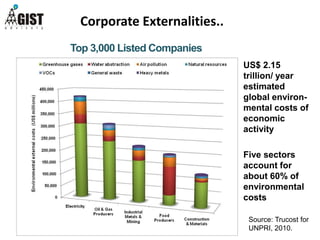

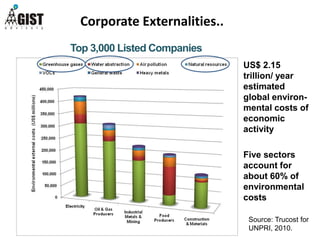

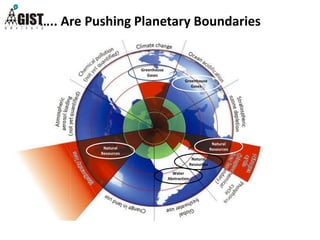

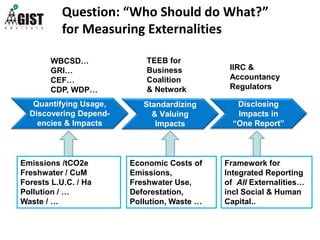

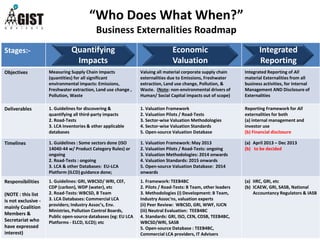

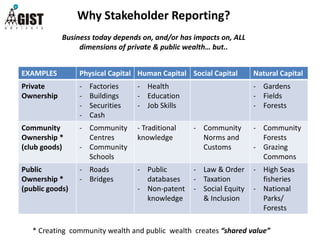

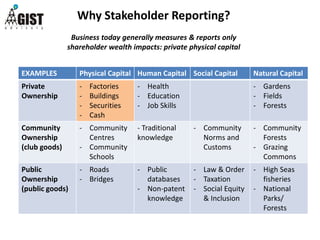

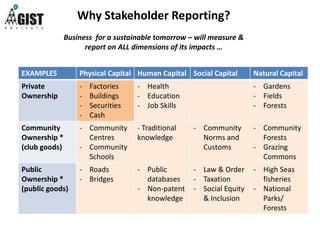

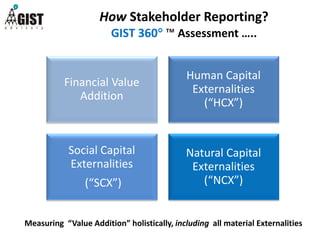

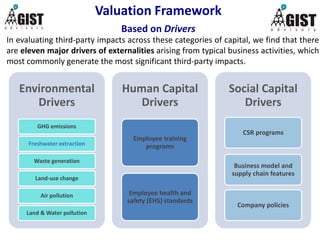

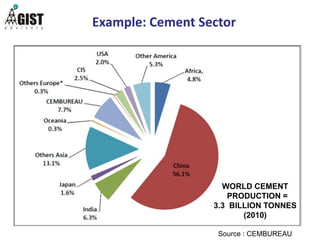

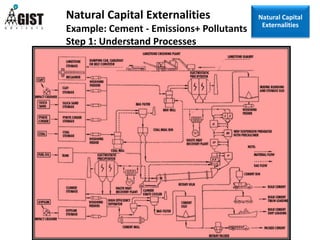

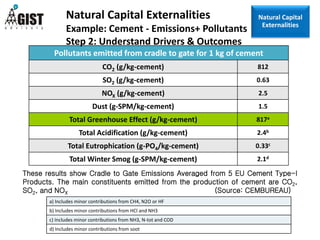

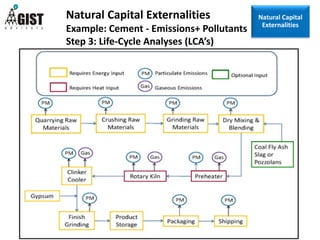

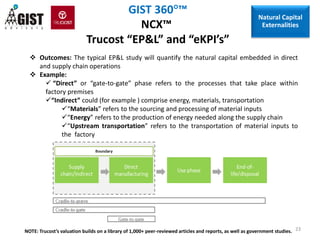

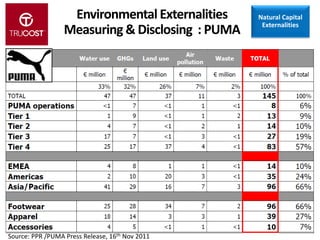

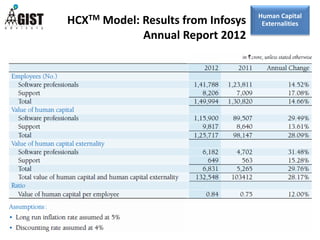

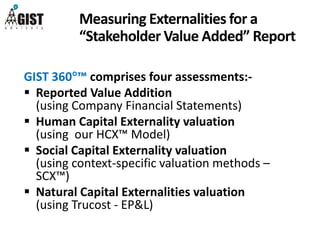

The document outlines the importance of managing corporate externalities through stakeholder reporting, emphasizing the need to measure, report, and manage environmental, social, and economic impacts effectively. It details various models and frameworks for integrated reporting of these externalities, highlighting the roles of key organizations and the development of guidelines and valuation methodologies. The document also discusses the significant economic costs related to environmental impacts and the necessity for businesses to include stakeholder impacts in their reporting for a sustainable future.