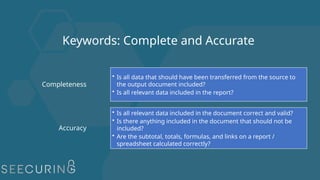

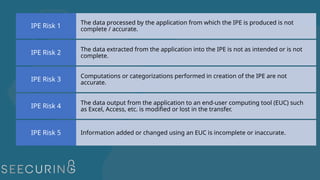

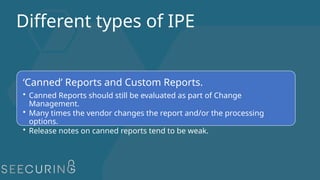

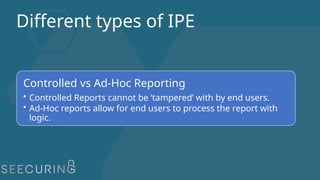

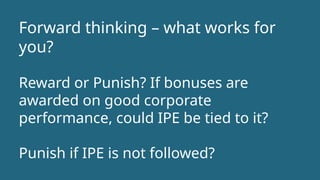

The document outlines best practices for Internal Control Evaluation (IPE) in audit and compliance, emphasizing the importance of data completeness and accuracy, particularly in the context of financial reporting requirements under Sarbanes-Oxley (SOX). It identifies various risks associated with IPE, including inaccuracies from data extraction, modifications during transfer, and challenges with ad-hoc reporting, as well as advocating for a strong corporate culture around IPE practices. Additionally, it discusses the need for tailored training and ongoing evaluations to ensure compliance and security in reporting processes.