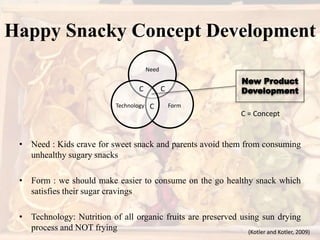

This document outlines a market analysis and business plan for Happy Snacky, a company that produces healthy fruit crisps as an alternative snack for school children. It identifies gaps in the snack market, segments the target market as school kids aged 4-18, and positions the product as a more nutritious snack option. The business plan then covers product development of sun-dried fruit crisps, competitors, stakeholders, sales projections, startup costs, and marketing and promotion strategies.

![References

• Department for Education (2014) “Statistical First Release: Schools, pupils and their characteristics”, available at

http://dera.ioe.ac.uk/20268/1/SFR15_2014_main_text_v2.pdf [accessed 18th of November]

• Family Education (2014) “Are We Too Sweet? Our Kids’ Addiction to Sugar” available at

http://life.familyeducation.com/nutritional-information/obesity/64270.html?page=1 [accessed 18th of November]

• Peelen, P.,Ed. (2005) Customer Relationship Management, Harlow, England: Pearson Education Limited

• Jha, L. (2008) Customer Relationship Management, Darya Ganj, New Delhi: Global India Publications Pvt Ltd.

• Schoolfoodplan.com, (2014). The Plan - School Food Plan. [Online] Available at:

http://www.schoolfoodplan.com/plan/ [Accessed 6 Dec. 2014].

• Olson, E., Walker, O. and Ruekert, R. (1995). Organizing for Effective New Product Development: The Moderating

Role of Product Innovativeness. Journal of Marketing, 59(1), pp.48-62.

• Michman, R. and Mazze, E. (1998). The food industry wars. Westport, Conn.: Quorum.

• Kurtz, D. and Boone, L. (2013). Boone & Kurtz contemporary marketing. 16th ed. USA: South-Western Cengage

Learning.

• Kotler, P. and Kotler, P. (2009). Marketing management. Harlow, England: Pearson/Prentice Hall.](https://image.slidesharecdn.com/happy-20snacky-20-281-29-141209065111-conversion-gate02/85/Happy-Snacky-1-pptx-12-320.jpg)