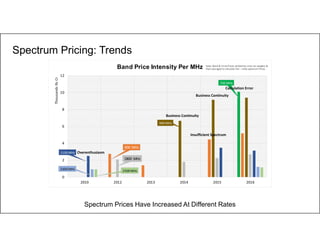

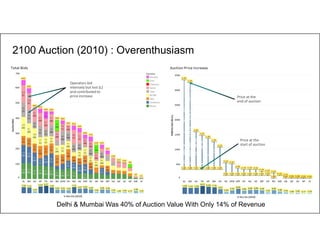

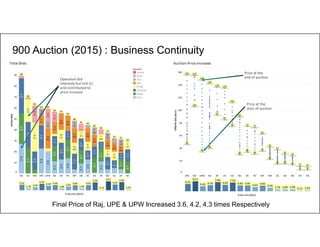

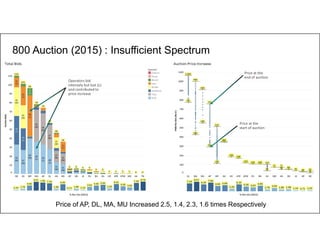

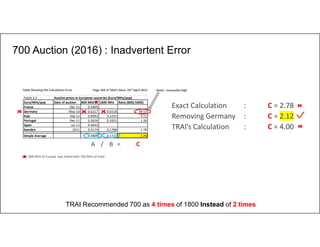

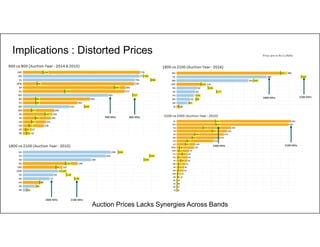

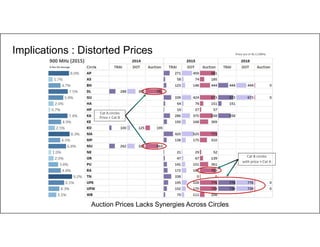

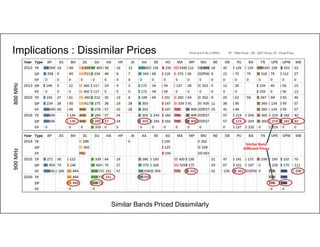

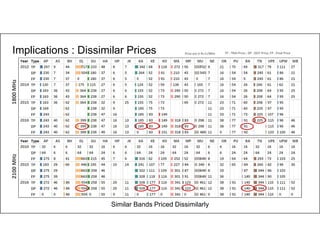

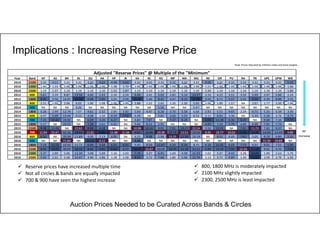

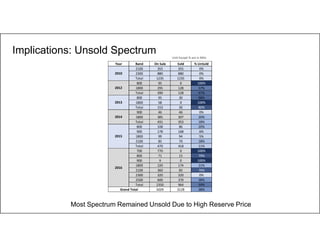

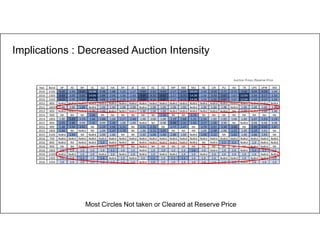

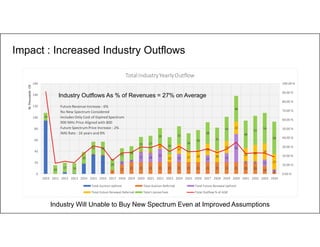

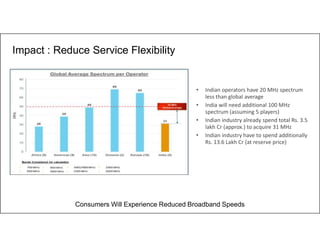

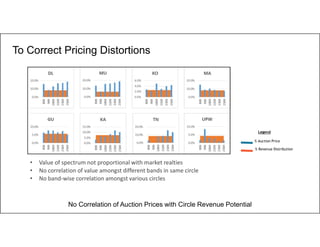

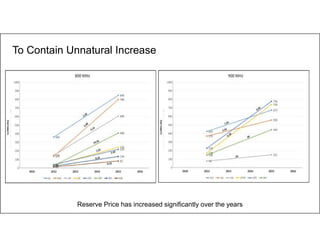

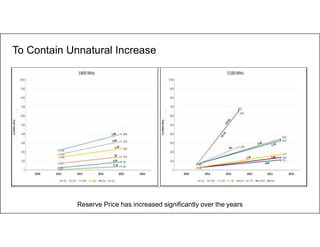

