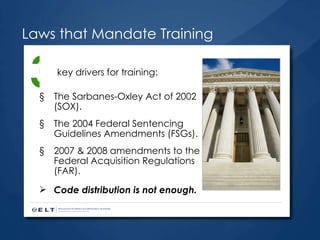

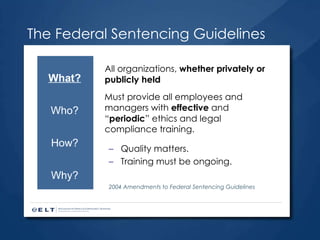

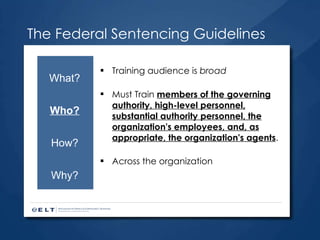

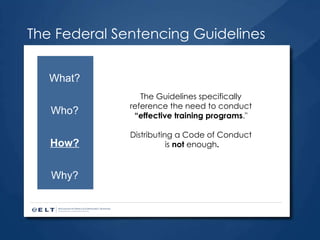

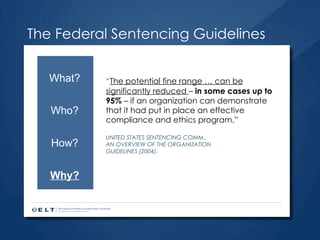

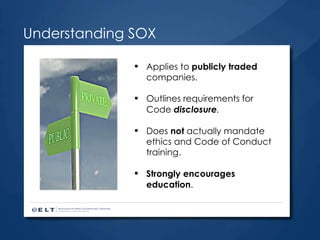

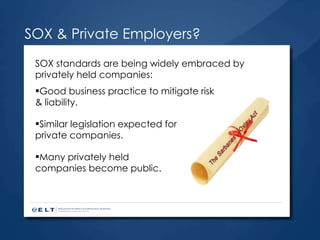

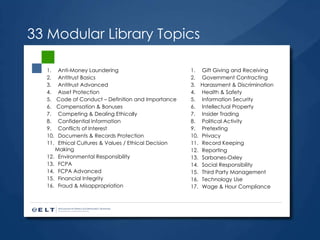

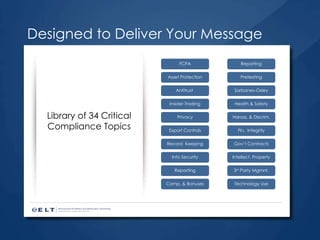

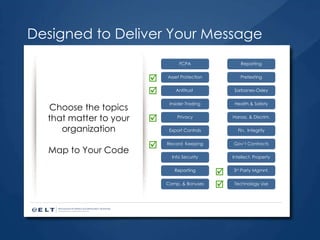

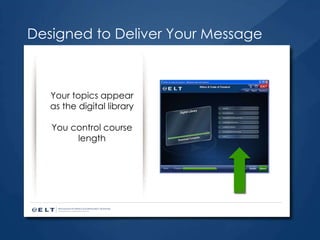

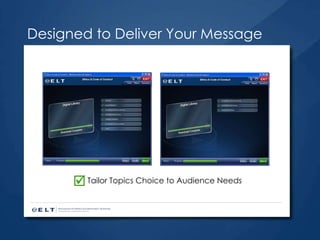

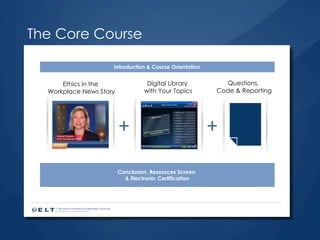

The document outlines the importance of ethics and compliance training for organizations, emphasizing legal requirements under laws such as the Sarbanes-Oxley Act and federal sentencing guidelines. It covers the necessity for ongoing training and effective compliance programs, particularly for government contractors and private companies aspiring to public status. Additionally, it discusses the structure and content of ELT's online compliance courses designed to meet these training needs.

![Interested in our solutions? [email_address] www.elt-inc.com │ 877.358.4621 Additional substantive questions? [email_address] [email_address]](https://image.slidesharecdn.com/ecoc-deminar-final-1305914243-phpapp02-110520130144-phpapp02/85/How-To-Provide-Superior-Ethics-Training-34-320.jpg)