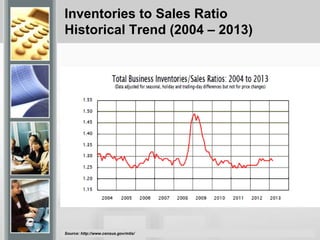

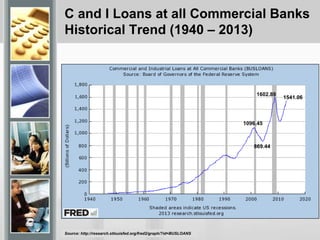

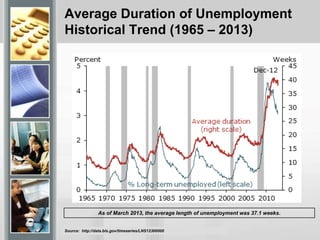

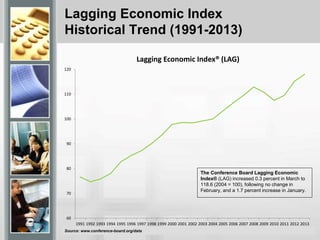

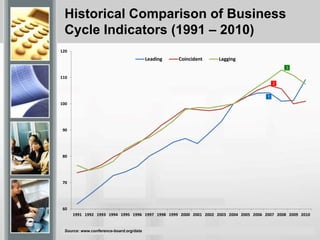

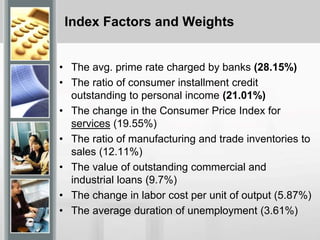

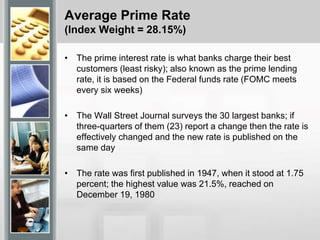

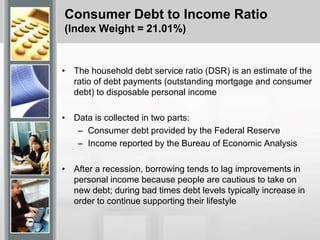

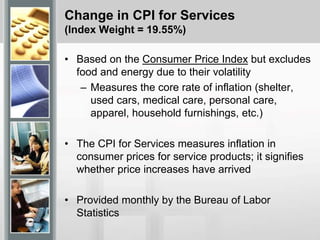

The composite index of lagging indicators is published monthly by The Conference Board to track changes in the business cycle after they have occurred. It comprises seven economic measures weighted as follows: the average prime rate charged by banks (28.15%), consumer debt to income ratio (21.01%), change in consumer price index for services (19.55%), business inventories to sales ratio (12.11%), commercial and industrial loans (9.7%), change in labor costs per unit of output (5.87%), and average duration of unemployment (3.61%). The index provides confirmation that the business cycle has shifted to a new stage, indicating peak and trough turning points. In March 2013, the lagging index increased 0.

![CPI for Services

Historical Trend (1980-2013)

The index for all items less food and

energy increased 0.1 percent in

March following increases of 0.3

percent in January and 0.2 percent

in February. 1982-84=100

Source: http://research.stlouisfed.org/fred2/graph/?s[1][id]=CPILFESL

232.76

0.000

50.000

100.000

150.000

200.000

250.000

Jan-70

May-71

Sep-72

Jan-74

May-75

Sep-76

Jan-78

May-79

Sep-80

Jan-82

May-83

Sep-84

Jan-86

May-87

Sep-88

Jan-90

May-91

Sep-92

Jan-94

May-95

Sep-96

Jan-98

May-99

Sep-00

Jan-02

May-03

Sep-04

Jan-06

May-07

Sep-08

Jan-10

May-11

Sep-12

CPI for Services

Jan 79 – Dec 80

Average = .93%](https://image.slidesharecdn.com/economiclaggingindicators-130424135425-phpapp02/85/Lagging-economic-indicators-10-320.jpg)