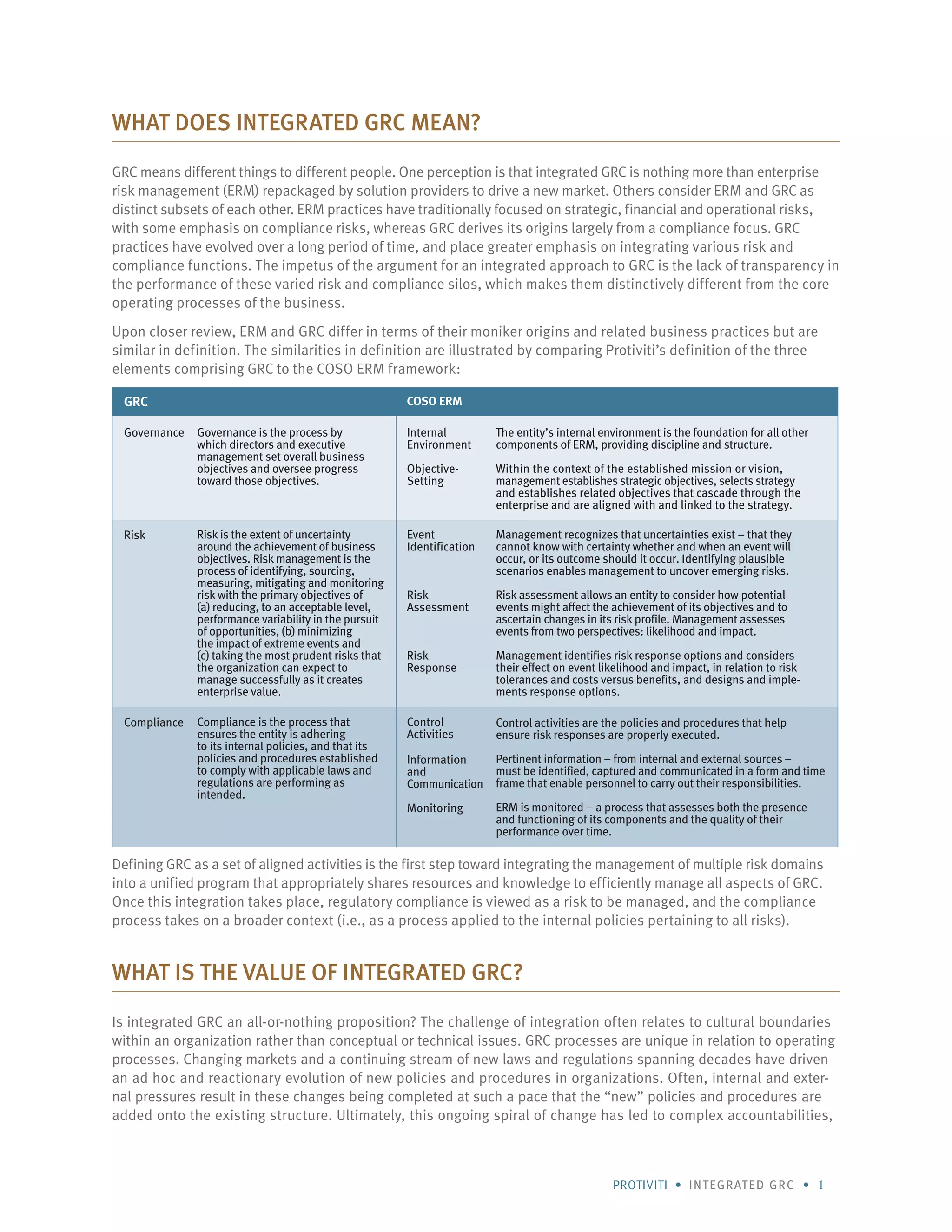

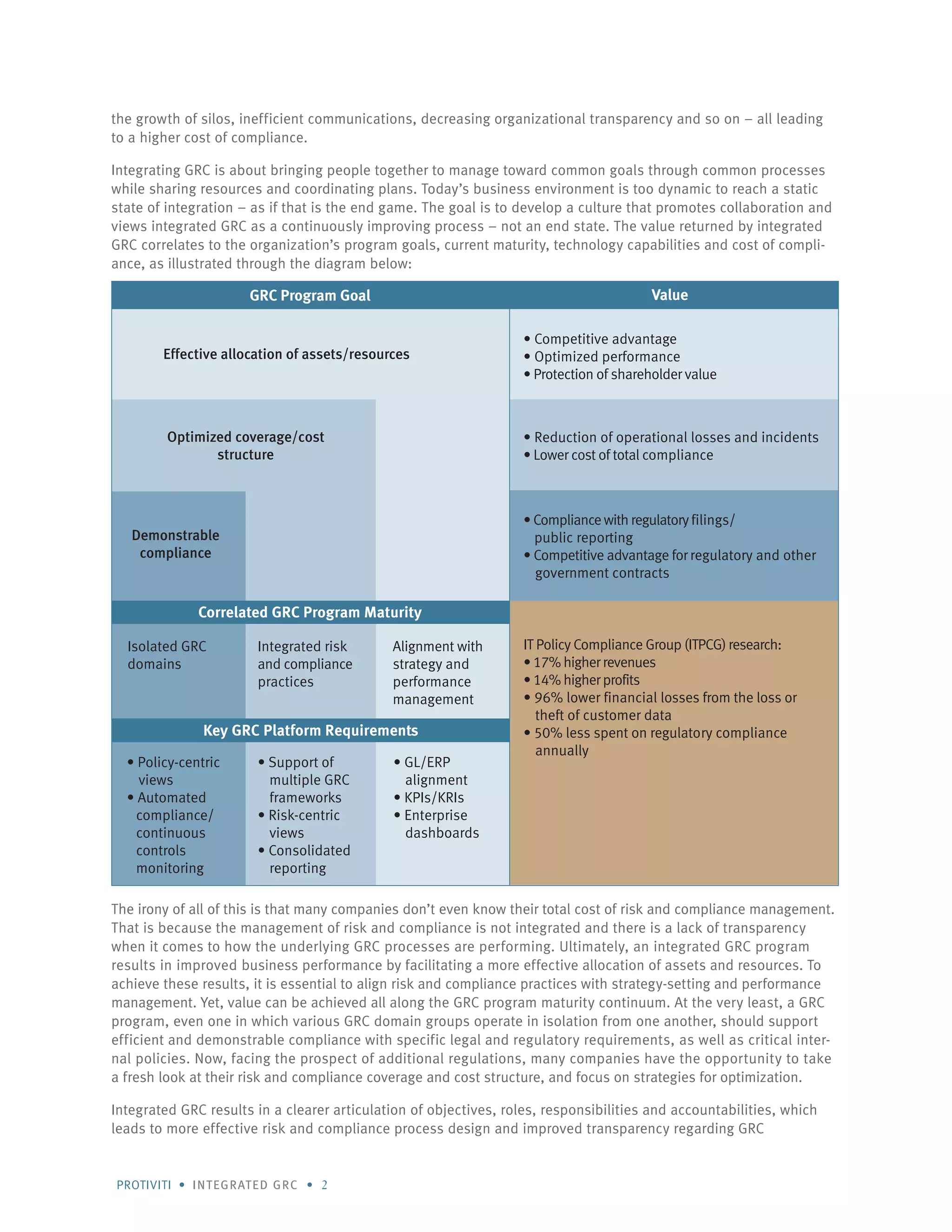

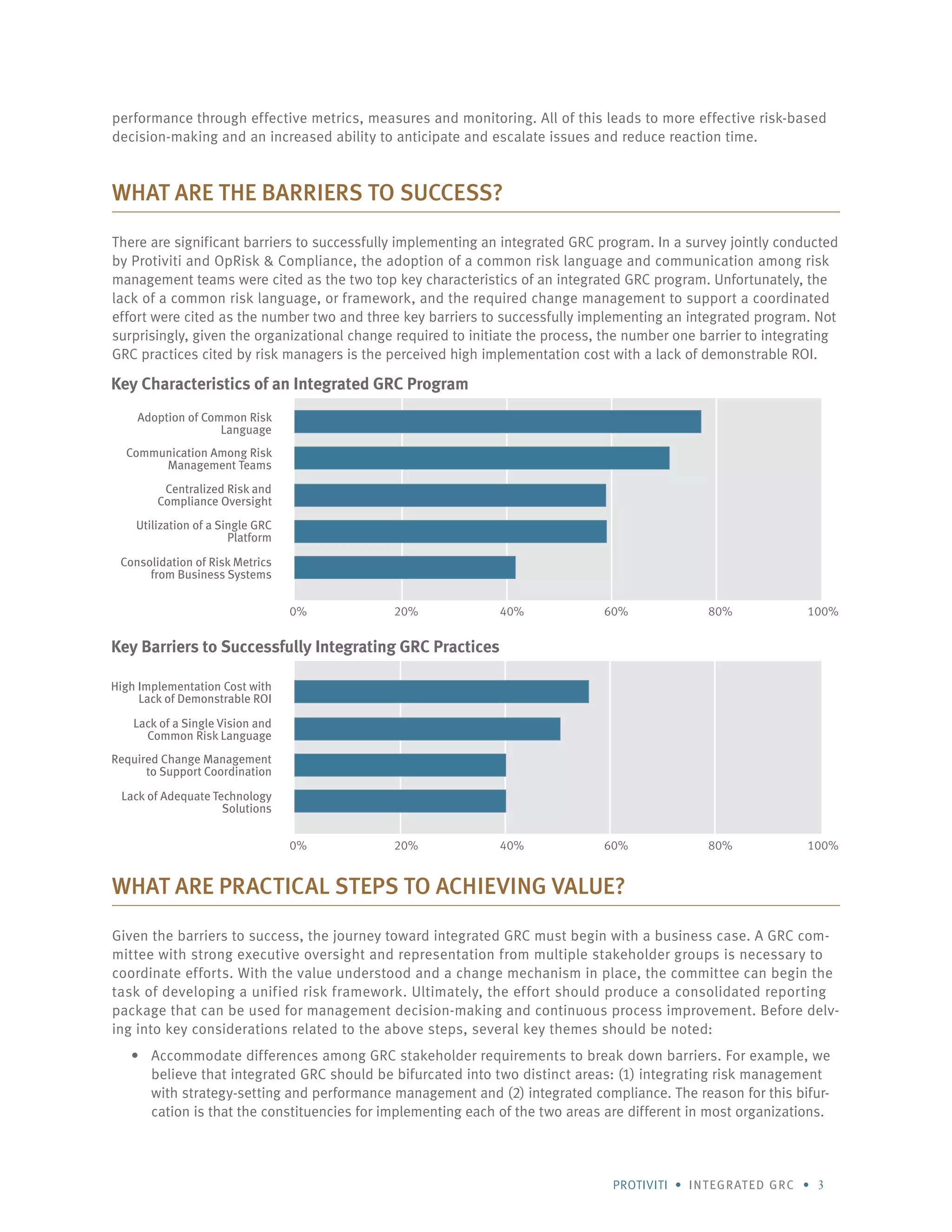

The document discusses key questions regarding integrated governance, risk management, and compliance (GRC). It begins by explaining that GRC means different things and considers the value of an integrated approach. An integrated GRC program can provide improved transparency, efficiency, and decision-making. However, there are also barriers like high costs and lack of a common framework. The document provides practical steps for organizations to achieve an integrated GRC approach, including building a business case, establishing a GRC committee, developing a unified risk framework, and establishing centralized oversight and reporting. The goal is to continuously improve GRC integration over time to optimize processes and better manage risks.