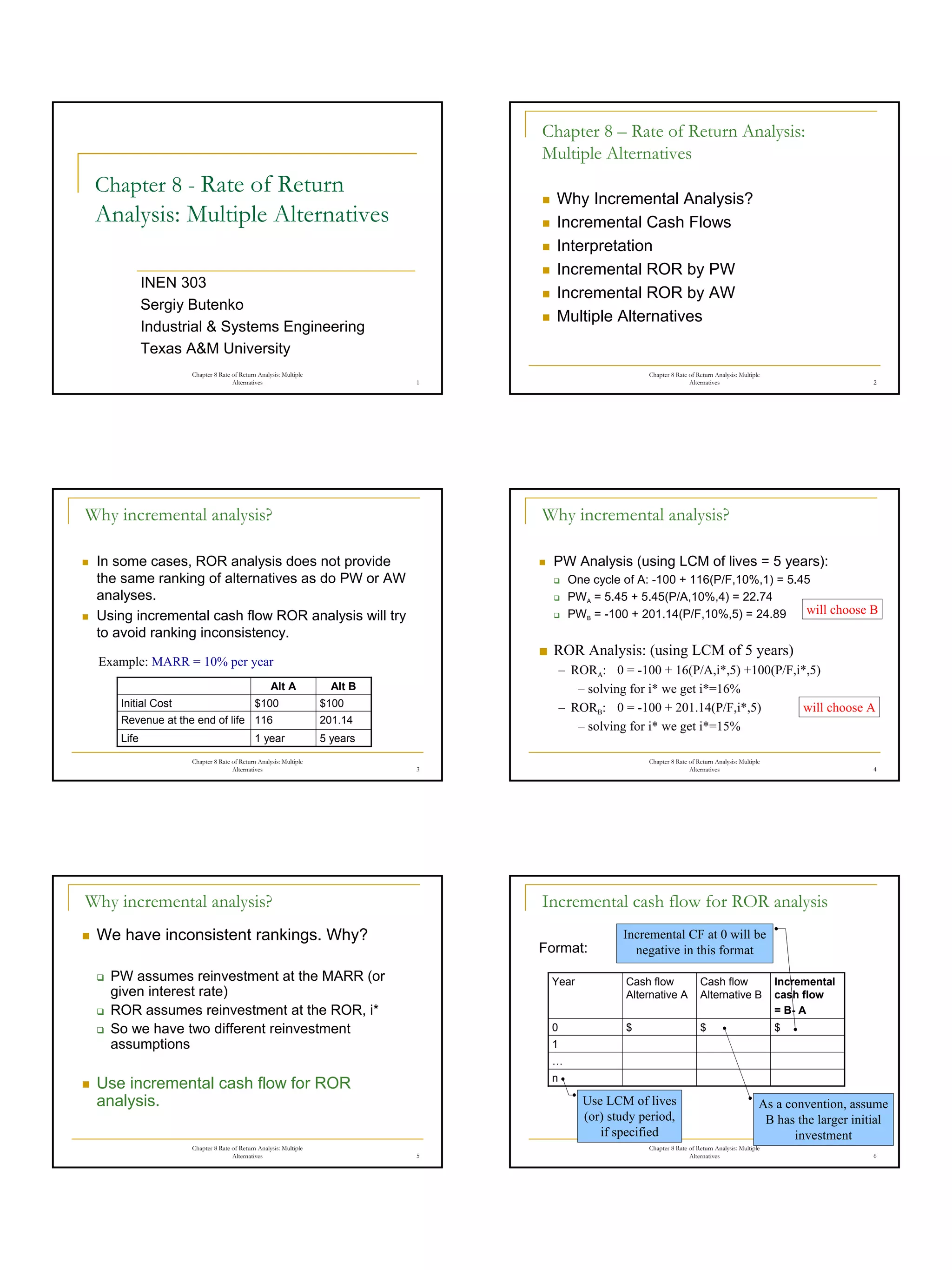

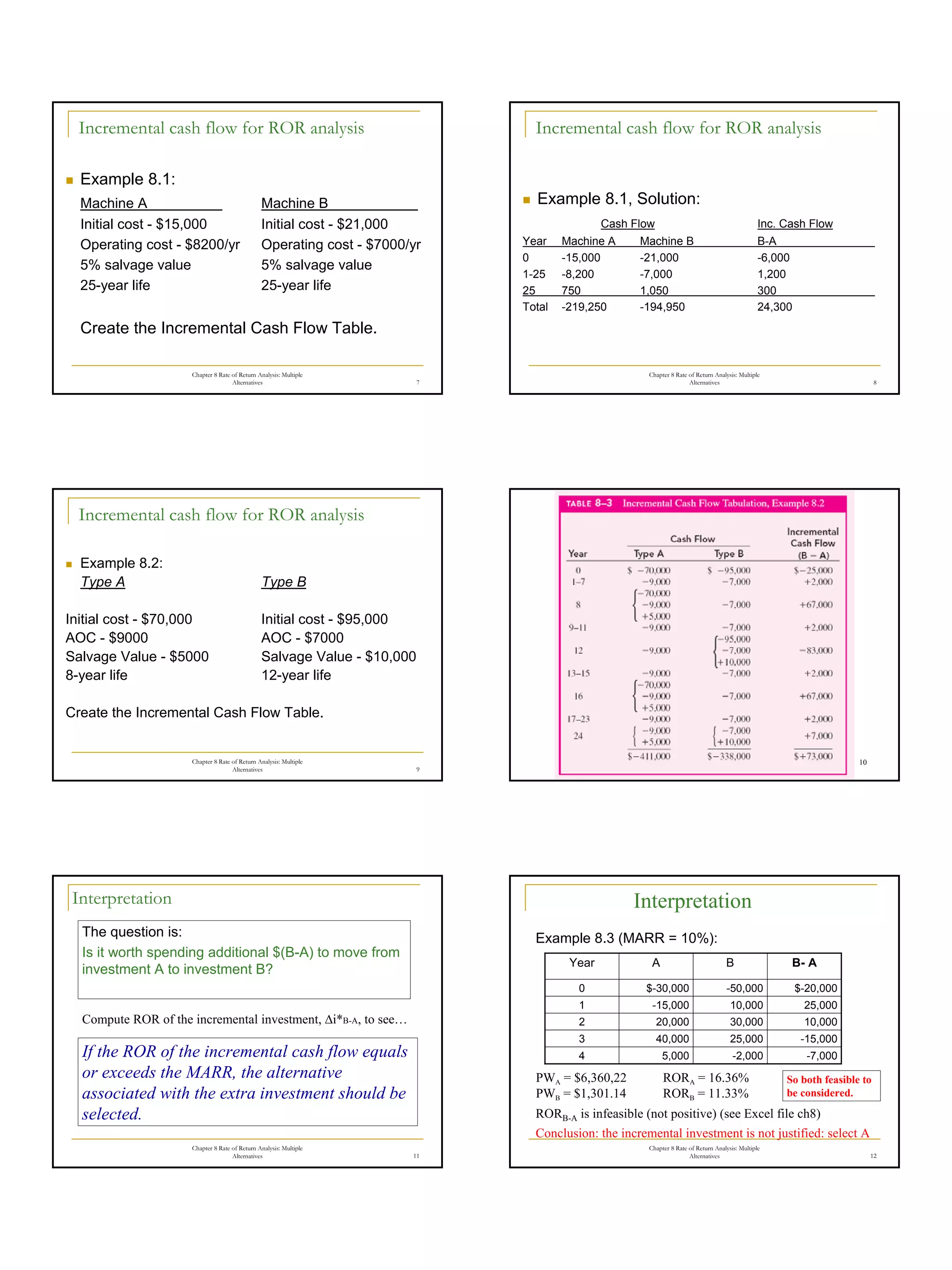

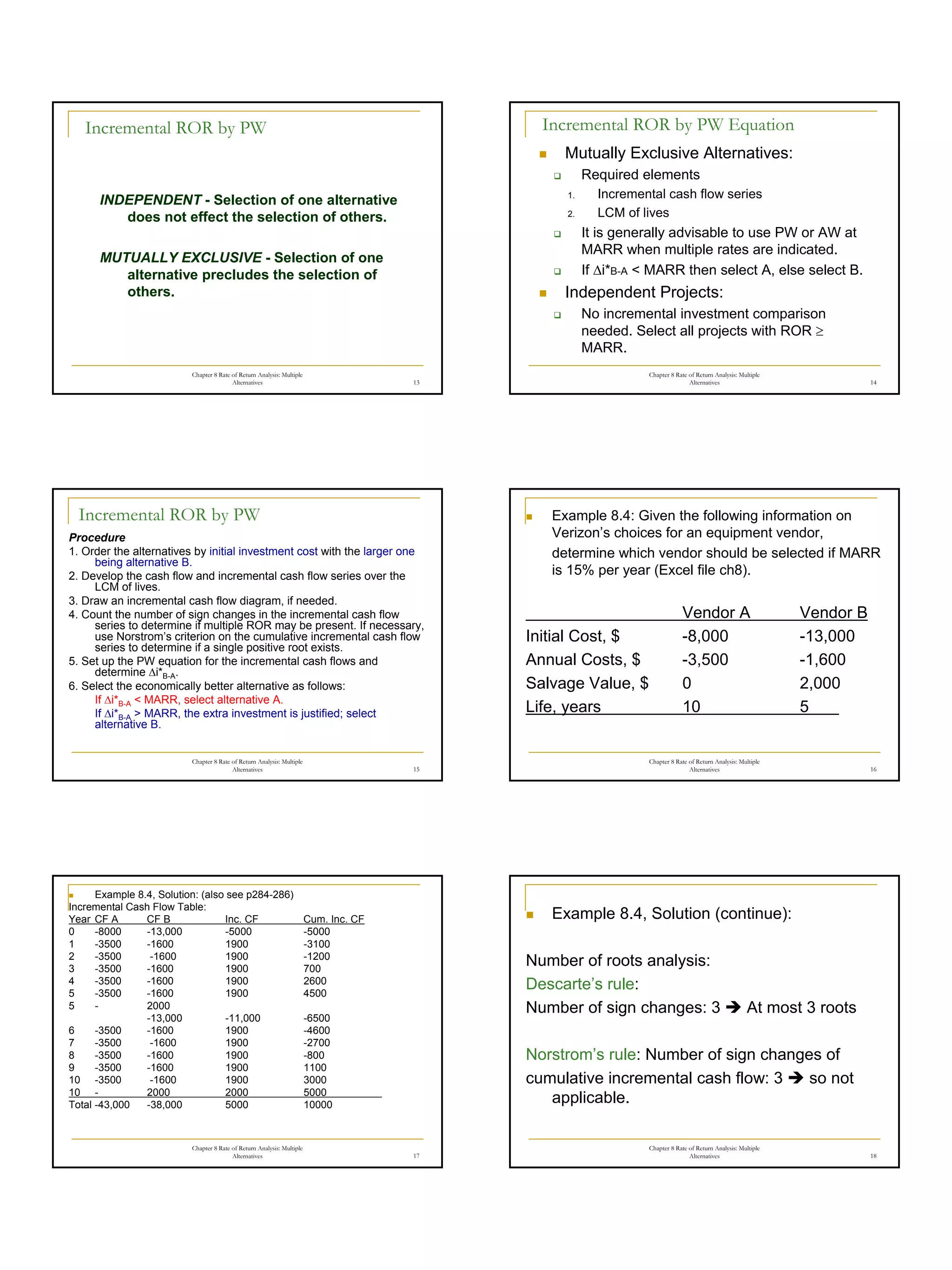

