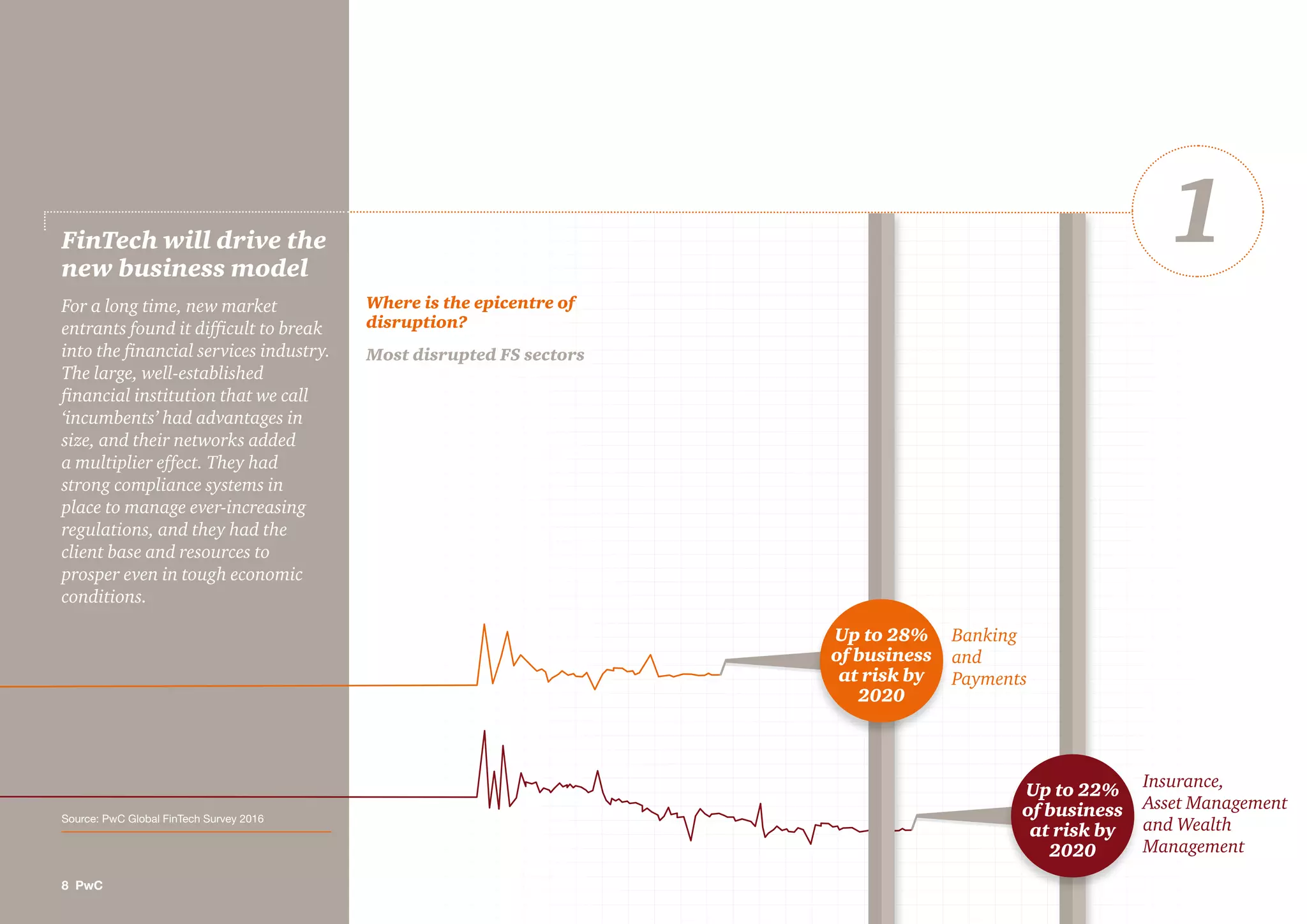

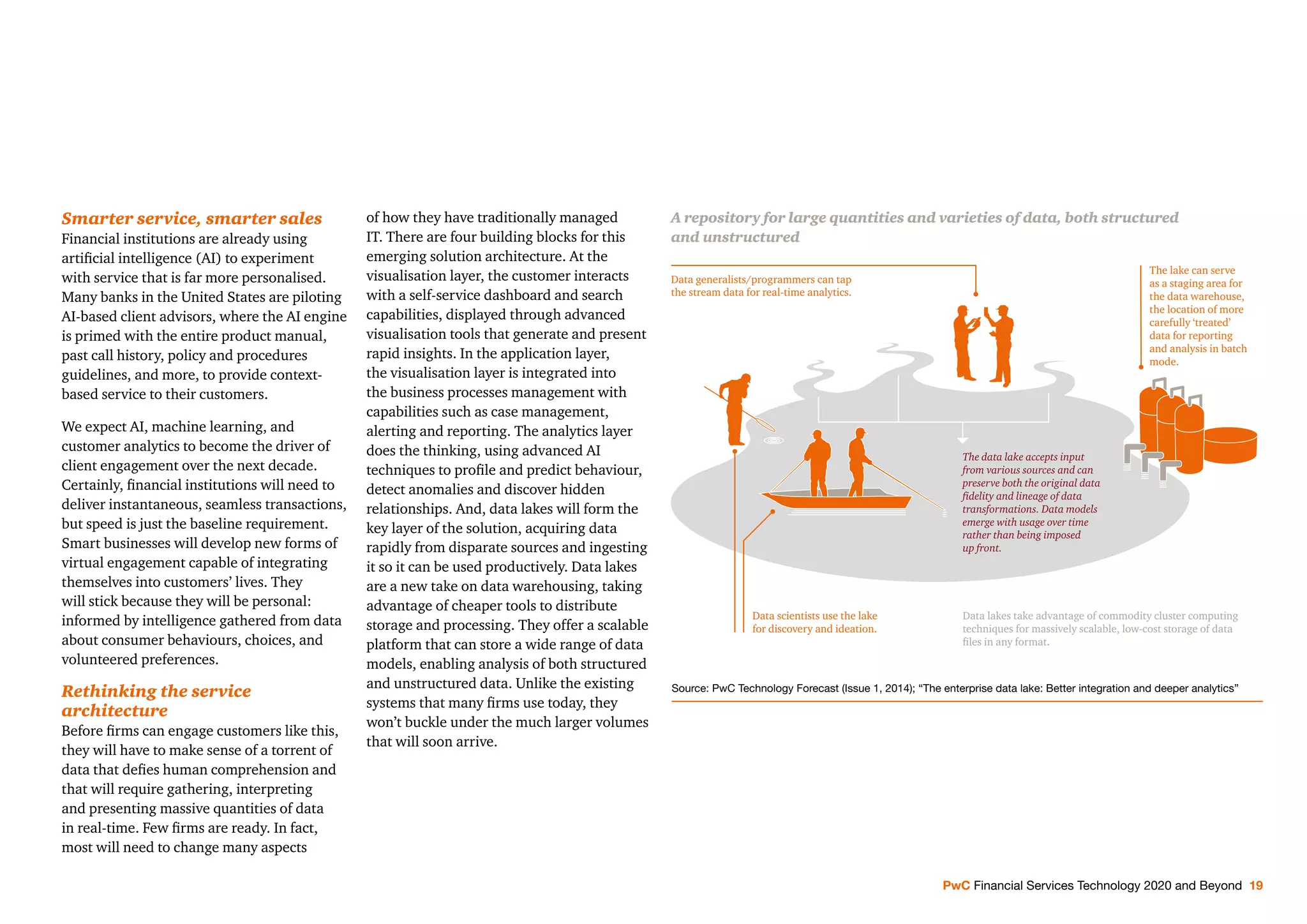

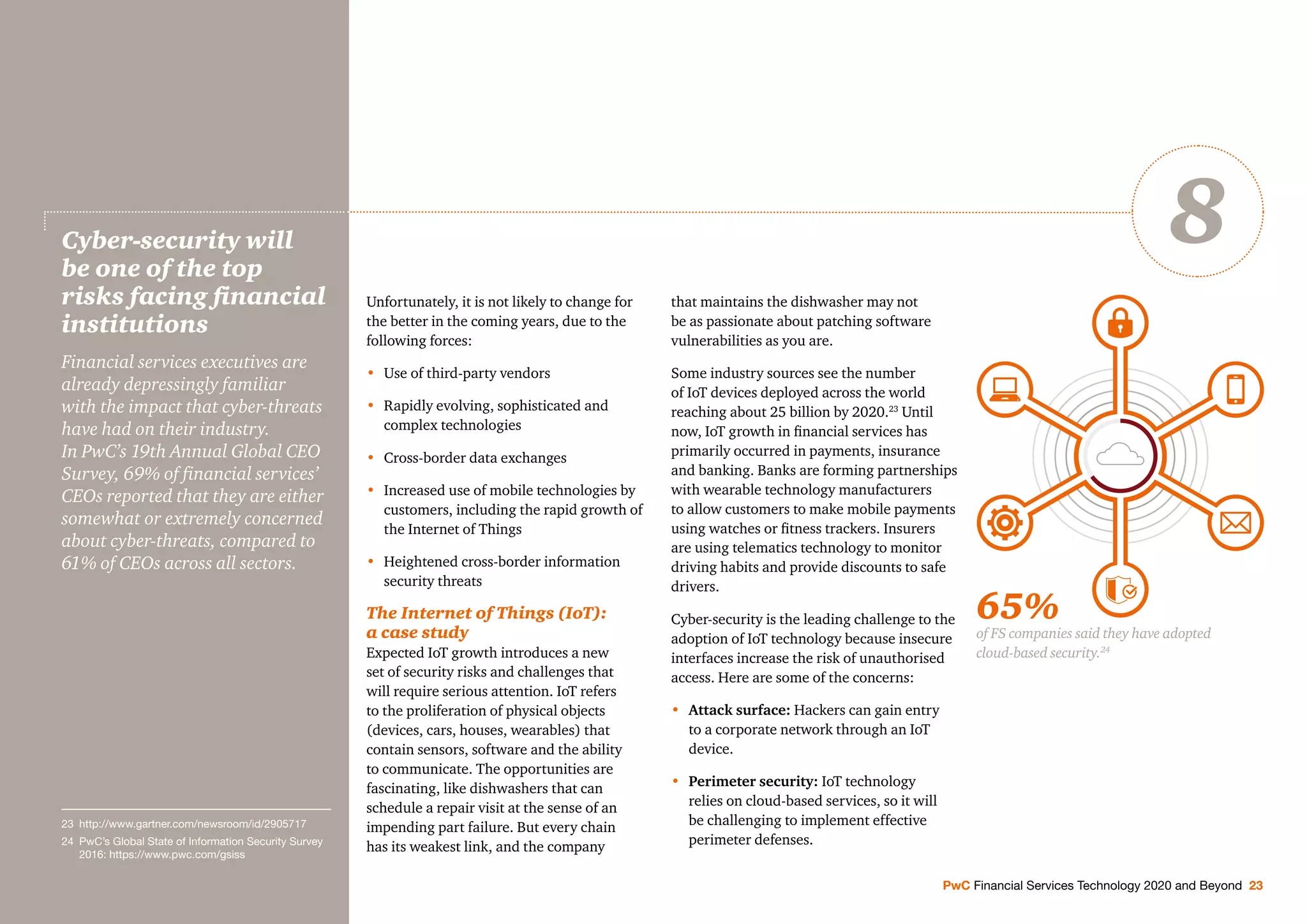

