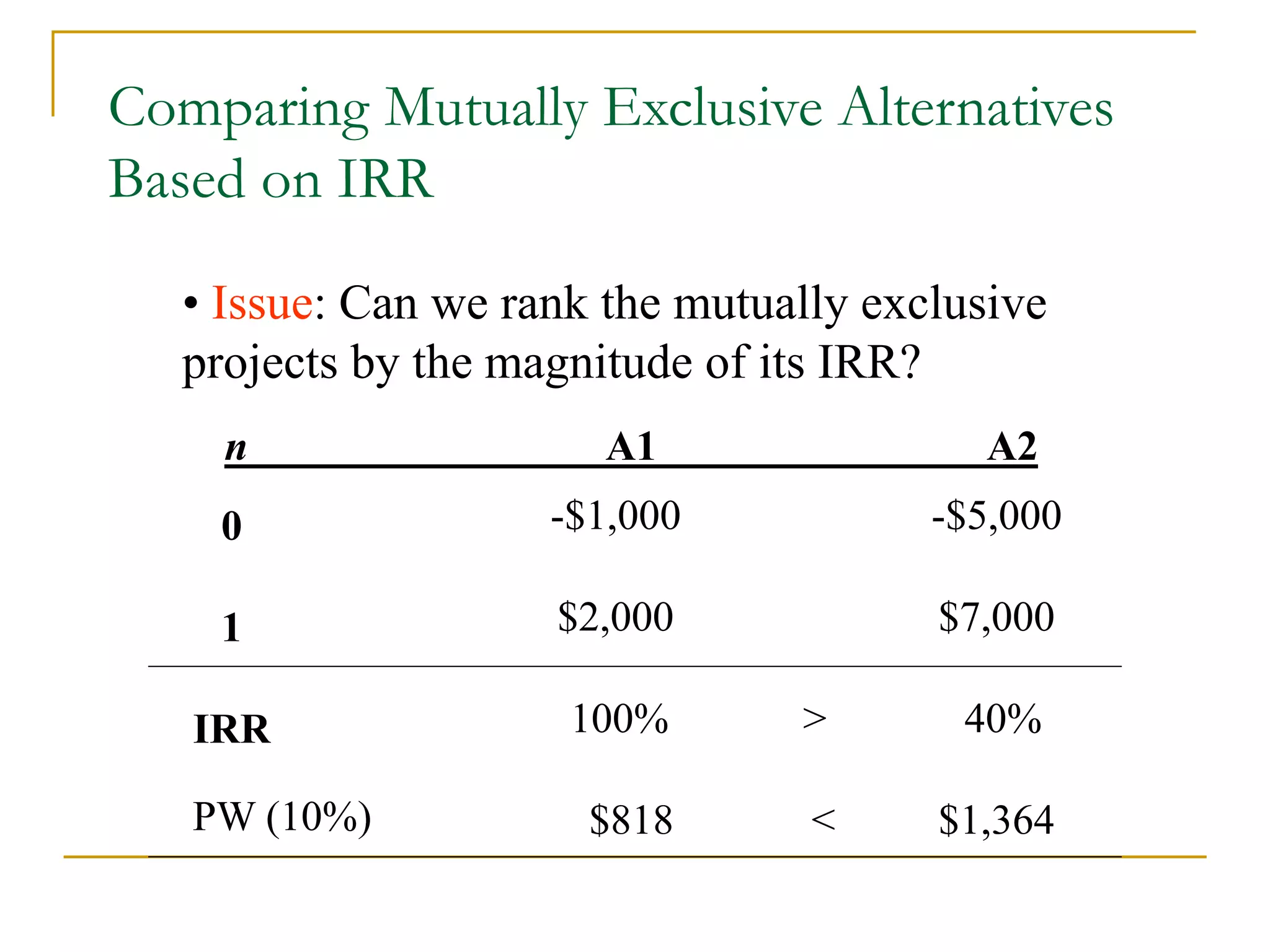

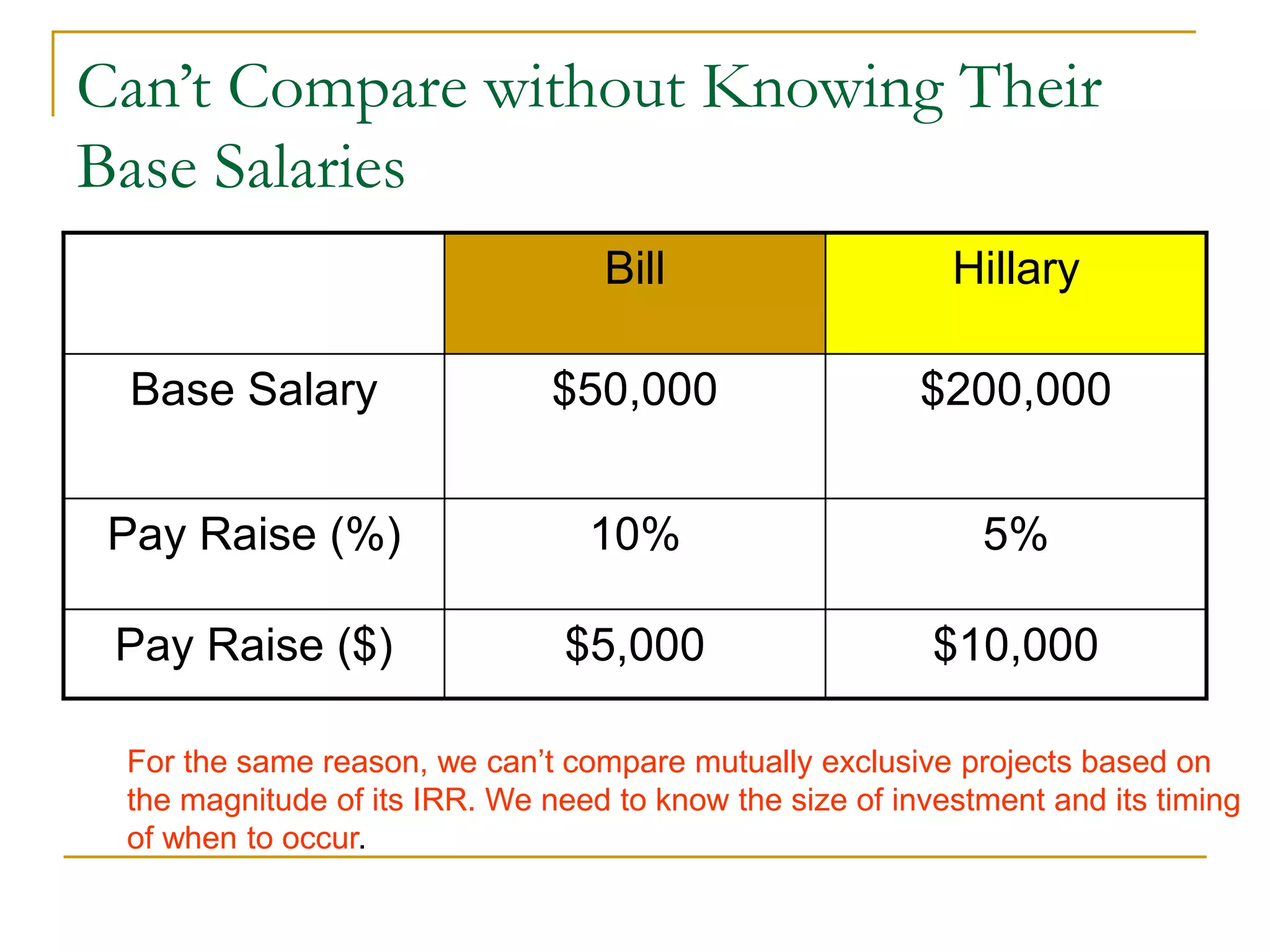

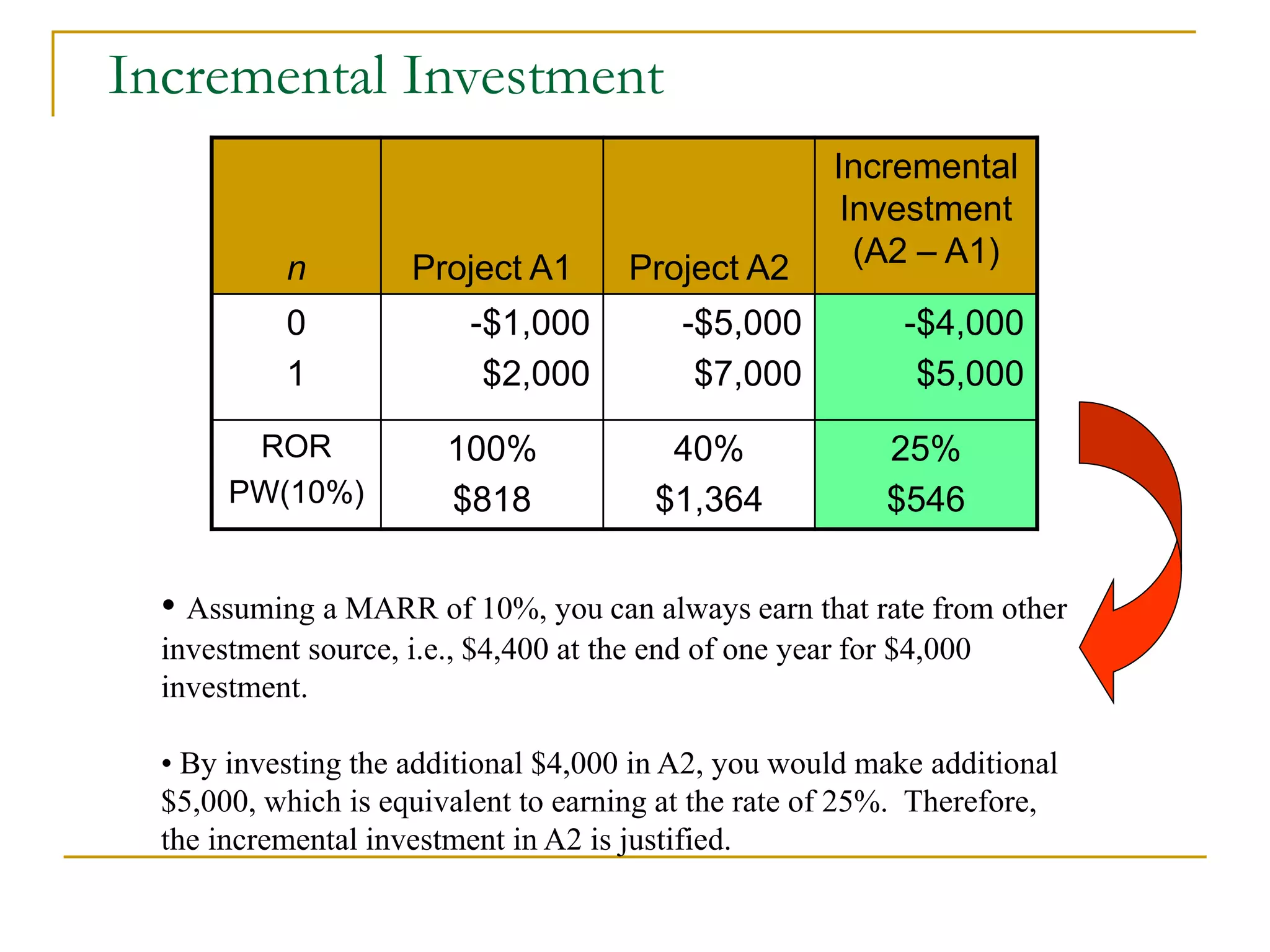

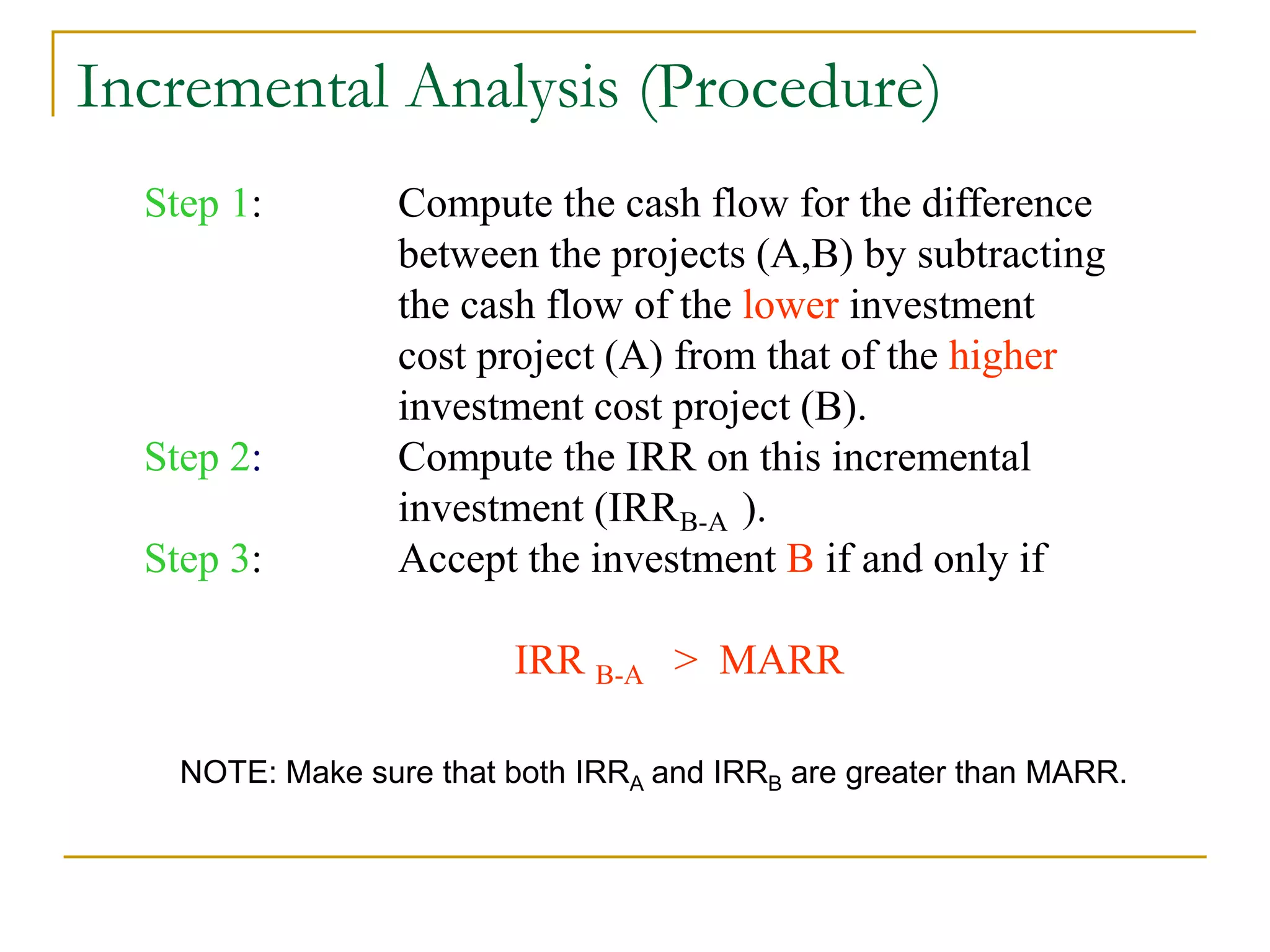

