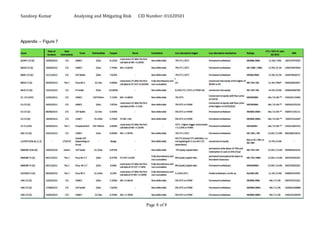

This document discusses hybrid securities and contingent capital notes. It begins by defining hybrid securities and contingent capital notes, then discusses their key design features. It analyzes why corporations and financial institutions issue hybrid securities, how rating agencies evaluate them, and considerations for investors. Recent hybrid issuances are also examined. In conclusion, while hybrid securities provide benefits to issuers, investors need to carefully assess the risks, particularly regarding how they are treated in default scenarios and how interest payments are structured.

![Sandeep Kumar Analysing and Mitigating Risk CID Number: 01020501

Page 7 of 8

REFERENCE LIST

BNP Paribas: European Credit Research: Valuing the Coco collection, September

2013.

Natixis Asset Management: Ideas Fixed Income, June 2014.

Moody’s Investor Services: Ratings Action, September 2013. Deutsche Bank

Financial Times (2014), Telefonica SA. [Online] Available from:

http://markets.ft.com/research/Markets/Tearsheets/Summary?s=TEF:MCE

[Accessed: April 3rd

2015]

Practical Law: Hybrid Securities: an Overview. Available from:

www.gobal.practicallaw.com/1-517-1581

[Accessed: April 3rd

2015]

Western Asset Management, Corporate Hybrids, May 2013.](https://image.slidesharecdn.com/hybridsandccnpdf-190313153744/85/Hybrids-and-CCN-7-320.jpg)