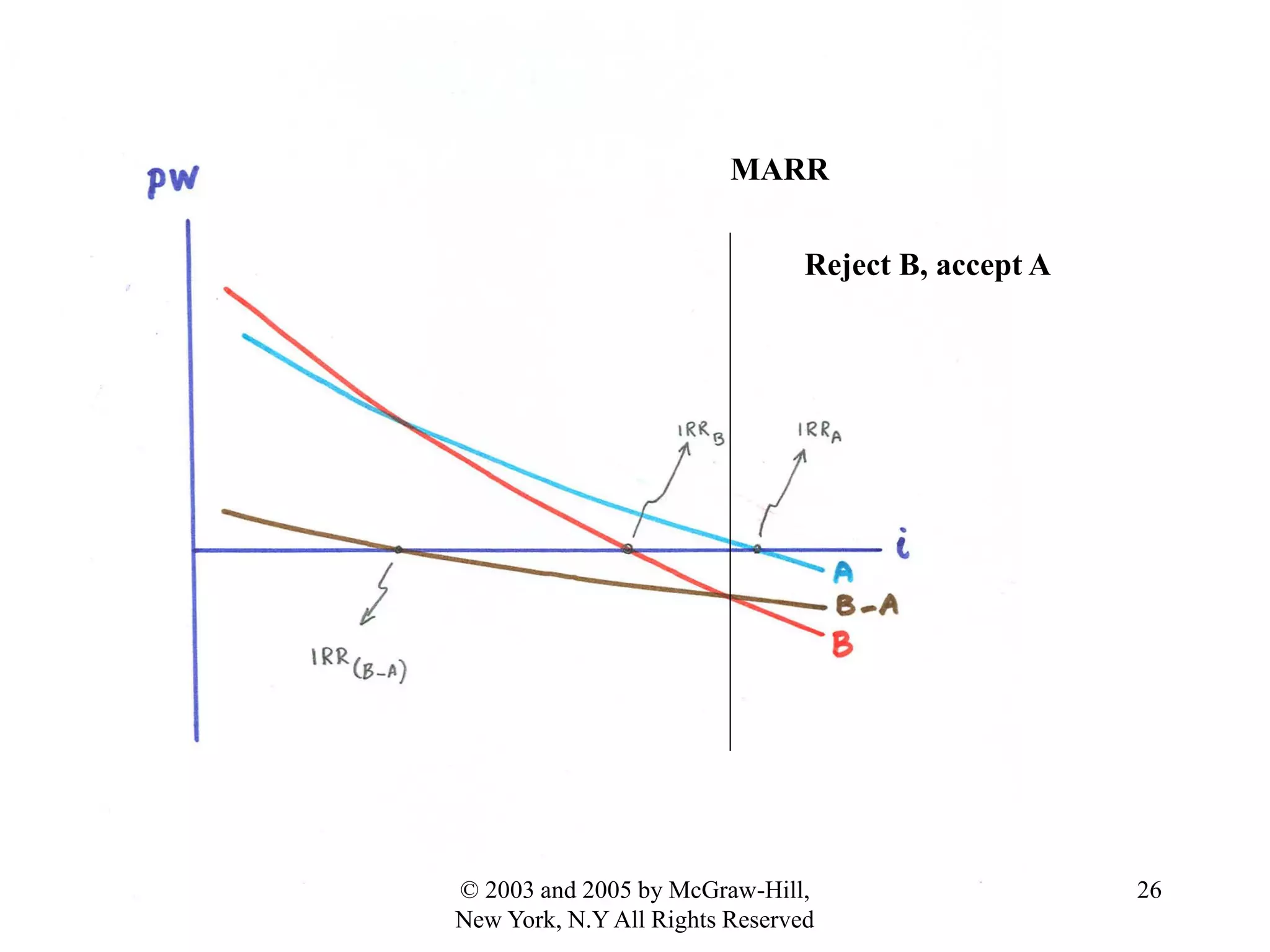

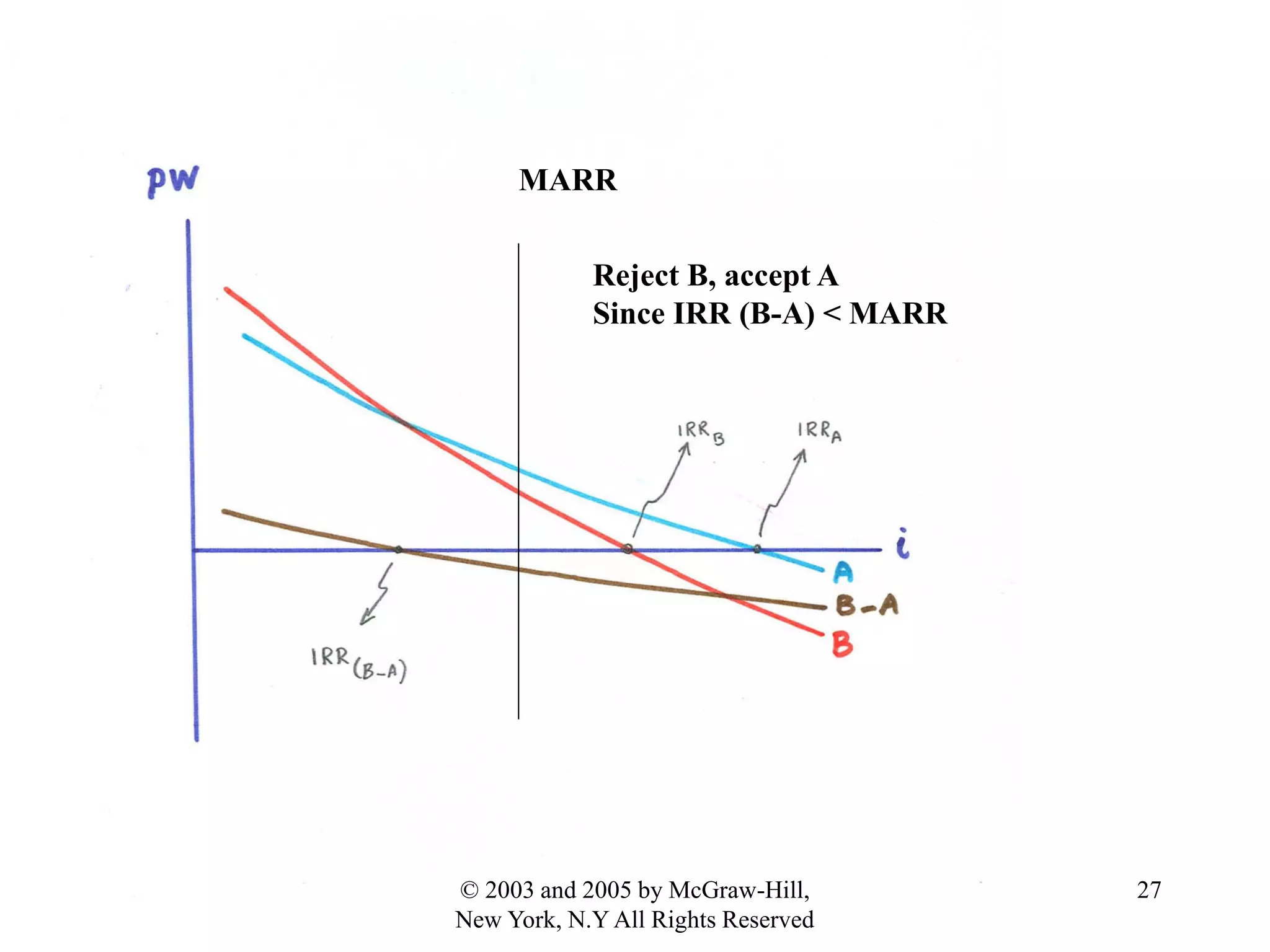

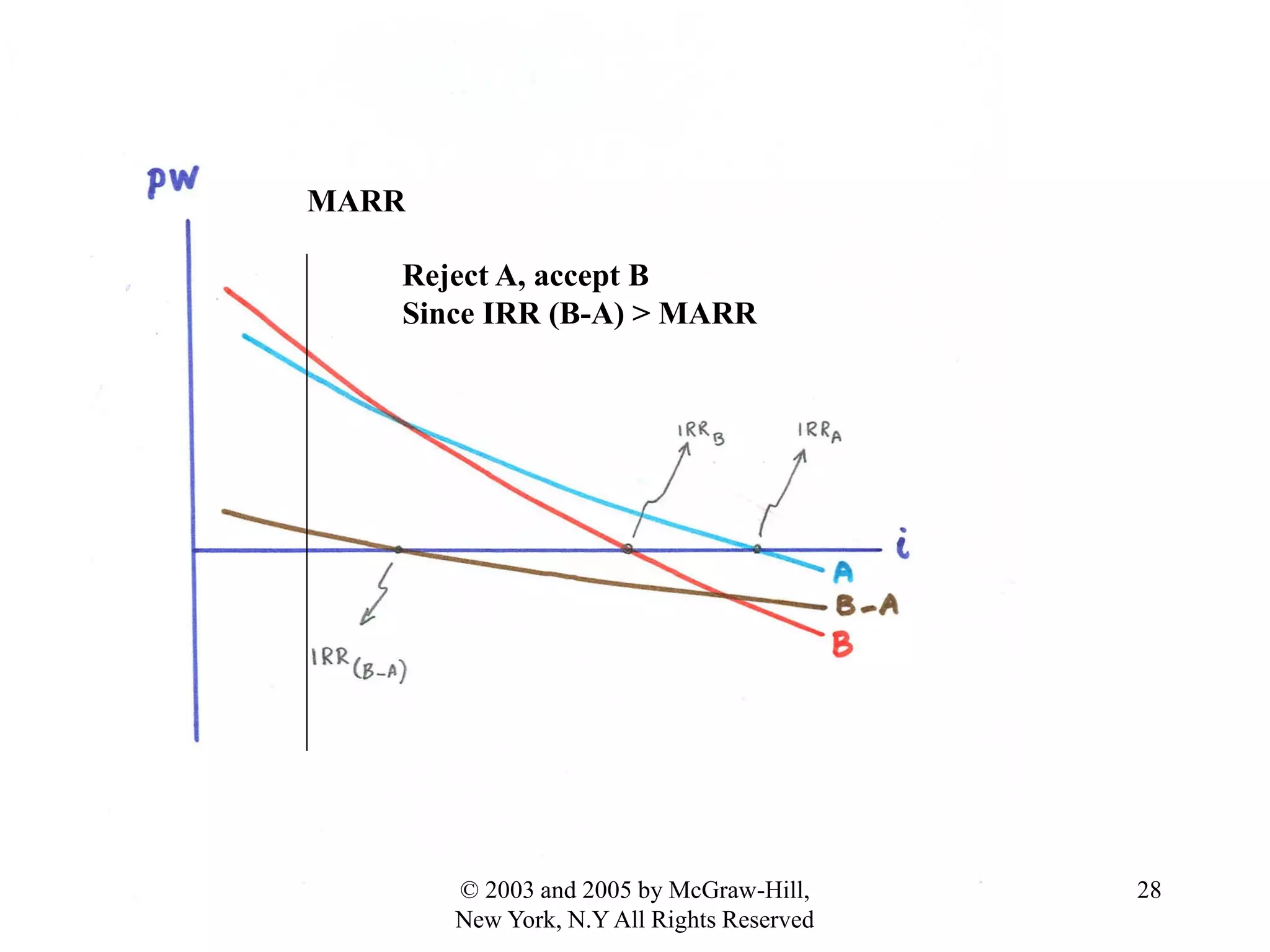

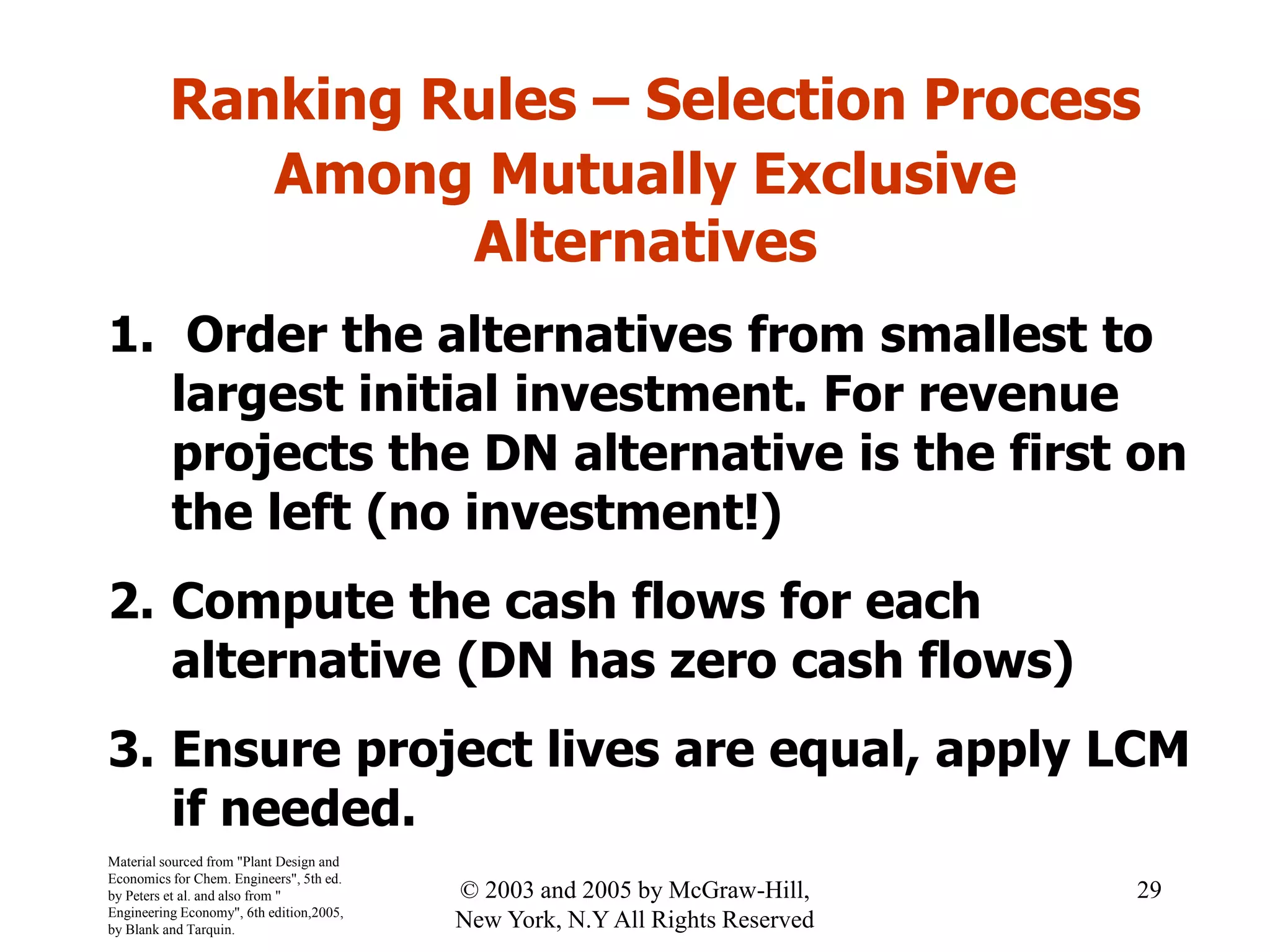

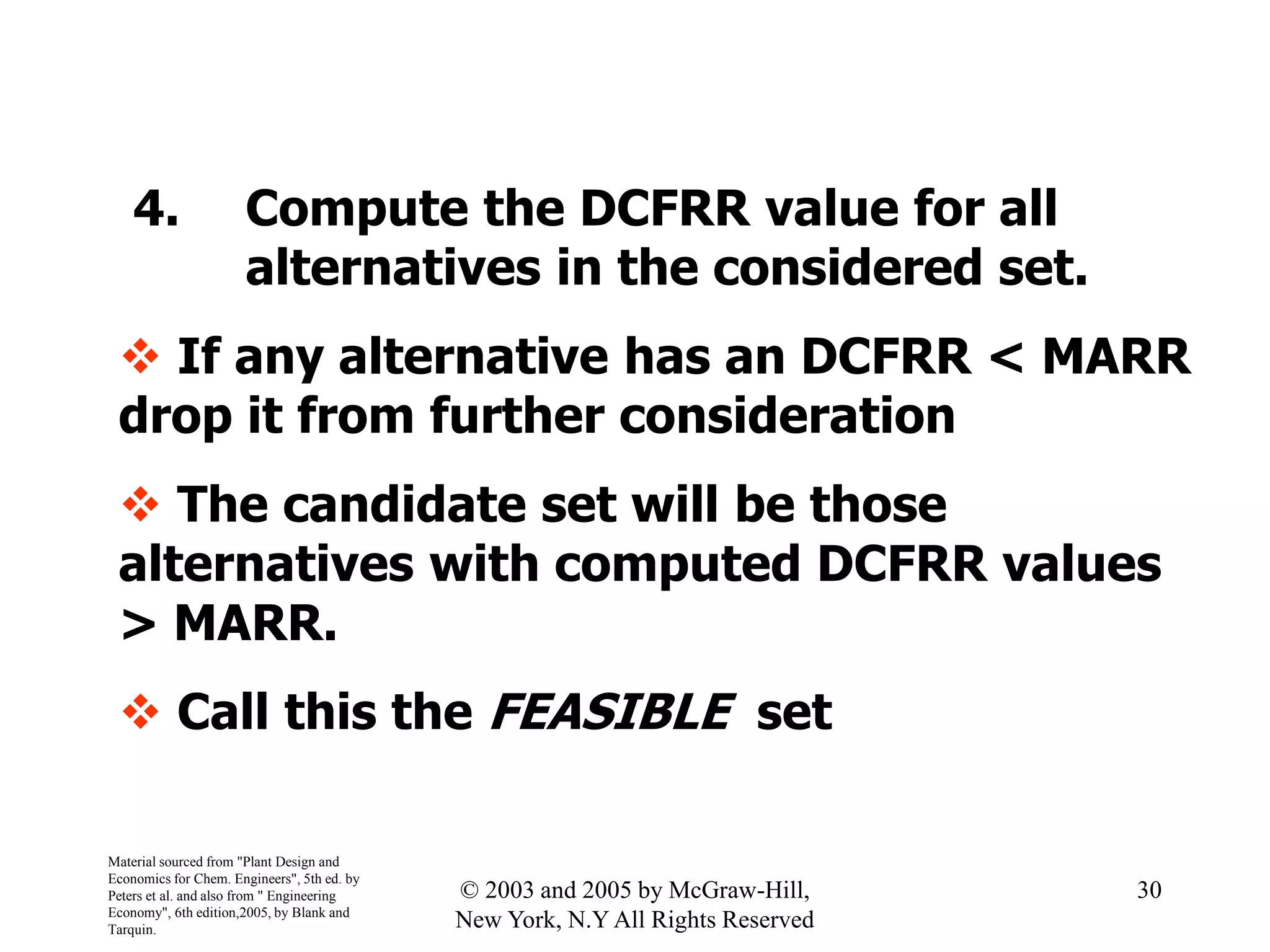

