Embed presentation

Download as PDF, PPTX

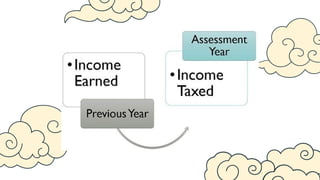

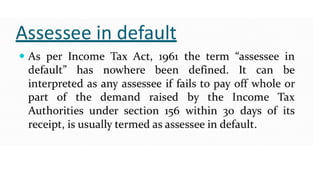

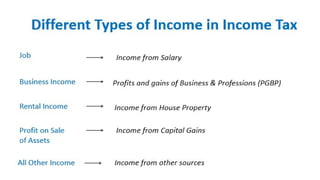

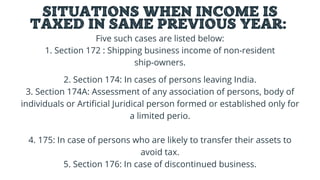

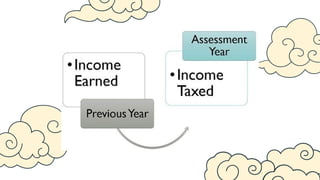

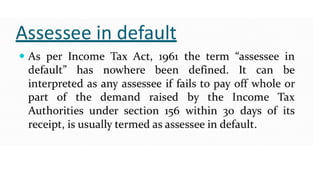

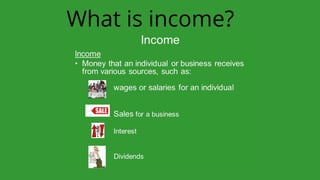

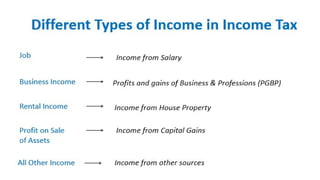

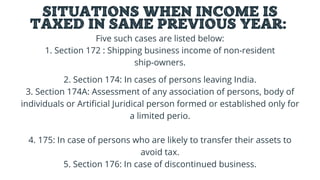

This document provides an outline for a presentation on income tax concepts in India. It begins with an introduction to income tax and outlines key topics to be covered, including definitions of person and income. It then lists 5 situations where income may be taxed in the same previous year, such as for non-resident ship owners, persons leaving India, or those likely to transfer assets to avoid tax.