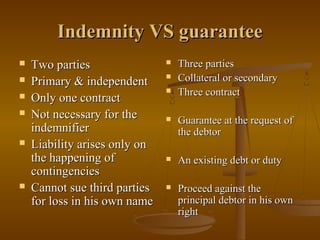

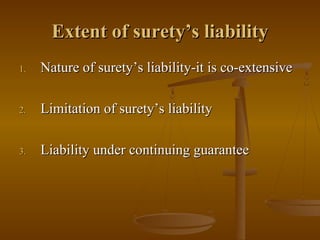

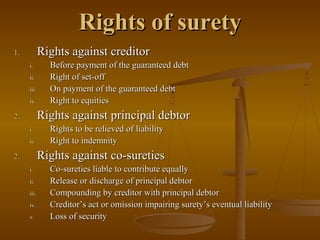

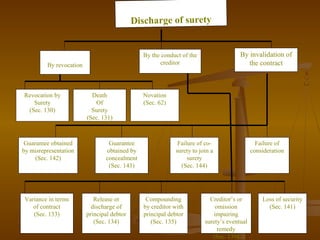

Indemnity and guarantee are both types of contracts where one party promises to compensate another for loss or liability. [1] Indemnity involves two parties, where the indemnifier promises to reimburse the indemnified for losses caused by the indemnifier or third parties. [2] Guarantee involves three parties, where the guarantor promises the creditor payment or performance by the principal debtor. [3] The rights and obligations of each party differ between indemnity and guarantee.