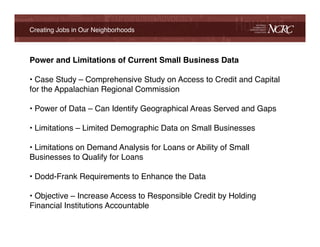

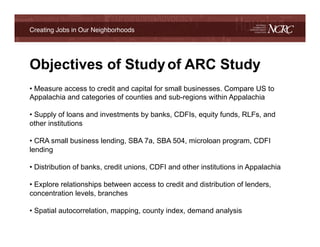

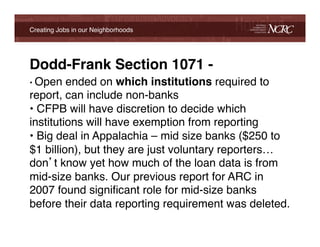

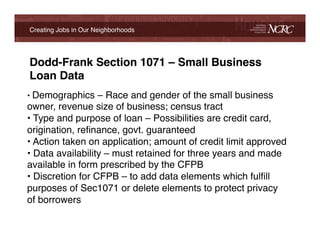

This document discusses the need for enhanced small business loan data collection. Currently, data is limited and does not include important demographic details about small business owners. The Dodd-Frank Act requires expanded data collection through Section 1071 to better identify credit needs, enforce fair lending laws, and help direct resources. The expanded data mandated by Dodd-Frank will include race, gender, business revenue size, loan details, and census tract information, helping analysts better assess if credit needs are being met for various small business owner groups.