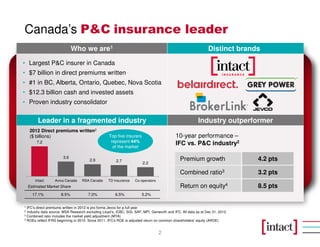

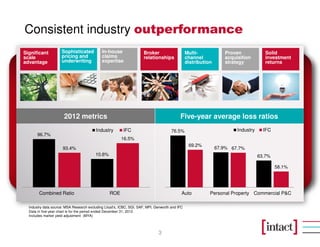

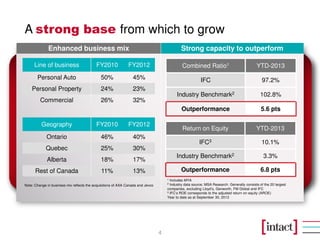

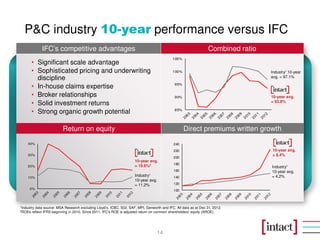

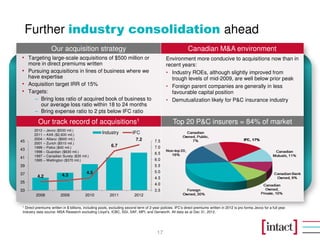

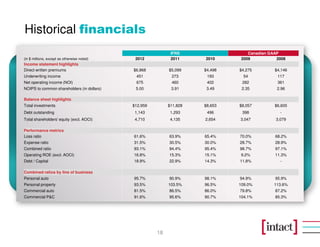

Intact Financial Corporation is Canada's largest property and casualty insurer, with a 17.1% market share. Over the past 10 years, Intact has consistently outperformed the Canadian P&C industry in key metrics such as return on equity, direct premiums written growth, and combined ratio. Intact attributes its strong performance to significant scale advantages, sophisticated pricing and underwriting, multi-channel distribution, proven acquisition strategy, in-house claims expertise, and broker relationships.