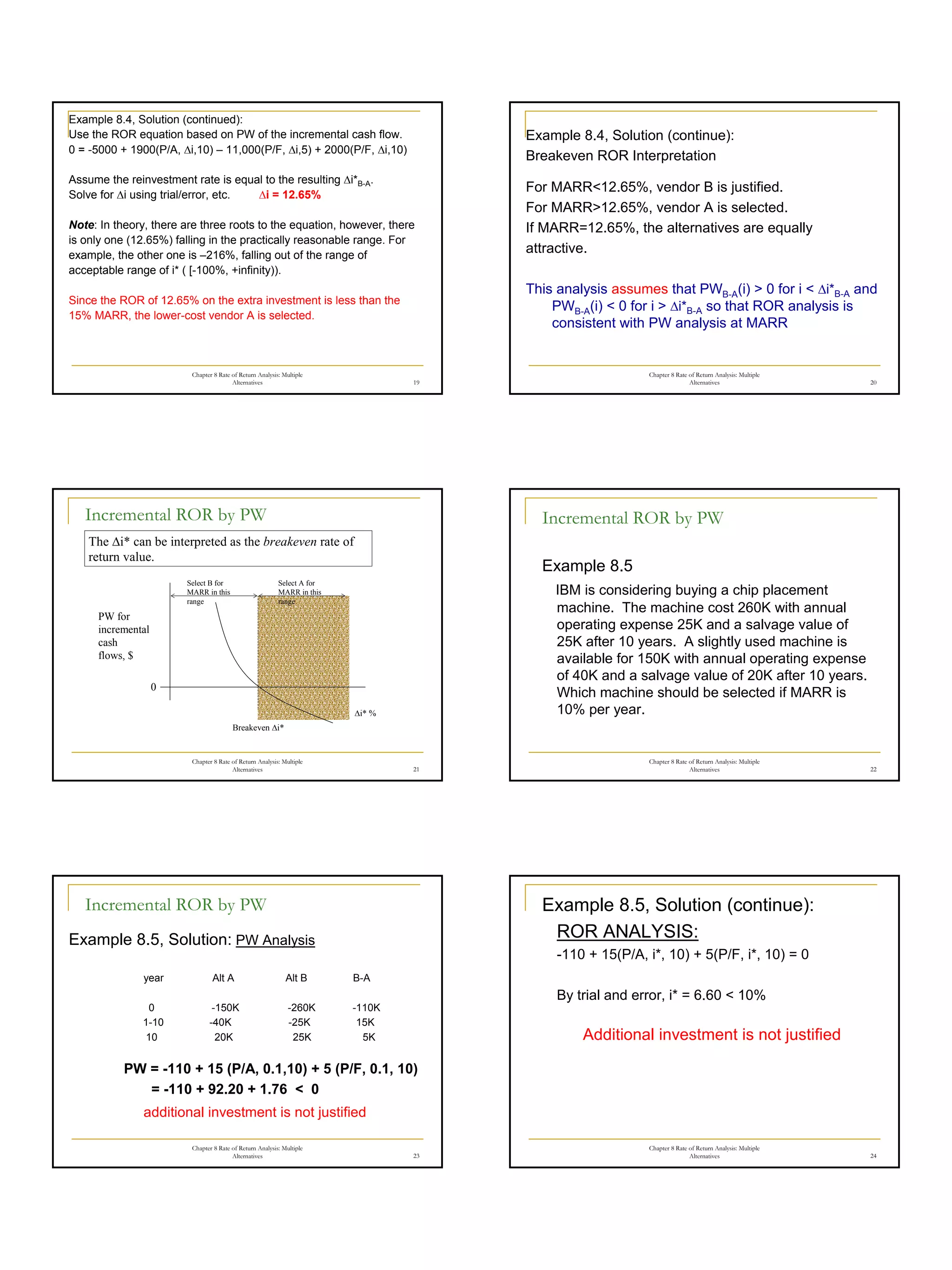

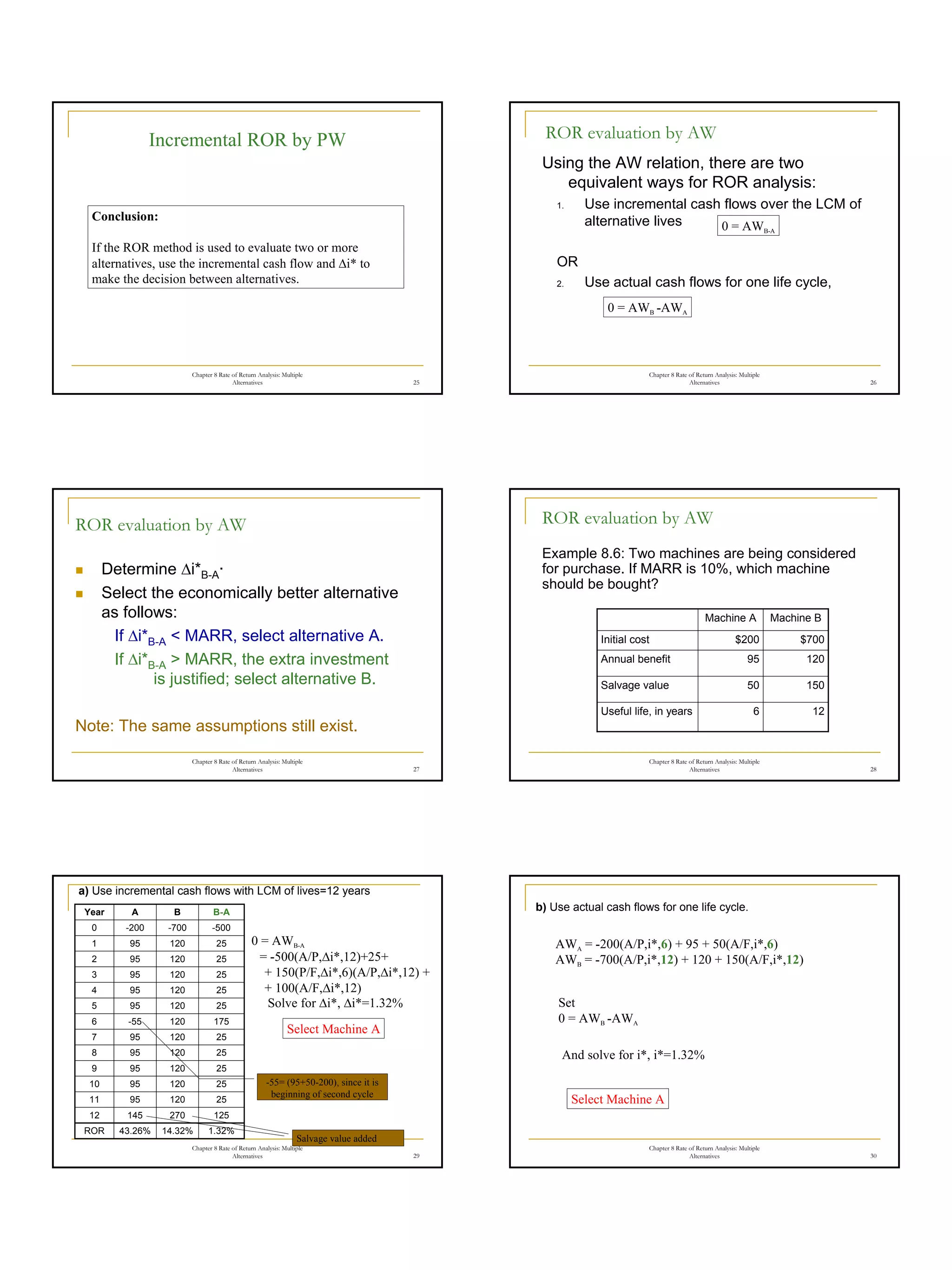

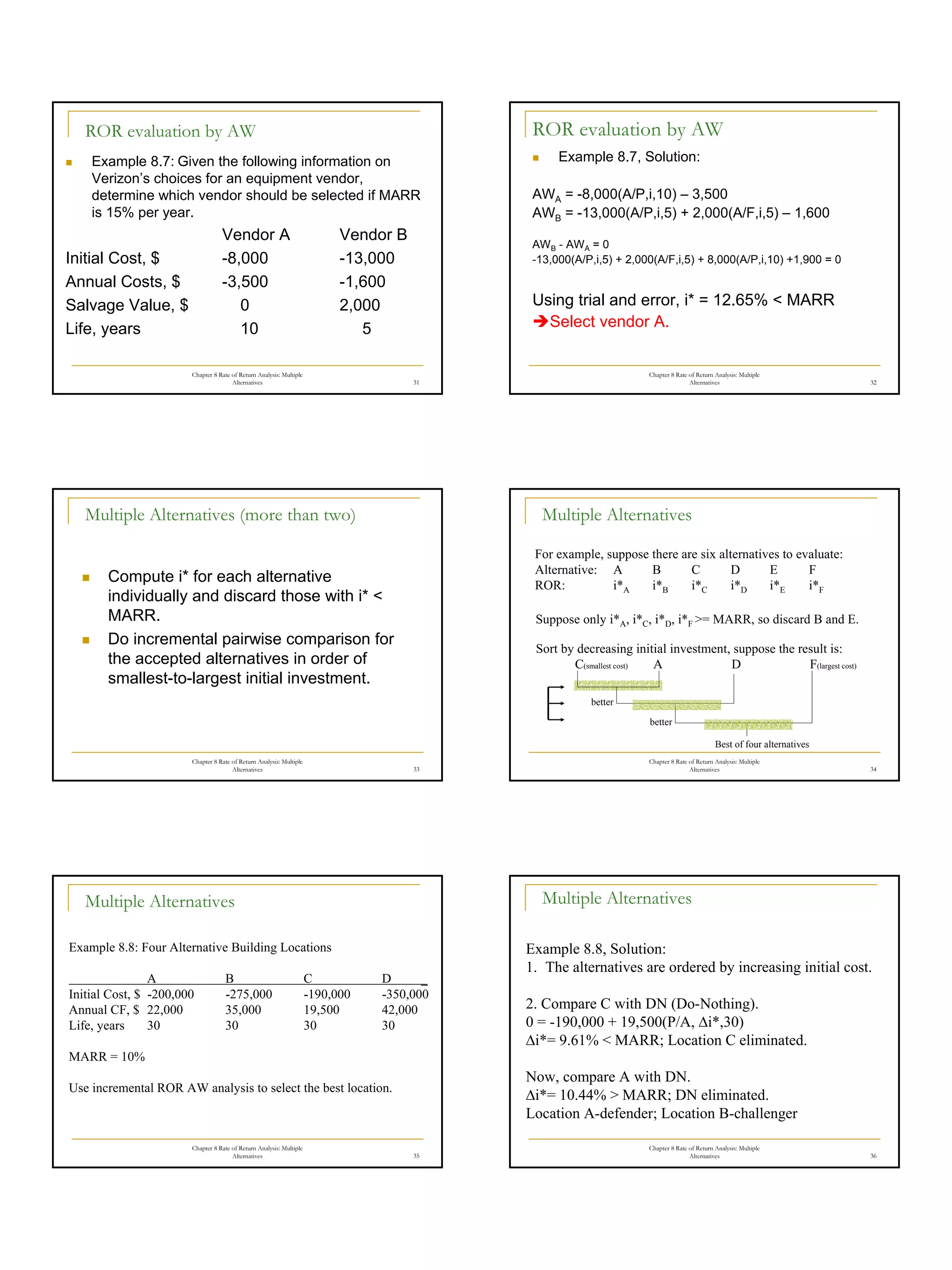

