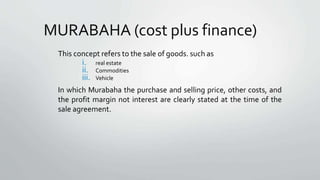

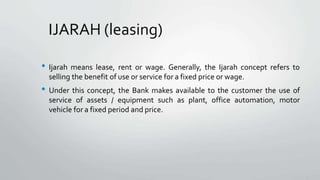

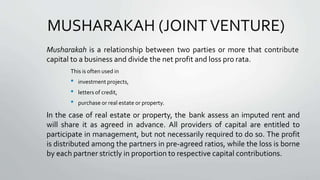

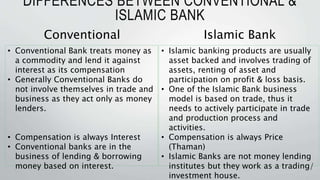

Islamic banking is a system that allows Muslims to deal with their finances according to their faith. It is based on avoiding interest (riba), which is forbidden. Common Islamic financing modes include mudarabah (profit-sharing), murabaha (cost-plus), ijara (leasing), musharaka (joint venture), takaful (Islamic insurance), and sukuk (Islamic bonds). The main differences between conventional and Islamic banks are that conventional banks lend money and charge interest, while Islamic banks engage in asset-backed trading and business partnerships based on profit/loss sharing.