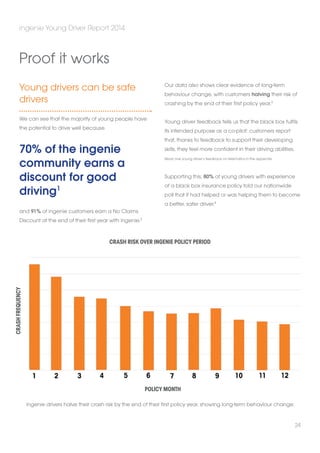

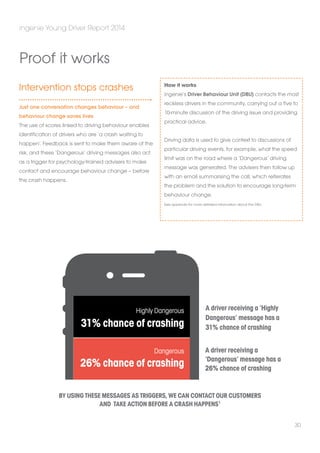

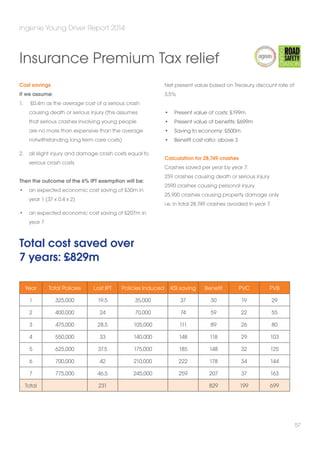

The Ingenie Young Driver Report 2014 highlights that young drivers, particularly those under 25, are disproportionately involved in serious crashes, often due to under-preparation and an immature risk assessment capability. It advocates for the use of telematics insurance as a solution to not only enhance young driver safety but also reduce insurance costs and fraud, suggesting government support for incentivizing this approach. By providing ongoing feedback and mentorship, telematics technology has been shown to significantly decrease crash risks among young drivers.