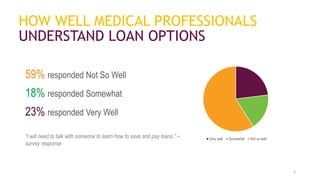

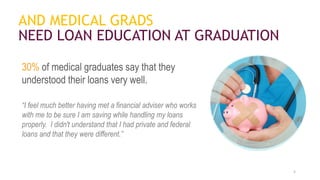

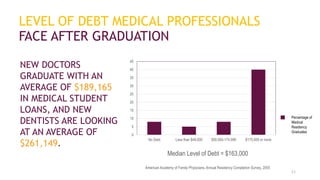

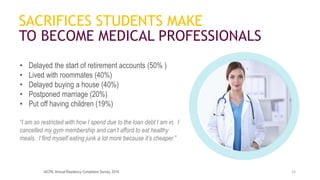

This document summarizes the challenges faced by medical professionals with student loan debt. It finds that most medical students and residents do not understand their loan options well and graduate with an average debt of $189,165. This level of debt forces many to delay saving for retirement, buying homes, marriage, and children. Younger medical professionals struggle to pay bills during training while also paying down their loans. The document recommends improved financial education for students and graduates to help them better manage loans and launch their careers.