Here are a few key points about using this book to write your business plan:

- The book walks you through all the important elements of a complete business plan, including an executive summary, company description, market analysis, operations plan, management team, and financial projections.

- It provides templates, worksheets, and examples to help you organize your information. You'll find guidance on how to complete each section in a clear, compelling way.

- The financial templates will help you create profit/loss, cash flow, and break-even projections - critical for obtaining financing.

- You can use the book to write either a complete comprehensive plan, or a quicker "quick plan" just focusing on the essential elements.

![The Trusted Name

(but don’t take our word for it)

“ In Nolo you can trust.”

THE NEW YORK TIMES

“ Nolo is always there in a jam as the nation’s premier publisher

of do-it-yourself legal books.”

NEWSWEEK

“ Nolo publications…guide people simply through the how,

when, where and why of the law.”

THE WASHINGTON POST

“ [Nolo’s]…material is developed by experienced attorneys who

have a knack for making complicated material accessible.”

LIBRARY JOURNAL

“ When it comes to self-help legal stuff, nobody does a better job

than Nolo…”

USA TODAY

“ The most prominent U.S. publisher of self-help legal aids.”

TIME MAGAZINE

“ Nolo is a pioneer in both consumer and business self-help

books and software.”

LOS ANGELES TIMES](https://image.slidesharecdn.com/howtowriteabusinessplan10thedition-120412054553-phpapp02-130216214724-phpapp01/85/Howtowriteabusinessplan10thedition-120412054553-phpapp02-4-320.jpg)

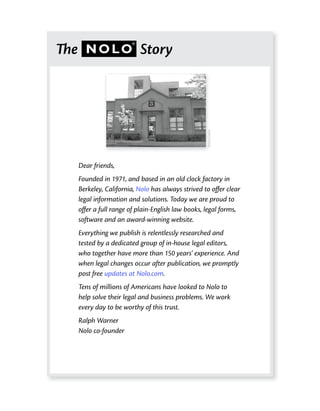

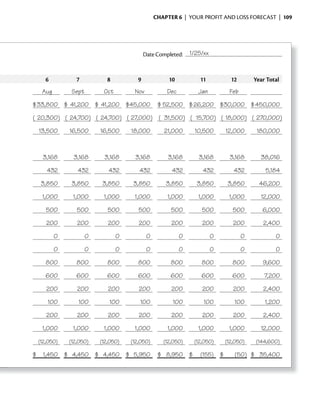

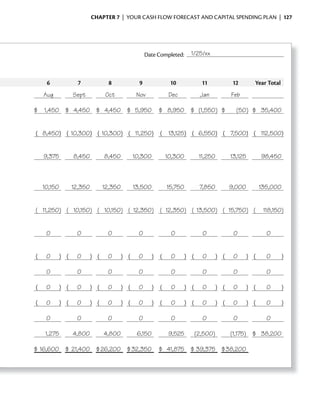

![126 | HOW TO WRITE A BUSINESS PLAN

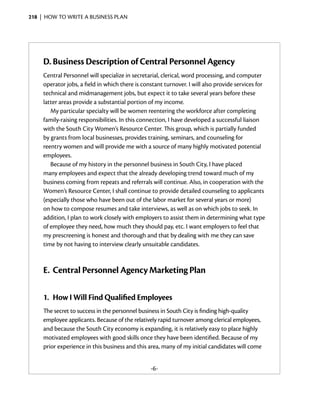

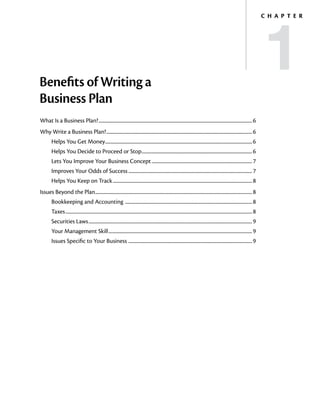

Cash Flow Forecast: Year One

for Antoinette’s Dress Shop

Cash In/(Out)

Month 1 2 3 4 5

Mar Apr May Jun Jul

1. Profit/(Loss) [P & L line 6] $ (50) $ 1,450 $ 5,950 $ 2,950 $ 1,450

2. Less: Credit Sales— 25 % on credit

× Sales Revenue [P & L line 1] ( 7,500) ( 8,450) ( 11,250) ( 9,375) ( 8,450)

