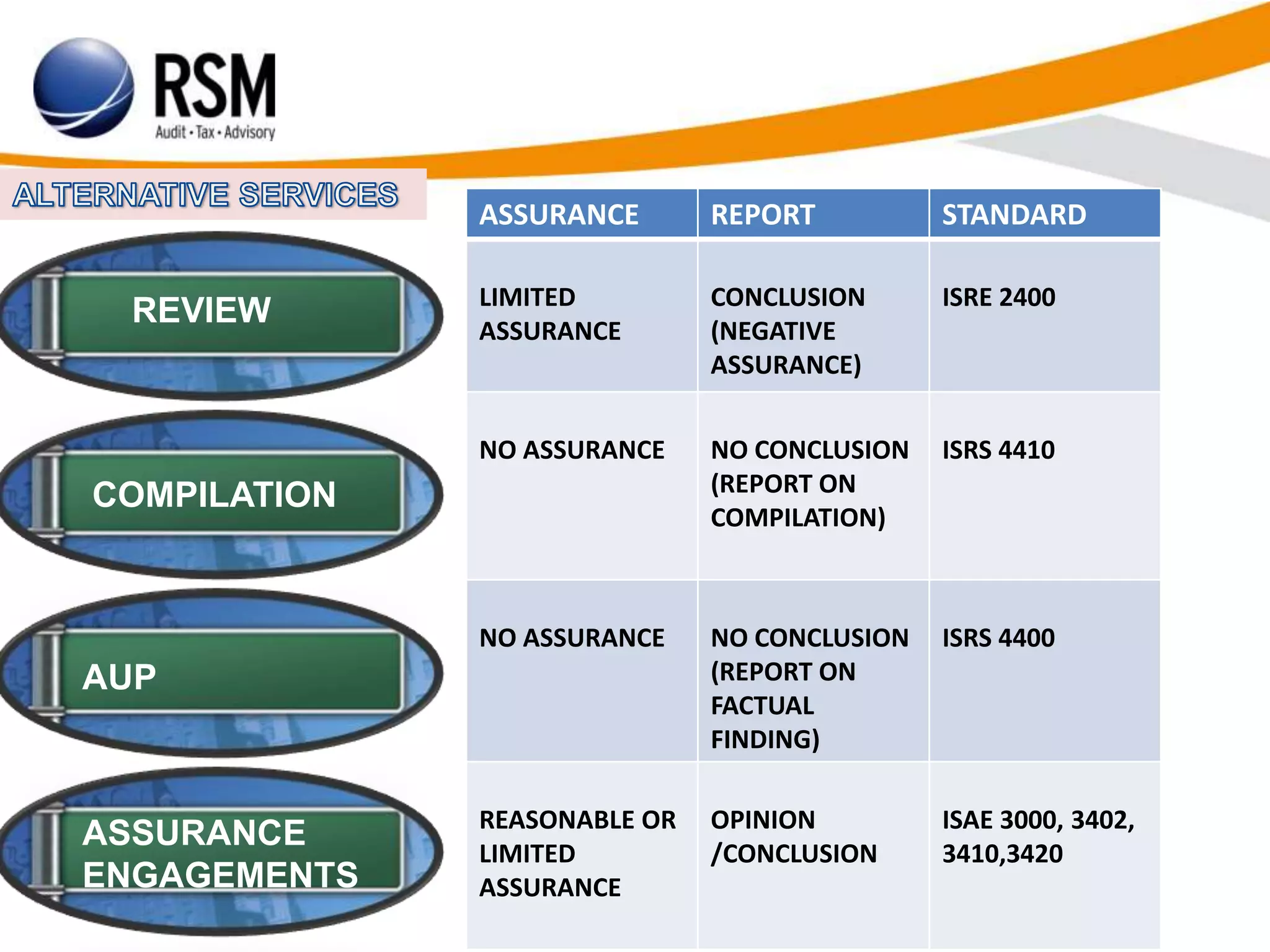

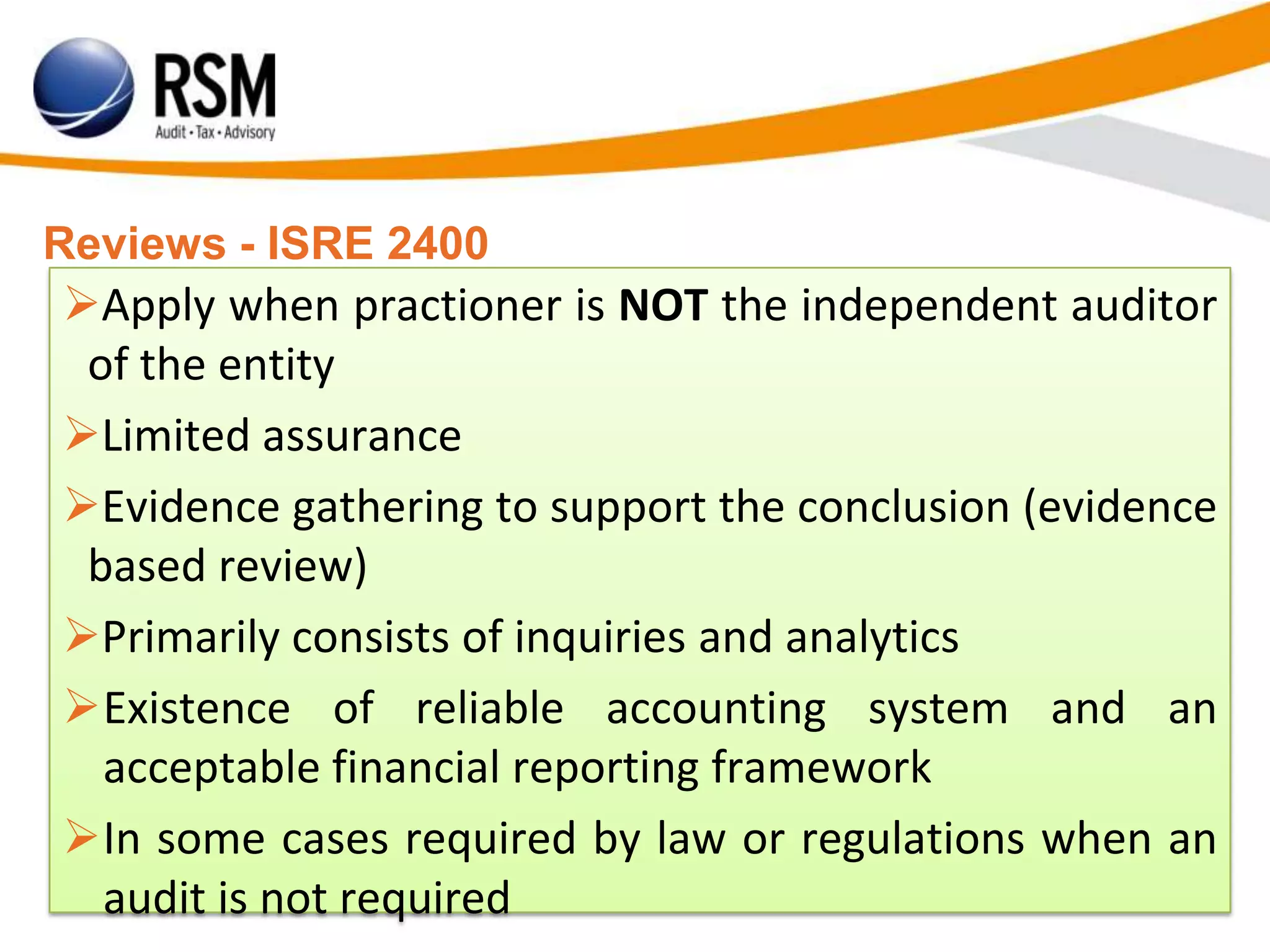

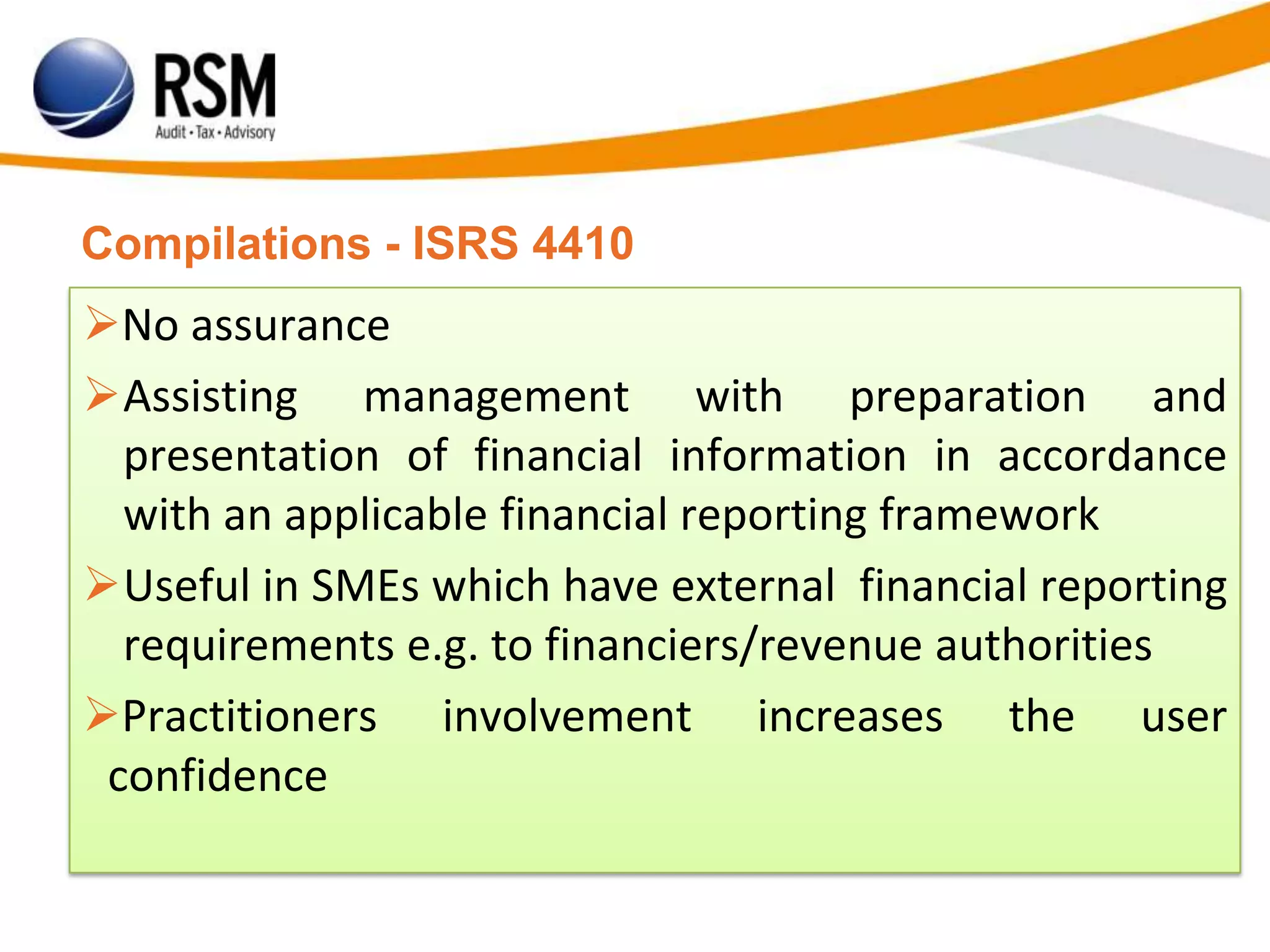

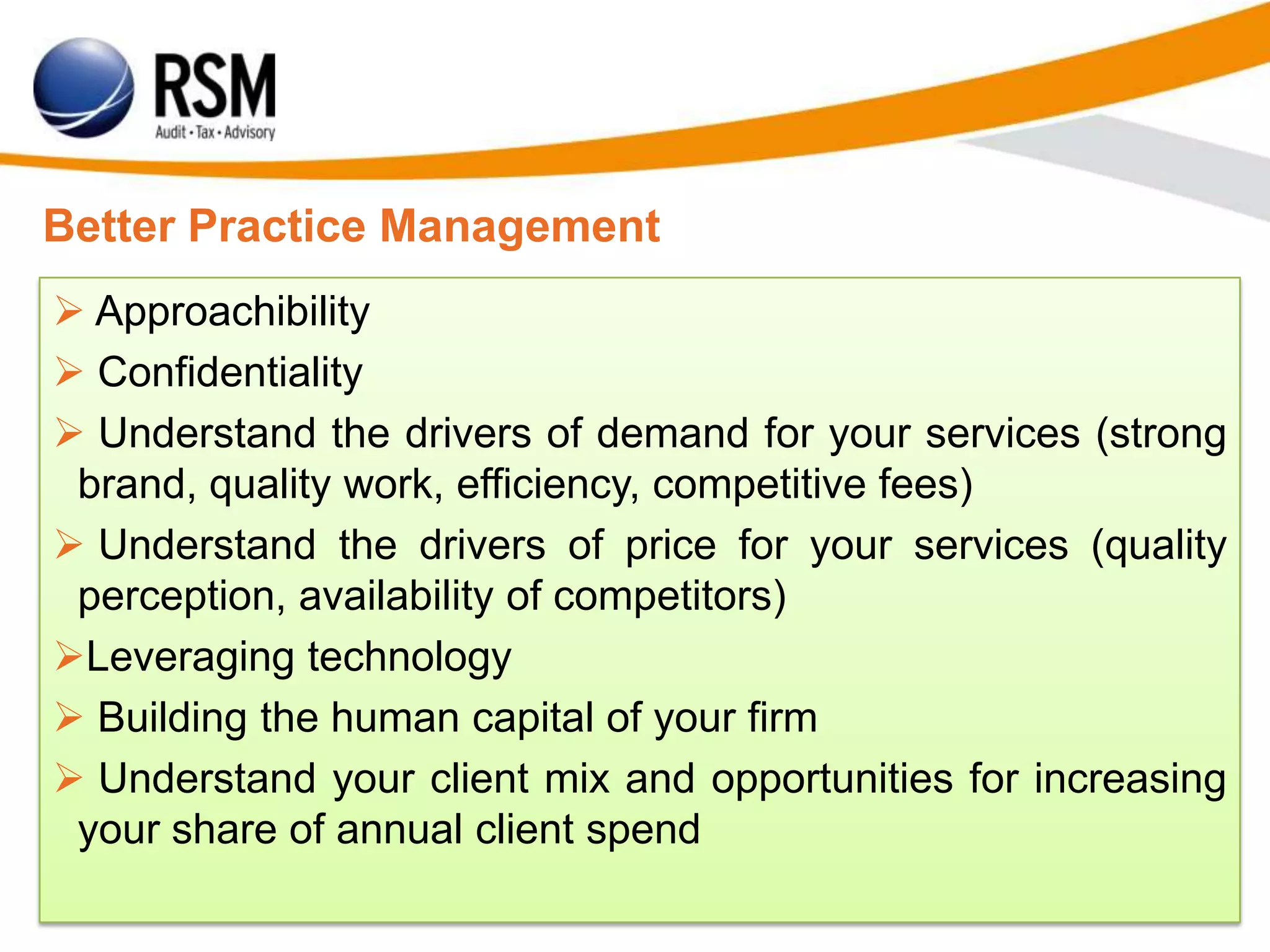

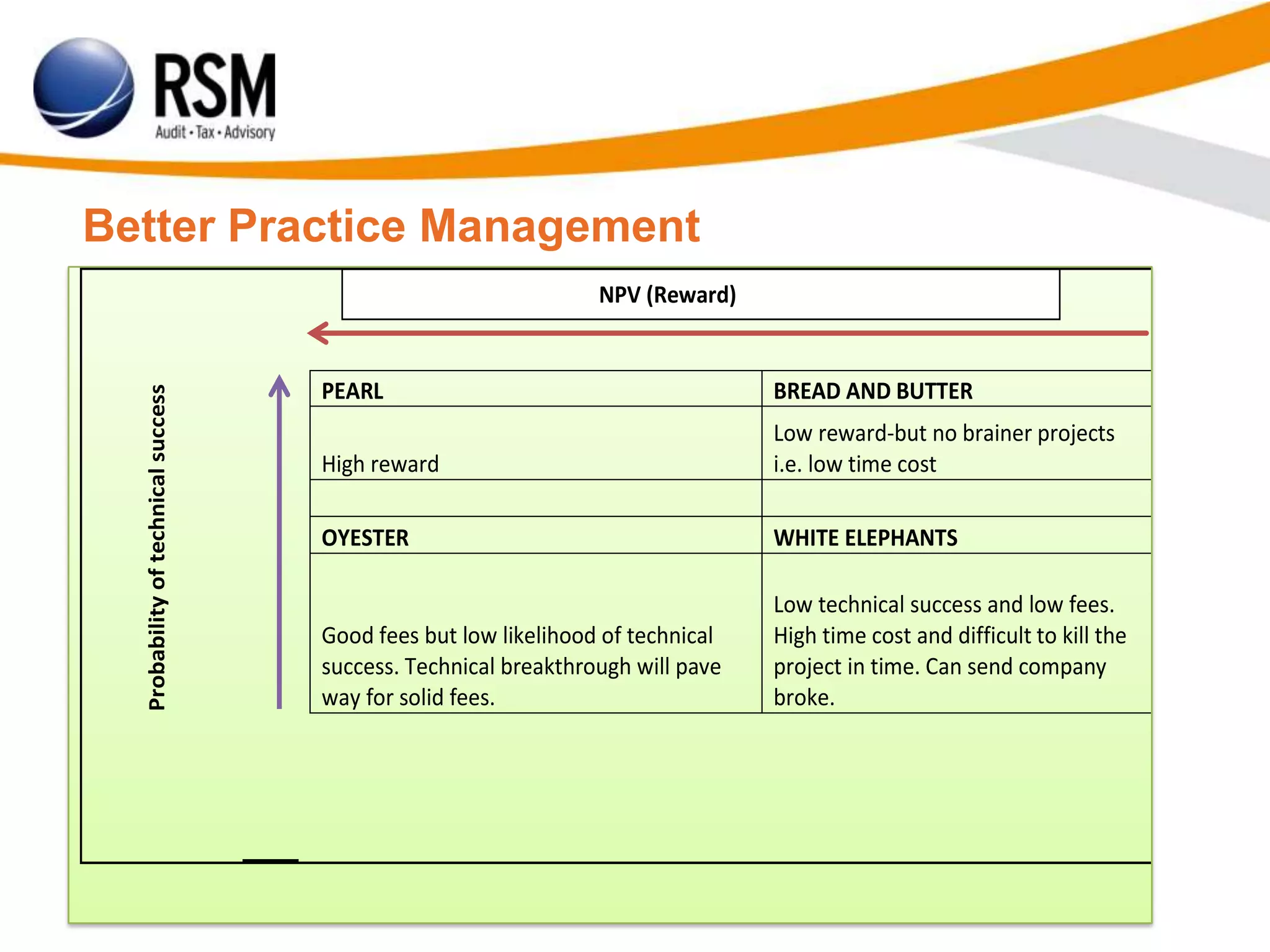

This document summarizes a presentation about how small and medium-sized professional practices (SMPs) are adapting to change through new service offerings and better practice management. It discusses the types of assurance engagements SMPs can provide, including reviews, compilations, agreed-upon procedures, and other assurance services. It outlines opportunities for SMPs in providing scalable services tailored to small and medium-sized enterprises, as well as challenges around regulatory trends, developing specialized knowledge, and managing costs. The presentation emphasizes the importance of understanding client needs, leveraging technology, developing human capital, and managing projects effectively for better practice management.