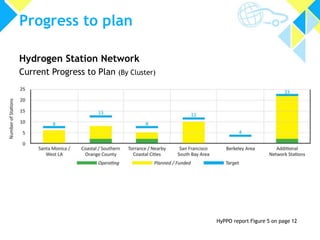

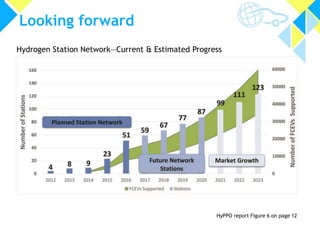

The document provides an update on California's hydrogen fuel cell vehicle roadmap, focusing on the commercialization of hydrogen fuel cell vehicles and the development of a supporting station network. It outlines past achievements, ongoing challenges, and necessary next actions to enhance station reliability and ensure customer satisfaction while increasing the number of functioning hydrogen stations. The report emphasizes the importance of policies and stakeholder involvement for the successful deployment and integration of hydrogen fuel cell technology.