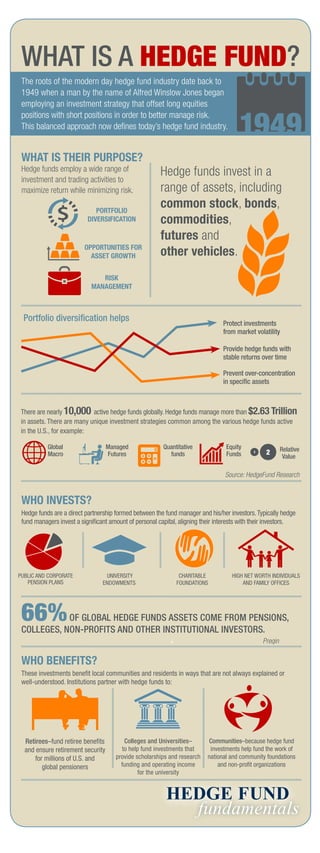

Hedge funds are direct partnerships between fund managers and investors where managers typically invest significant personal capital, aligning interests. The modern hedge fund industry traces back to 1949 when Alfred Winslow Jones employed a strategy of offsetting long and short positions to better manage risk. Hedge funds invest in a range of assets like stocks, bonds, commodities and futures to maximize returns while minimizing risk through diversification and hedging. They provide benefits to local communities and institutions by helping fund pensions, universities, non-profits and providing stable returns over time.