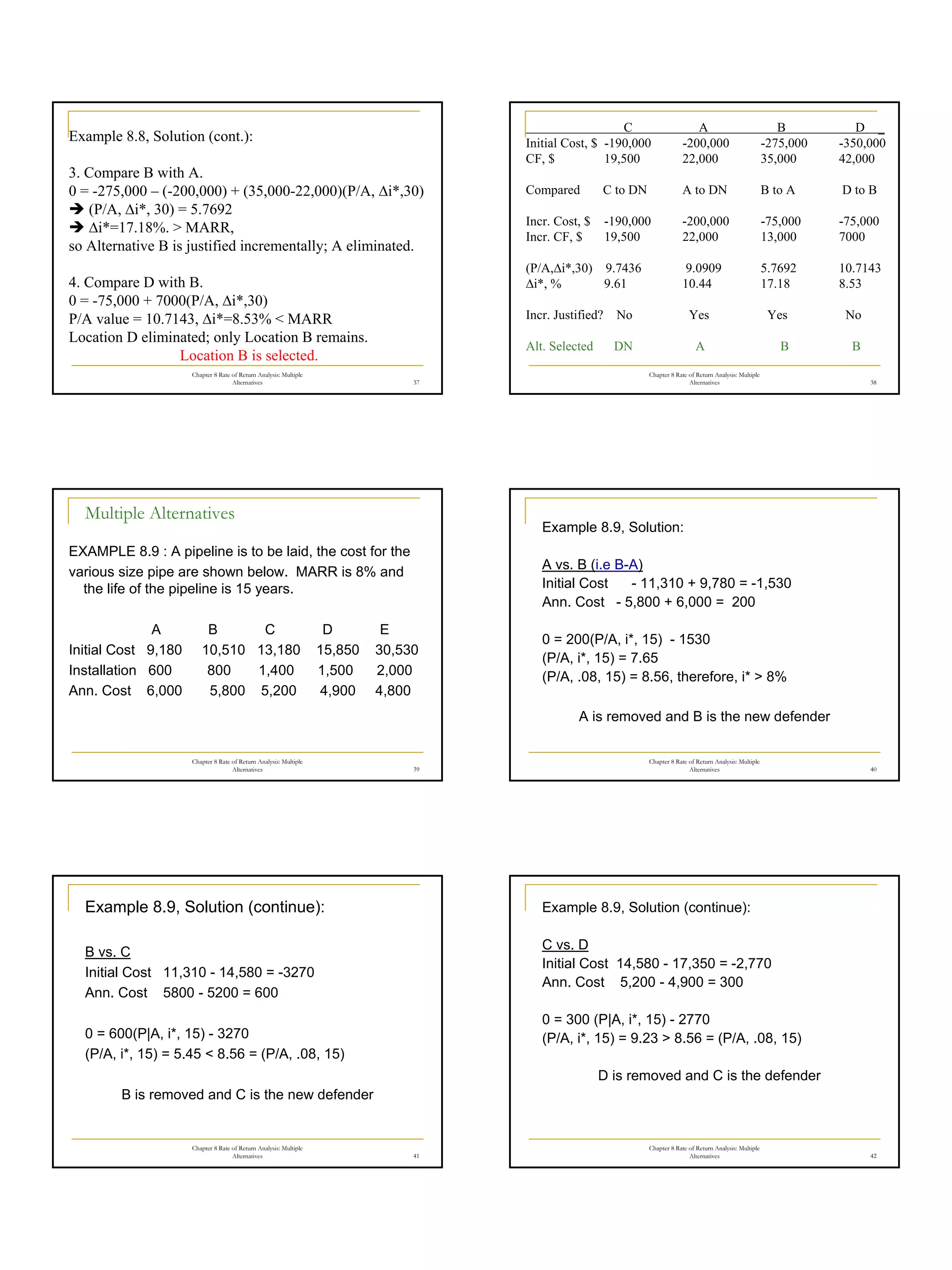

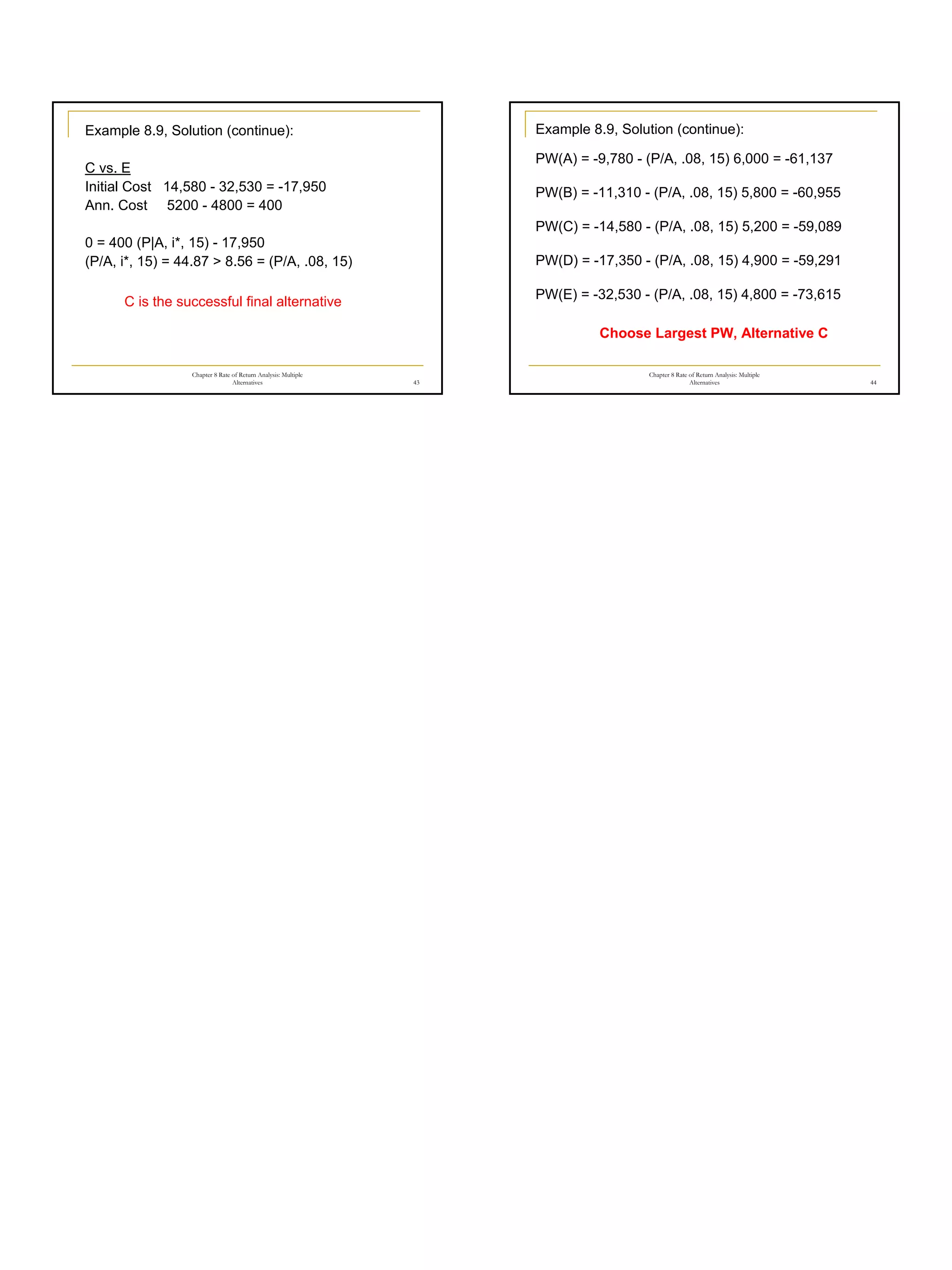

This document discusses incremental rate of return analysis for multiple alternatives. It explains that incremental analysis avoids inconsistent rankings that can occur when alternatives have different lives. Incremental cash flows are calculated as the difference between alternatives' cash flows. The rate of return for the incremental cash flows (Δi*) is computed and compared to the minimum acceptable rate of return to determine which alternative provides the higher return. The analysis can be done using present worth of incremental cash flows or using annual worth of total cash flows for one life cycle.