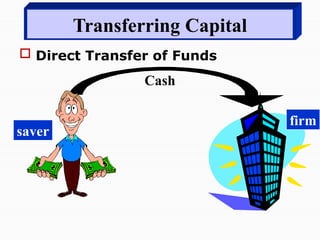

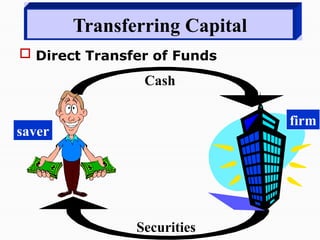

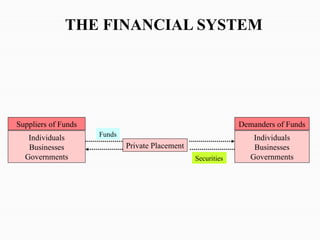

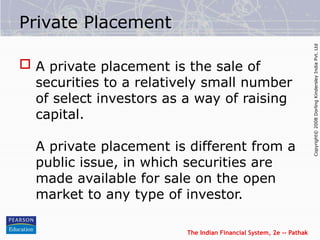

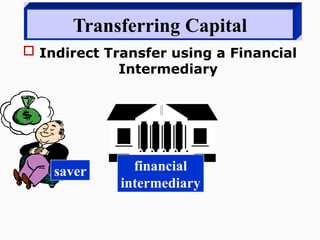

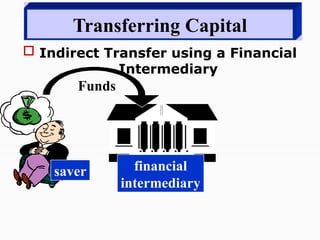

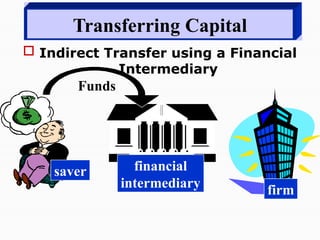

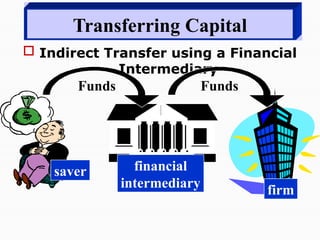

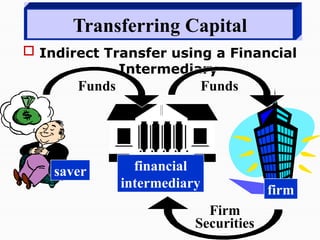

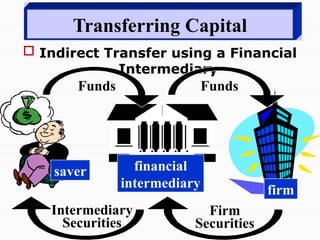

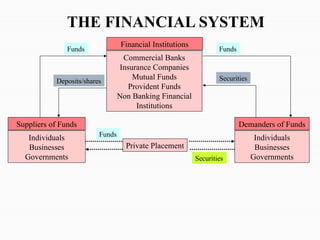

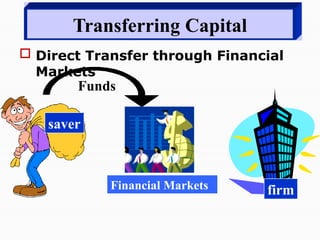

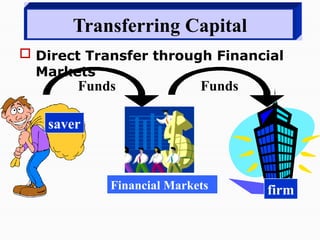

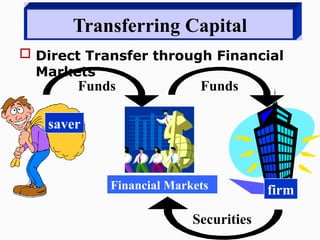

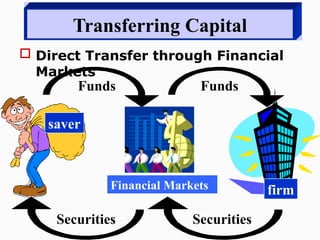

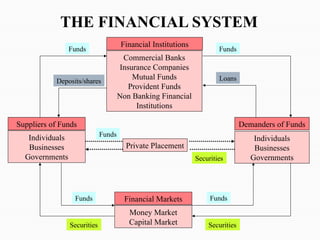

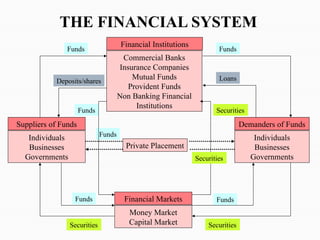

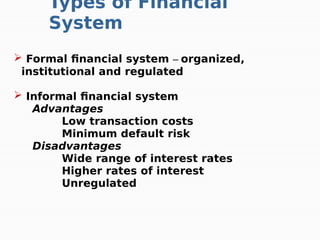

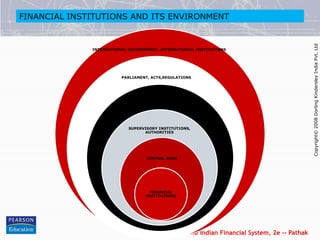

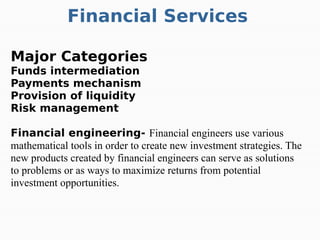

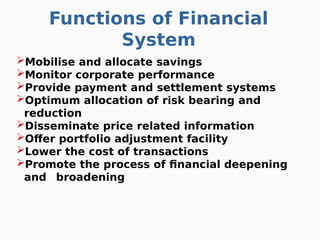

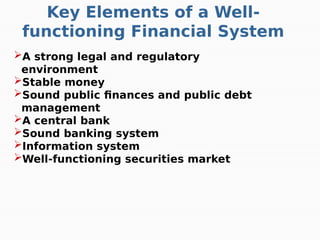

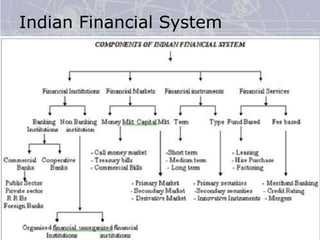

The document discusses the structure, functions, and components of the Indian financial system, highlighting the roles of financial institutions and markets in transferring capital. It covers key reforms since 1991, including changes in banking, stock markets, and the introduction of the Insolvency and Bankruptcy Code. Additionally, it emphasizes the financial system's contribution to economic development and the importance of a strong regulatory environment.