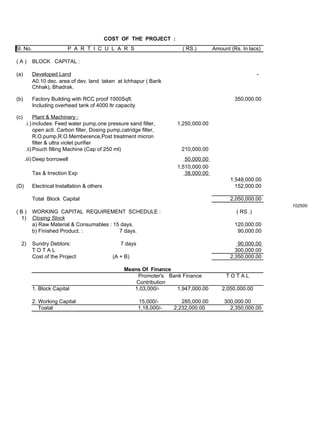

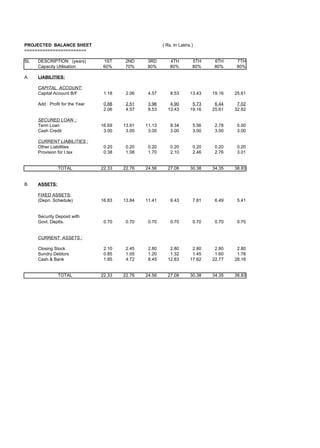

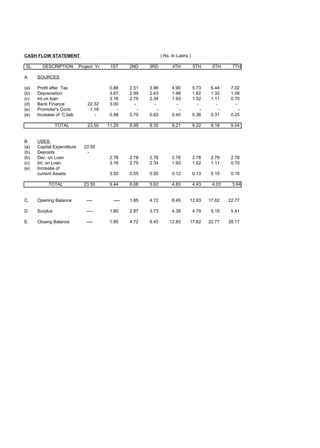

The document provides cost details for a water purification project. It estimates the total cost of the project to be Rs. 2,350,000 which includes block capital costs of Rs. 2,050,000 and working capital requirements of Rs. 300,000. It then outlines schedules for loan repayment, depreciation, projected profitability and the projected balance sheet over a 7 year period. The key financial projections show annual net profits increasing from Rs. 0.88 lakhs in year 1 to Rs. 7.02 lakhs in year 7.