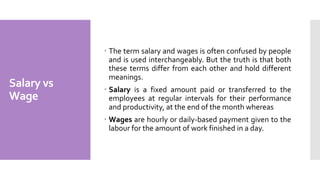

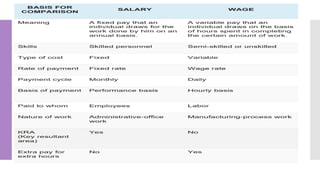

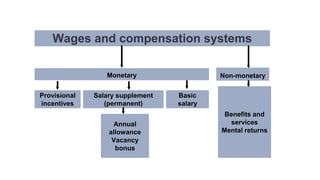

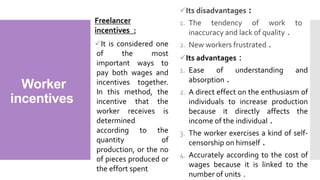

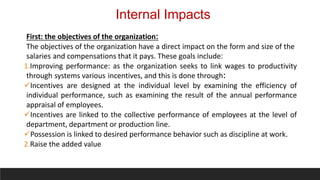

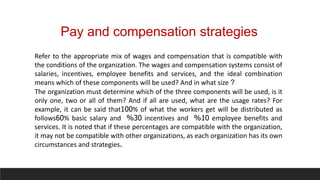

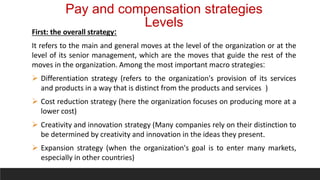

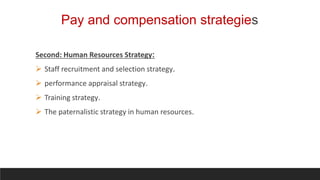

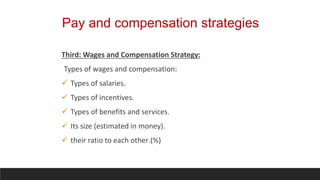

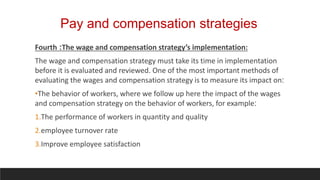

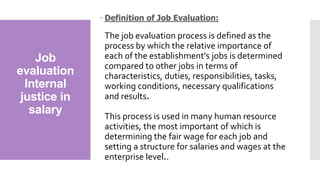

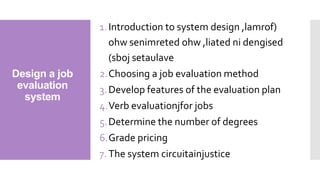

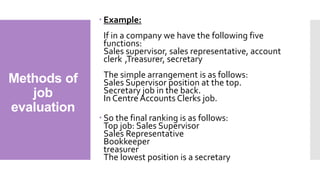

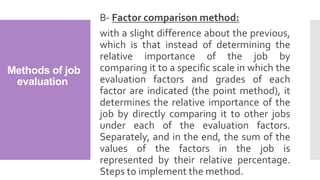

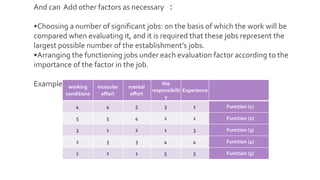

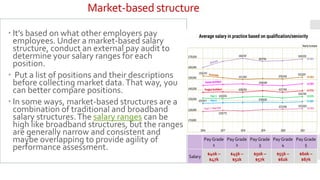

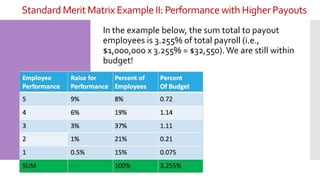

The document outlines a human resources management course agenda covering topics like HR strategic concepts, job analysis, recruitment, performance appraisal, and compensation systems. It explains the differences between salaries and wages, the importance of pay for organizations and employees, and various compensation methods including incentives and benefits. Additionally, it discusses job evaluation methods to ensure internal fairness in salaries and the factors affecting wage and compensation systems.

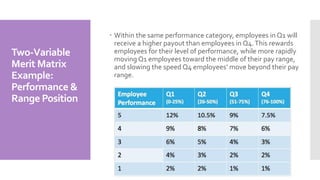

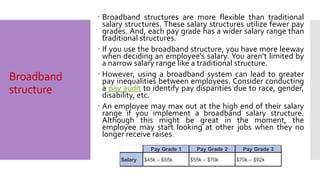

![ In this example, employees are divided into

four quartiles, from the bottom fourth of their

salary range (Q1) to the top fourth of their

salary range (Q4.).You can calculate where an

employee falls in their salary range by using

the compa-ratio or range penetration

formulas.

compa-ratio: (base salary / midpoint of salary

range)

range penetration:

([base salary – range minimum] / [range

maximum – range minimum])

Two-Variable

Merit Matrix

Example:

Performance &

Range Position](https://image.slidesharecdn.com/humanresourcesmanagement5-240907062217-e3130489/85/HUMAN-RESOURCES-MANAGEMENT-outlines-and-presentation5-pdf-66-320.jpg)