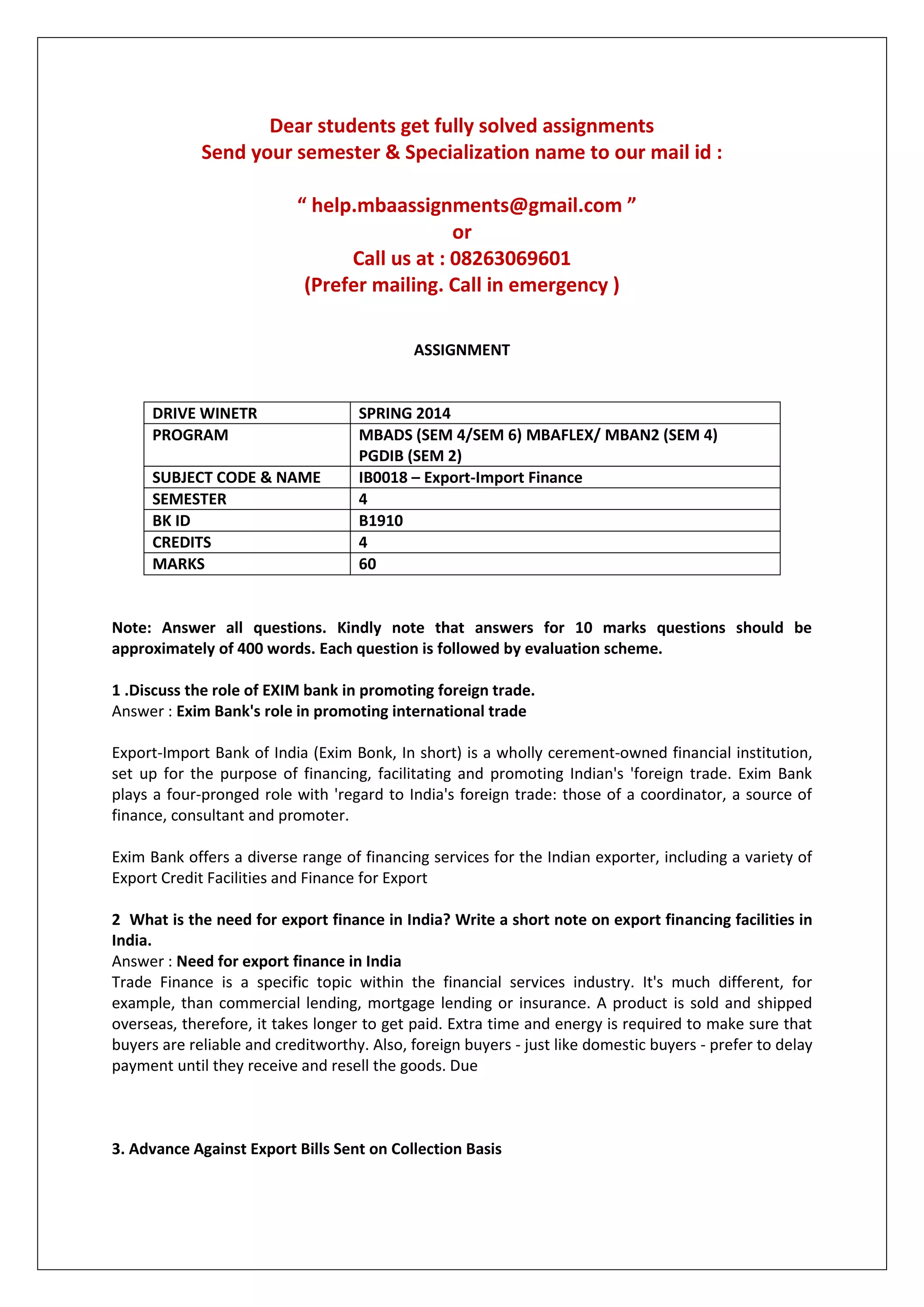

The document provides information about obtaining fully solved assignments from an assignment help service. It lists the contact email and phone number and specifies the programs, semesters, subjects, and courses for which assignments are available. It then provides a sample assignment question related to export-import finance, covering topics like the role of EXIM Bank in promoting foreign trade, export financing facilities in India, advance against export bills, export credit guarantee corporation, foreign exchange risk, payment options for exporters and importers, and types of custom duties. Students are instructed to answer all questions and provide approximately 400 word answers for 10 mark questions.