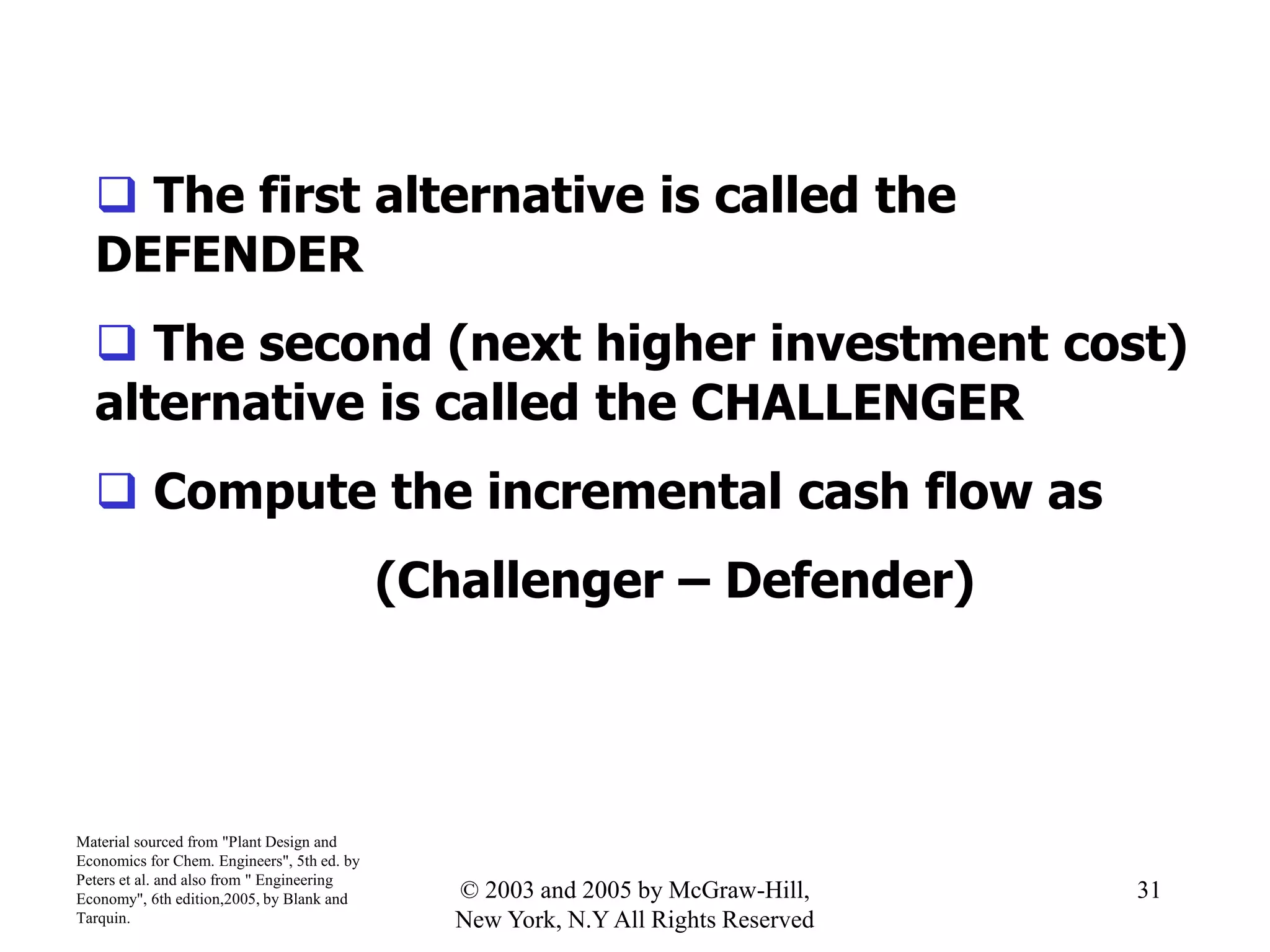

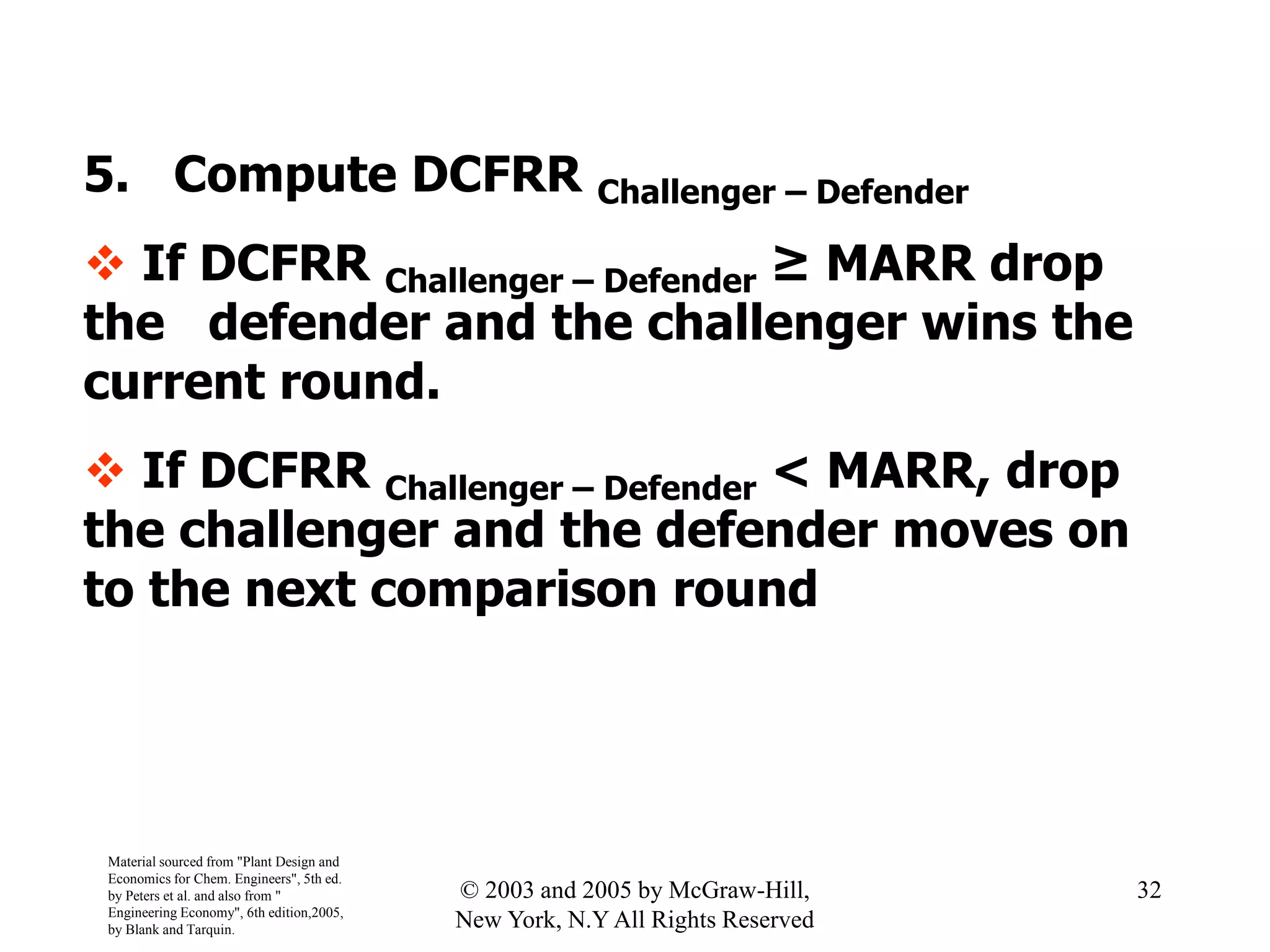

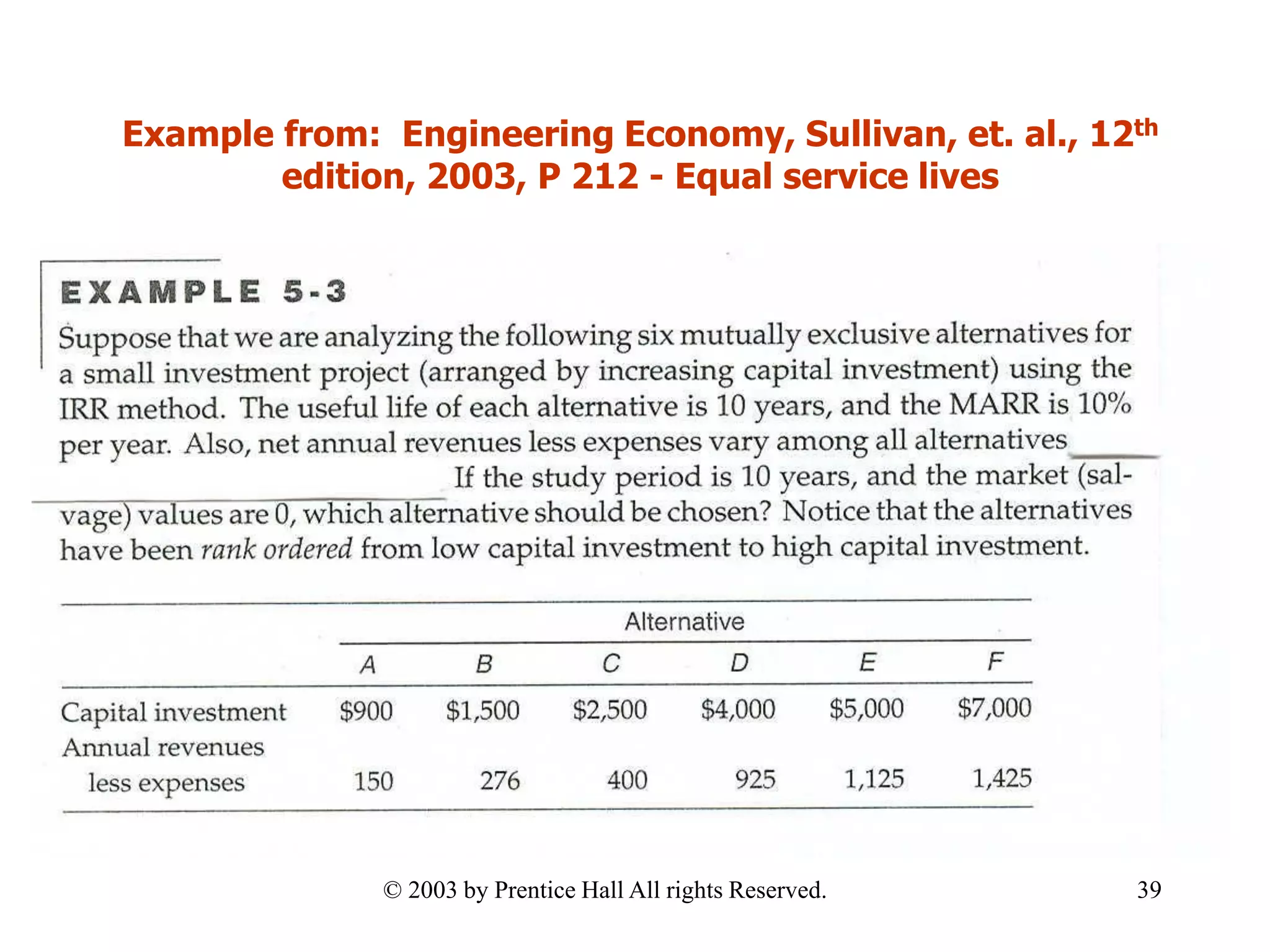

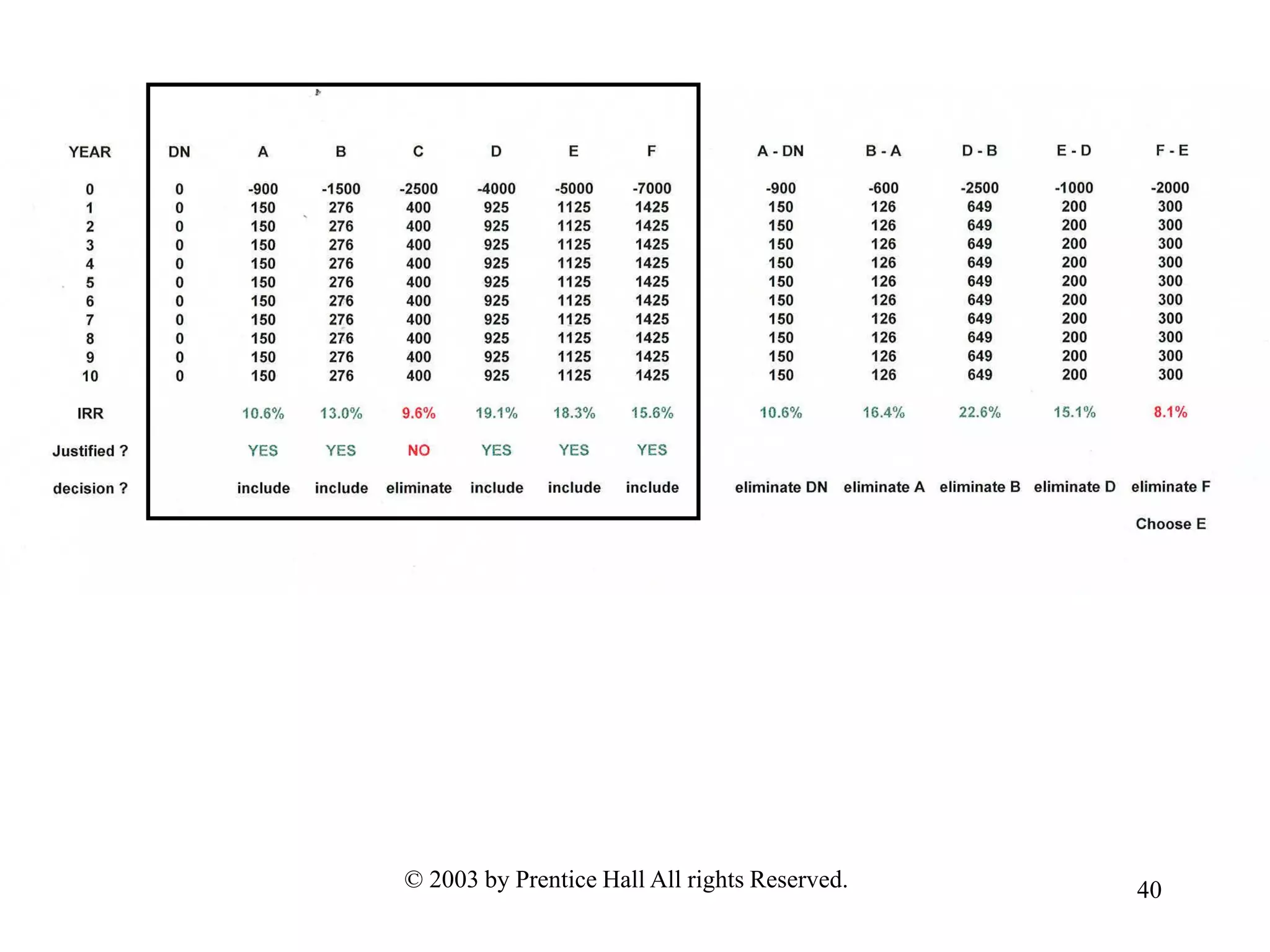

