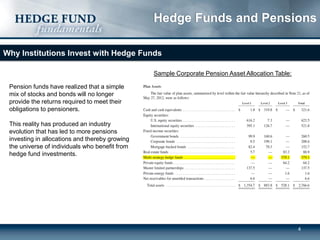

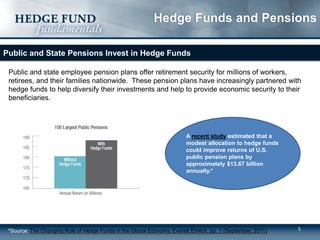

Institutions such as pension plans, universities, and foundations face challenges in meeting their financial obligations. As a result, they have increasingly turned to alternative investments like hedge funds to diversify their portfolios and generate reliable returns. Over 65% of hedge fund assets are now from institutional investors seeking to place themselves on firmer footing. The document discusses how public and corporate pensions, endowments, and foundations have benefited from partnerships with hedge funds.