3. Plus: Collections of Credit Sales

2 months after sale 0 0 7,500 8,450 11,250

4. Plus: Credit Purchases— 50 % of

purchases on credit × Cost of Sales

[P & L line 2] 9,000 10,150 13,500 11,250 10,150

5. Less: Payments for Credit Purchases

2

months after purchase ( 0 ) ( 0 ) ( 9,000) ( 10,150) ( 13,500)

6. Plus: Withholding % of total

wages (if paying taxes quarterly) 0 0 0 0 0

7. Less: Quarterly withholding

payments (if paying taxes quarterly) ( 0 ) ( 0 ) ( 0 ) ( 0 ) ( 0 )

8. Plus: Depreciation 0 0 0 0 0

9. Less: Principal Payments ( 0 ) ( 0 ) ( 0 ) ( 0 ) ( 0 )

10. Less: Extra Purchases ( 0 ) ( 0 ) ( 0 ) ( 0 ) ( 0 )

11. Other Cash Items in/(out) 0 0 0 0 0

12. Monthly Net Cash 1,450 3,150 6,700 3,125 900

13. Cumulative Net Cash $ 1,450 $ 4,600 $ 11,300 $ 14,425 $ 15,325](https://image.slidesharecdn.com/howtowriteabusinessplan10thedition-120412054553-phpapp02-130216214724-phpapp01/85/Howtowriteabusinessplan10thedition-120412054553-phpapp02-139-320.jpg)

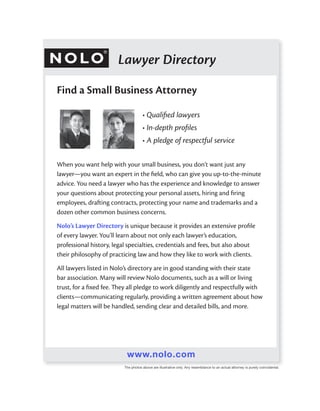

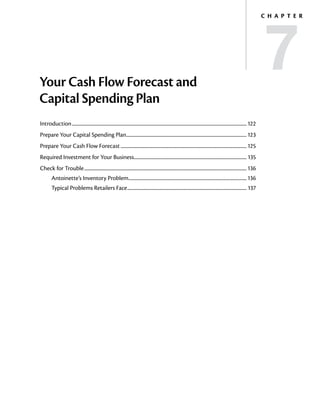

![ChApter 8 | WRITE YOUR MARKETING AND PERSONNEL PLANS | 151

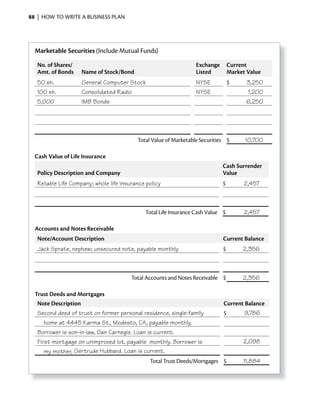

Antoinette’s Dress Shop: Risk Analysis

Like every new business, Antoinette’s faces trouble meeting our sales revenue goals. In

several risks. I believe I can overcome each addition, by starting with relatively modest

risk with the actions discussed below. capital, we will have no large loan payments.

The primary risk we face is that our Also, we have had several potential investors

concept of an entire store selling business express an interest in the business. If our

clothing to working businesswomen is new to working capital reserves are exhausted,

this area. No one else in New City is presently but the business demonstrates potential,

doing exactly what we propose. Although we should be able to attract investors. [But

we believe we have identified a market niche remember we discovered that, on the basis of

that the competition has failed to adequately the Cash Flow Forecast, Antoinette’s business

exploit, our assumption remains to be proven has a fatal flaw (Chapter 7) and her entire

here in New City. On the positive side, the plan will need reworking from the beginning.]

population base of our target customers is Finally, there is a slight risk that the

more than adequate to support a store of population of younger working women in

our size and we have based our volume and New City will decline. However, we do not

profit projections on average figures for the expect this to happen. White collar jobs have

industry. In addition, the type of store we doubled here in the last decade and it seems

propose has been very successful elsewhere. reasonable to expect that the population of

Nevertheless, we must demonstrate that working women will continue to grow and

this type store will work here. It must take that we will profit from that expansion. This

sufficient business away from stores with a projection is based on the fact that many

broader line of merchandise to make a profit. well-established firms have located here and

