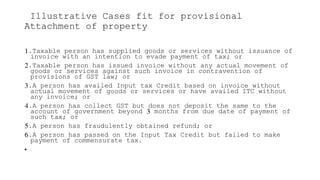

The document outlines the guidelines for the provisional attachment of property and bank accounts under the CGST Act, specifically detailing when and how such attachments can be executed by the Commissioner. It describes the necessary conditions, procedures, and illustrative cases justifying the attachment, such as failure to issue invoices or fraudulent tax activities. The document emphasizes the protective measures for revenue interests during pending proceedings against taxable persons.