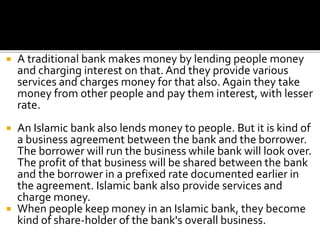

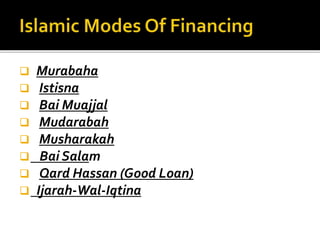

The document discusses Islamic banking principles and how it differs from conventional banking. It provides details on various Islamic banking concepts like profit and loss sharing, prohibition of riba or interest, and financing based on real assets. Some key Islamic banking contracts discussed include murabaha, istisna, bai muajjal, mudarabah, musharakah, and ijarah-wal-iqtina. While Islamic banking aims to align with Shariah principles, critics argue it resembles conventional banking by simply renaming interest. Implementation challenges also exist regarding monitoring costs and lack of unification among Islamic banks.