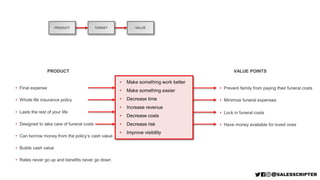

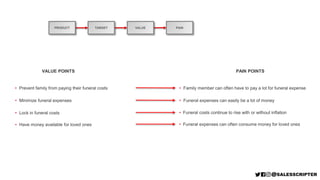

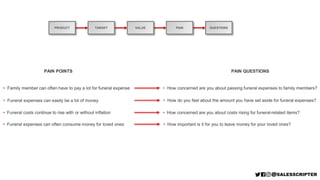

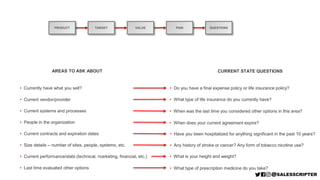

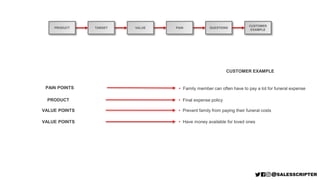

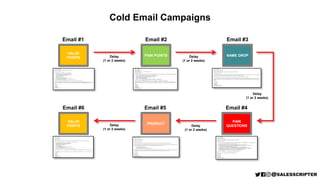

This document provides guidance on creating a sales script for final expense life insurance policies. It outlines the product details, target customer type, value points around preventing funeral costs for loved ones, and pain points around rising funeral expenses. It also provides example questions to assess a customer's current funeral planning and insurance coverage, as well as their concerns about leaving expenses to family members. The document then gives suggestions for structuring a cold call, appointment, and email campaign scripts to sell these policies.