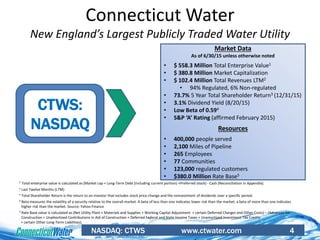

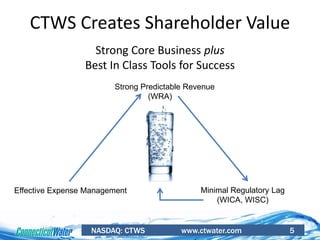

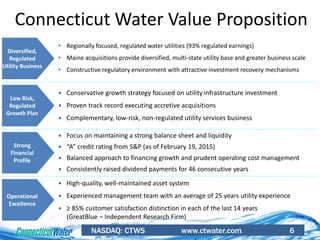

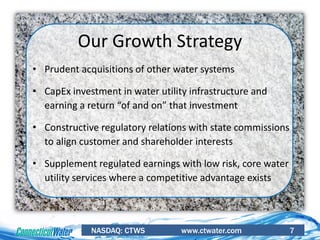

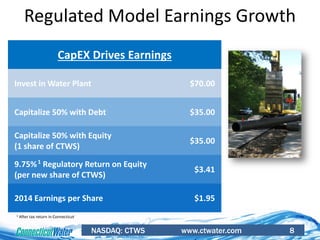

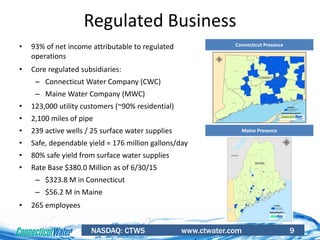

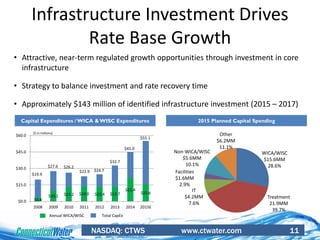

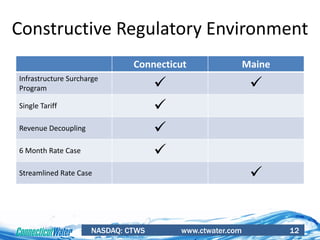

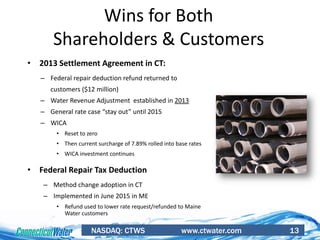

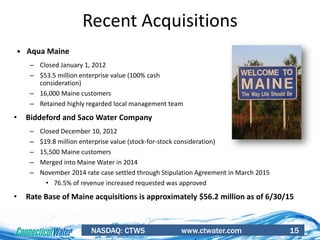

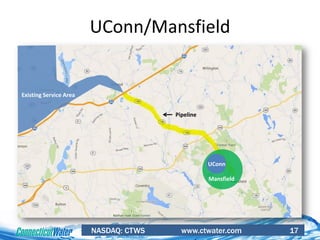

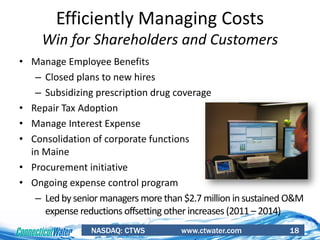

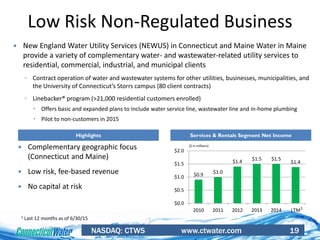

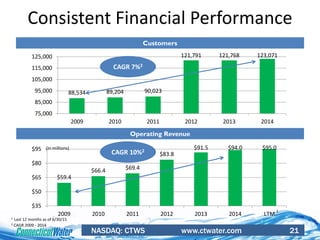

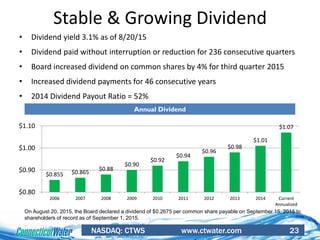

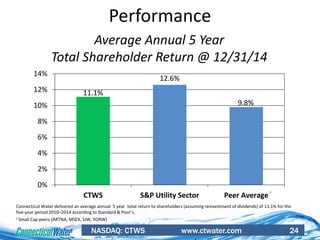

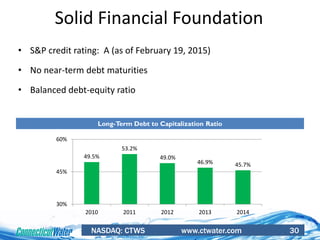

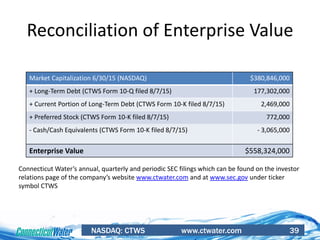

This document provides an investor presentation for Connecticut Water Service, Inc. It summarizes the company as the largest publicly traded water utility in New England, serving over 400,000 people through regulated water utilities in Connecticut and Maine. The presentation outlines Connecticut Water's growth strategy of infrastructure investment, acquisitions, and cost management to drive regulated earnings growth while maintaining financial strength and operational excellence.