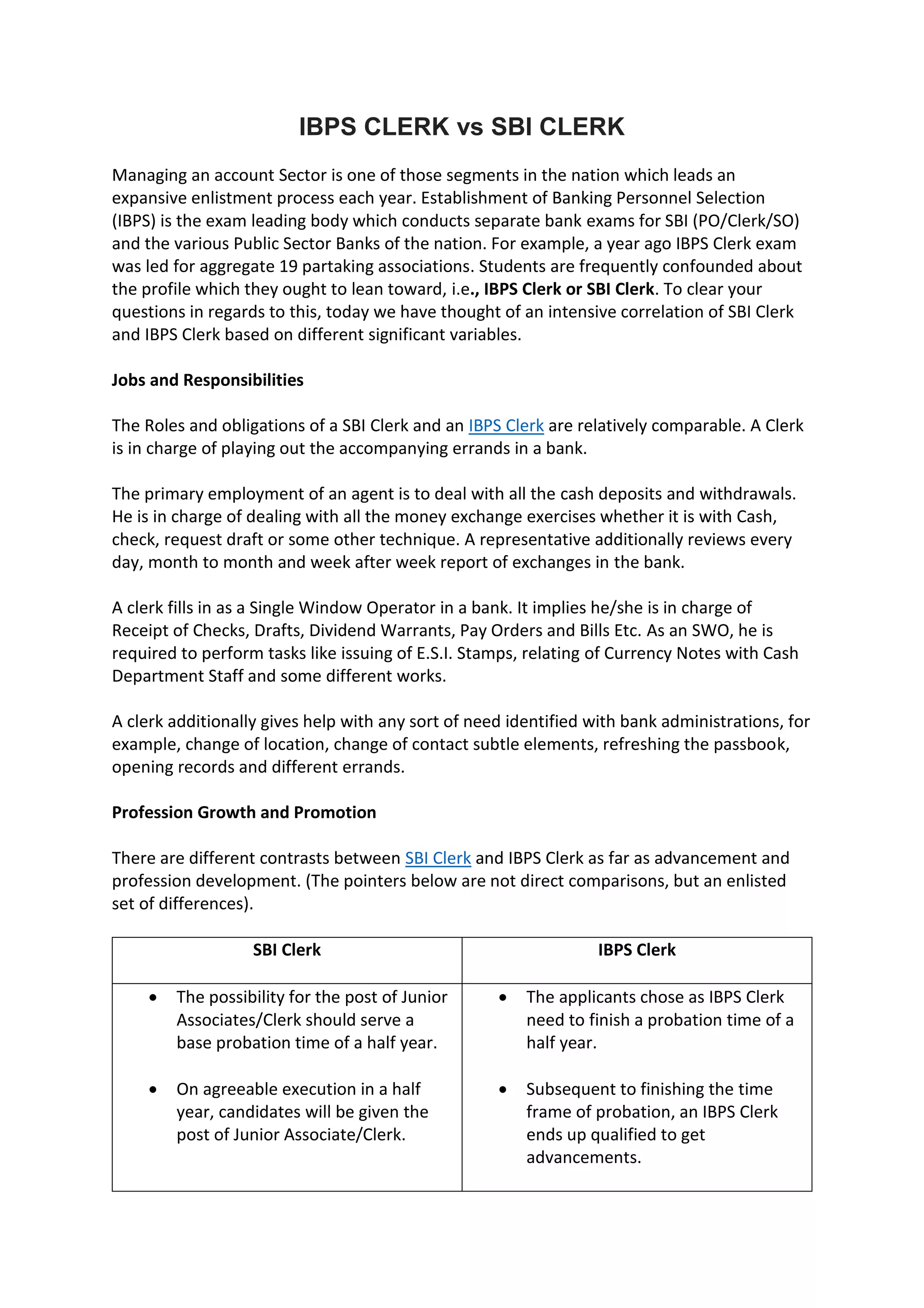

This document compares the roles and responsibilities, career growth, and salary structures of IBPS clerks and SBI clerks, emphasizing that while their job duties are similar, there are key differences in promotions and compensations. SBI clerks generally have a clearer path for advancement and receive higher salaries along with additional benefits compared to IBPS clerks. Ultimately, the differences outlined aim to help candidates make informed decisions regarding their career paths in banking.