A secondary risk is that we are thinly more are expected to do so. Nevertheless, if

capitalized. If our sales volume fails to meet for any reason general industry declines, or a

projections in the first year, our small working significant number of local companies fail or

capital reserve may be inadequate to meet move overseas, we could face some problems

our cash-flow needs. On the positive side,

and might have to change our marketing

however, we believe our sales projections are strategy.

conservative and that we will have little](https://image.slidesharecdn.com/howtowriteabusinessplan10thedition-120412054553-phpapp02-130216214724-phpapp01/85/Howtowriteabusinessplan10thedition-120412054553-phpapp02-164-320.jpg)

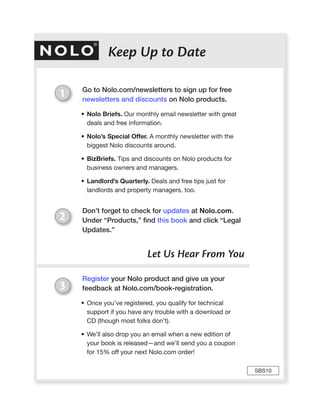

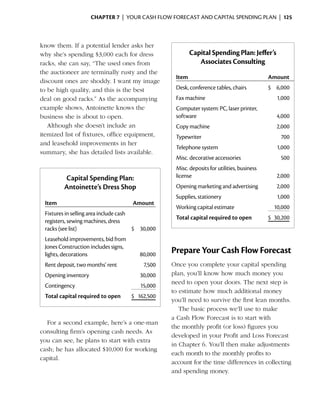

![ChApter 9 | EDITING AND FINALIzING YOUR BUSINESS PLAN | 163

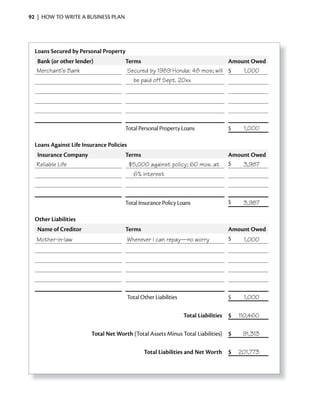

Antoinette’s Dress Shop

Business Plan Summary

[In her summary, Antoinette puts her best foot fund will be allocated as follows: furniture,

forward and tries to answer any questions the fixtures, and leasehold improvements

lender may ask.] $110,000, rent deposit $7,500, opening

This business plan requests a loan of $110,000 inventory $30,000, and contingency $15,000.

to open a dress shop catering to working and Cash flow forecasts show a positive cash

professional women in New City. flow from opening, so no allocation is made

Today, many women identify themselves as for working capital.

“professionals.” This is part of an evolution in My qualifications include three years of

work force patterns and no local store caters experience as a clothing buyer and assistant

to this group’s needs for moderately priced, merchandise manager for the local Rack-

stylish work clothing—including carrying the a-Frax department store. I was able to

three most popular labels: Narak, YYY, and show a 35% sales increase in my principal

Pag. Antoinette’s will fill this gap. We will sell area of responsibility, the Designer Dress

stylish, good quality, and moderately priced Department. During that time, I developed

clothing to upwardly mobile women, provide many industry contacts which will be

free alterations, and help our customers dress invaluable at Antoinette’s.

well at a reasonable cost. Sally Walters will be my assistant

Financial projections show first year reve- manager. She has five years’ experience in

nues of $450,000, with a profit of $35,000 the field, the last three as assistant manager

before loan payments and a nominal personal of the dress department at Glendale’s. We

draw. Second year revenues rise to $540,000 plan to open Antoinette’s by Labor Day in

and profits increase to $46,000. Profits are the downtown shopping mall and have an

adequate in both years to service the loan and informal commitment from the shopping

provide me with a draw. To secure the loan, I center manager to lease space to us. We will

will consider a second trust deed on my home, both continue our activities in New City

which has equity of about $200,000. service clubs, especially those that feature

I will combine loan proceeds with $50,000 women members.

in savings to provide a $160,000 cash fund. The

Dated

Antoinette Gorzak](https://image.slidesharecdn.com/howtowriteabusinessplan10thedition-120412054553-phpapp02-130216214724-phpapp01/85/Howtowriteabusinessplan10thedition-120412054553-phpapp02-176-320.jpg)