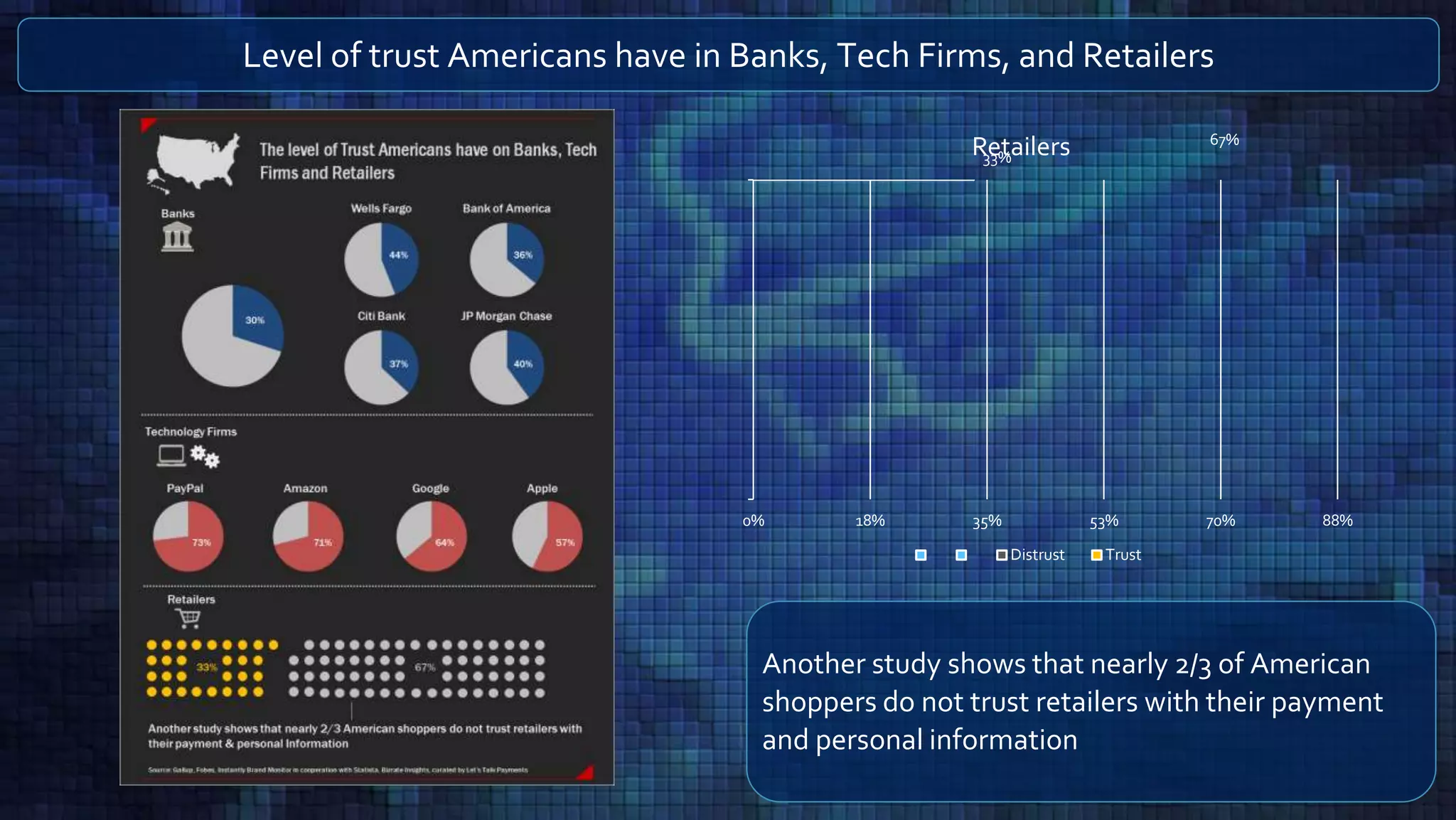

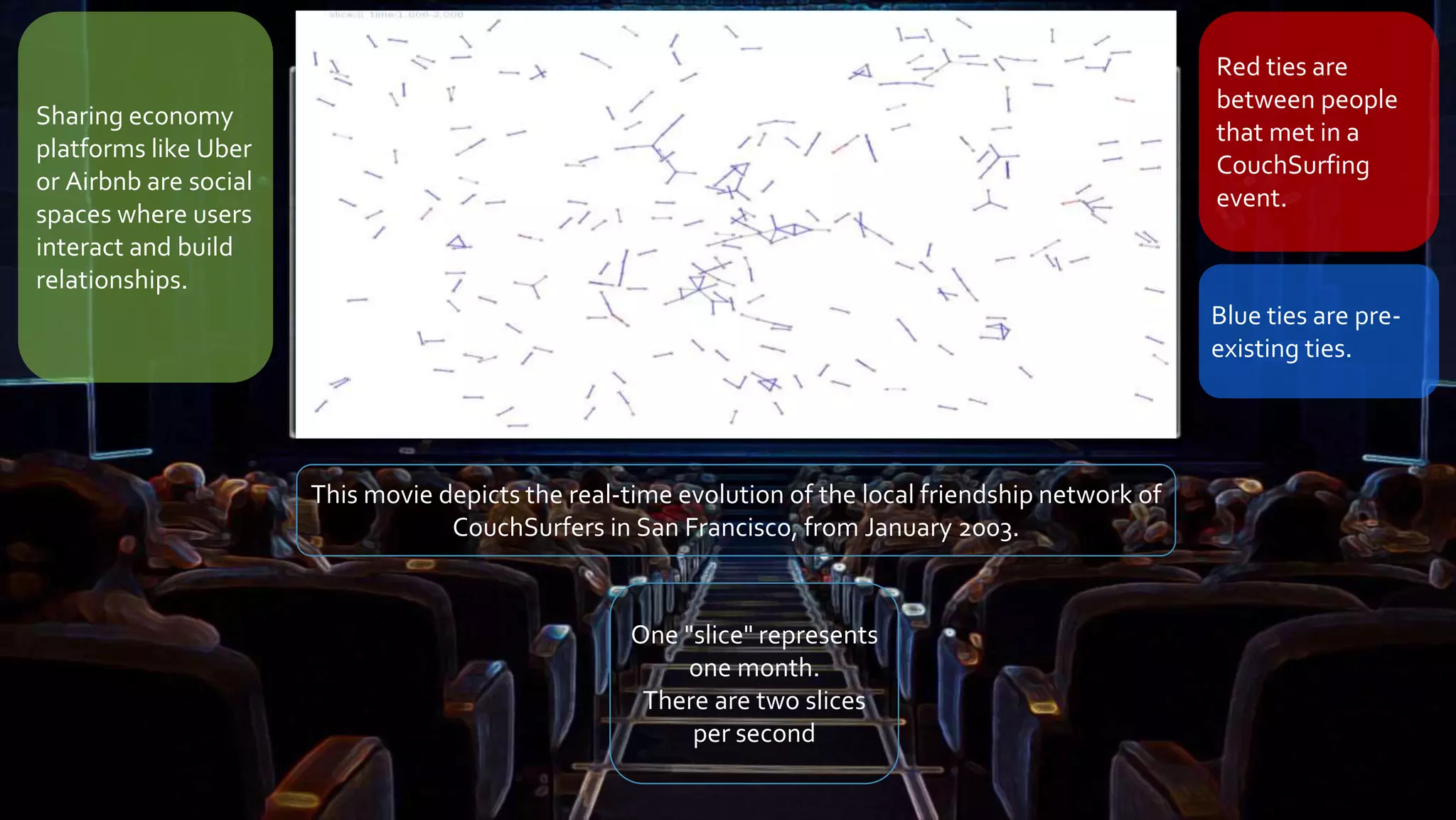

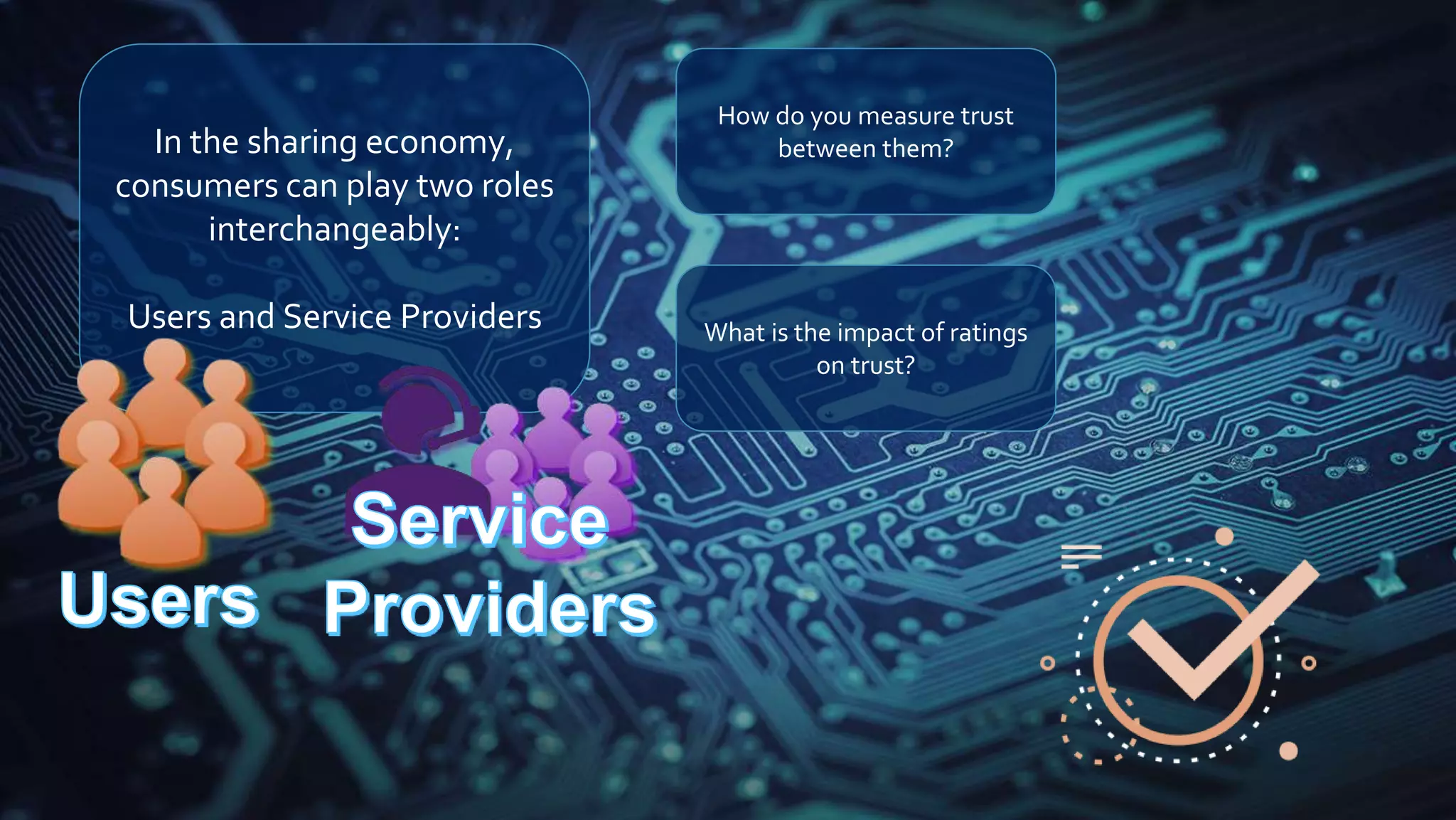

