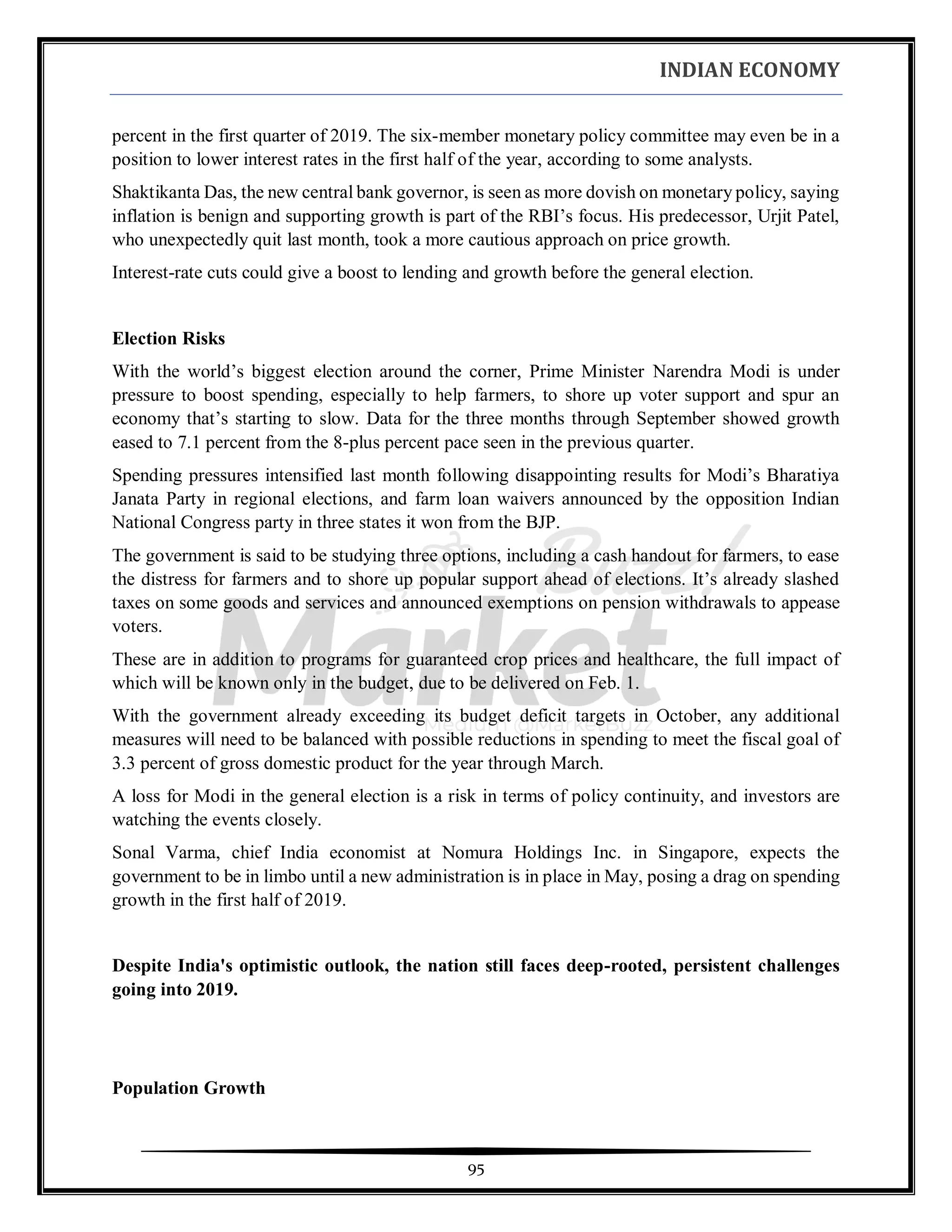

This document provides an overview of the Indian economy through history and to the present day. It discusses:

1) India's economy through ancient civilizations like the Indus Valley and periods under the Mughal Empire when it accounted for 25% of global GDP.

2) The impact of British colonial rule from 1793-1947, which caused India's economy to decline and left it poorly industrialized.

3) Post-independence policies from 1947-1991 that focused on import substitution, a large public sector, and business regulation.

![INDIAN ECONOMY

5

Indian peasants before its adoption in European agriculture, and higher per-capita agricultural

output and standards of consumption.

The Mughal Empire had a thriving industrial manufacturing economy, with India producing about

25% of the world's industrial output up until 1750, making it the most important manufacturing

center in international trade. Manufactured goods and cash crops from the Mughal Empire were

sold throughout the world. Key industries included textiles, shipbuilding, and steel, and processed

exports included cotton textiles, yarns, thread, silk, jute products, metalware, and foods such as

sugar, oils and butter. Cities and towns boomed under the Mughal Empire, which had a relatively

high degree of urbanization for its time, with 15% of its population living in urban centres, higher

than the percentage of the urban population in contemporary Europe at the time and higher than

that of British India in the 19th century.

In early modern Europe, there was significant demand for products from Mughal India, particularly

cotton textiles, as well as goods such as spices, peppers, indigo, silks, and saltpeter (for use in

munitions). European fashion, for example, became increasingly dependent on Mughal Indian

textiles and silks. From the late 17th century to the early 18th century, Mughal India accounted for

95% of British imports from Asia, and the Bengal Subah province alone accounted for 40% of

Dutch imports from Asia. In contrast, there was very little demand for European goods in Mughal

India, which was largely self-sufficient. Indian goods, especially those from Bengal, were also

exported in large quantities to other Asian markets, such as Indonesia and Japan. At the time,

Mughal Bengal was the most important center of cotton textile production and shipbuilding.

In the early 18th century, the Mughal Empire declined, as it lost western, central and parts of south

and north India to the Maratha Empire, which integrated and continued to administer those

regions.[85] The decline of the Mughal Empire led to decreased agricultural productivity, which

in turn negatively affected the textile industry. The subcontinent's dominant economic power in

the post-Mughal era was the Bengal Subah in the east., which continued to maintain thriving textile

industries and relatively high real wages. However, the former was devastated by the Maratha

invasions of Bengal and then British colonization in the mid-18th century. After the loss at the

Third Battle of Panipat, the Maratha Empire disintegrated into several confederate states, and the

resulting political instability and armed conflict severely affected economic life in several parts of

the country – although this was mitigated by localised prosperity in the new provincial kingdoms.

By the late eighteenth century, the British East India Company had entered the Indian political

theatre and established its dominance over other European powers. This marked a determinative

shift in India's trade, and a less-powerful impact on the rest of the economy.

British era (1793–1947)

From the beginning of the 19th century, the British East India Company's gradual expansion and

consolidation of power brought a major change in taxation and agricultural policies, which tended

to promote commercialisation of agriculture with a focus on trade, resulting in decreased

production of food crops, mass impoverishment and destitution of farmers, and in the short term,](https://image.slidesharecdn.com/indianeconomy-august-2019-191007082949/75/Indian-Economy-2019-6-2048.jpg)