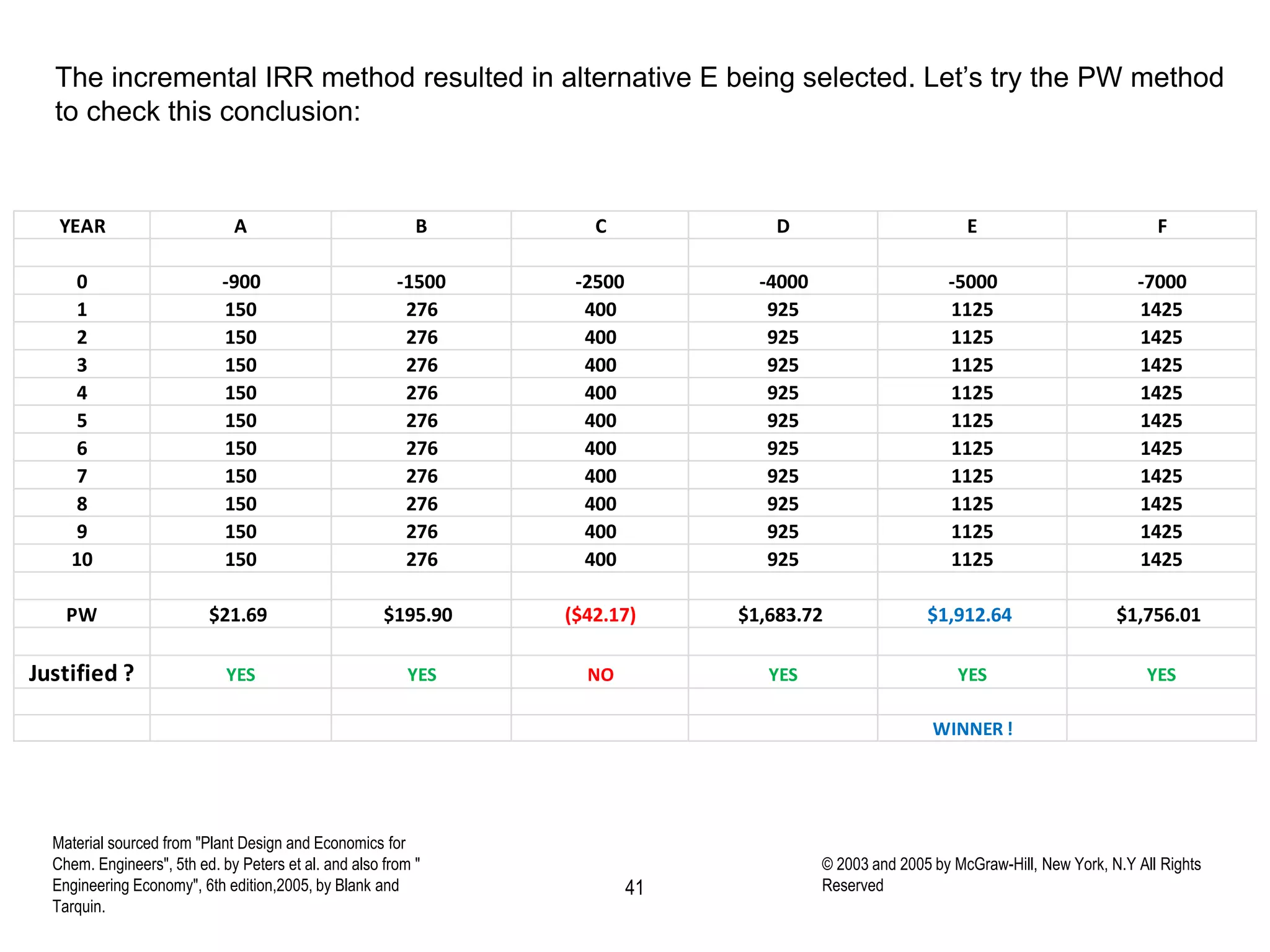

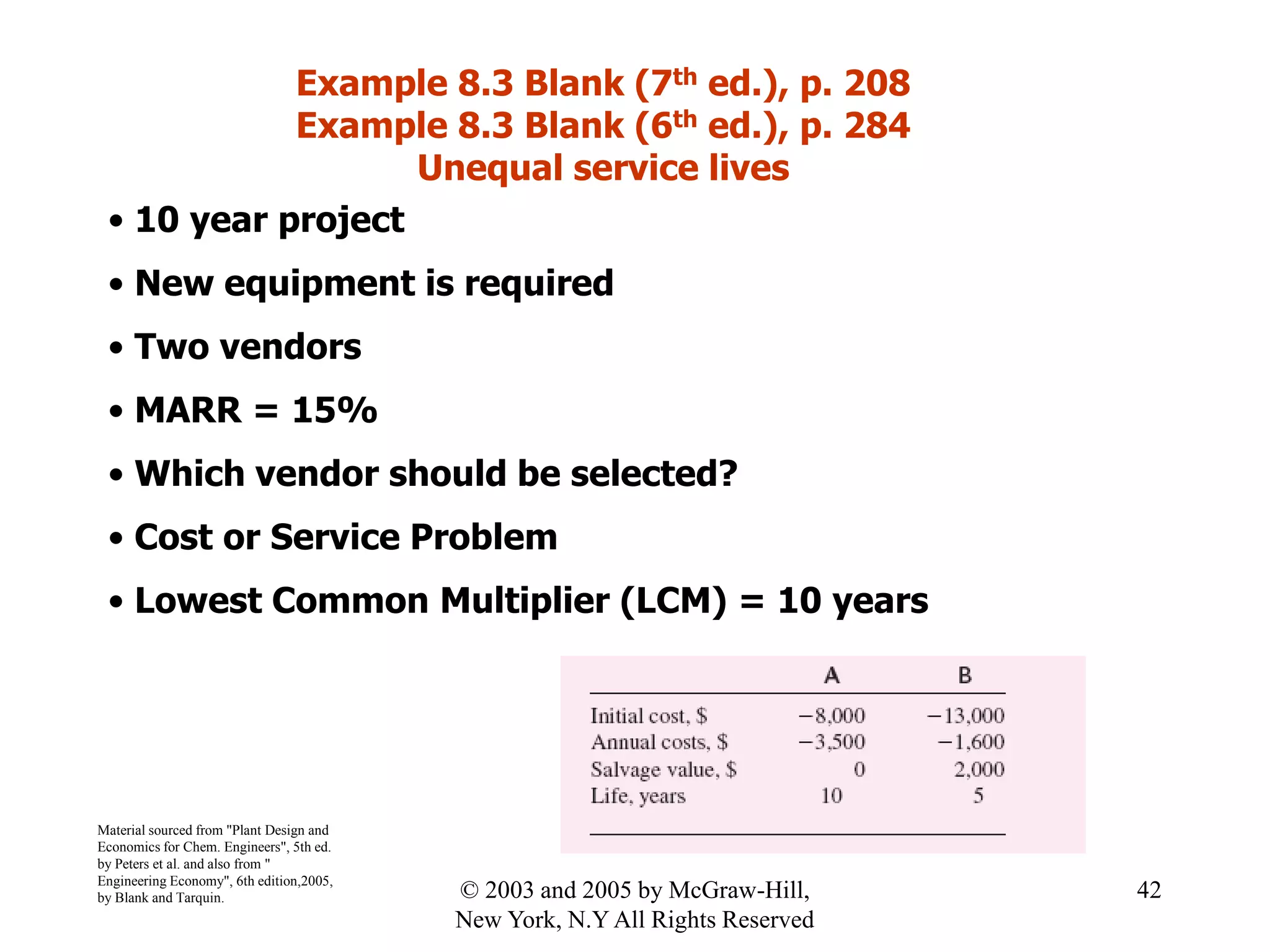

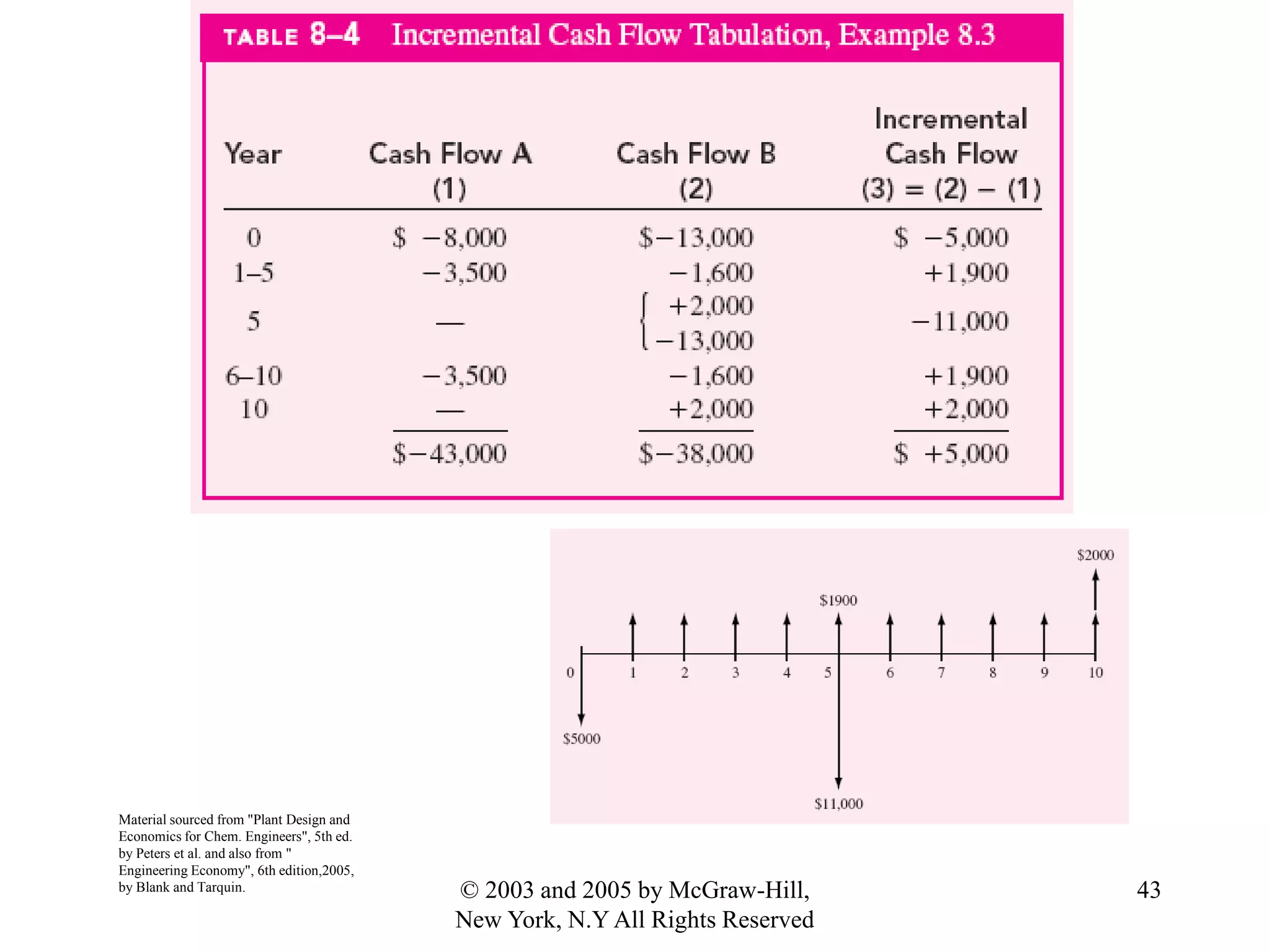

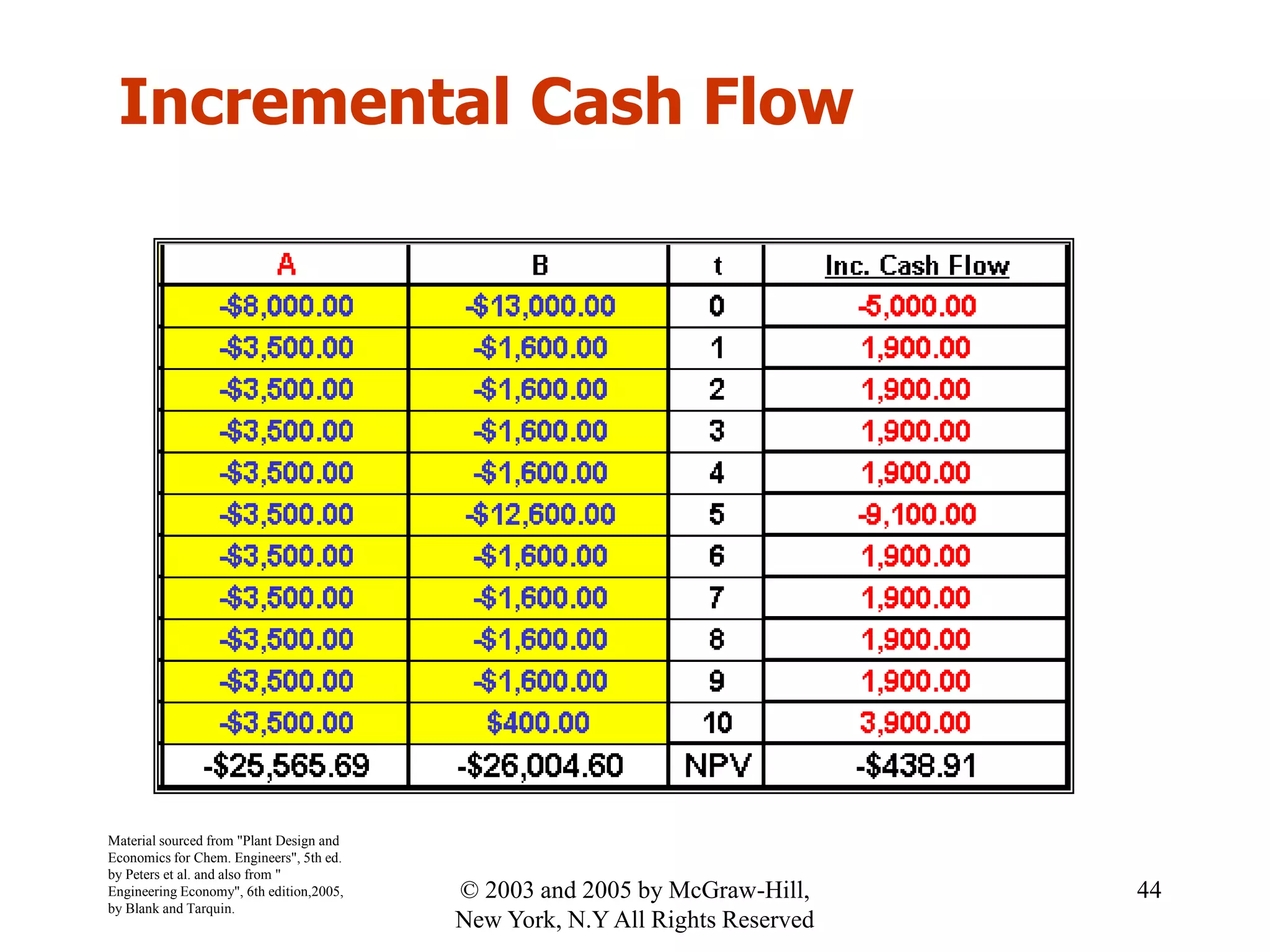

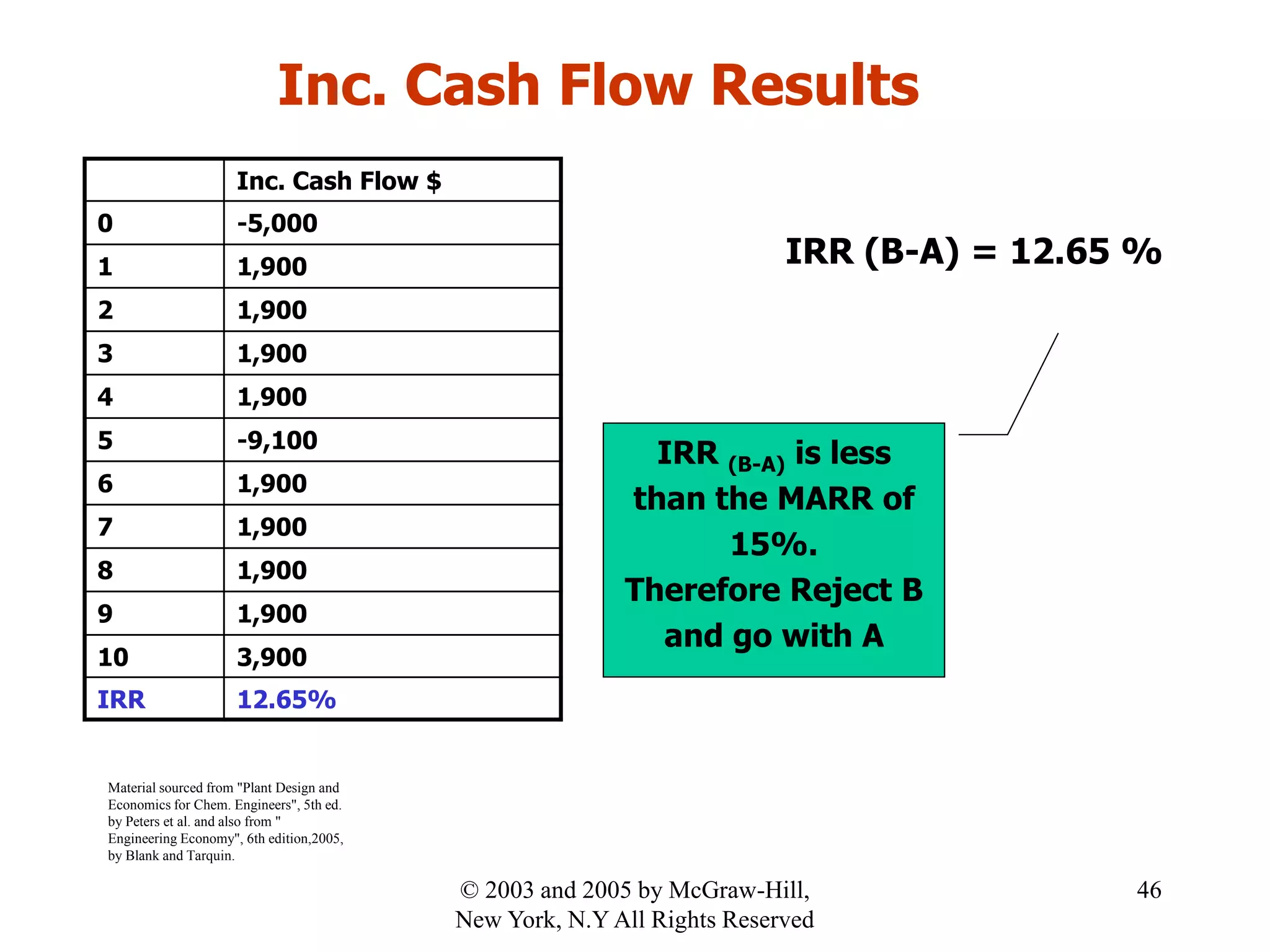

