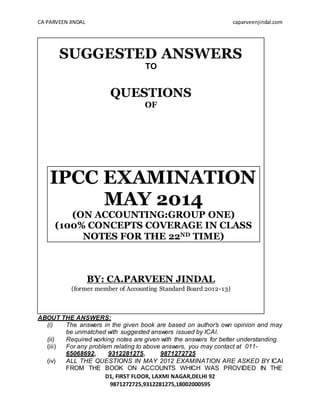

- The document provides suggested answers to IPCC exam questions from May 2014 on accounting group one, authored by CA Parveen Jindal.

- It notes that the answers are based on the author's opinions and may differ from the official ICAI answers, and provides page references to the relevant questions in the author's class notes.

- Contact information is given for any issues relating to the answers.