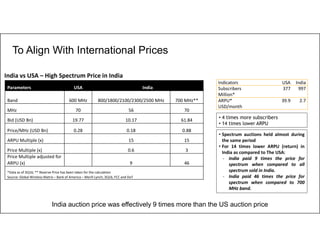

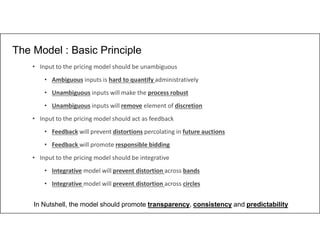

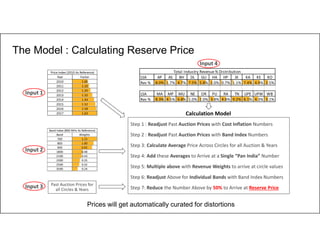

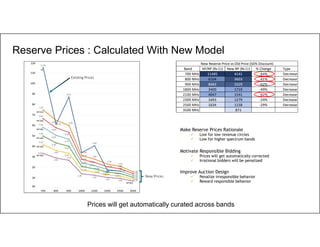

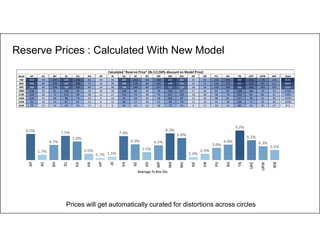

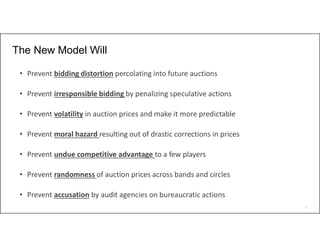

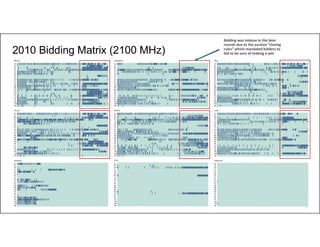

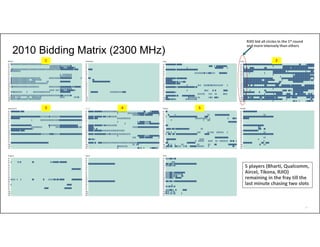

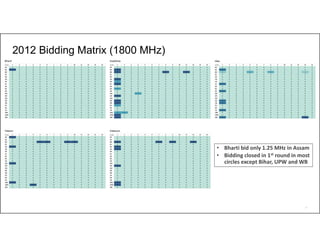

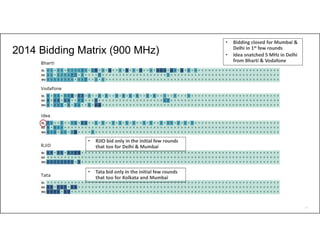

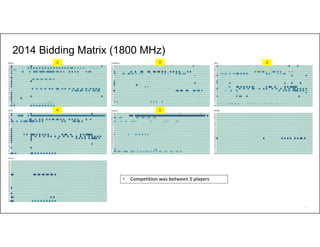

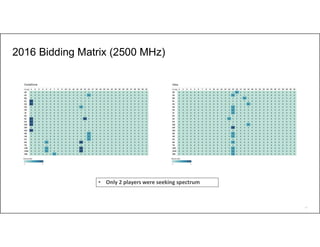

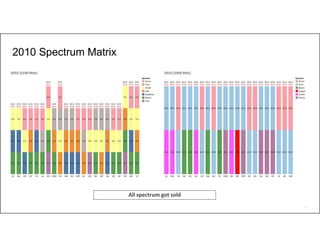

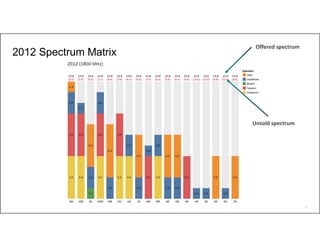

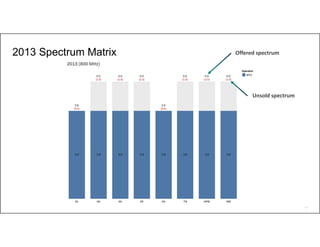

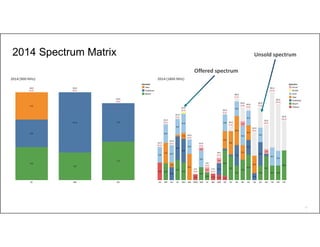

