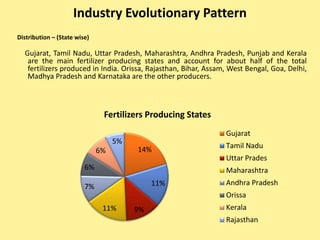

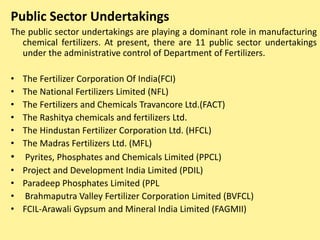

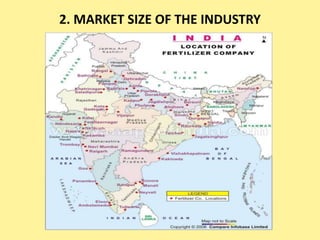

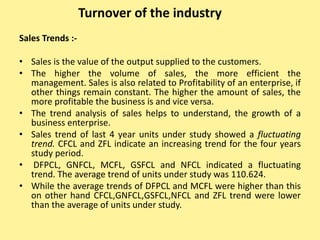

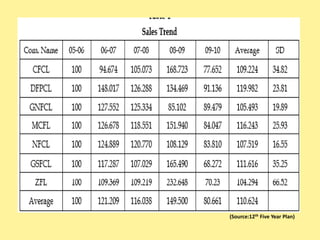

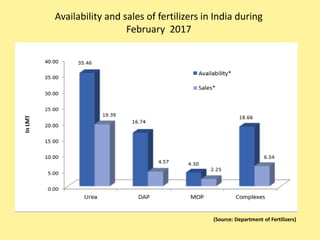

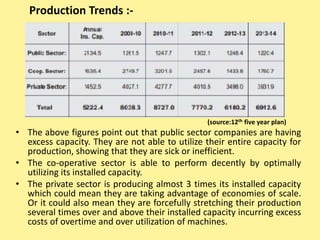

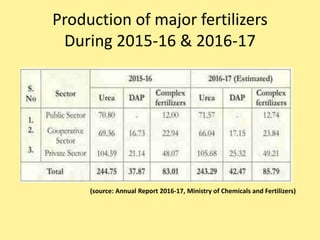

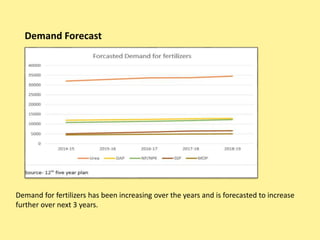

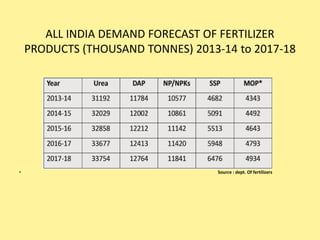

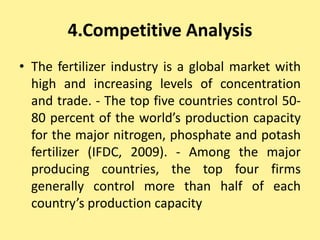

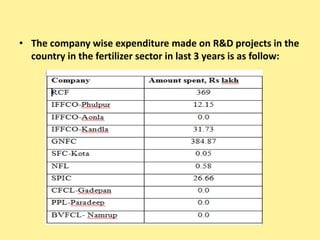

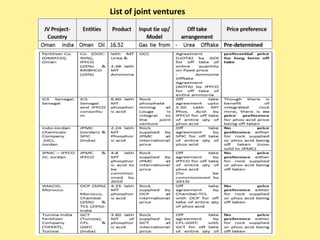

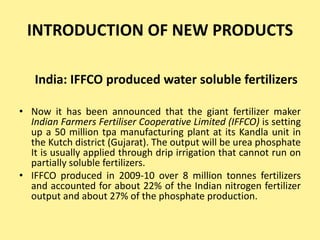

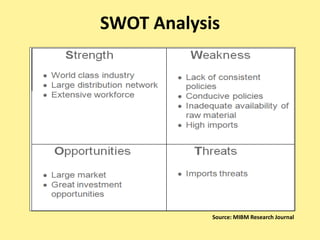

The document provides an industry analysis of industrial fertilizers in India. It discusses the types and classification of fertilizers, and traces the evolution and growth of the fertilizer industry in India from its beginnings in 1906. It outlines the major players in the industry including public sector undertakings, cooperative societies, and private sector companies. It also examines the market size and structure of the industry, production and sales trends, demand forecast, raw materials, and manufacturing processes used. The fertilizer industry in India is a vital industry for agricultural production.