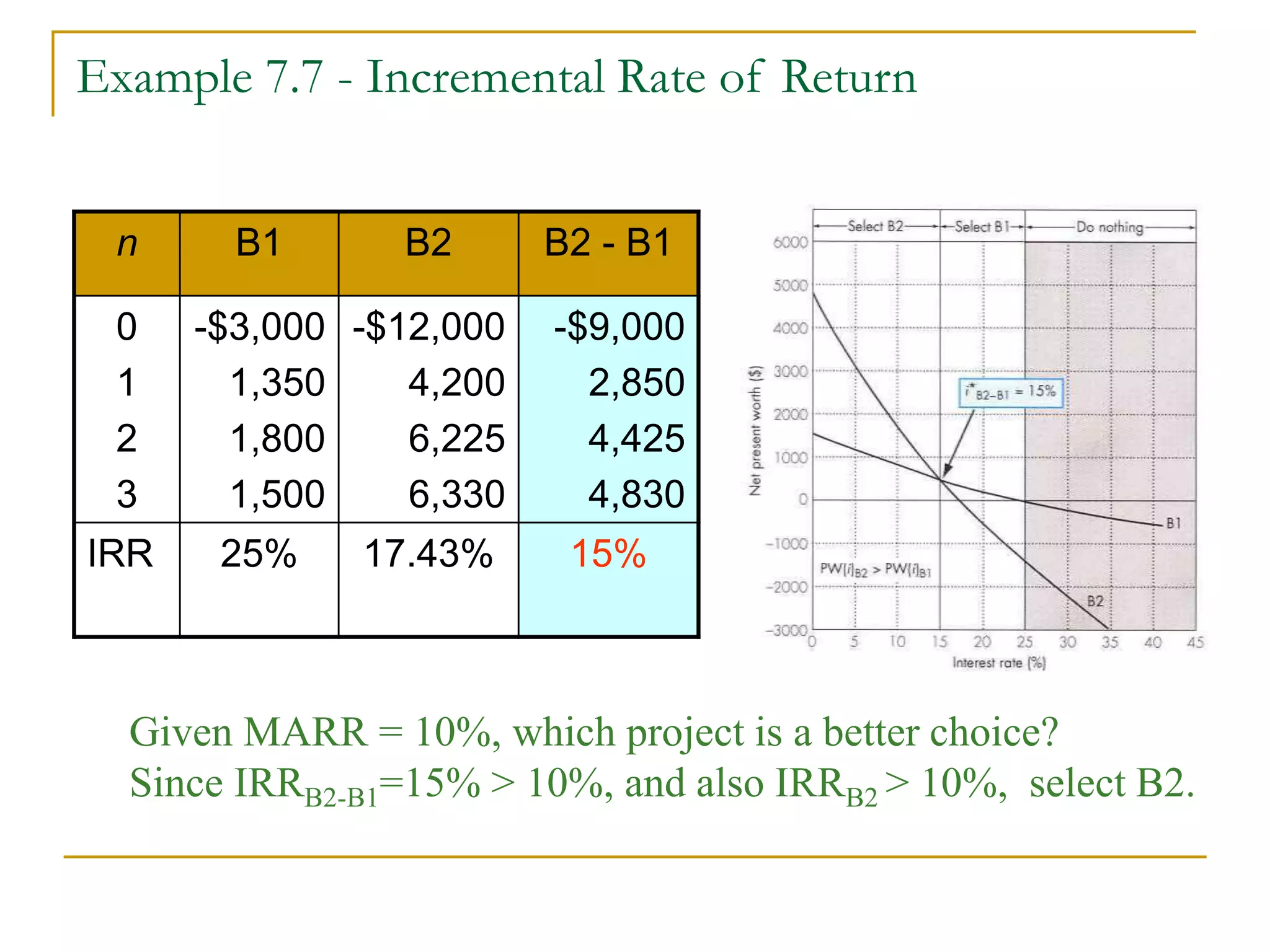

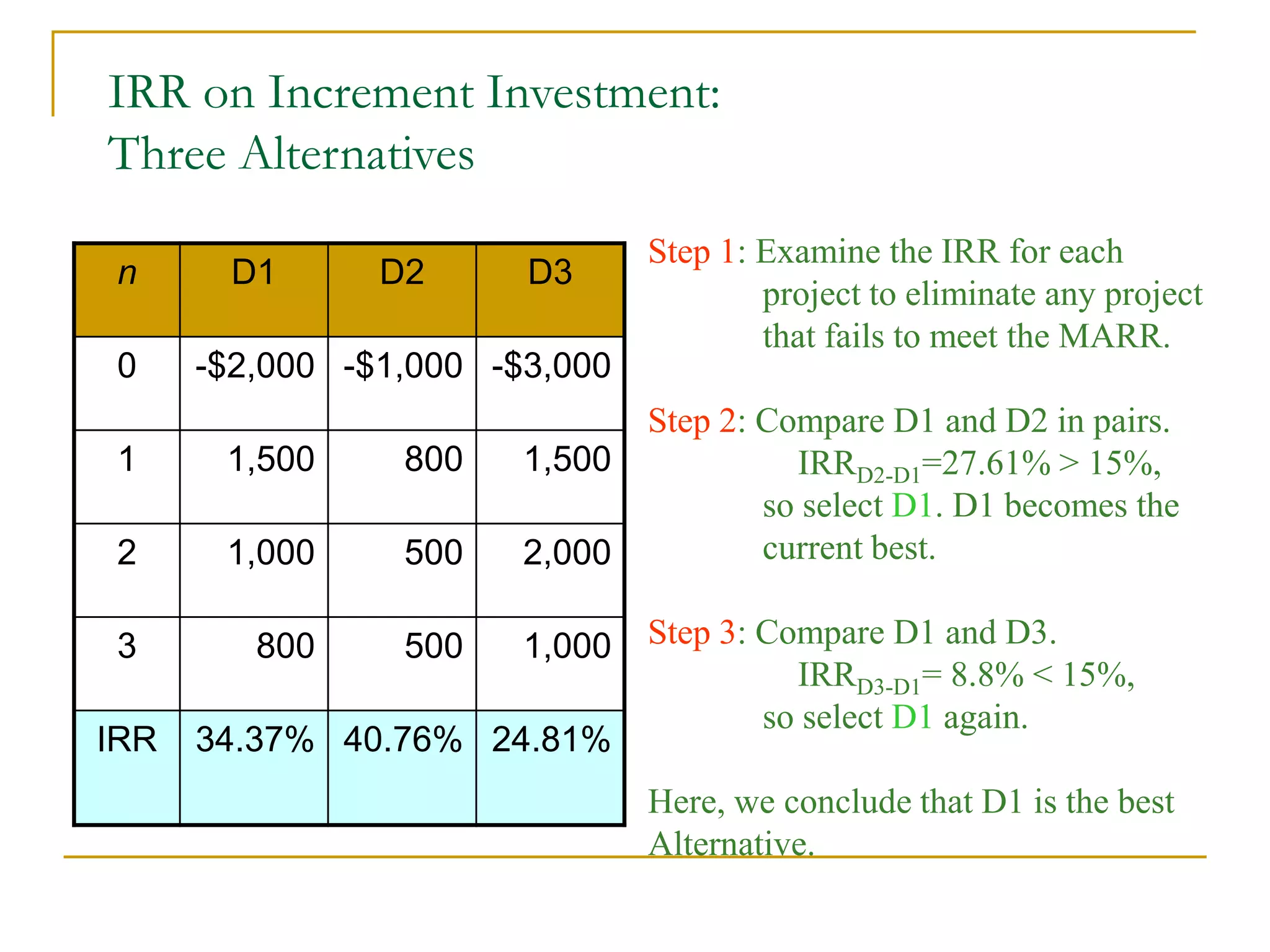

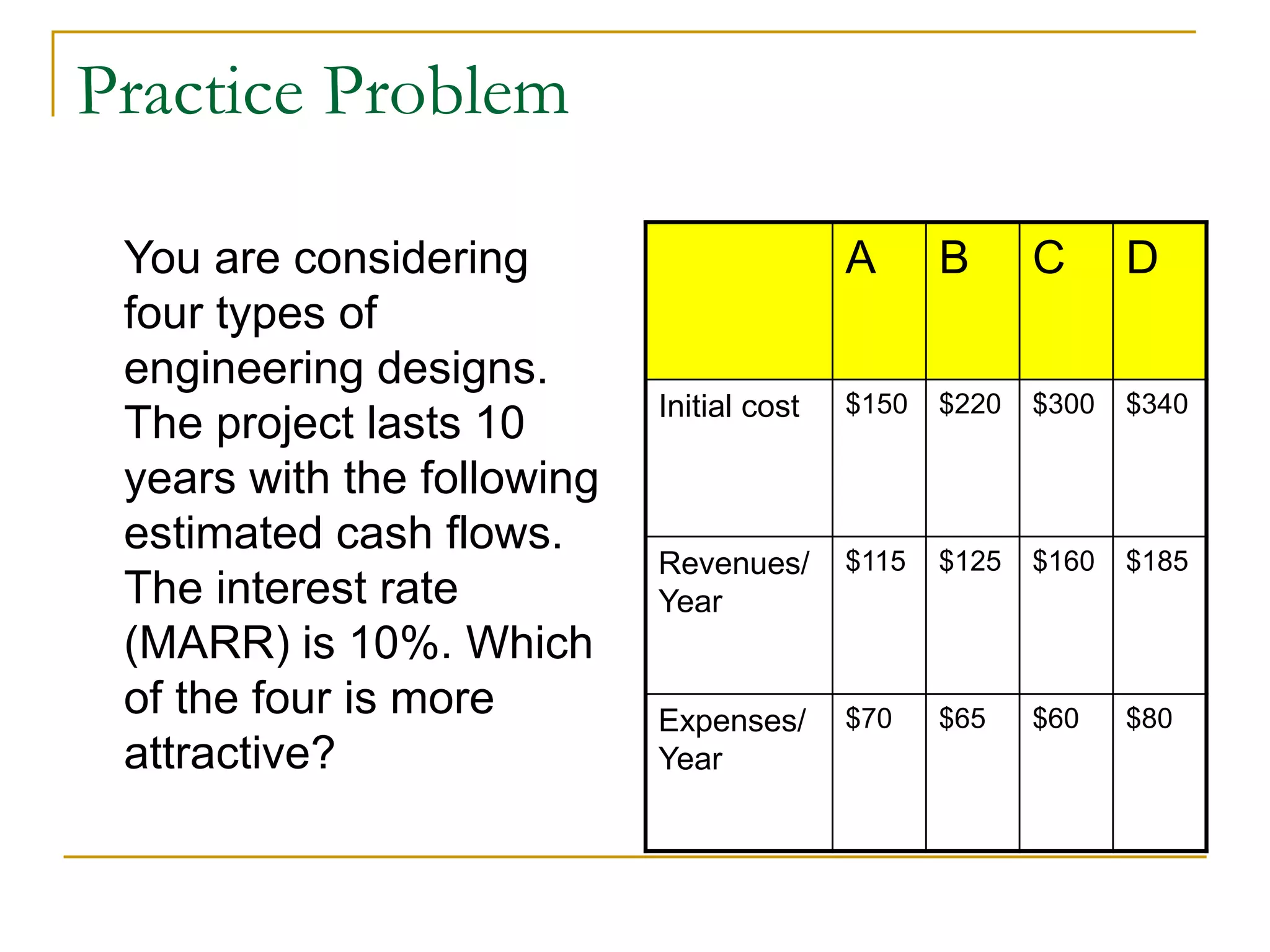

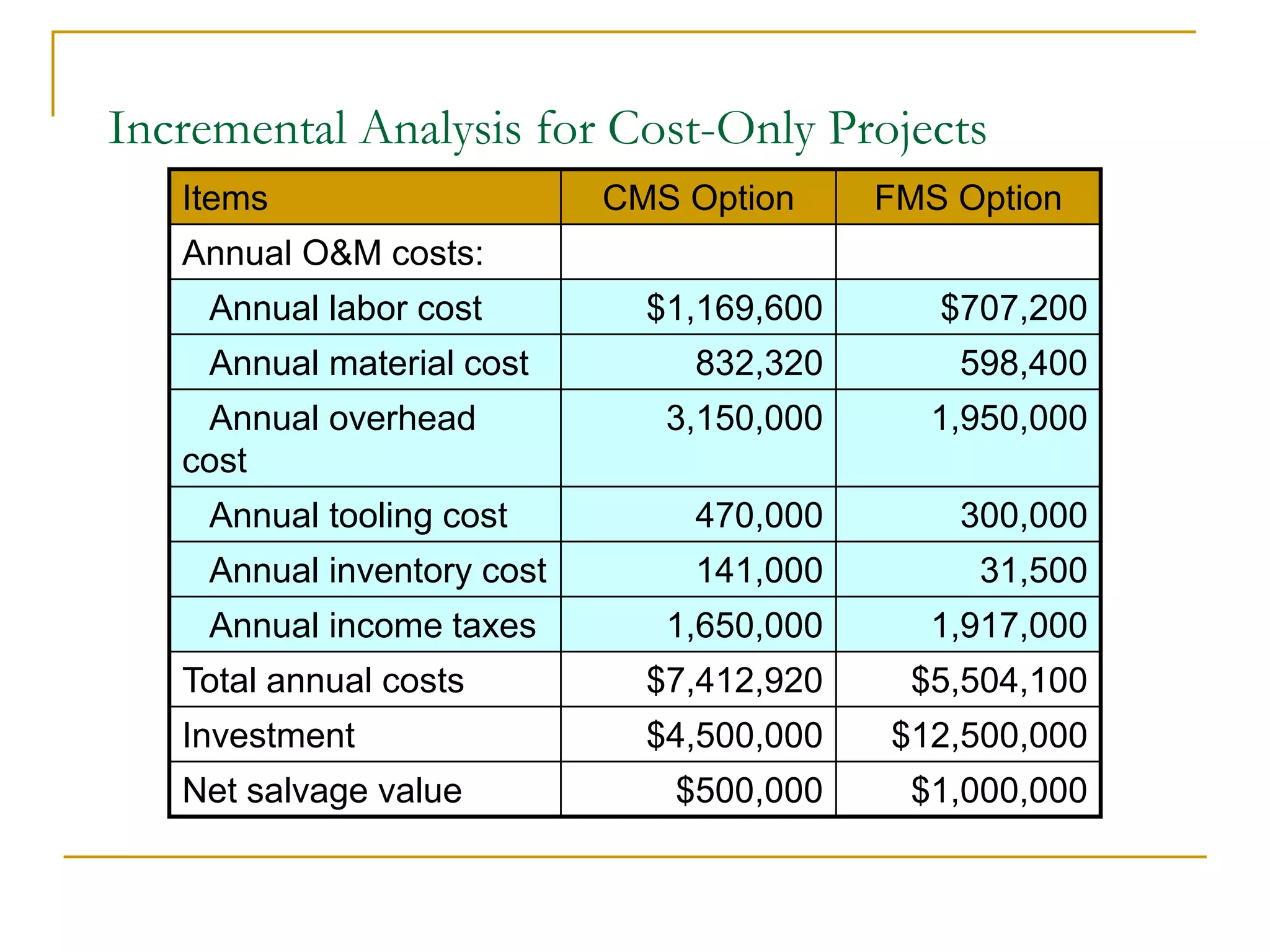

