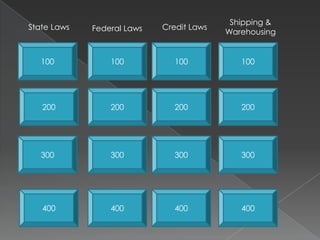

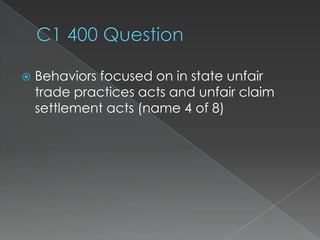

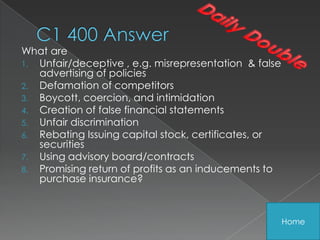

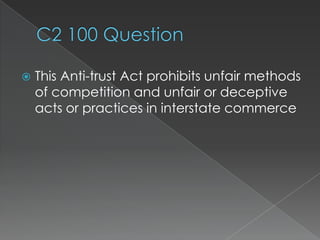

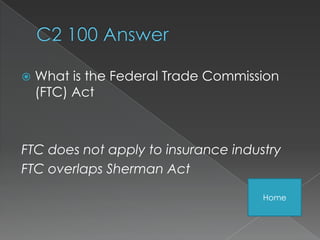

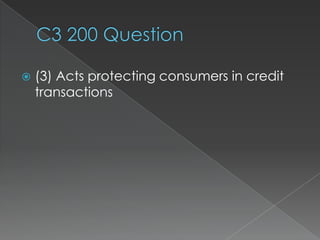

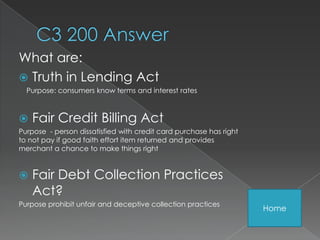

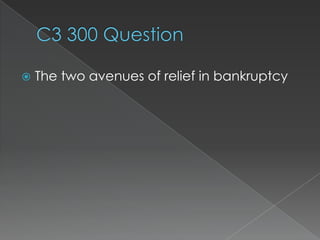

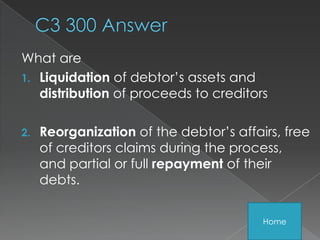

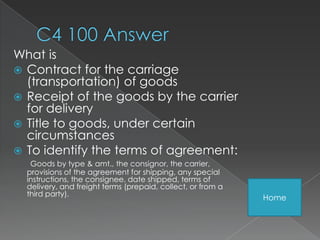

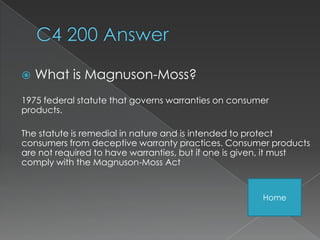

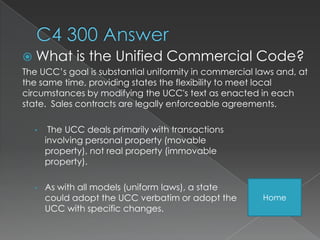

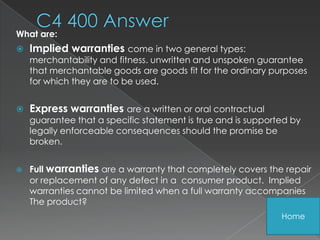

The document discusses various laws related to commerce including antitrust laws, consumer protection acts, bankruptcy law, commercial acts, and warranty laws. It addresses key aspects of the Sherman Antitrust Act, Federal Trade Commission Act, McCarran-Ferguson Act, Truth in Lending Act, Fair Credit Billing Act, Fair Debt Collection Practices Act, Magnuson-Moss Warranty Act, and the Uniform Commercial Code. Specifically, it defines these acts, explains their purpose, and compares differences between them, such as how the FTC Act differs from the Sherman Act in scope.