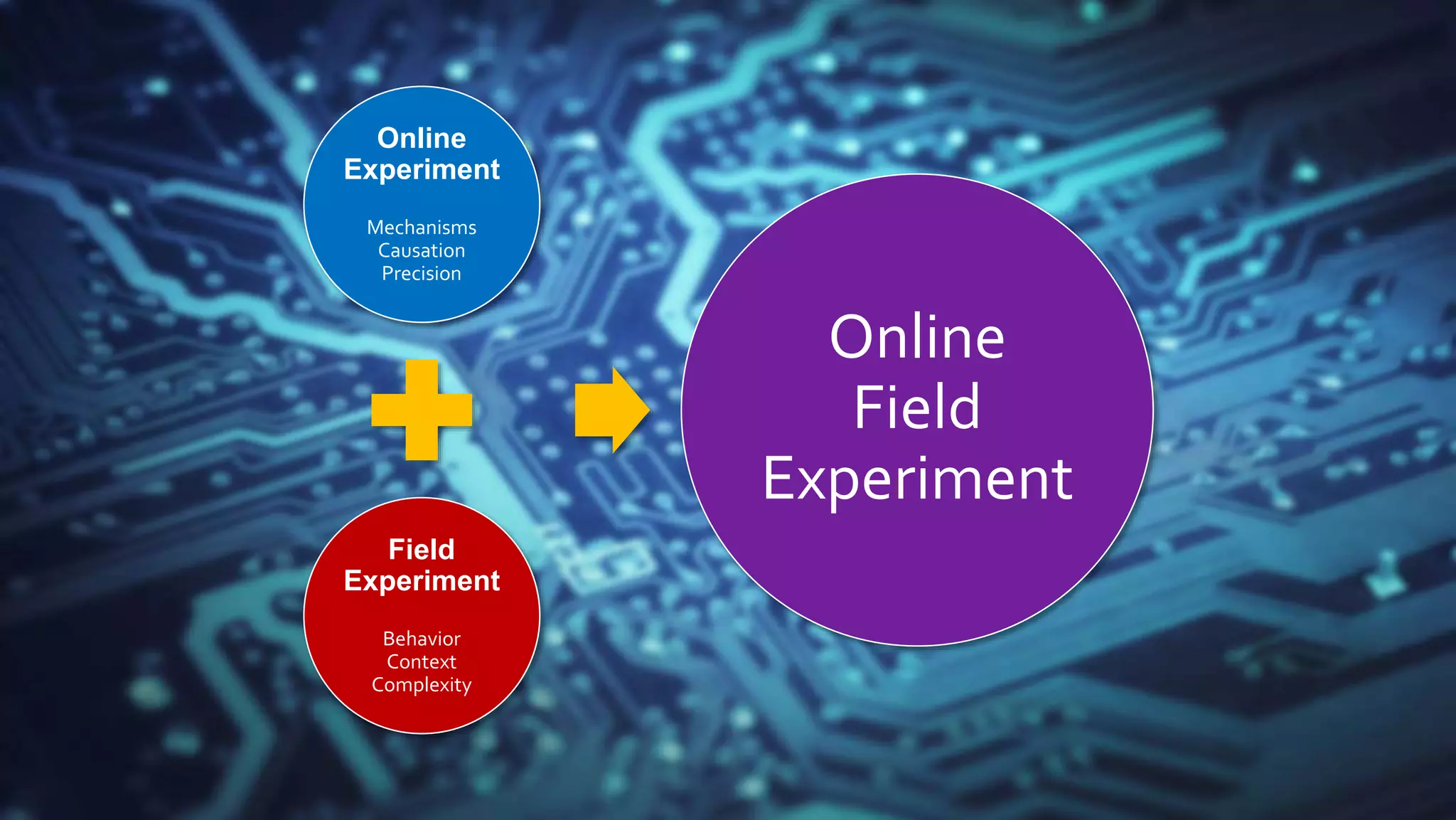

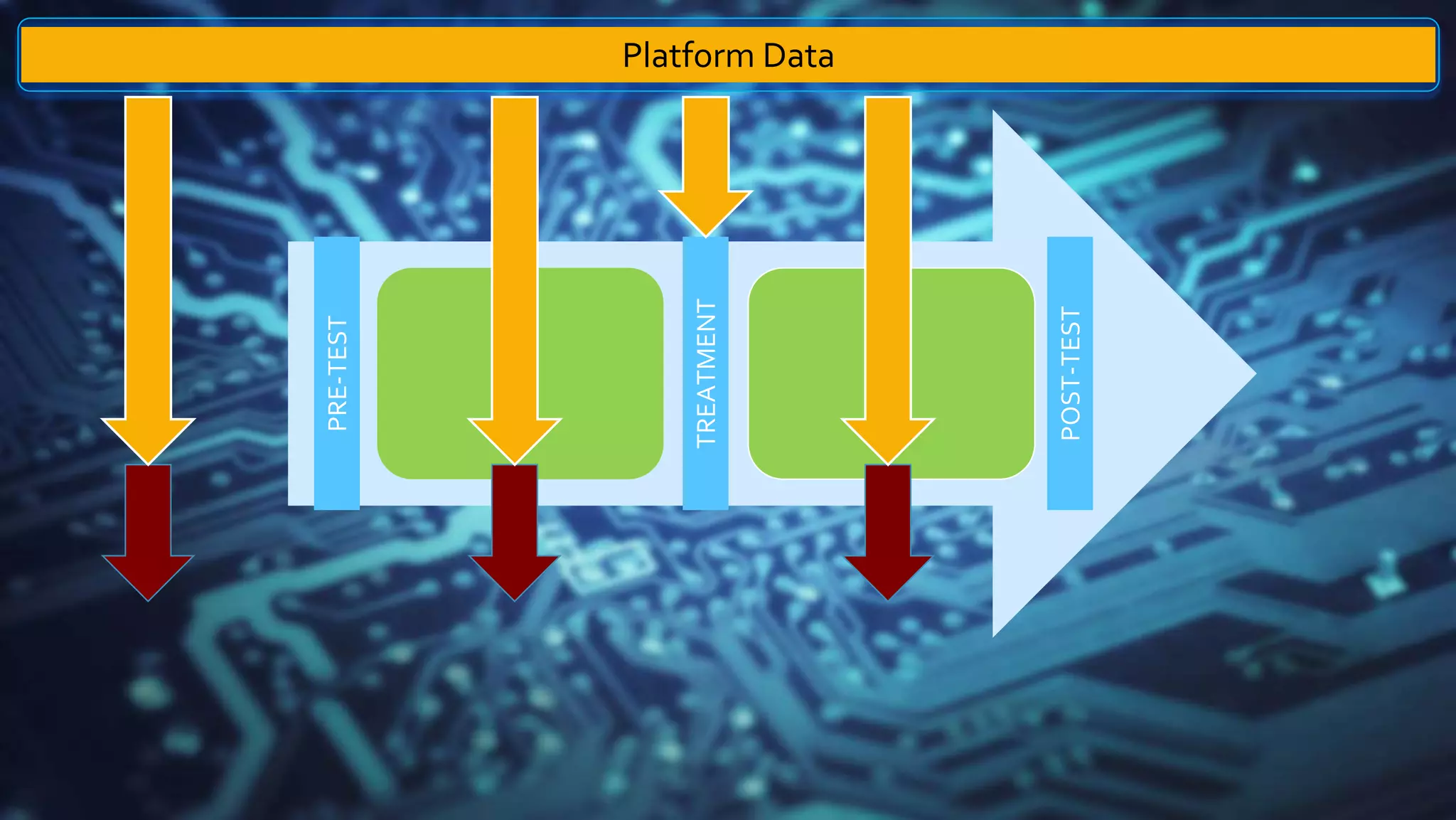