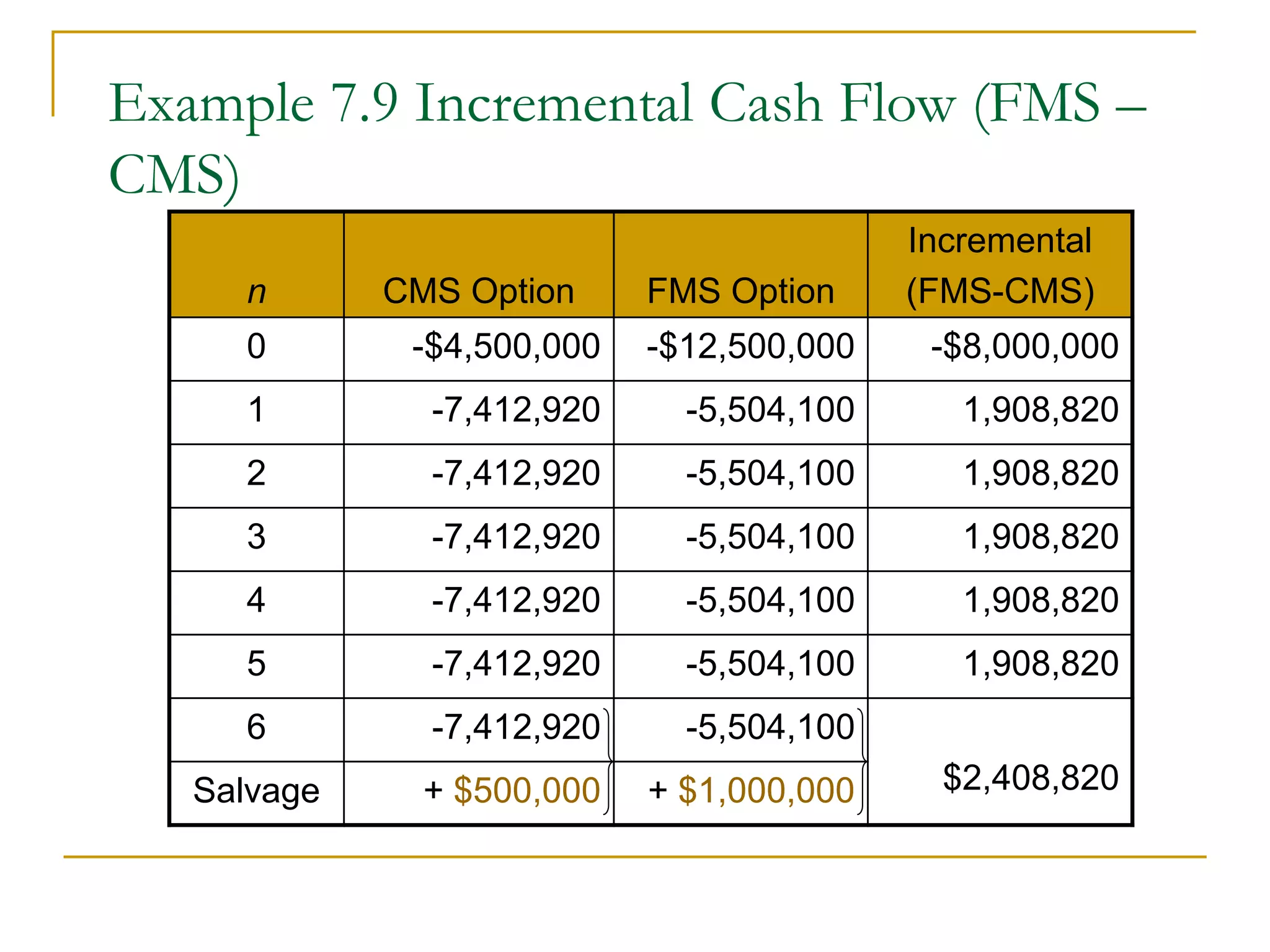

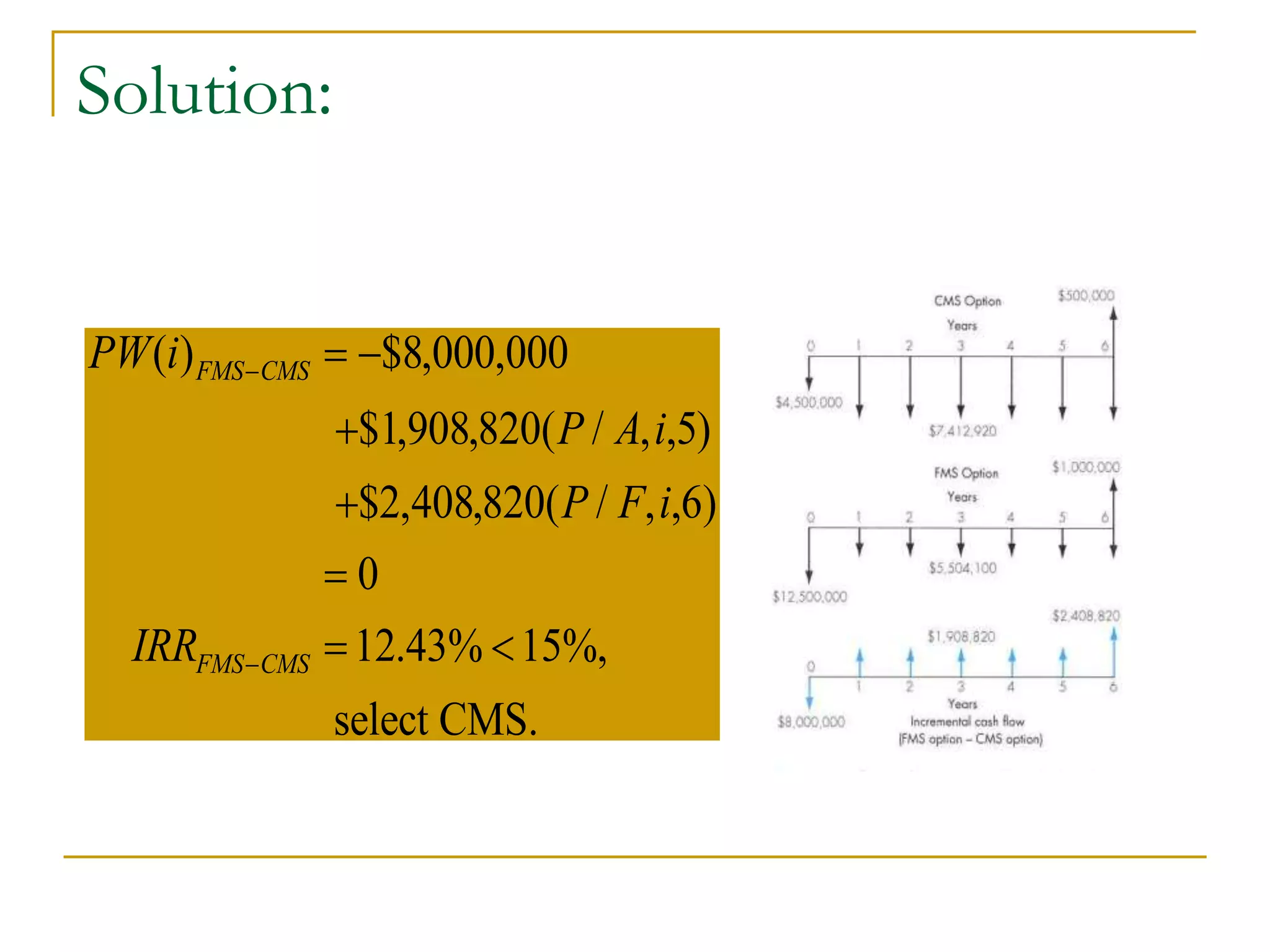

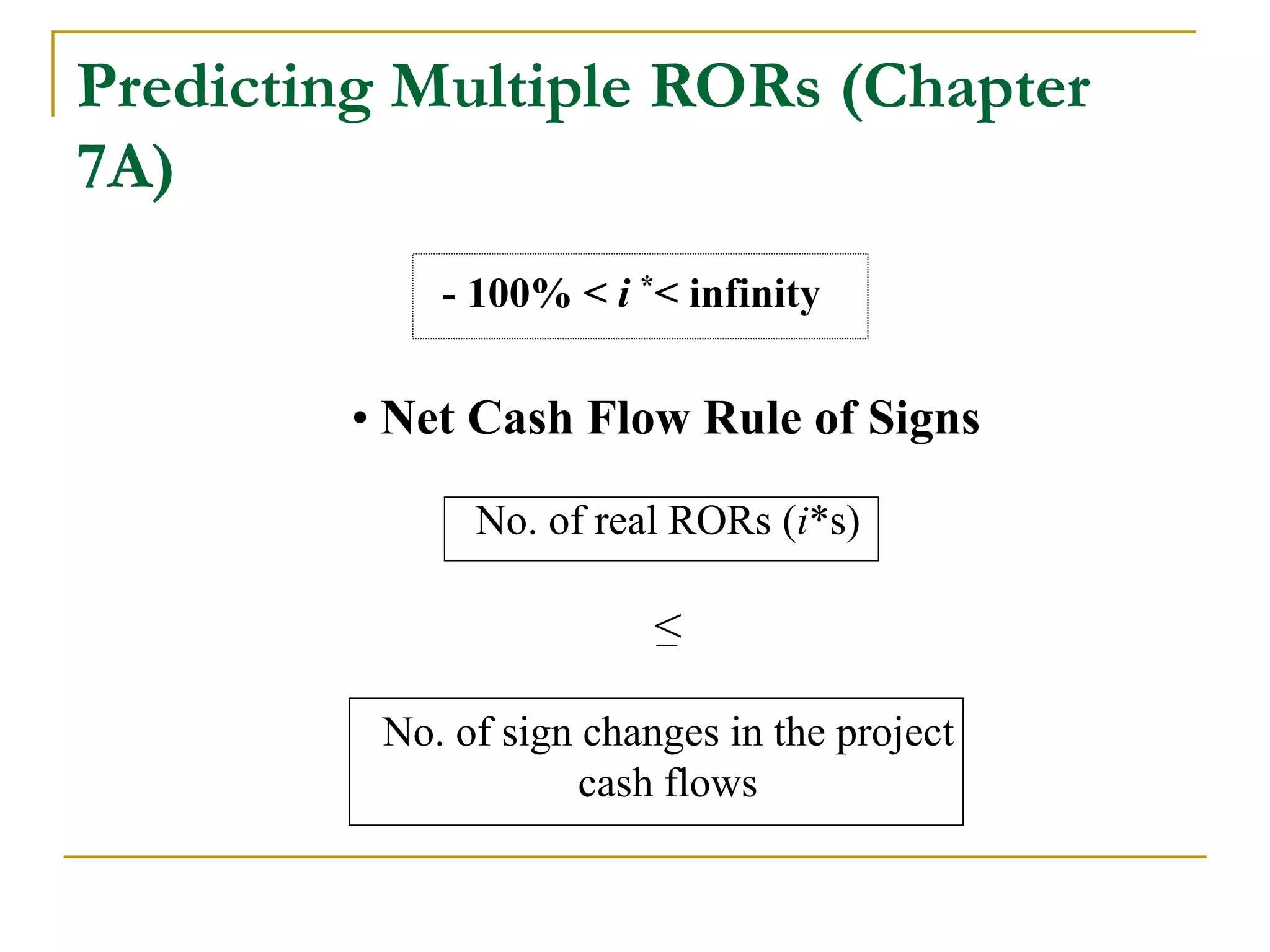

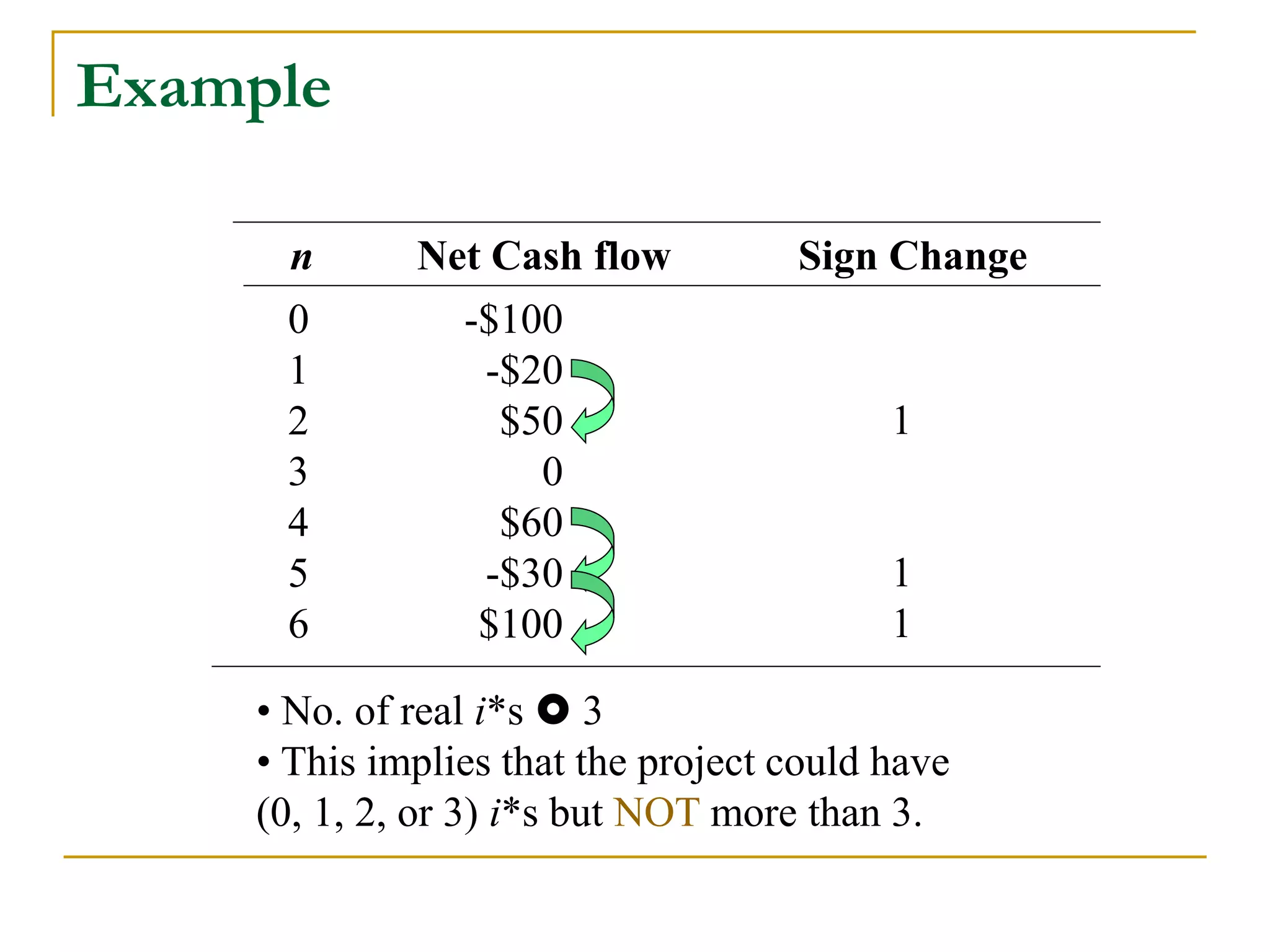