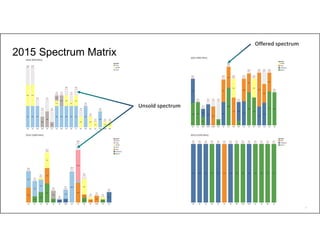

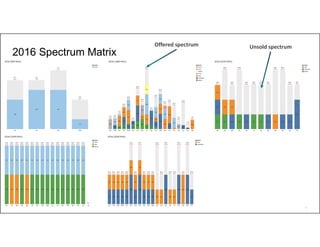

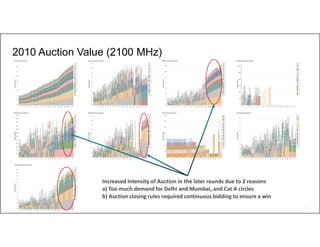

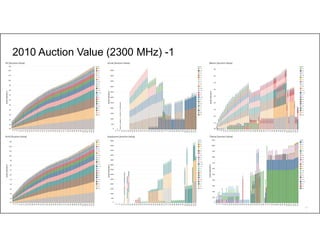

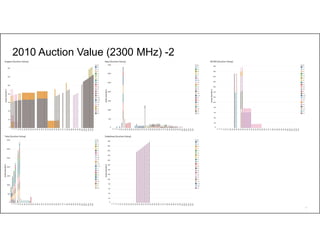

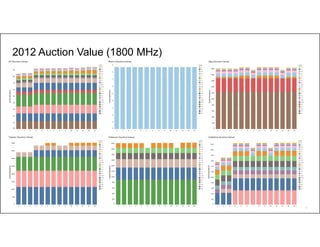

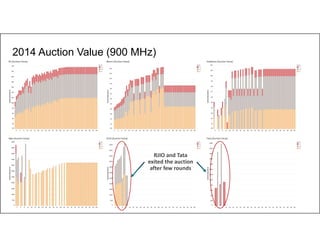

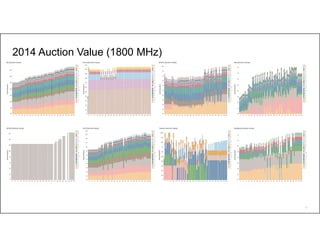

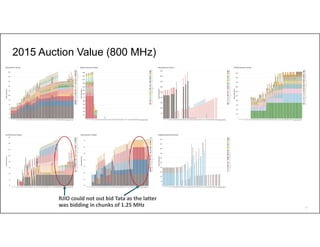

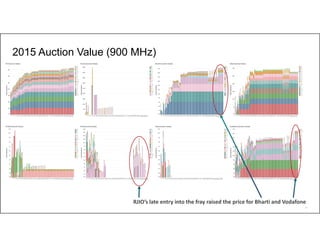

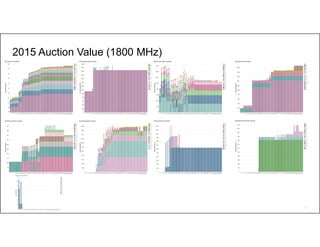

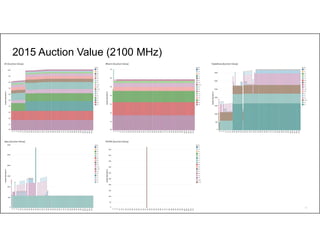

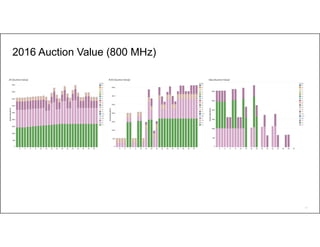

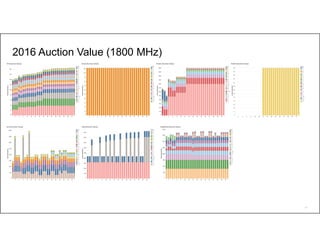

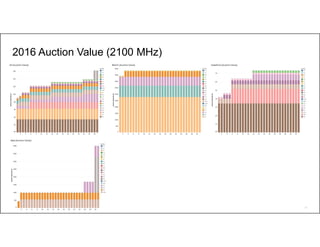

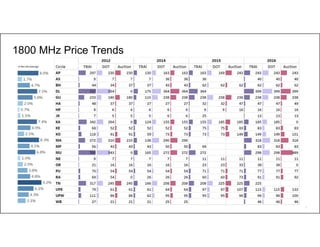

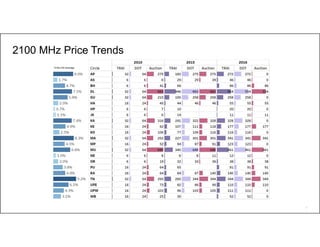

