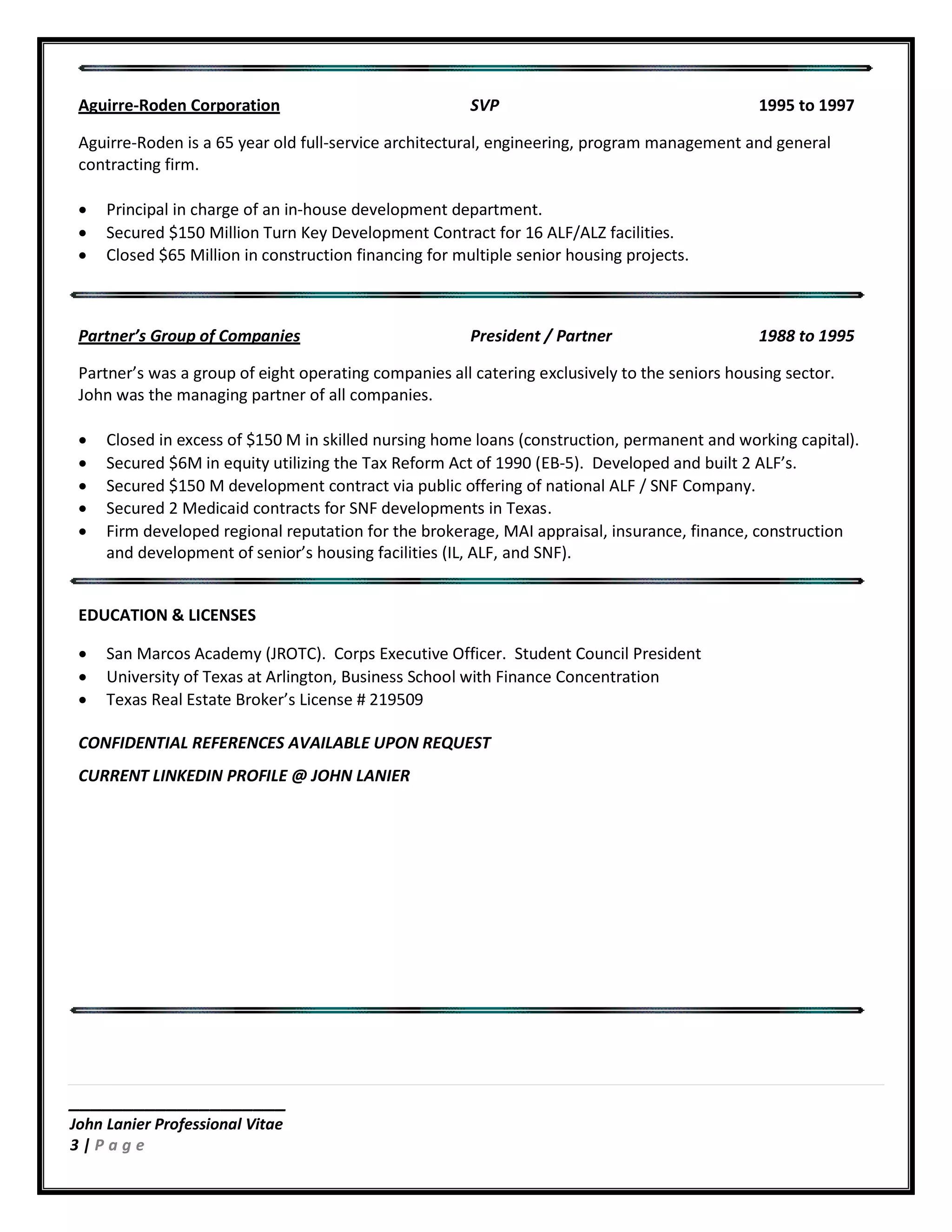

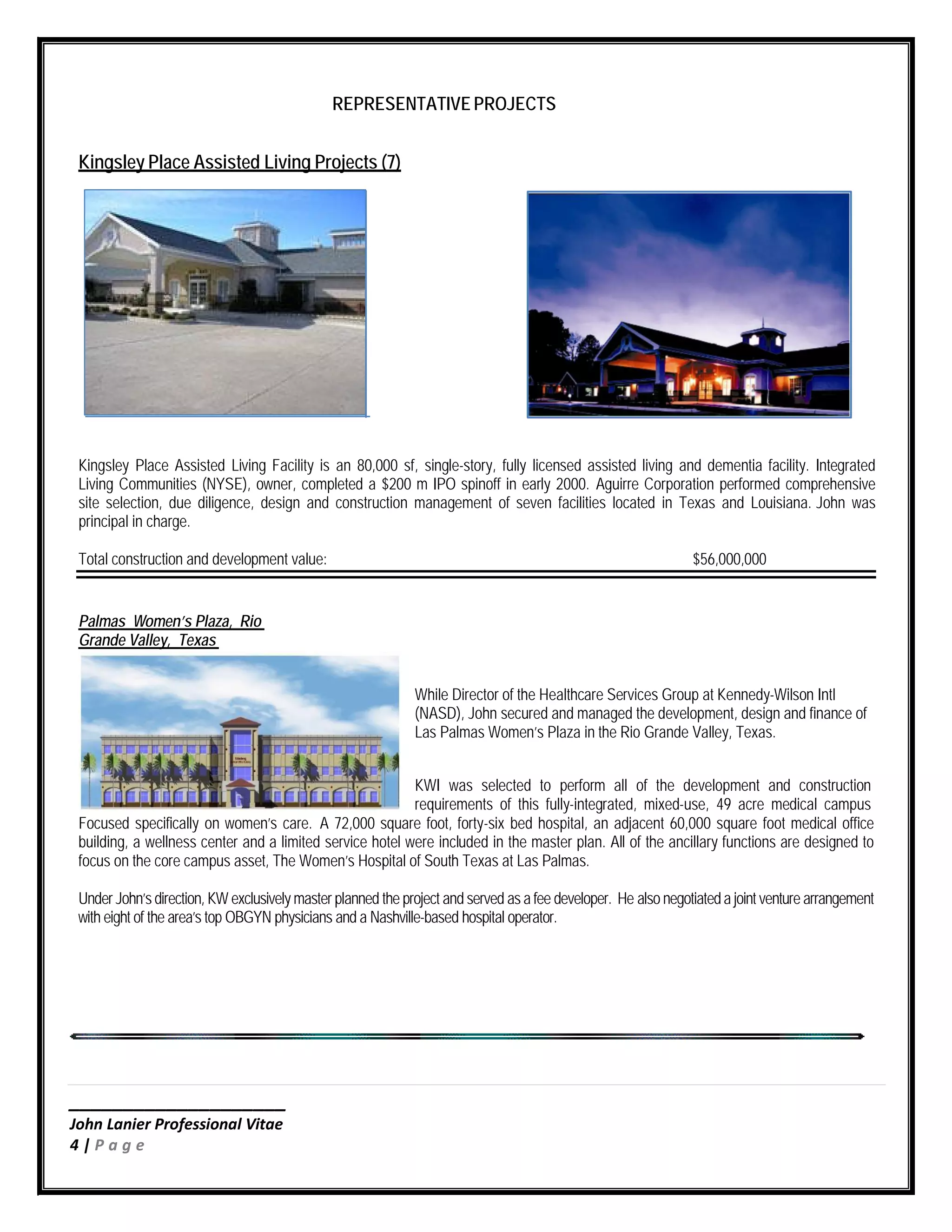

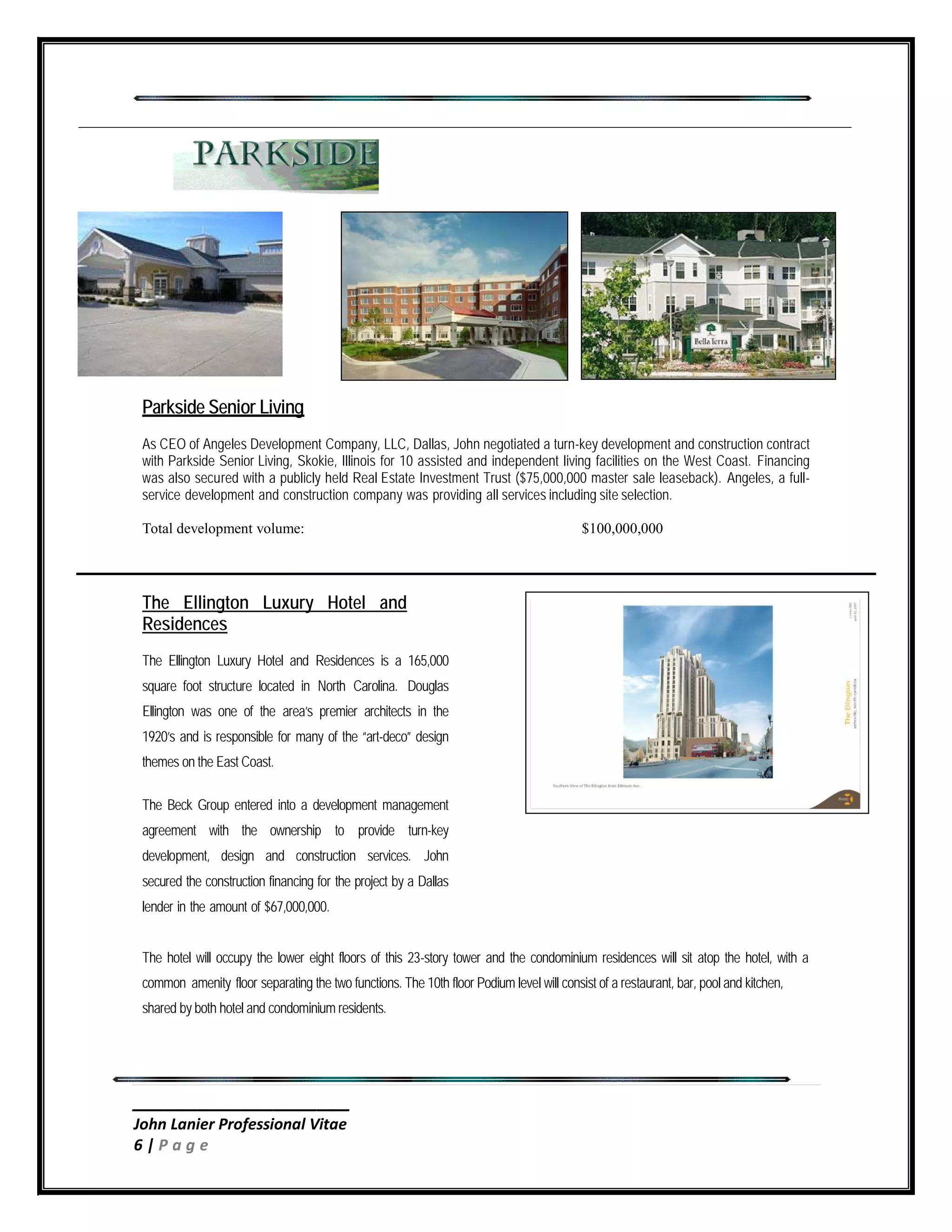

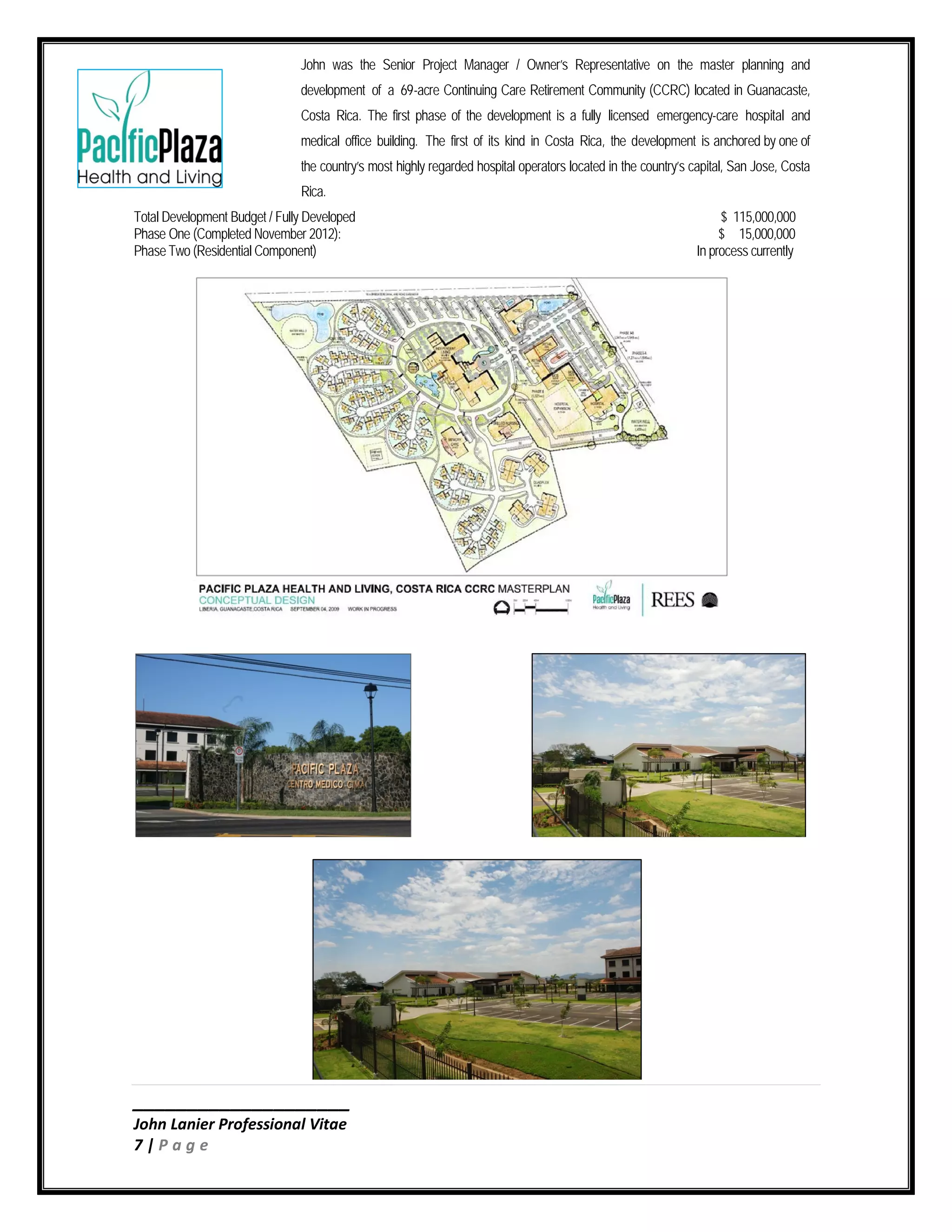

The document is a 4-page vitae for John Lanier outlining his professional experience and accomplishments. It details his extensive experience over 30+ years in developing over $200 million of senior housing and healthcare facilities. His background includes negotiating contracts, securing financing, and leading development projects for various companies. The vitae provides examples of major projects he has worked on and his educational background.