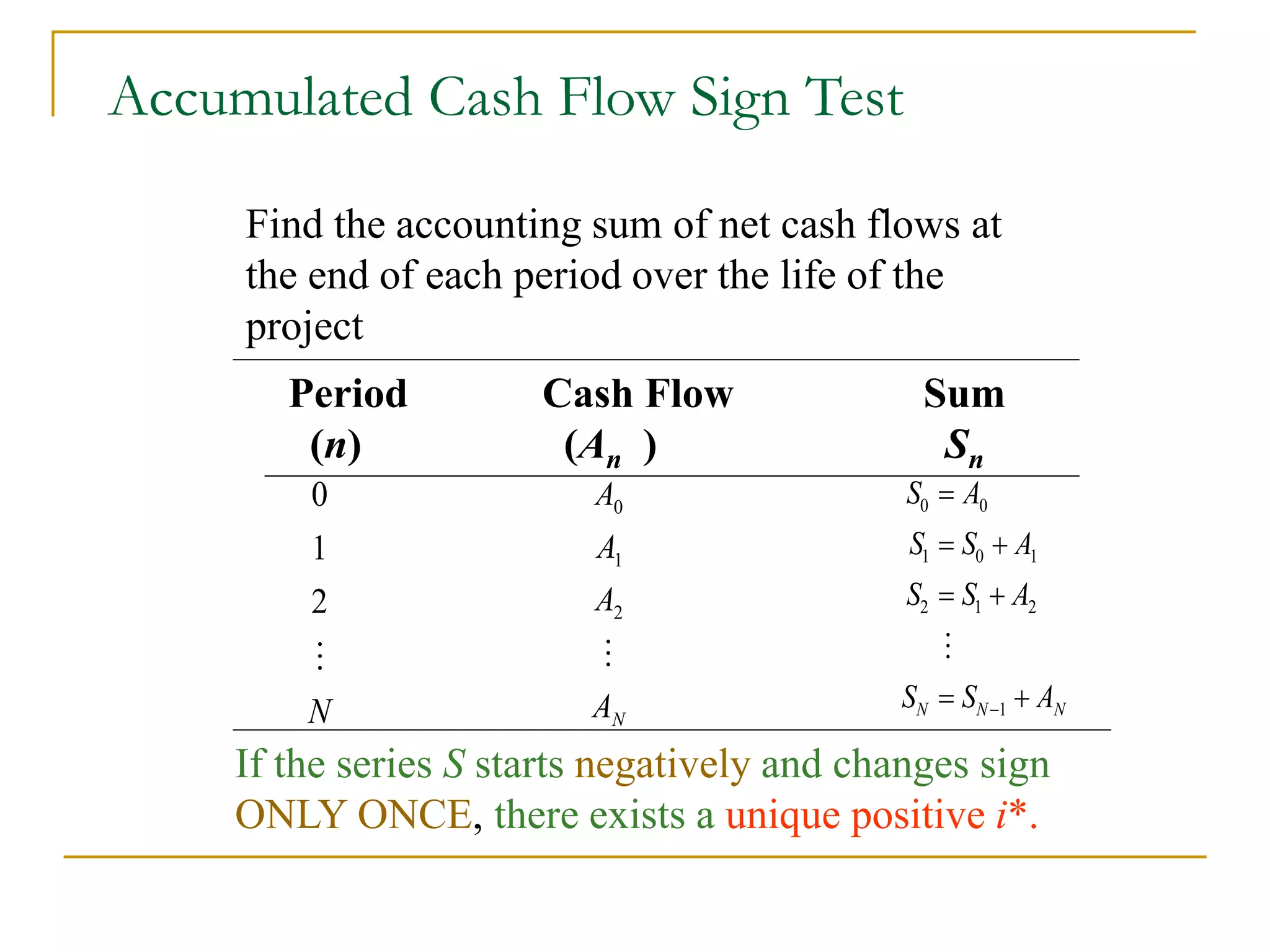

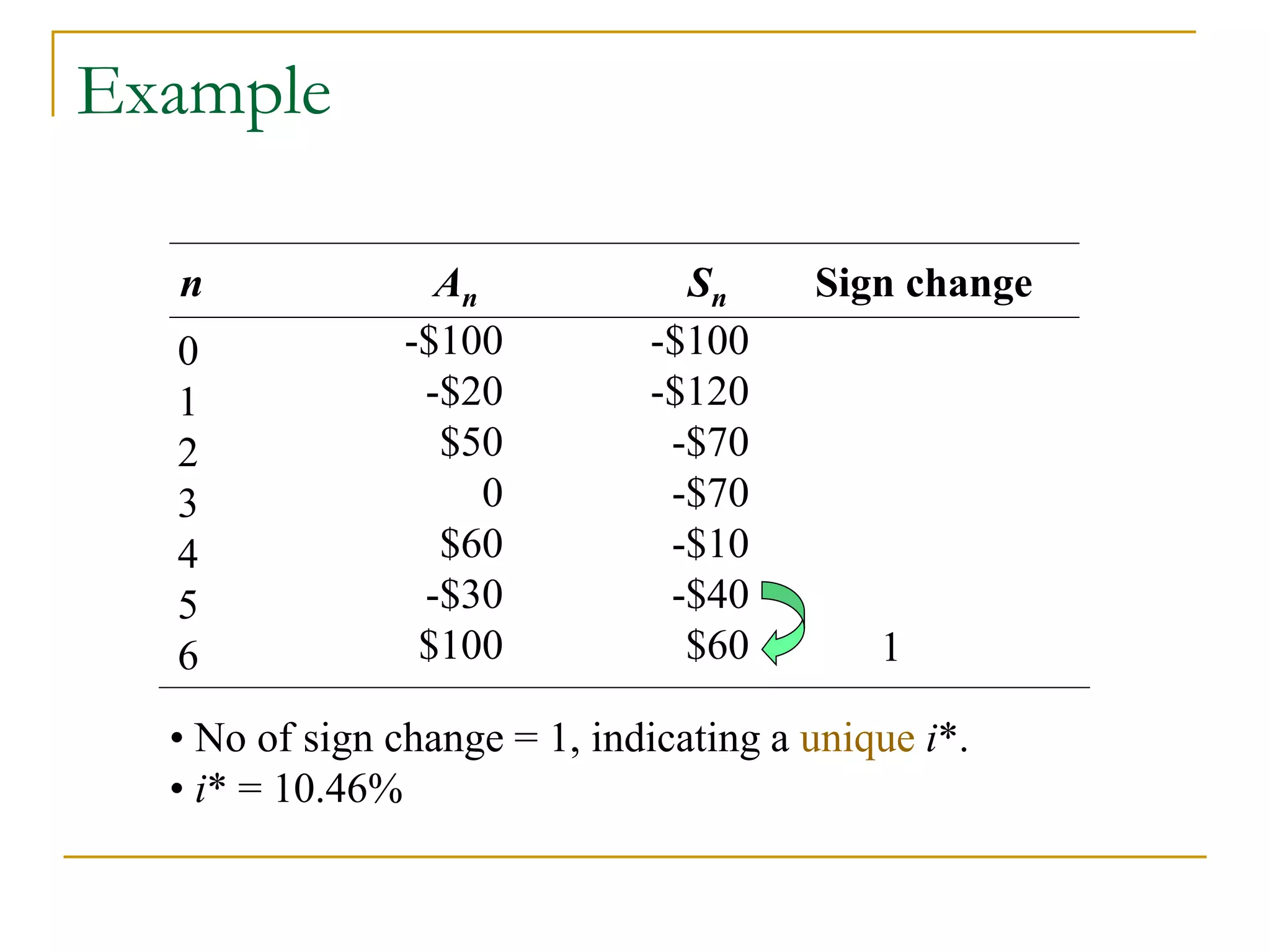

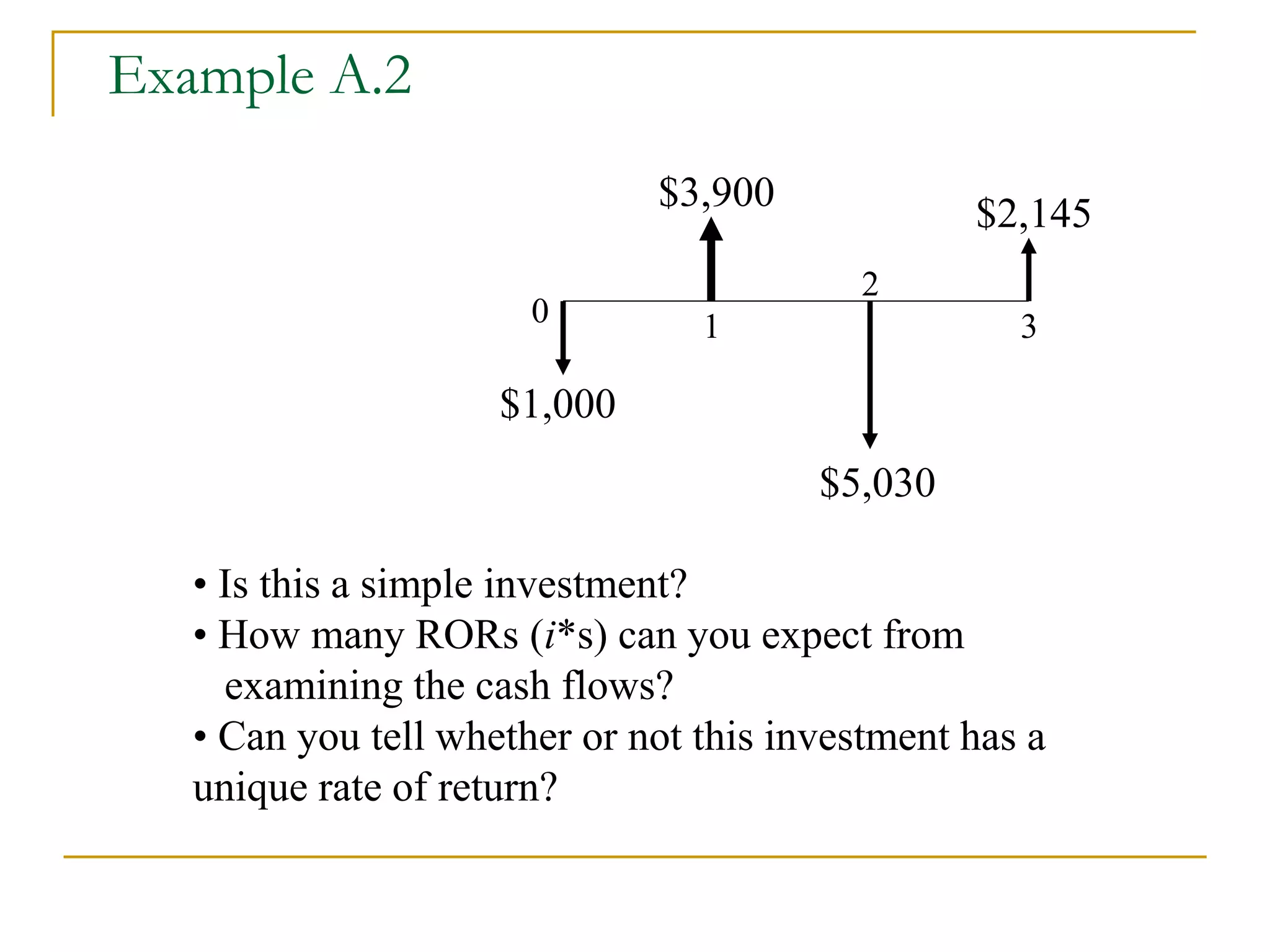

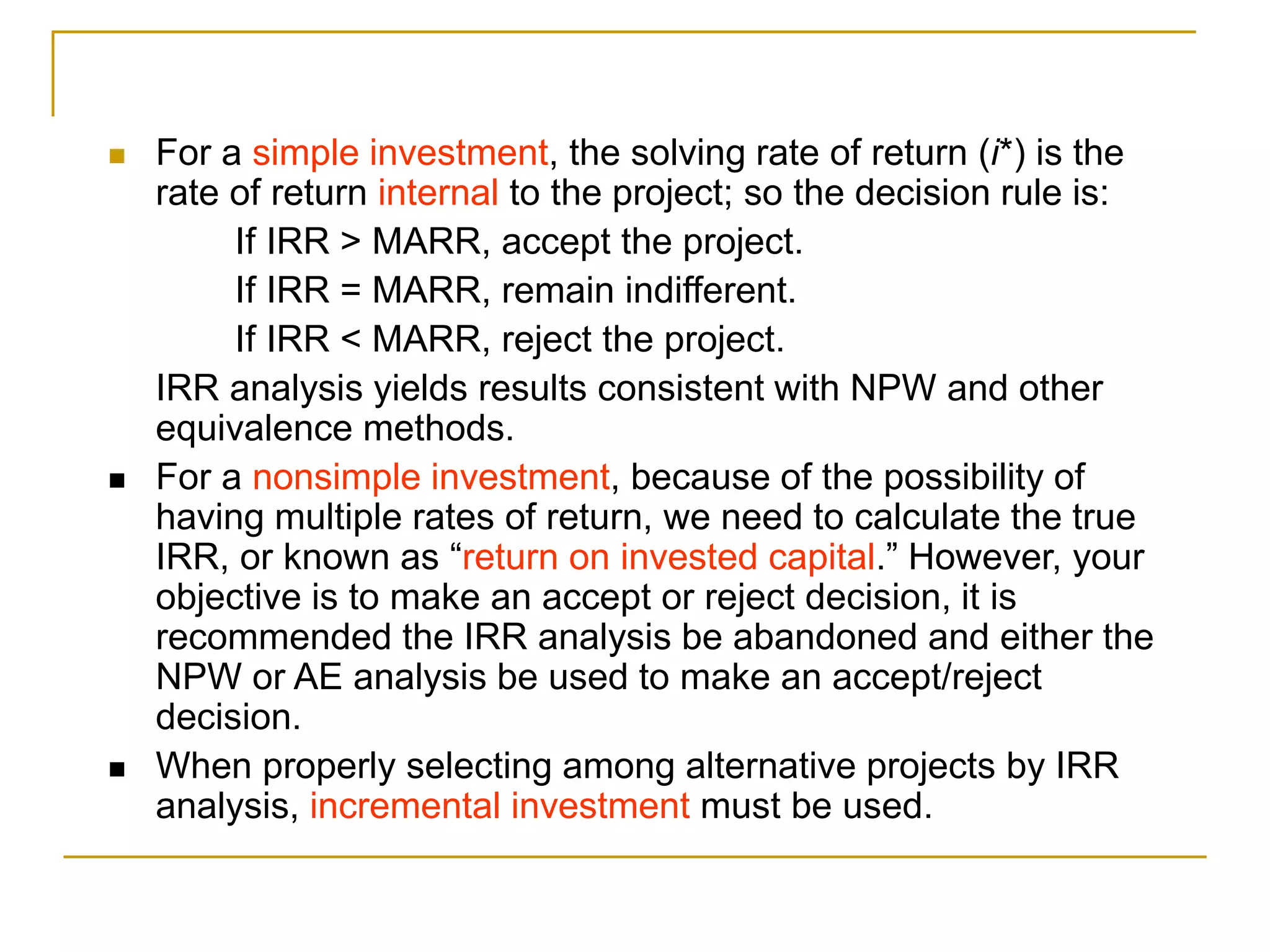

This document discusses incremental analysis and internal rate of return (IRR) for evaluating mutually exclusive investment projects. It addresses issues like: (1) IRR alone cannot be used to compare projects without knowing investment sizes; (2) incremental investment looks at the additional returns from one project over another; (3) incremental IRR must exceed the minimum acceptable rate of return (MARR) for a project to be selected. Examples are provided to illustrate incremental cash flows and IRR calculations to determine the best project. The document also distinguishes between simple and non-simple investments that have implications for using IRR as a decision criterion.