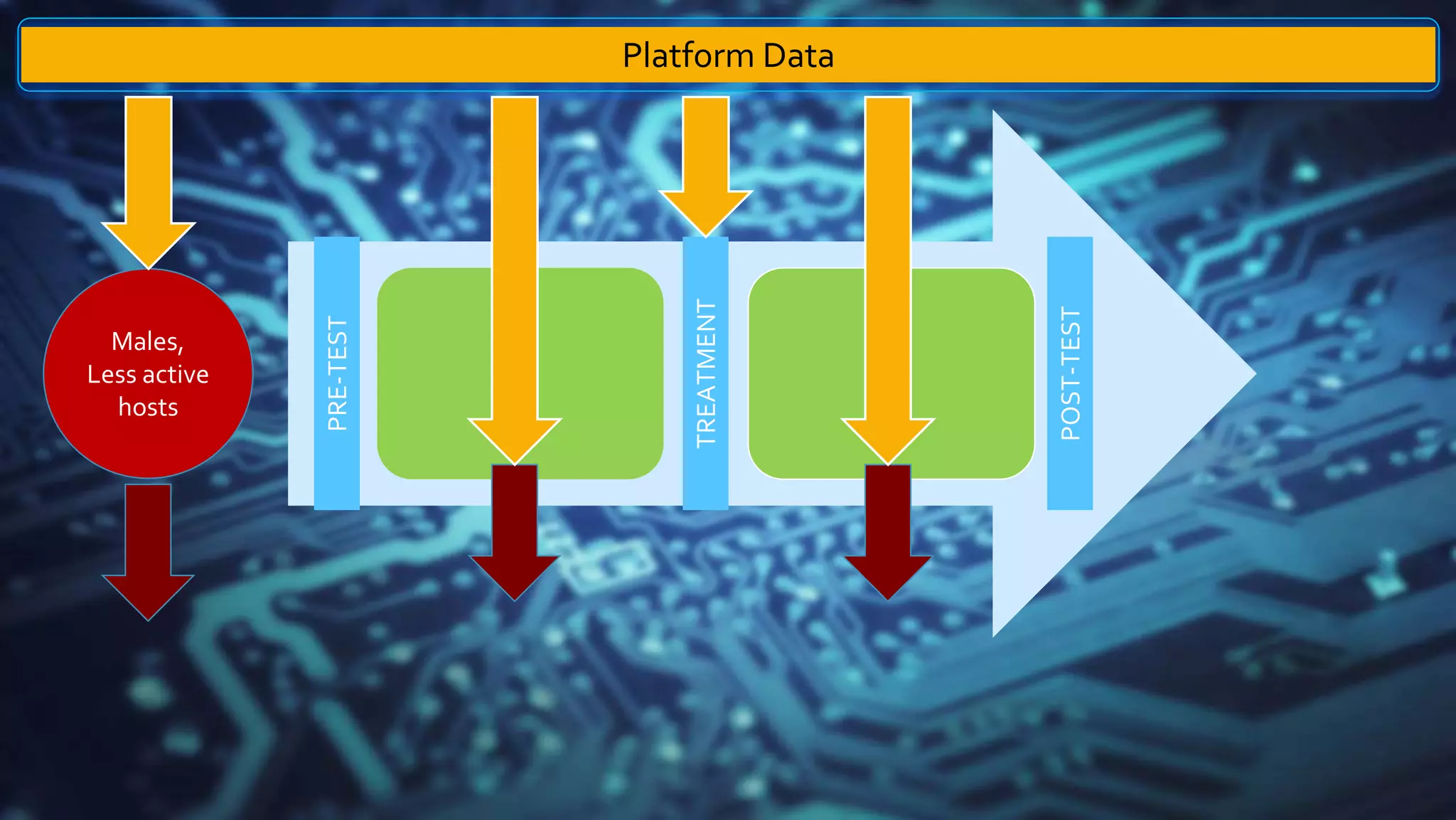

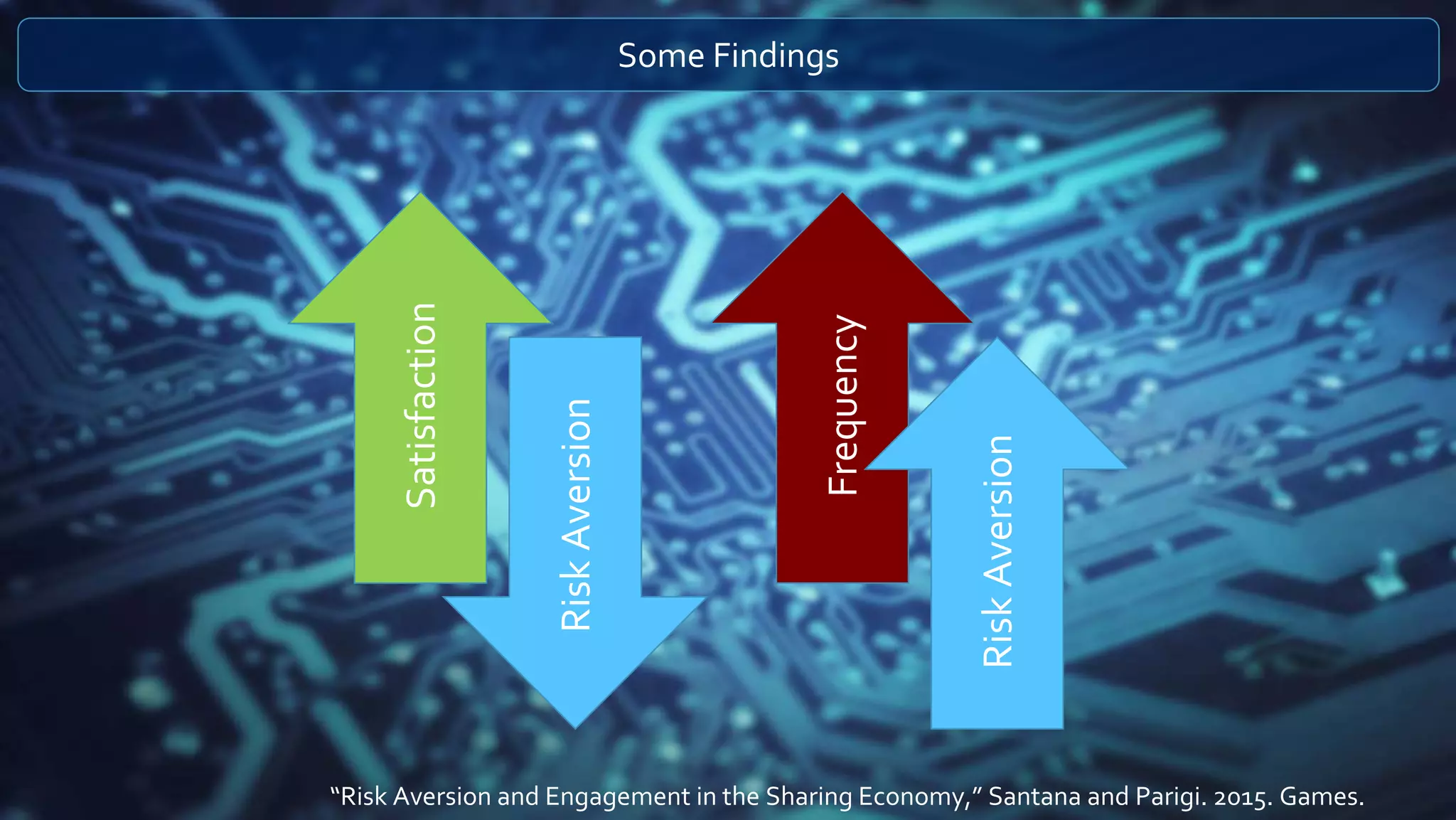

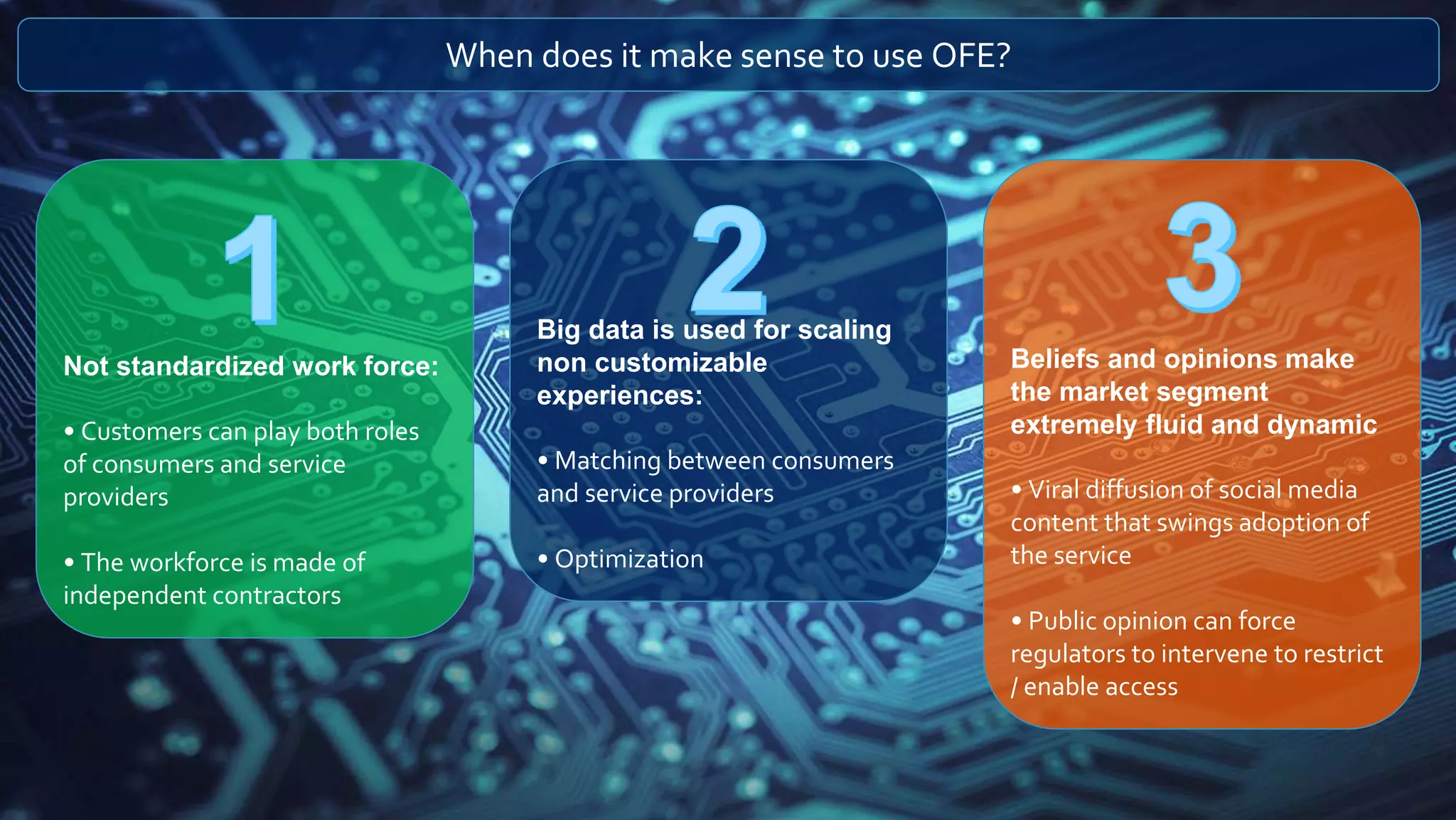

