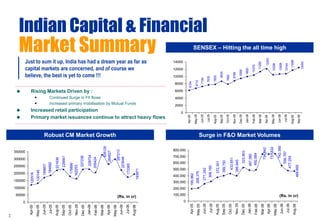

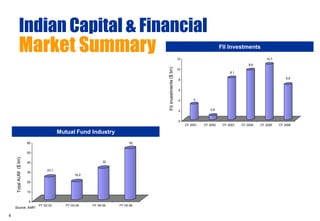

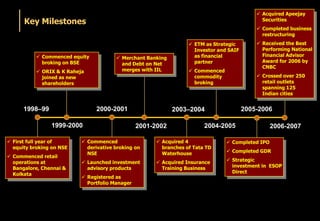

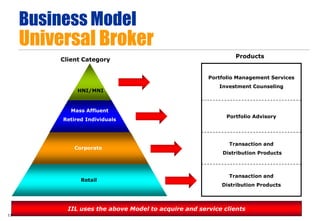

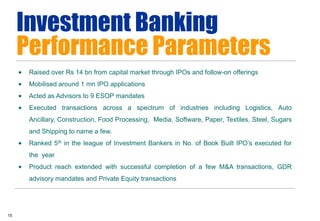

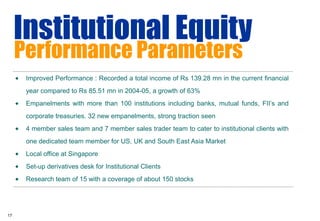

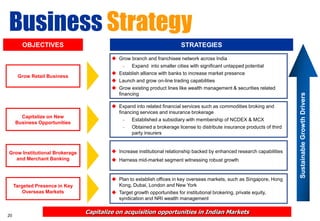

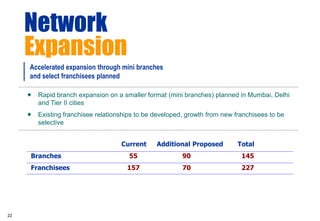

The document appears to be an agenda for a meeting on the Indian financial market and IL&FS Investsmart. The agenda includes sections on an overview of the Indian financial market, a company overview of IL&FS Investsmart, their business strategy, and highlights. Some key points include that IL&FS Investsmart has a network of 259 outlets across India, total income of Rs. 2170 million in FY06, and is promoting growth through expanding its product offerings and branch network.