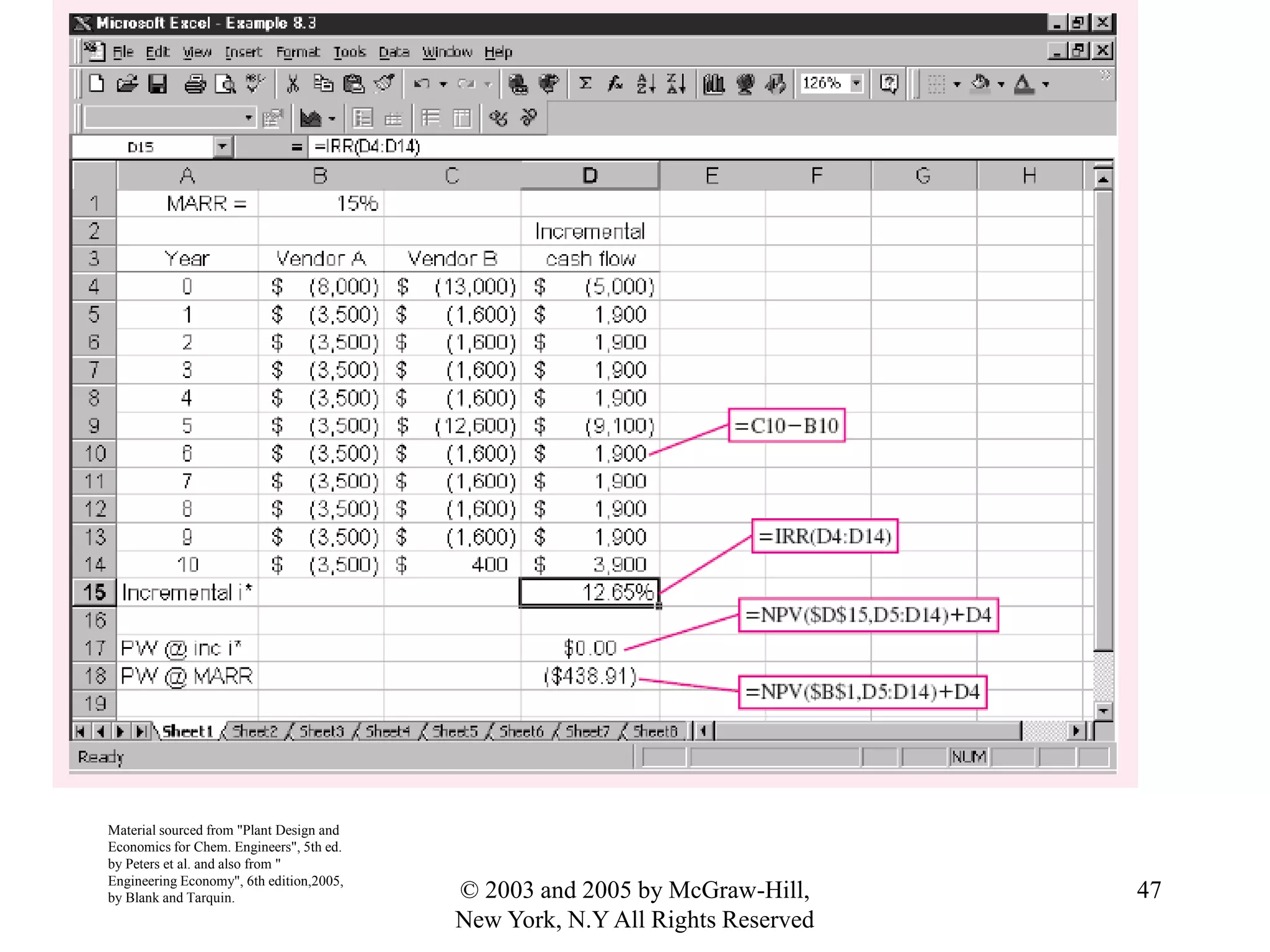

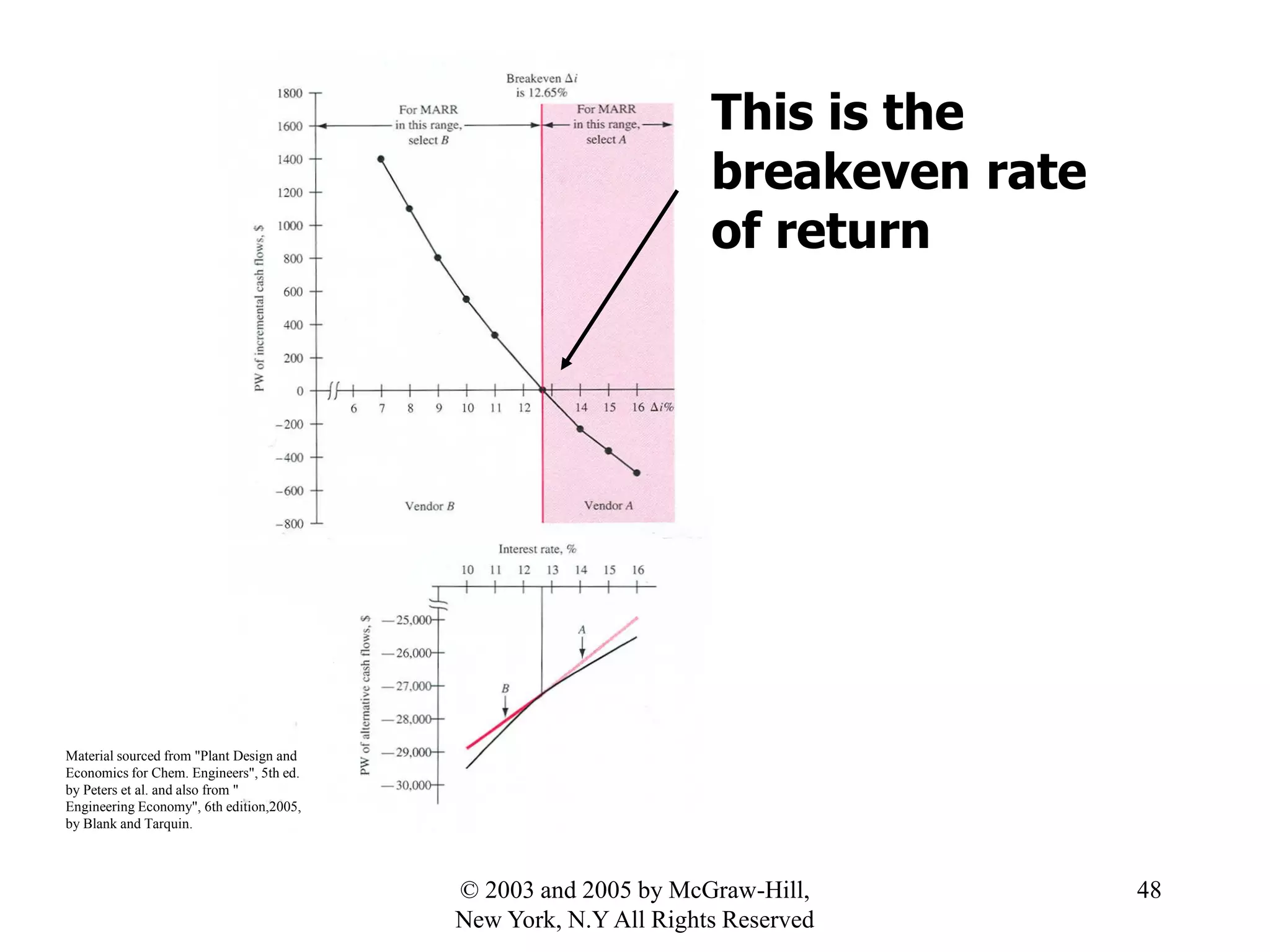

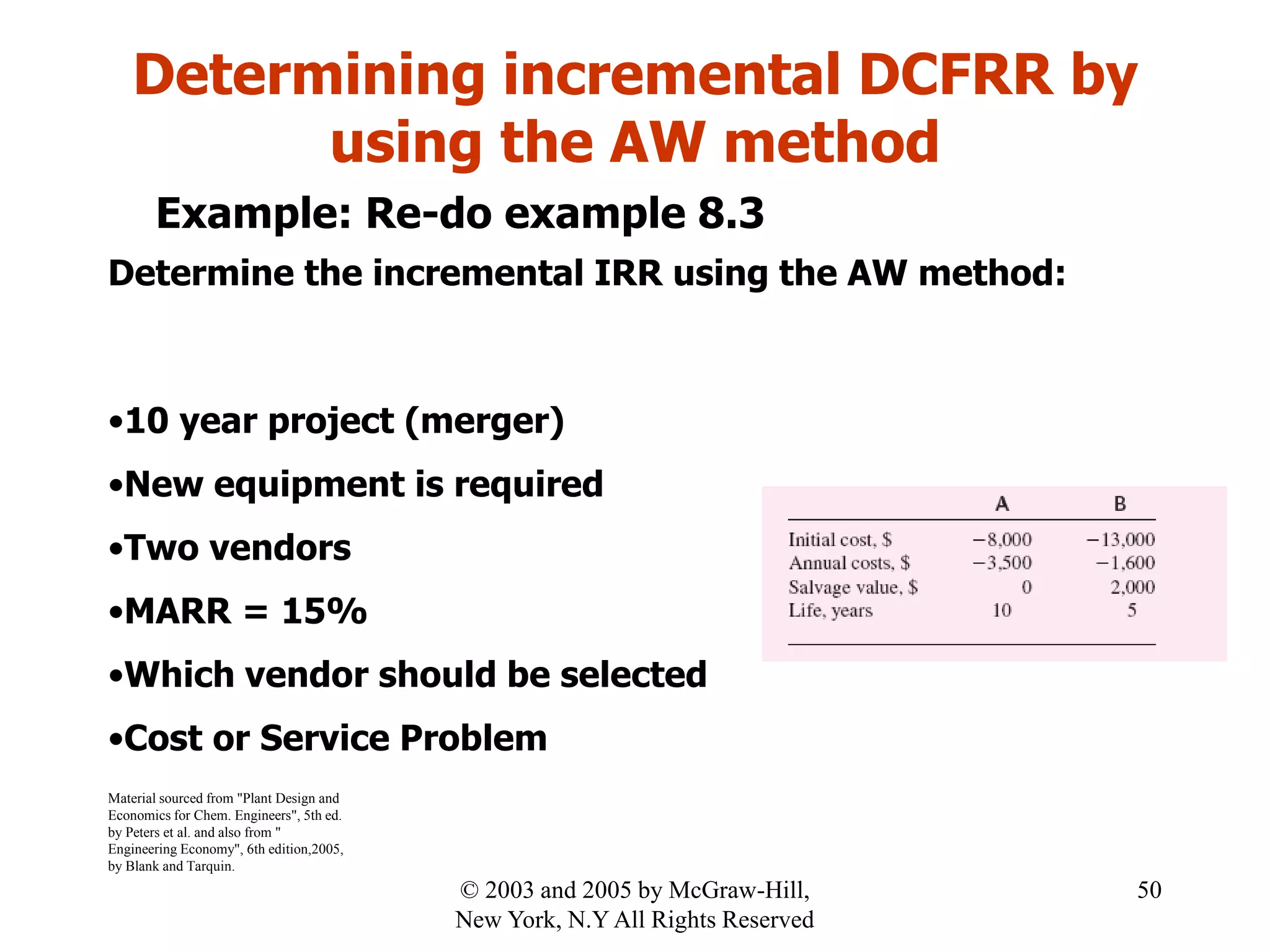

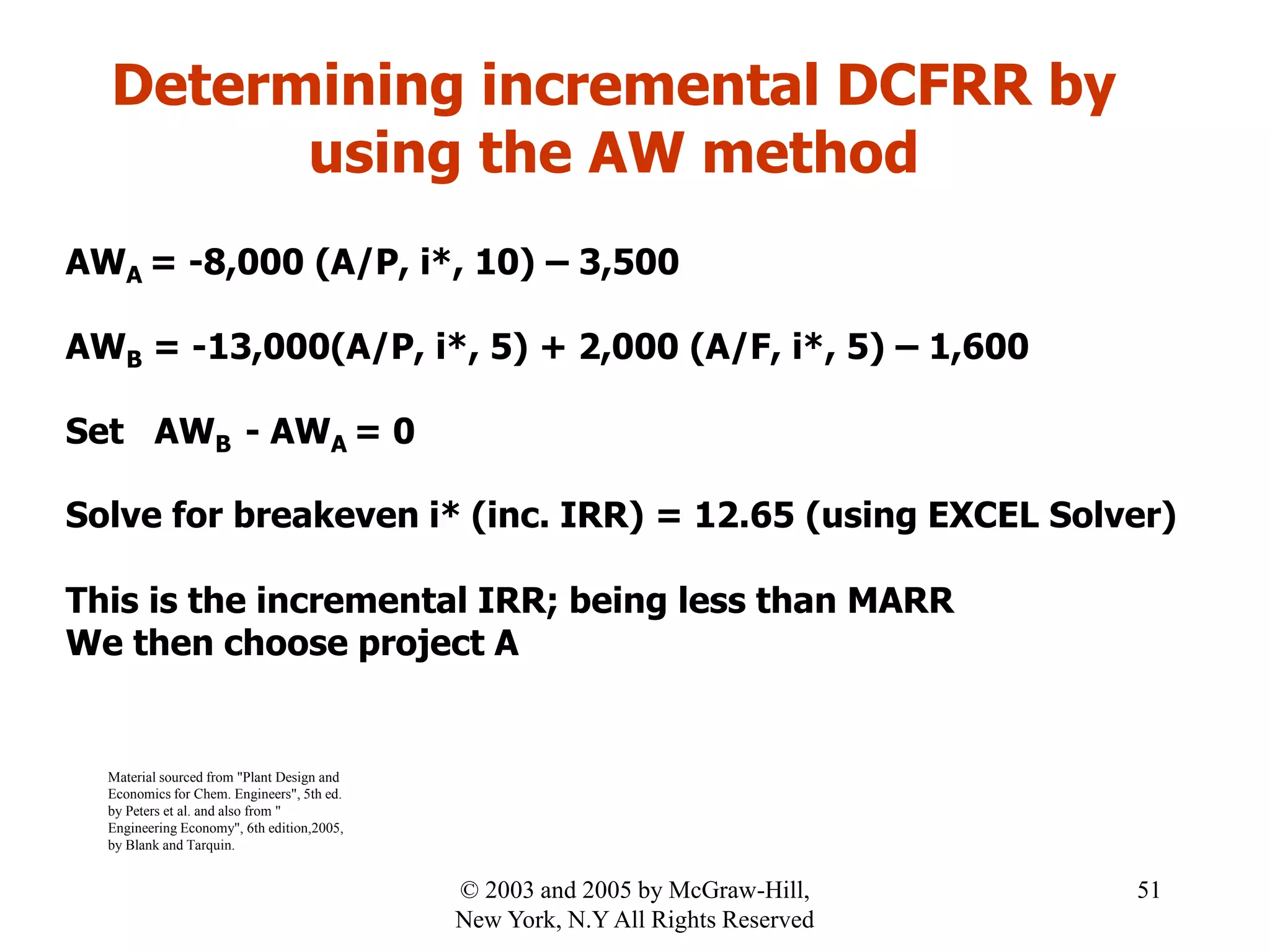

