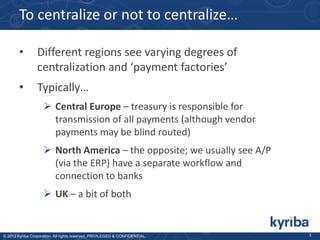

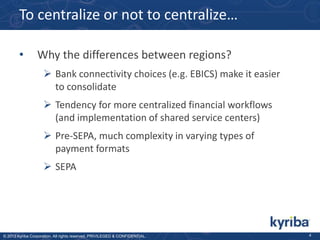

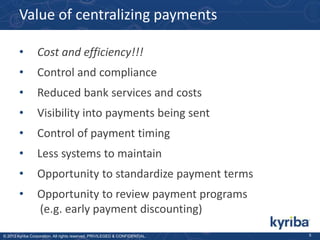

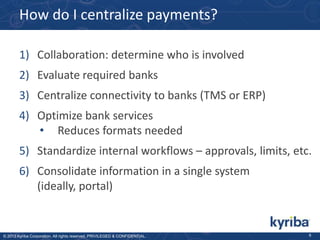

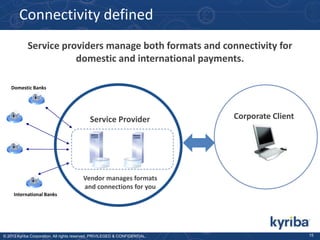

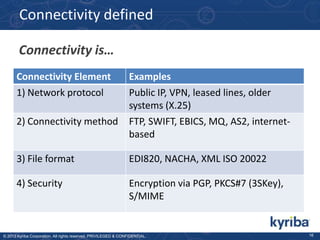

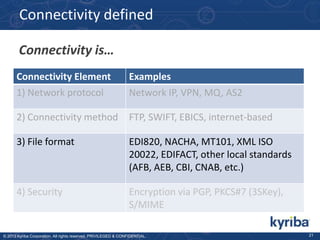

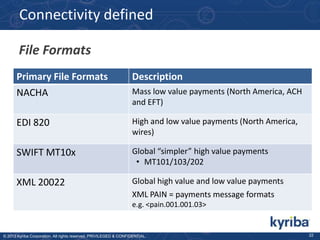

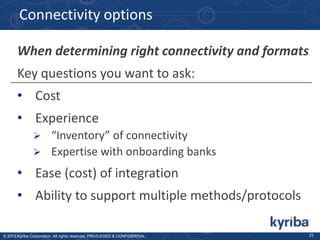

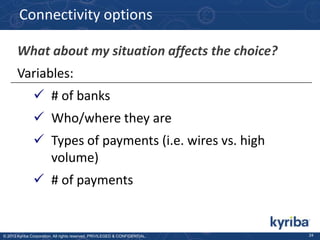

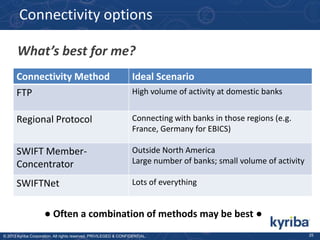

The document discusses trends in payment centralization across various regions, highlighting differences in how payments are managed, including cost efficiency and control. It emphasizes the benefits of centralizing payments, such as reduced costs, improved visibility, and increased security through standardized workflows and digital signatures. Additionally, it outlines connectivity methods for payments and introduces Kyriba solutions for managing payment workflows.