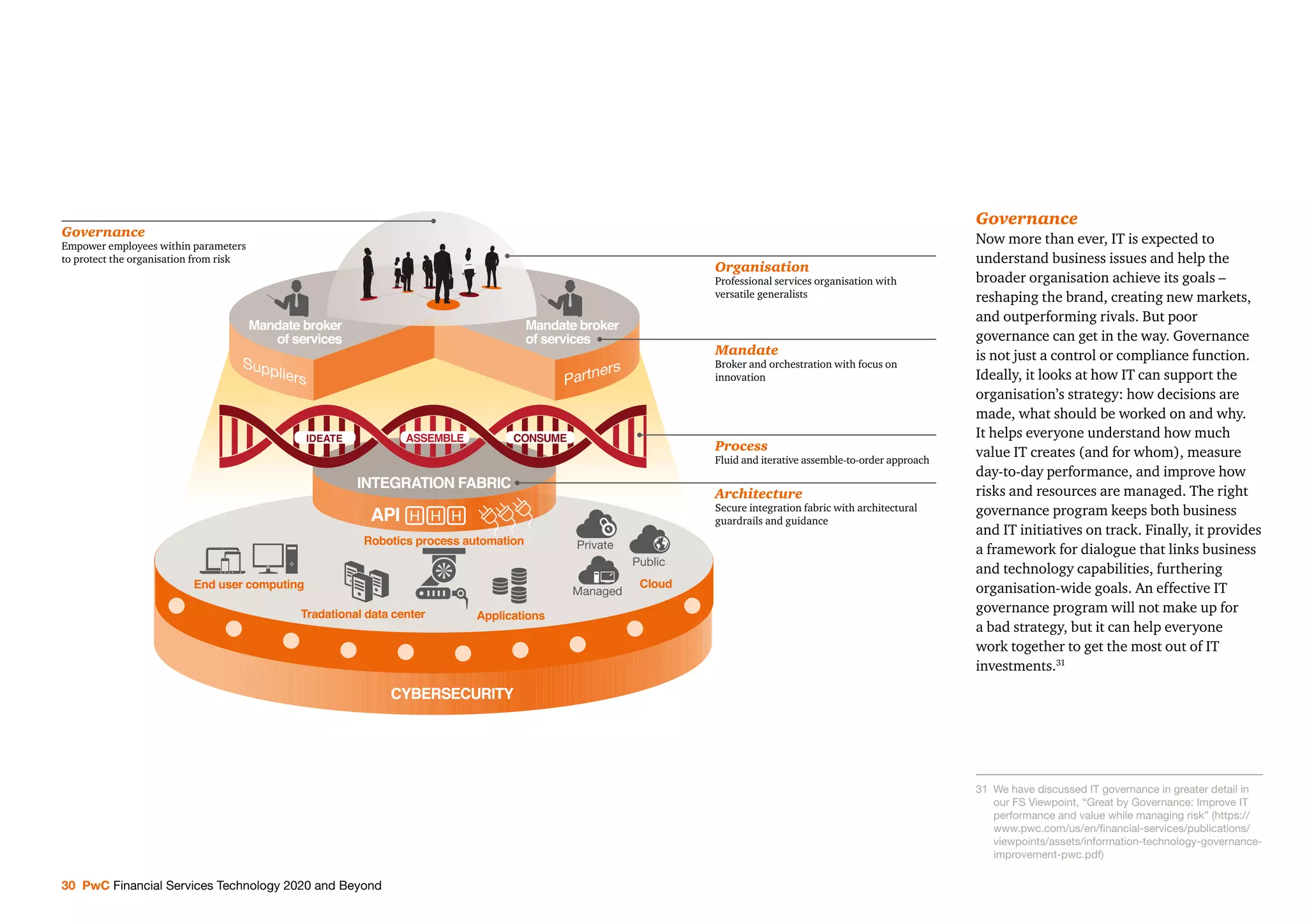

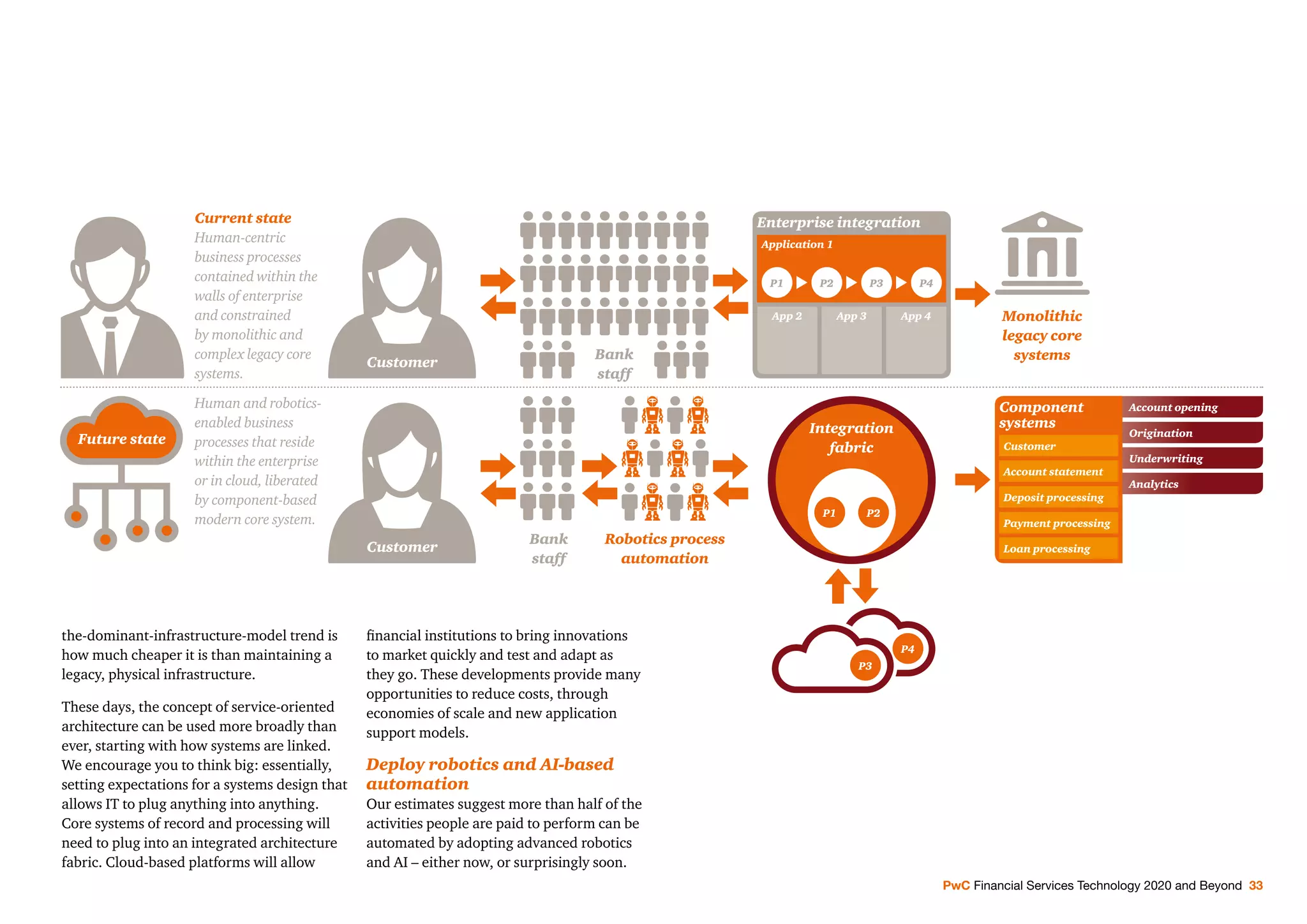

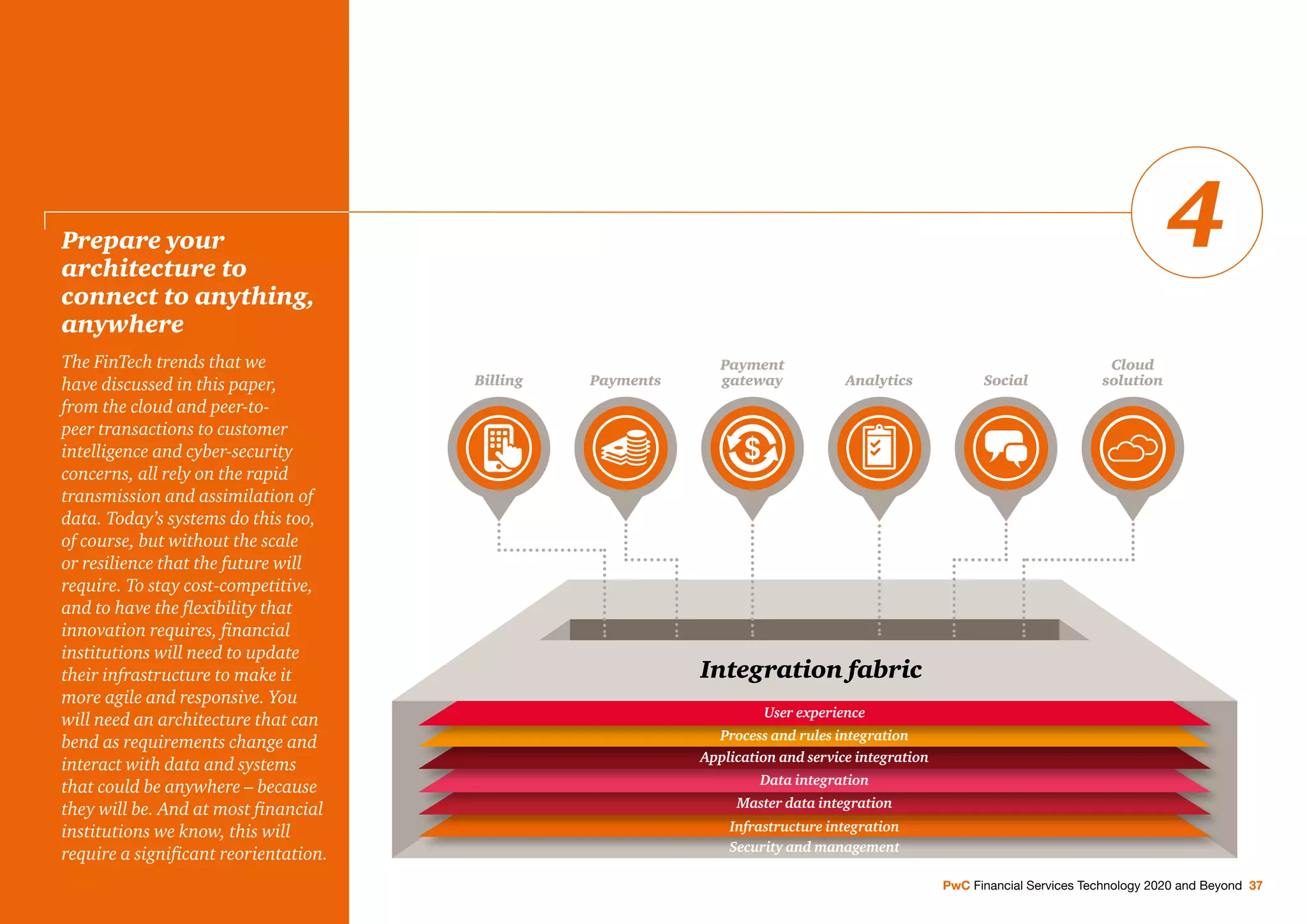

This document discusses the rapidly changing landscape of technology in the financial services industry from 2020 and beyond. It identifies 10 key technology trends that will impact financial institutions, including the rise of fintech driving new business models, adoption of blockchain, increased use of customer data analytics, growth of cloud computing and cybersecurity risks. The document urges financial institution executives to develop clear technology strategies to navigate these changes and compete successfully in the future.