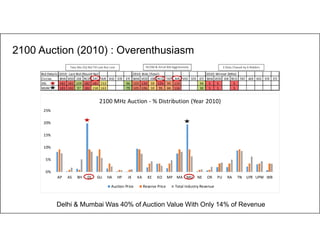

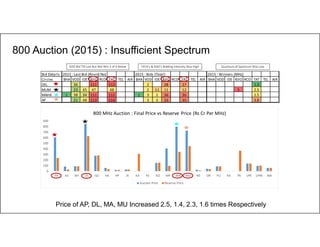

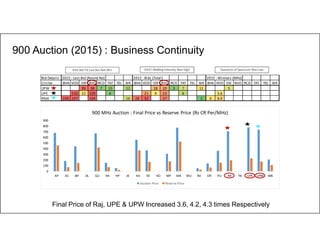

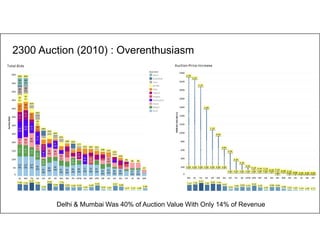

The document discusses the need for a revised model to calculate reserve prices in Indian spectrum auctions, highlighting past auction experiences and their implications on spectrum pricing. It identifies trends in auction prices, the impact of overenthusiastic bidding, and significant errors in price calculations that led to distorted spectrum prices. The author advocates for a more curated approach to setting reserve prices across different bands and circles to avoid unsold spectrum and maintain business continuity.