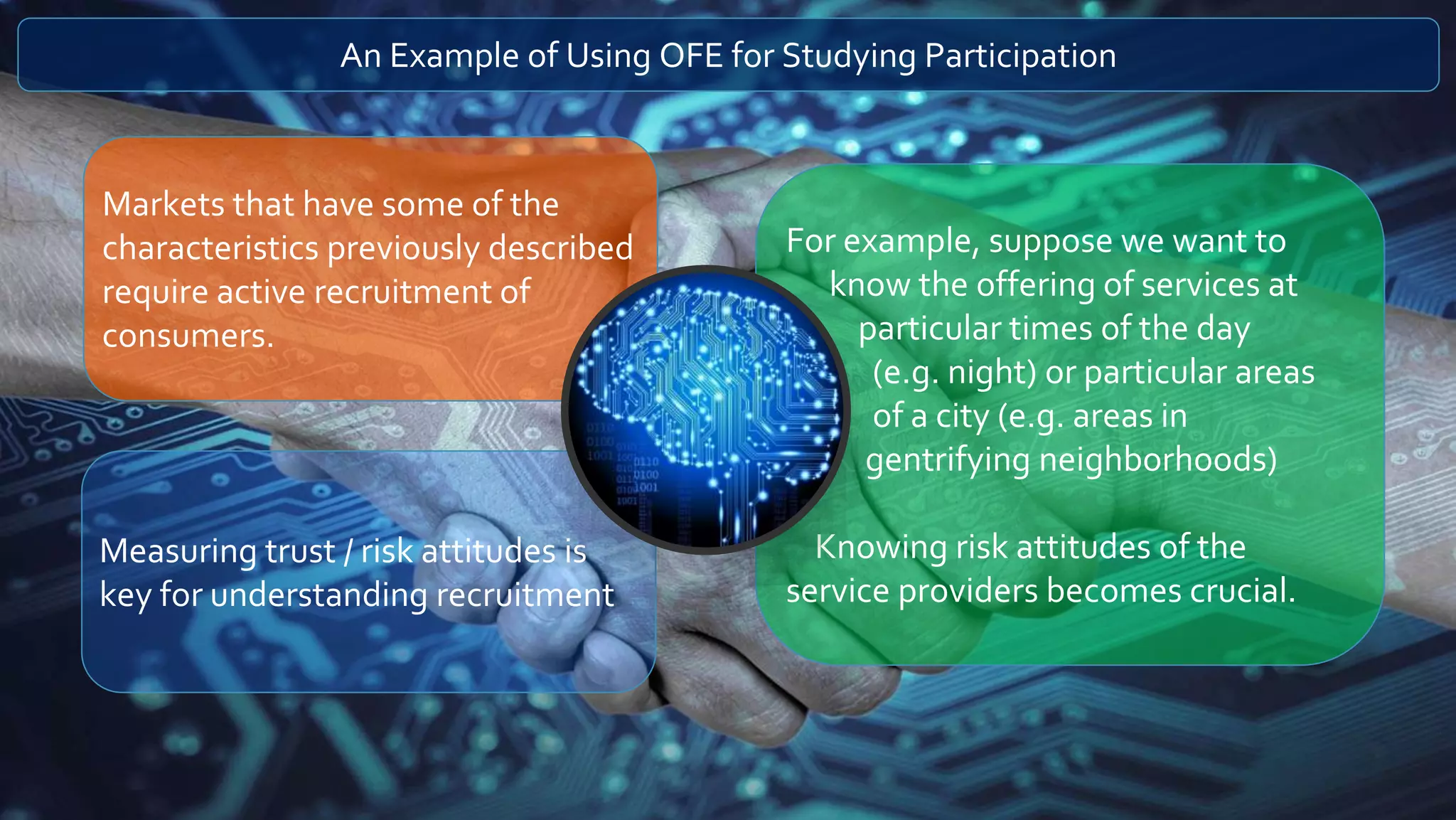

The document discusses the measurement of trust within the sharing economy, highlighting that two-thirds of American shoppers lack trust in retailers with personal information. It explores the roles of consumers as both users and service providers and the impact of online ratings on trust. Additionally, it emphasizes the importance of understanding risk attitudes and trust for recruiting participants in service markets characterized by dynamic consumer-provider relationships.