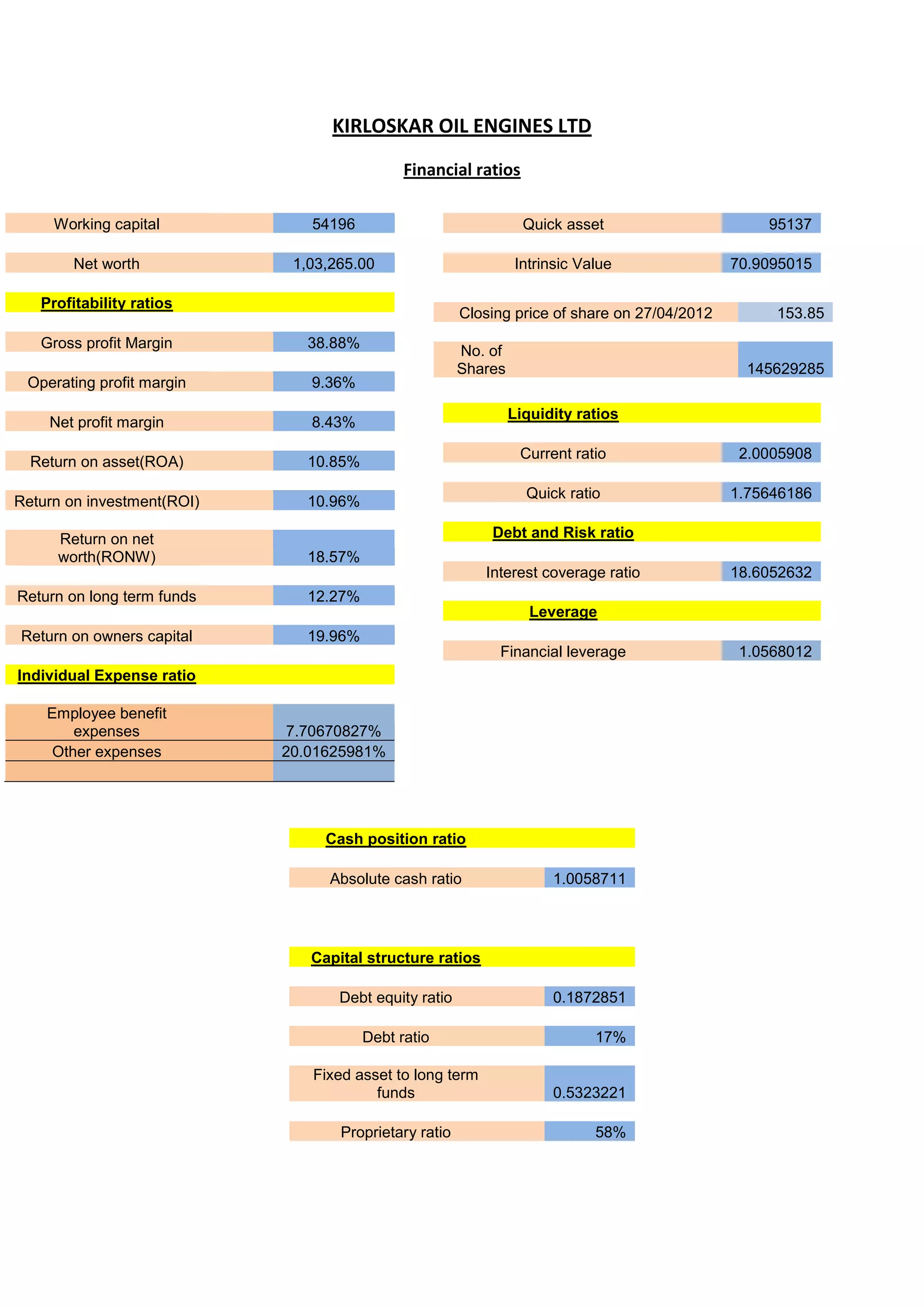

This document provides various financial ratios for Kirloskar Oil Engines Ltd for the year ending 27 April 2012. Key ratios include a current ratio of 2.0005908, quick ratio of 1.75646186, interest coverage ratio of 18.6052632, debt equity ratio of 0.1872851, and return on net worth of 18.57%. The company had a net worth of Rs. 1,03,265.00 and the closing share price on 27/04/2012 was Rs. 153.85.