The document provides information about the Industrial Development Bank of Pakistan (IDBP). It states that IDBP was established in 1961 with the primary objective of extending term finance for investment in Pakistan's manufacturing sector. Some key details include:

- IDBP is owned 57% by the Federal Government, 36% by the State Bank of Pakistan, and 7% by provincial governments.

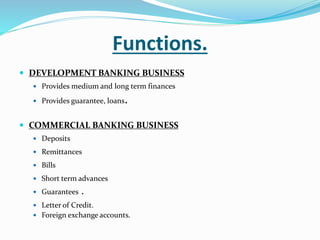

- It provides medium and long term financing in local and foreign currencies for new and expanding industrial projects.

- In addition to development banking, IDBP also engages in commercial banking, merchant banking, and bill collection activities.