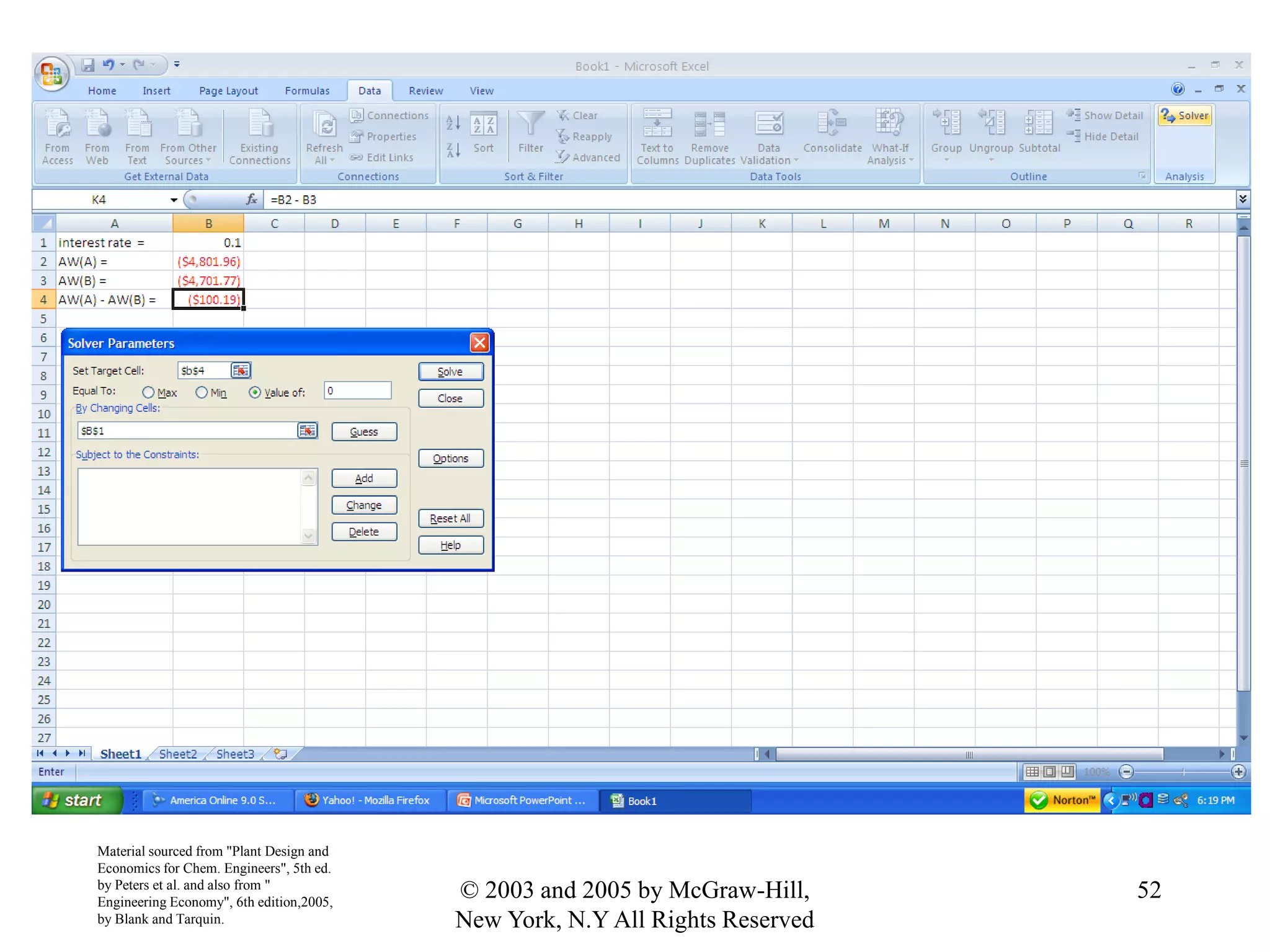

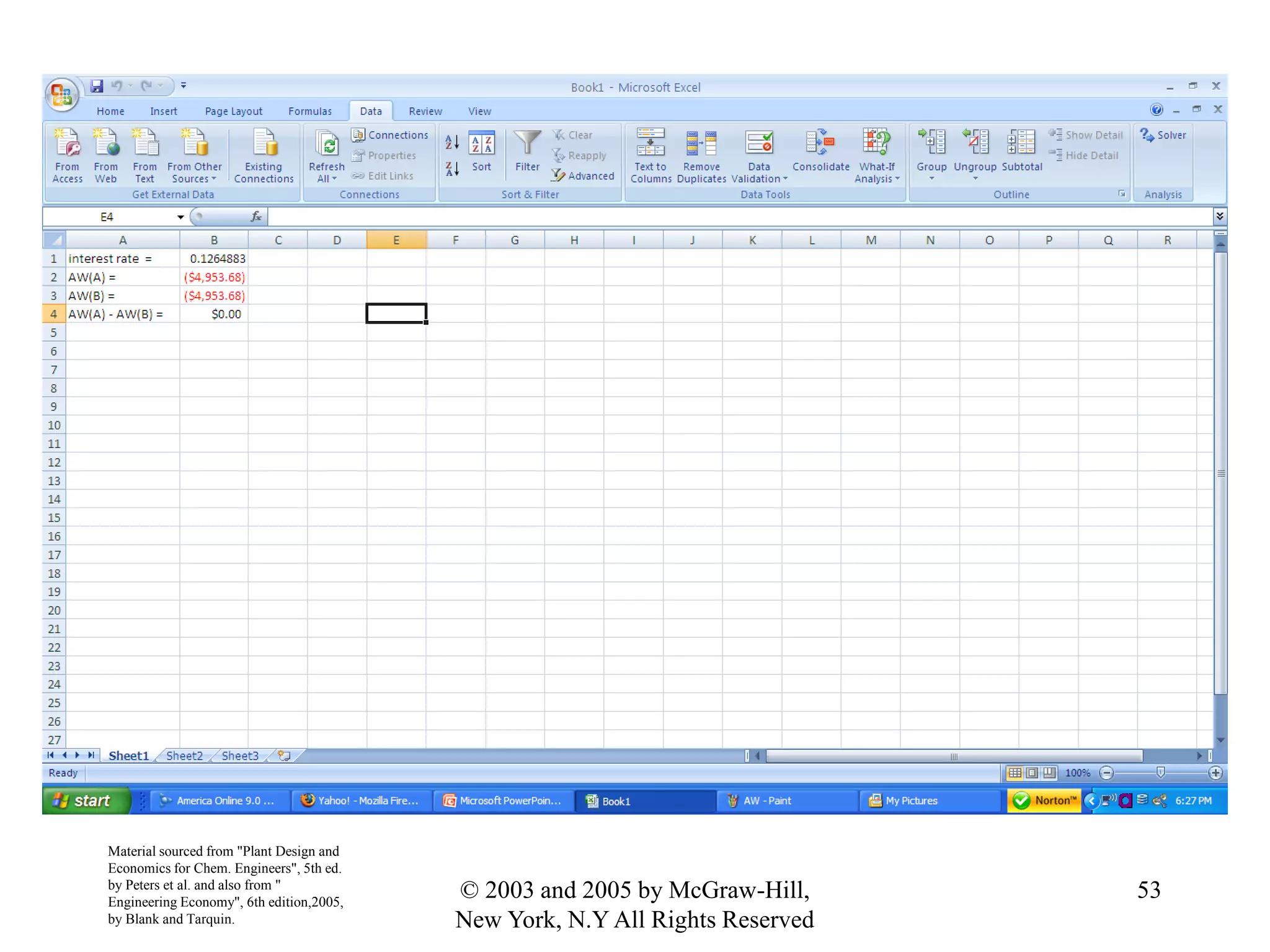

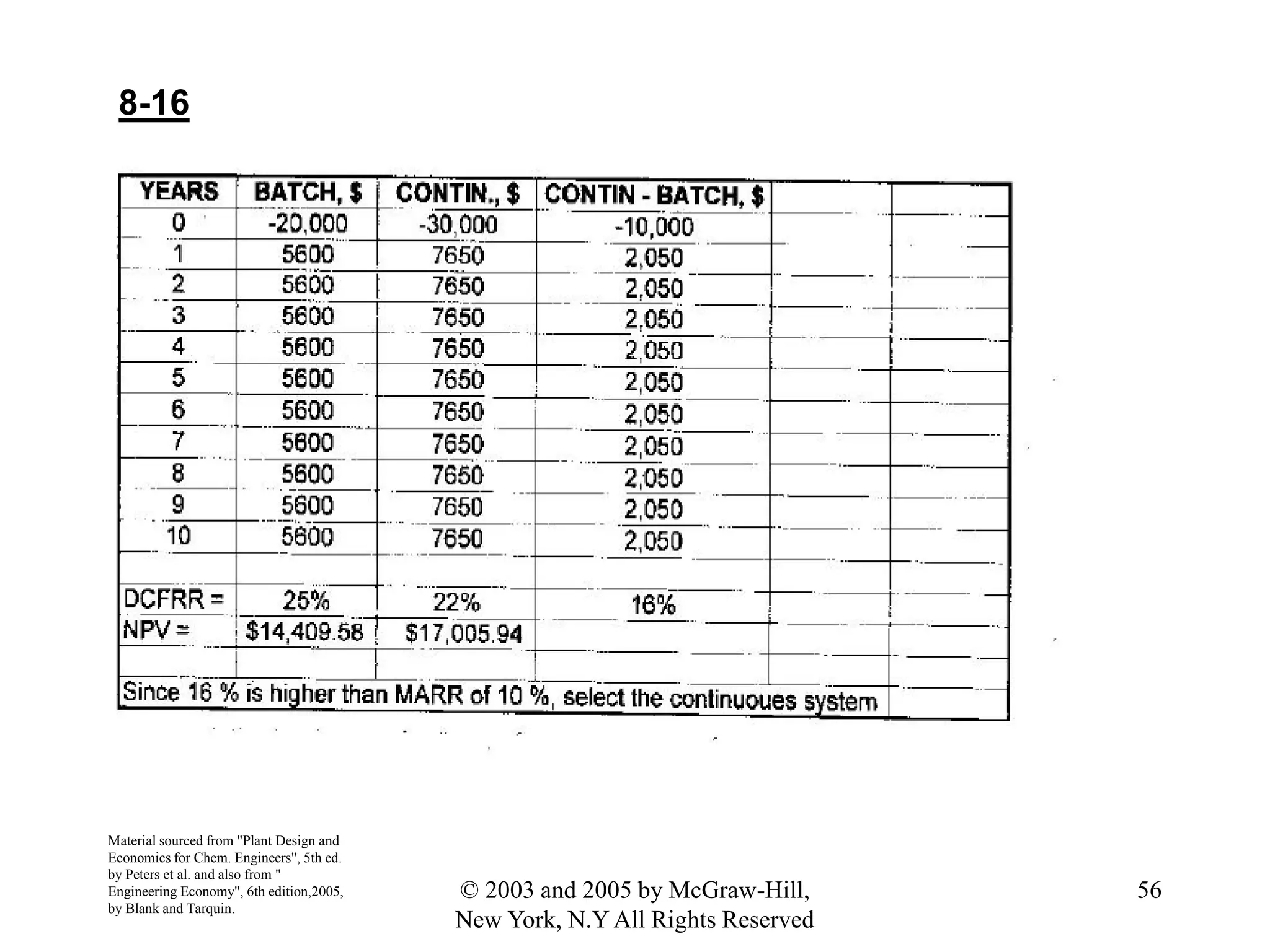

This document discusses incremental return on investment (ROI) and discounted cash flow rate of return (DCFRR) analysis for evaluating mutually exclusive investment alternatives. It explains that the alternative with the highest investment should be selected if the incremental ROI or IRR between it and another acceptable alternative is greater than or equal to the minimum acceptable rate of return (MARR). This ensures every additional dollar invested generates a return at or above the MARR. An example compares three investment options and selects the one with the highest investment since it has an incremental ROI greater than the MARR.