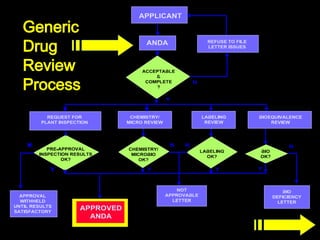

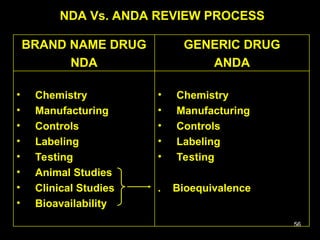

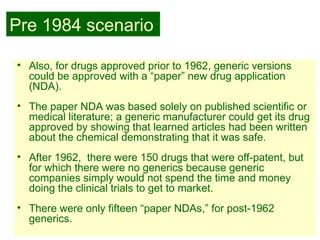

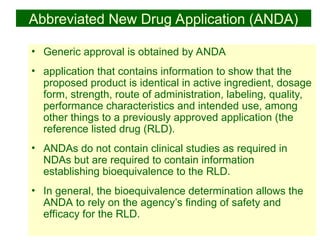

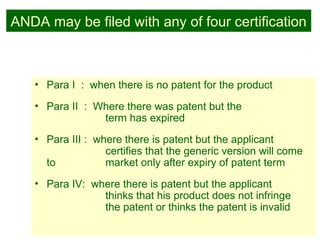

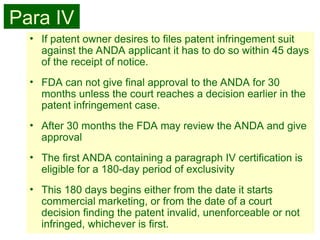

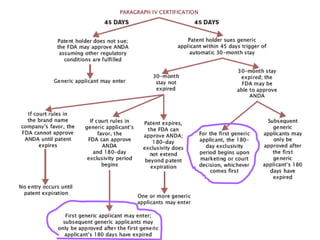

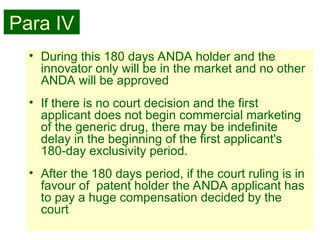

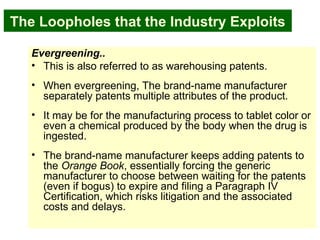

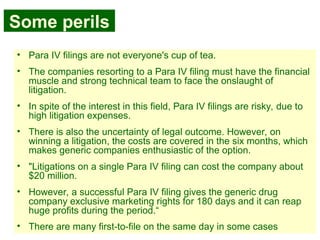

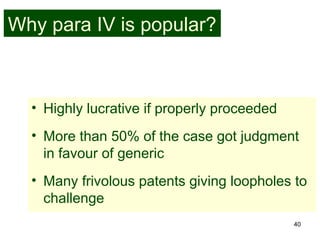

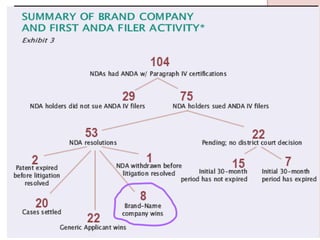

The document discusses the impact of the Hatch-Waxman Act on India's pharmaceutical industry, highlighting how it has facilitated growth through changes in patent regulations and increased access to international markets. It details the act's objectives, such as reducing drug prices and encouraging research, while describing the complexities involved in obtaining drug approvals via abbreviated new drug applications (ANDAs) and the challenges associated with patent litigation. Furthermore, it outlines various strategies used by companies to navigate the regulatory landscape, including para IV filings and loopholes exploited within the patent system.

![47

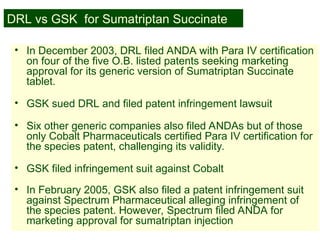

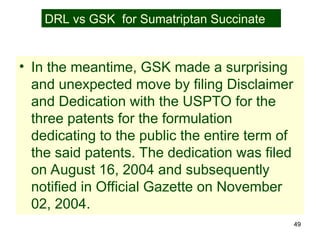

• U.S. Patent # 5,863,559 for pharmaceutical composition

for film-coated tablet of 3-[2-(dimethylamino)ethyl]-N-

methyl-1H-indole-5-methanesulphonamide succinate

(1:1) salt as active ingredient.

• U.S. Patent # 6,020,001 for pharmaceutical composition

for film-coated tablet of 3-[1-(dimethylamino)ethyl]-N-

methyl-1H-indole-5-methanesulphonamide succinate

(1:1) salt as active ingredient.

• U.S. Patent # 6,368,627 directed to a method of treating

or prophylactically treating a human suffering from

migraine which comprises oral administration of a

pharmaceutical composition comprising a film-coated

solid dosage form of 3-[2-dimethylamino)ethyl]-N-methyl-

1H-indole-5-methanesulfonamide or a pharmaceutically

acceptable salt or solvate therefore as active ingredient.

DRL vs GSK for Sumatriptan Succinate](https://image.slidesharecdn.com/hatchwaxmanact-250201043037-133ed248/85/Hatch-Waxman-Act-for-Generic-ANDA-application-47-320.jpg)

![52

DRL’s unique way

• Pfizer Inc. had patents for amlodipine salts including

maleate and besylate

• Pfizer investigated the maleate salt all the way through

Phase III and then switched to the besylate salt, due to

stability problem with maleate.

• DRL attacked active ingredient patent for amlodipine

besylate in a unique way

• It filed NDA and not ANDA through section 505(b)(2)

[ similar to Paper NDA] using the clinical trial data

submitted by Pfizer to market amlodipin maleate.

• Lower court gave verdict in favour of DRL

• Pfizer went for appeal](https://image.slidesharecdn.com/hatchwaxmanact-250201043037-133ed248/85/Hatch-Waxman-Act-for-Generic-ANDA-application-52-320.jpg)