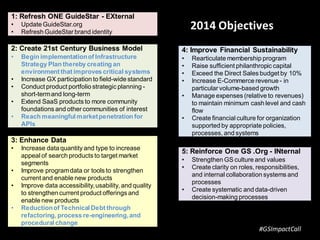

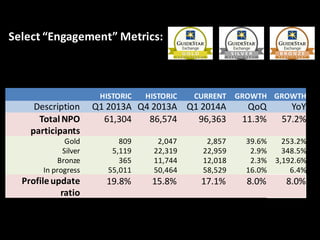

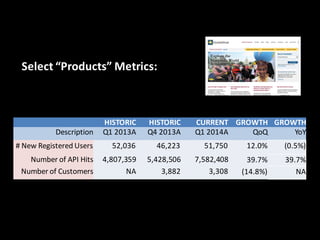

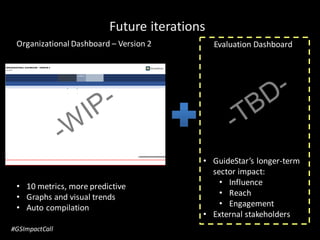

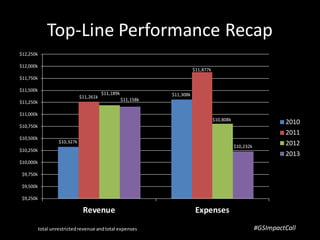

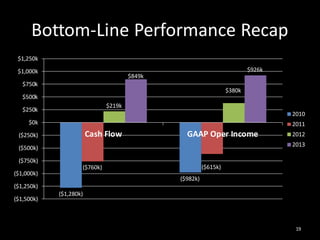

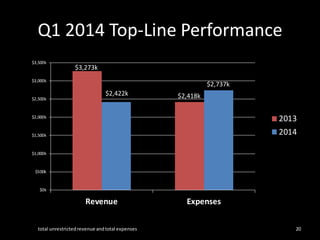

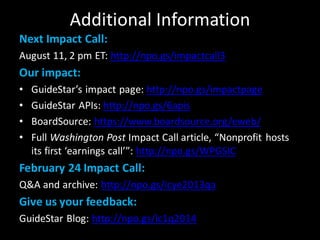

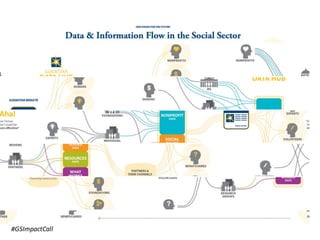

GuideStar held its first impact call for Q1 2014 with over 450 participants, featuring discussions on strategic planning, programmatic results, and financial outcomes. The organization aims to enhance its data accessibility and financial sustainability while reinforcing its internal culture and collaboration. Key metrics showed significant growth in web service hits and social media followers, alongside an increasing number of nonprofit participants and members.

![#GSImpactCall

“Nonprofits need to help

their donors make the

shift from focusingon a

ratio to…assessment of

[nonprofits’]goals,

effectiveness and

impact.”– “The Great

Debate,” AFP

“My call to action is for

nonprofits to be

systematicabout

includingall different

kinds of information

when they tell their

story.”– Jacob Harold in

“The Great Debate,” AFP](https://image.slidesharecdn.com/q1impactcallslidesfinal5-140514120318-phpapp01/85/GuideStar-Impact-Call-05-12-14-7-320.jpg)