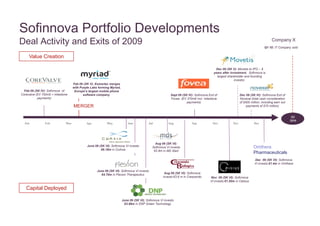

The document discusses Sofinnova Capital VI's investment activities and trends as of January 2010, highlighting the firm's strong performance in 2009 amidst economic challenges. It outlines the focus on early-stage investments in areas such as biopharmaceuticals, medical devices, and green technologies, while also projecting continued growth in M&A and IPO activities. Additionally, it identifies key trends for 2010, including advancements in mobile internet, digitalization, and disruptive innovations in medicine.

![2010 Trends: Vaccines

Growth Old technology

35

30

25

20

15

10

5

0

2002 2003 2004 2005 2006 2007 2008 2012

[E]

Future Innovation

SHIFT

30.0

PROPHYLACTIC VACCINES THERAPEUTIC VACCINES

Births per year (m)

Seven major markets BRIC countries

25.0

18

20.0

INFECTIOUS DISEASE

$B CHRONIC DISEASE

15.0

Bacterial 10.0

2008 2018

Cancer

Viral Diabetes

Alzheimer’s Disease 5.0

0.0

BRIC: Brazil, Russia, India, China

Copyright © 2006 Sofinnova Partners](https://image.slidesharecdn.com/breakfastpresentationjan262010-100127141943-phpapp02/85/Sofinnova-Partners-picks-up-260m-for-sixth-fund-18-320.jpg)

![2010 Trends: Antibodies

Growth Past Innovation

450 70

400 60

350

50

300

250 40

$B

200 30

Murine Chimeric Humanized Fully Human

150

20

100 Murine % 100 30-35 5-10

50 10

0 0 Human % 60-65 90-95 100

2002 2003 2004 2005 2006 2007 2008 2009 2012 2014

[E] [E]

NCE MAB Mouse Human

Future Innovation

Variable region of

Heavy chain (Vh)

Constant region 1 of

Heavy chain (Ch1)

19

Variable region of

Light chain (Vl)

Constant region of

Light chain (Cl) Single-chain Antigen-binding

antibody (SCA) Fragment (Fab)

Full-size antibody

Copyright © 2006 Sofinnova Partners](https://image.slidesharecdn.com/breakfastpresentationjan262010-100127141943-phpapp02/85/Sofinnova-Partners-picks-up-260m-for-sixth-fund-19-320.jpg)